Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Rough Road to Net-Zero

The reduction of carbon footprints has become top of mind for many governments, companies and other stakeholders as the threat of climate change grows. Given the disruptions of the early 2020s, can the concept of net-zero carbon emissions survive in a constantly changing world? S&P Global Commodity Insights explored the question in its recent report, “Unraveling Uncertainty: 2023 Scenarios and Net-Zero Cases.”

The global energy markets were confronted with a series of disruptions at the start of the decade: the rising frequency and intensity of extreme weather events, the COVID-19 pandemic, Russia’s invasion of Ukraine, international climate negotiations and the emergence of multibillion-dollar clean technology subsidy programs. Taking these challenges and opportunities into account, the report outlined five long-term outlooks on the global transition to net-zero — the state in which the amount of carbon emitted is offset by the amount of carbon removed from the atmosphere.

Three of the outlooks in the report are plausible scenarios: Inflections, Green Rules and Discord. Under the Inflections base-case scenario, countries would implement multibillion-dollar cleantech funding programs and net-zero commitments to cover more than 90% of greenhouse gas emissions, but there is no concerted effort by governments globally to maximize decarbonization outcomes. Some emerging economies also returned to the increased use of fossil fuels following COVID-19 to address more urgent energy security concerns. If the rebound in fossil fuel use continues after 2050, global warming in the Inflections scenario would reach about 2.4 degrees C above preindustrial levels by 2100.

The Green Rules outlook described a world where a revolutionary shift to a sustainable low-carbon economy takes place, but one that does not achieve net-zero until around 2085, S&P Global Commodity Insights Research & Analysis Executive Director Paul McConnell wrote in the report. This scenario highlighted the significant socioeconomic inequality between countries, with some closing in on their targets by 2050, but most failing to do so given the high cost of the transition. Global warming would improve to 1.7 degrees above preindustrial levels by 2100 due to the progress in decarbonization efforts made by midcentury.

For the Discord scenario, the report pointed to a world stagnated by years of geopolitical and macroeconomic challenges and one that is "highly reliant on fossil energy with significant [greenhouse gas] emissions and very little chance of reaching net-zero emissions." Global warming in a Discord world would reach 3 degrees above preindustrial levels by 2100.

The report also examined two speculative net-zero cases: accelerated carbon capture and storage and multi-tech mitigation. In the first case, carbon capture and storge is widely adopted across key energy segments, and extensive use of the technology will sequester 5.9 billion metric tons of CO2 by 2050. For the latter scenario, carbon capture and storage adoption is expected to sequester 1.5 billion metric tons of CO2, but greater focus is placed on electrification and diversifying energy supply.

Across all five outlooks, GHG emissions in 2050 are forecast to be lower than current levels, while renewable power output will soar. The demand for fossil fuels will be displaced by the growth in clean energy sources. Still, all three plausible scenarios suggest that the Paris Agreement on climate change is not on track to meet its goal of bringing GHG emissions to net-zero by 2050 and limit global warming to 1.5 degrees by the end of the century. Achieving net-zero is only possible in the two speculative cases, according to the report, which was released ahead of the 2023 UN Climate Change Conference.

"Without a net-zero EU or US in 2050, or a China on its way to net-zero in 2060, the global goal of limiting warming to 1.5 [degrees] C by 2100 is probably out of reach," McConnell said. "We remain alert to ’blind spots‘ but also cognizant that the world has not yet emerged from the confluence of crises that has defined the early 2020s.”

As the world zeroes in on decarbonization, one thing is apparent: The road to net-zero is not a clear, straight path but one paved with uncertainties. It is going to be a bumpy ride.

Today is Friday, November 17, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

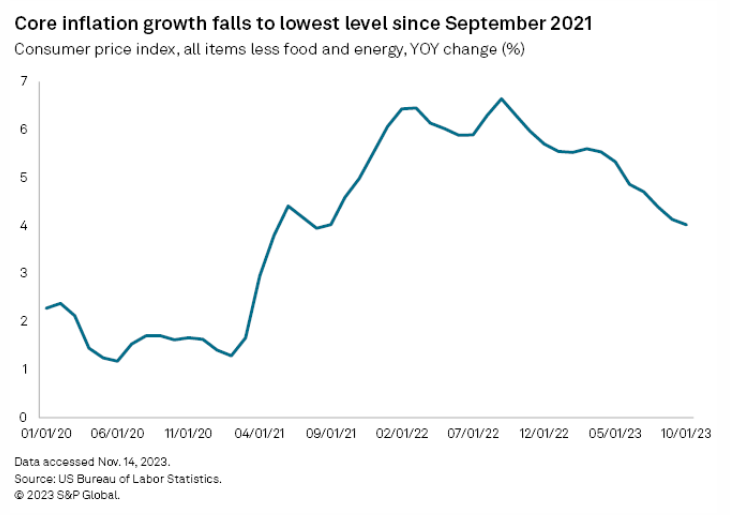

Inflation Measure Dips To Multiyear Low, Boosting Rate-Cut Odds For Next Spring

An inflation measure watched closely by the Federal Reserve has fallen to its lowest level in more than two years, signaling that the central bank's push to fight rising prices with higher interest rates is nearing an end. The core consumer price index, which strips out volatile food and energy prices, increased 4% from October 2022 to October 2023, the smallest yearly increase since September 2021, the US Bureau of Labor Statistics reported Nov. 14.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

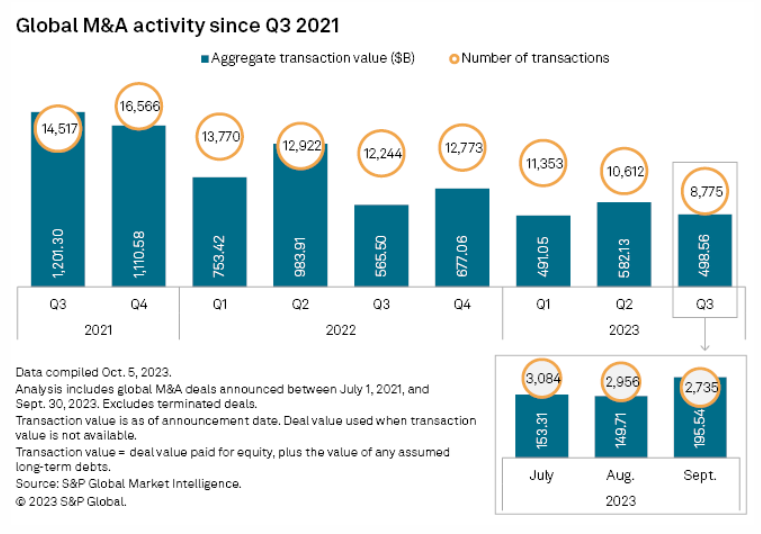

I-Bank Executives See Light At End Of 'Long Dark Tunnel' For M&A

Investment banking executives are adding a bit more optimism to their outlooks for M&A, which has been mired in a slump for over a year. In the third quarter, the number of global M&A announcements dropped below 10,000 for the first time since the pandemic, and the number of deals in the US fell 31% year over year to 3,175 — a faster decline than in the first two quarters of the year, according to S&P Global Market Intelligence's latest M&A and Equity Offerings report.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

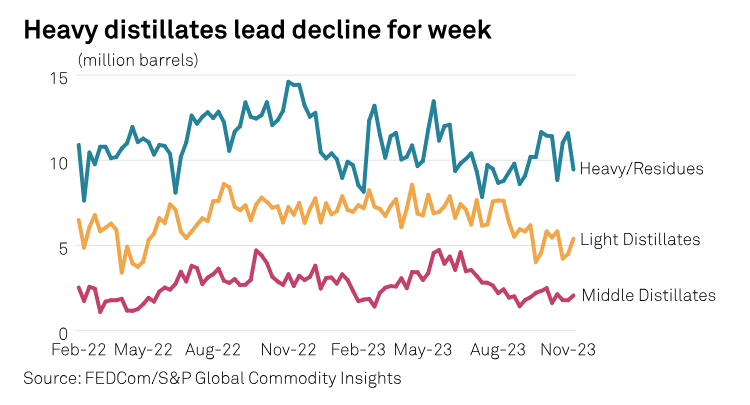

Oil Product Stocks Drop For First Time In Three Weeks

Stockpiles of oil products at the UAE's Port of Fujairah dropped 5.3% in the week ended Nov. 13, the first drop in three weeks, according to data from the Fujairah Oil Industry Zone. The total fell to 16.919 million barrels as of Nov. 13, the FOIZ data published Nov. 15 showed. The total stockpile is now down 18% since the end of 2022.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: COP28 Is A Pivotal Moment For Carbon Markets: Can Countries Move Forward On Article 6?

Article 6 of the Paris Agreement is seen as an essential enabler of international emissions trading, providing countries and businesses with a key pathway to meet and accelerate their climate goals. However, many key decisions and rules around the use of Article 6.2 and Article 6.4 need to be clarified at the COP28 climate summit in Dubai in order to move carbon markets forward. S&P Global Commodity Insights' experts Dana Agrotti, Vandana Sebastian and Eklavya Gupte explore some of the complexities of Article 6 and its implications for both the compliance and voluntary carbon markets.

—Listen and subscribe to Platts Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

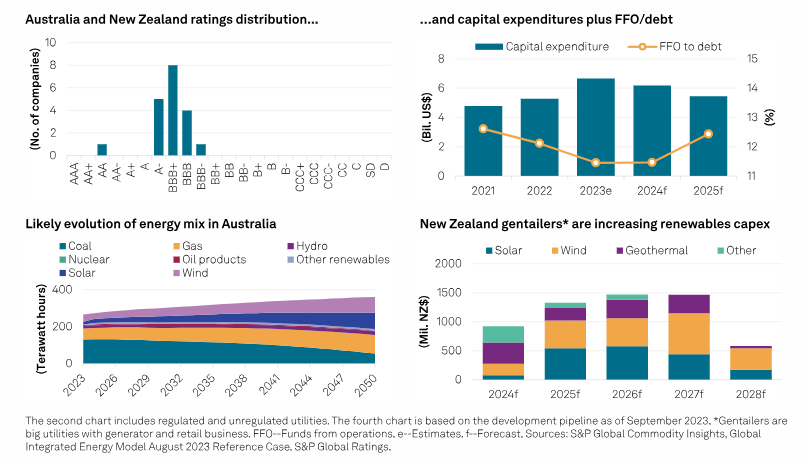

Asia-Pacific Utilities Outlook 2024: Earnings Recovery Should Temper Higher Transition Spending

Volumes for Asia-Pacific utilities will expand 4%-5% in 2024-2025, amid resilient economic growth in the region. Softening fuel costs can help protect cash flows, given fossil fuels still dominate the region's overall energy consumption. That said, the trend could change if geopolitical risks further escalate. Spending will be heavy to meet growing user demand and energy-transition targets in the region; this will weigh on already stretched financial metrics.

—Read the report from S&P Global Ratings

Access more insights on energy and commodities >

Cloud Price Quarterly: India Yields Bargains; Public Cloud Benchmarks Tick Up

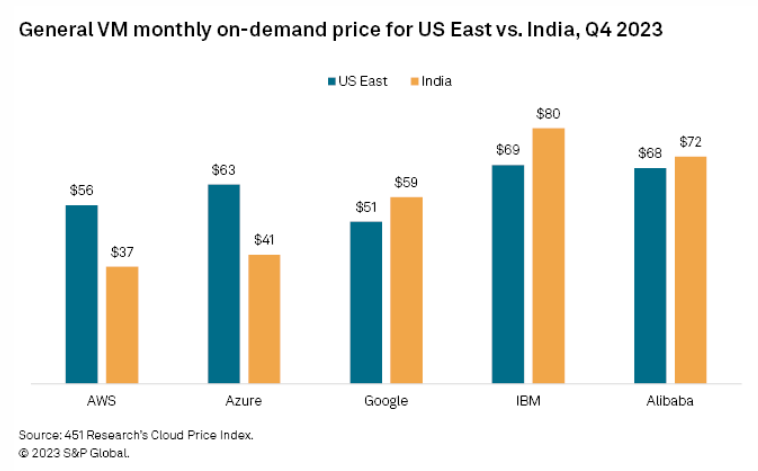

Thanks in part to government initiatives, public cloud prices for general, compute and memory virtual machines in India are now the lowest among the 10 regions tracked by 451 Research's Cloud Price Index, while leased datacenter capacity in this market is expected to more than triple over the next five years. Overall, hyperscaler pricing rose for the third consecutive quarter in the third quarter of 2023, and Amazon Web Services, Microsoft Corp. (Azure) and Google Cloud continued to add generative AI products and services.

—Read the article from S&P Global Market Intelligence