Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Global Economy Chugs Along

Monitoring growth across the world economy in 2023 is like watching trains trundling slowly along different, yet interconnected, tracks.

“Global economies have mixed macro narratives but a common short list of key issues,” wrote S&P Global Ratings Global Chief Economist Paul Gruenwald, introducing the rating agency’s fourth-quarter global economic outlook report on Sept. 27.

These common issues include slow growth, inflation, subdued global trade and a strong US dollar.

The global economy has not yet hit the buffers. On the plus side, interest rate increases by the US Federal Reserve and other central banks are having an impact on inflation — raising the possibility that the end of the line for rate hikes is near. Another piece of positive news is that the short-lived macro effects of the COVID-19 pandemic, which provoked supply chain disruptions, appear to have departed.

The big risk to the outlook is that demand and inflation remain more persistent than expected, resulting in further increases in rates and a harder landing for the global economy.

S&P Global Ratings improved its forecast for 2023 world GDP growth to 3.1%, up 0.2 percentage point from its previous forecast, partly due to better expectations for the US, Japan and Latin America. Growth expectations for 2024 weakened to 2.8%, down by the same amount, due to downward revisions for economies such as China and the UK.

One of this year’s bright spots has been the US economy, which has outperformed expectations. Following a succession of rate hikes, S&P Global Ratings thinks policy rates may be at their peak, although it may take some time to get inflation close to the Fed’s 2% target. The world’s biggest economy may now endure below-trend growth for an extended period.

In contrast to the US, the eurozone economy trailed behind in 2023 and barely expanded in the last three quarters. Like the Fed, the European Central Bank has been busy battling inflation with higher rates, while steep energy prices amid the war in Ukraine have contributed to a lower trade surplus. Overall, S&P Global Ratings’ 2023 forecast for the 20-member euro area remains unchanged.

China is on a different track. The country’s recovery following COVID-19 had “lost steam,” analysts noted. A property market slowdown has affected business and consumer confidence, industrial production has been subdued and exports and government spending were lower than expected. These factors contributed to a cut in S&P Global Ratings’ China GDP growth forecast for 2023, but underlying strengths remain.

Emerging markets globally have benefited from improved labor dynamics, fiscal support and excess private-sector savings since COVID-19. However, with the prospect of weaker growth in developed countries, developing countries may struggle to avoid the knock-on effects. Tighter monetary policy could also spell trouble for emerging economies, potentially diminishing investment and leading to lower economic and productivity growth.

The UK has endured a combination of high inflation and muted growth in the past year, a trend S&P Global Ratings expects to continue. Real wage growth recently turned positive — an encouraging sign — but other economic indicators don’t look so rosy. “The impact of tighter financing conditions is already being felt throughout the economy, but still has some way to go before it reaches its full effect,” wrote Boris Glass, senior economist at S&P Global Ratings. One factor to watch is the impact on residential mortgages, Glass said.

Canada’s economy saw a mild contraction in the second quarter, due in part to strikes and wildfires that caught global attention. Output in the country’s large natural resources sector was curtailed and growth in services slowed. Factors such as these led S&P Global Ratings to downgrade its expectations for full-year GDP growth by 0.3 percentage point to 1.2%. Canada now appears to be back on a sluggish growth path, albeit with inflation running above target.

Today is Wednesday, November 15, 2023, and here is today’s essential intelligence.

Written by Mark Pengelly.

Singapore's Economic Growth Improves In Third Quarter Of 2023

Singapore's economic growth momentum in 2023 year-to-date has slowed significantly compared with annual GDP growth of 3.6% in 2022. A key factor driving the weakness of economic growth has been contracting manufacturing output and exports. However, GDP growth momentum improved to a pace of 0.7% growth year-over-year (y/y) in the third quarter of 2023, compared with 0.5% y/y in the second quarter of 2023.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

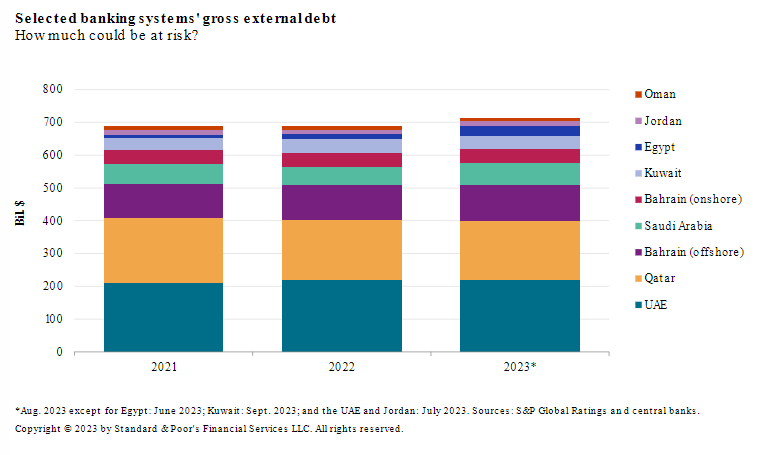

What A Regional Escalation Could Mean For MENA Banks' External Funding

The latest war between Hamas and Israel heightens global geopolitical risks with potential adverse implications for investor confidence and external funding flows. While not underestimating the severity of the human tragedy, S&P Global Ratings assumes the conflict remains largely limited to Israel and Gaza and does not trigger external funding outflows or pressure banking sectors in the Middle East and North Africa. However, there may be scenarios where the conflict widens, leading more risk-averse investors to withdraw funds from the region.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

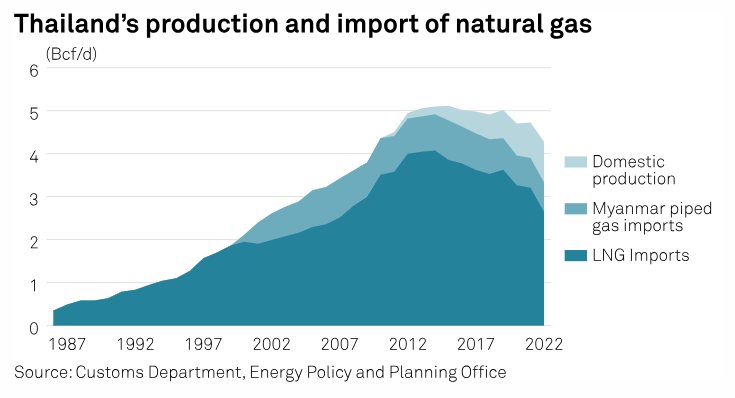

US Sanctions On Myanmar, Russia Pose Risks To Asia's Gas And LNG Supply

In a span of three days, two sets of US sanctions have impacted gas and LNG projects that expose Asian importers to supply risks. On Oct. 31, the US Department of the Treasury's Office of Foreign Assets Control (OFAC) published a new directive that prohibits US persons from providing certain financial services to Myanma Oil and Gas Enterprise (MOGE) aimed at cutting revenue flows to the military regime.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: What To Expect From COP28, The UN’s Big Climate Change Conference

Every year, ESG Insider brings you coverage of the “Conference of the Parties,” or COP, the annual UN summit that convenes world leaders to work together on solutions to tackle climate change. This year’s conference, COP28, takes place in Dubai in the United Arab Emirates starting Nov. 30. In this episode, the ESG Insider podcast is talking about what to expect from the gathering, including what’s at stake and what big themes will be discussed.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

Listen: US Elections 2024: For Republicans, Energy Dialogue Still Possible

With this year’s elections barely in the rear-view mirror, the 2024 US elections are just one year away. Already, there are questions about how energy policy, climate change and prices at the pump will play into this election cycle. Capitol Crude spoke with a Democratic and a Republican strategist for their take on these issues. Last week, Antjuan Seawright weighed in with the Democratic perspective. And this week, you will hear from Tom Hassenboehler, who discussed the GOP’s thinking.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

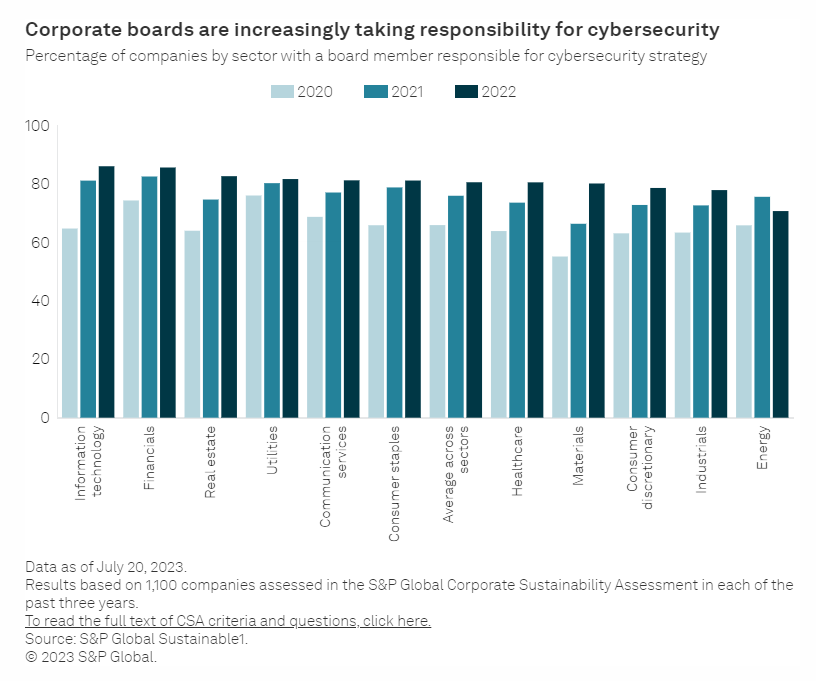

With Cybersecurity Risks On The Rise, Some Sectors Can Do More To Prepare

Cybersecurity breaches and data theft are becoming more frequent and more costly, making information security and consumer data protection key governance issues for companies. S&P Global Sustainable1 data shows that a majority of companies in every sector have given a board member responsibility for cybersecurity strategy, but some companies still lack cybersecurity incident response plans. Among companies that do have plans, almost one-third do not test them regularly.

—Read the article from S&P Global Sustainable1