Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Nov, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Russian Exports Beyond Oil and Gas

In the mid-1950s, worrisome results of air quality studies in Los Angeles drove French mechanical engineer Eugene Houdry to reduce the pollutants found in vehicle and smokestack exhaust. Houdry's solution? The catalytic converter.

Within Houdry’s invention, palladium and platinum serve as oxidation catalysts to reduce harmful emissions in automobile exhaust. Catalytic converters in gas-fueled vehicles tend to use palladium, whereas those in diesel-fueled vehicles use platinum. Autocatalyst makers are in a hurry to substitute palladium with platinum as companies and governments curb their reliance on Russia, a major palladium producer that accounts for about 40% of the world's mined palladium, in response to the country’s invasion of Ukraine.

Russia is a major producer of several other important commodities, two of which — oil and gas — often capture headlines. While oil and gas are lucrative, making them prime sanctions targets, they're far from the only commodities affected by the war in Ukraine and subsequent sanctions.

The list of sanctions continues to grow. What started as targeted sanctions on individuals and entities is quickly metastasizing across industries. The European Council adopted its eighth set of sanctions against Russia on Oct. 6, expanding the import ban on Russian steel products to include semifinished steel, subject to a transition period for some products. This set of sanctions also includes bans on exports to Russia and on imports of certain chemical products from the country, S&P Global Commodity Insights reported.

Sanctions in and of themselves are not the only factors sending volatility cascading through commodity markets. Speculation surrounding future sanctions is also affecting energy and metals trading as market participants work to position themselves favorably in the wake of such uncertainty.

Take nickel, for example. Russia is one of the world's largest producers of class 1 nickel, a critical input for making nickel sulfate for electric vehicle batteries. On March 8, London Metal Exchange, or LME, three-month prices surged above $100,000 per tonne on a historic short squeeze and triggered a suspension in trading due to concerns over sanctions on Russian nickel exports. Prices have simmered since, but the LME's Oct. 6 announcement that it's considering the ban of new Russian nickel from its warehousing network has boosted the LME three-month nickel price.

As for aluminum, an Oct. 12 Bloomberg article speculating about future U.S. actions against Russian aluminum mentioned the potential for an import ban, a spike in tariffs or sanctions on Rusal, one of the world's largest aluminum producers. Chairman Christopher Burnham of EN+, a metals company with a controlling stake in Rusal, warned Oct. 14 that such "irresponsible market speculation" could cause issues for the company by restricting its market access, and could hurt the U.S. economy.

The LME three-month aluminum contract closing price rose from $2,236 per tonne on Oct. 11 to $2,359.5 per tonne on Oct. 13. Market participants have mixed assessments of the article's impact on the market, given that the U.S. has already taken several actions to reduce its reliance on Russian aluminum.

Metals companies, and companies that create renewable and low-carbon technologies, face difficult circumstances as they shift from Russia to alternative suppliers of metals and minerals to realize increasingly ambitious energy transition goals. With the looming possibility of further sanctions and diversification of global commodities imports away from Russia, we may see additional uncertainty in global trade and acceleration in the quest to innovate and adapt.

Today is Tuesday, November 1, 2022, and here is today’s essential intelligence.

Written by Wyatt Scott.

Week Ahead Economic Preview: Week Of Oct. 31 2022

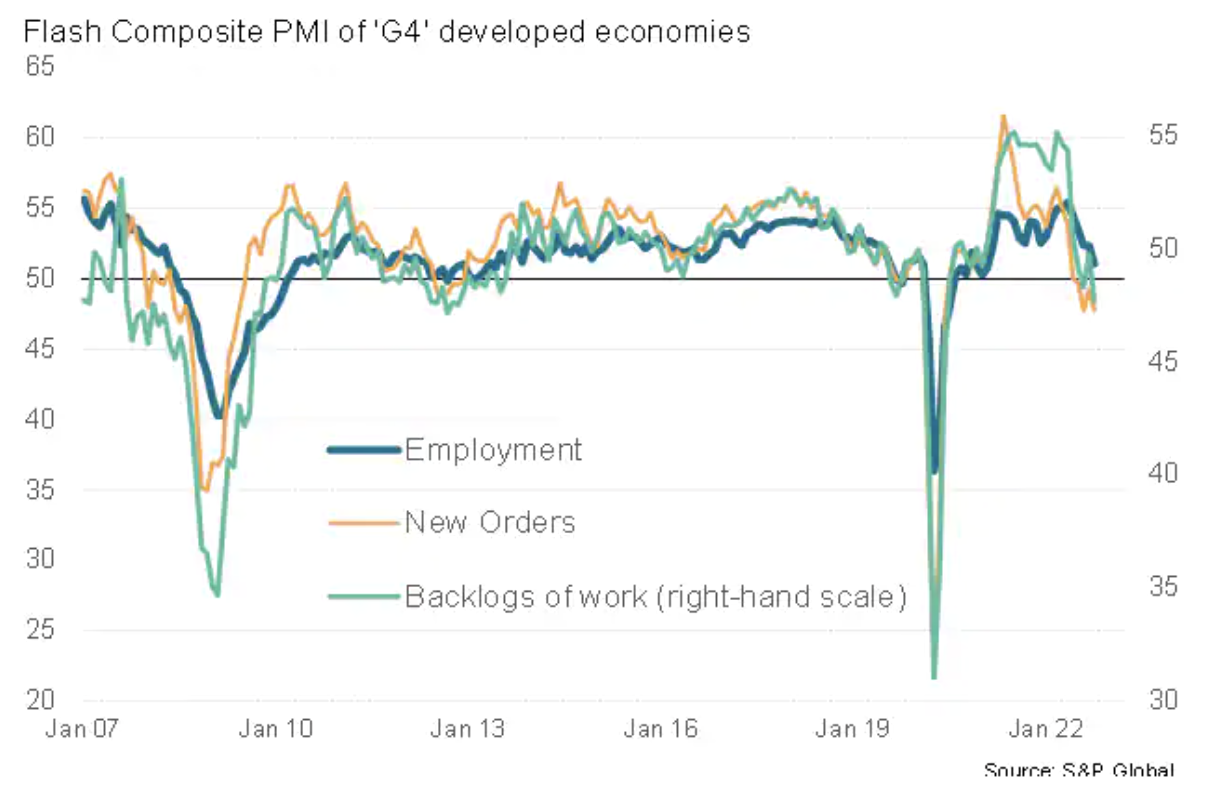

Worldwide manufacturing and services PMI data will be eagerly anticipated next week for the first indications of early Q4 performance around the globe. Intertwined with the PMI data releases will be central bank meetings across the U.S., U.K., Norway, Australia and Malaysia with further rate hikes expected, especially from the US Federal Reserve. A series of tier-1 economic data including October U.S. payrolls and eurozone Q3 GDP and October flash CPI figures will also be anticipated.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Private Equity Moves Cautiously; Deals In Japan On The Rise

Private equity fund managers have plenty of investable capital at their disposal, but they've been slower to put that money to work this year amid high inflation and signs of a global recession. The total value of private equity entries across the globe dropped more than 60% year over year in September to $34.91 billion. The industry recorded $587.99 billion in entries between Jan. 1 and Sept. 30, about 30% lower than the $853.01 billion total through the first nine months of 2021.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

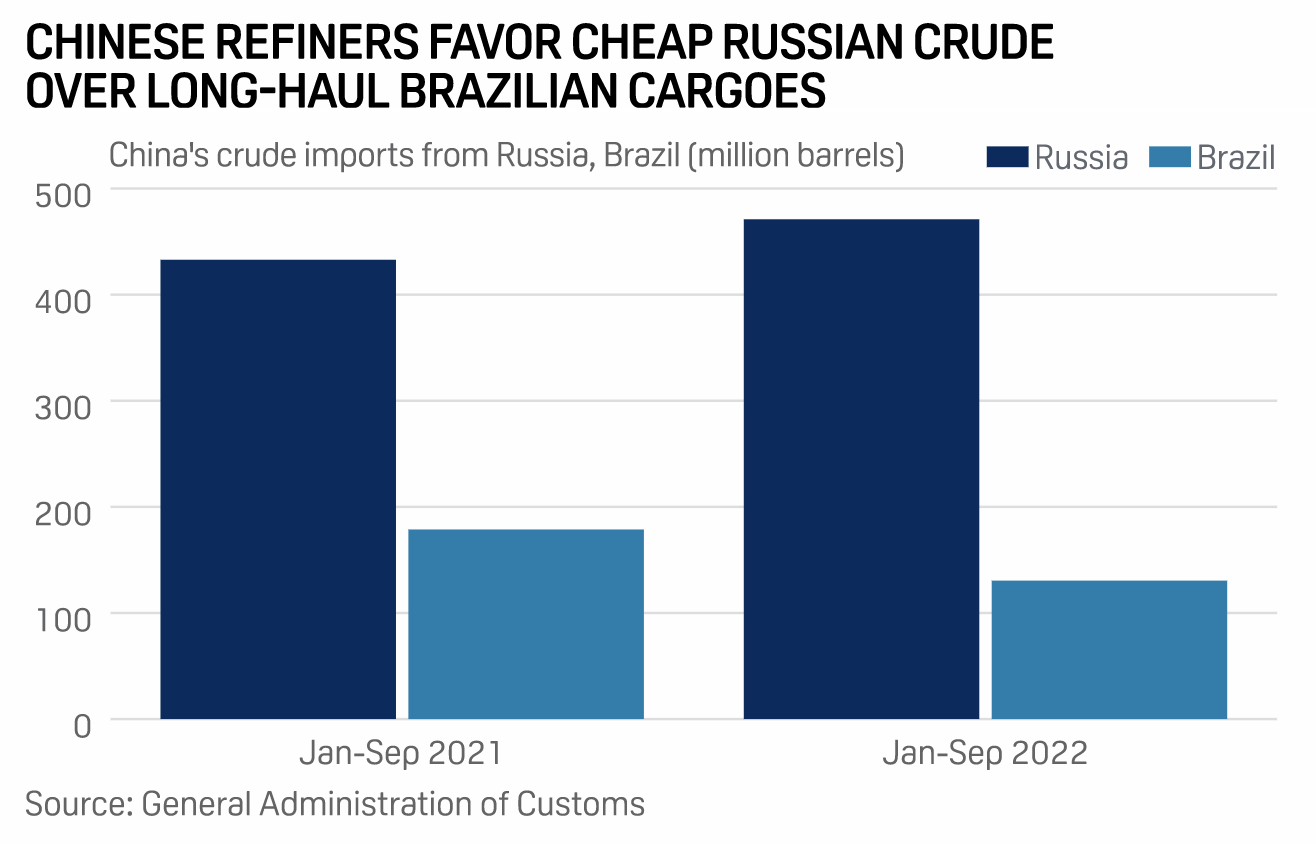

Asian Buyers Cautious As Dec. 5 Ban On Russian Crude Nears

Uncertainty surrounding the impact of the western ban and implementation of a price cap on Russian oil from Dec. 5 are giving pause to China and India's appetite for Russian crude oil, industry sources told S&P Global Commodity Insights. Refiners and crude buyers from both these key Asian markets for Russian oil are unsure as to what to expect post Dec. 5 and this was reflected in the little to no trade information heard for December-loading Far East Russian barrels, traders said.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Climate Modeling In Focus As We Count Down To COP27

In this episode of the ESG Insider podcast, hosts Lindsey Hall and Esther Whieldon look at how companies and investors are using climate modeling to measure and manage the future financial impacts of climate hazards such as wildfires, drought and flooding. According to a new S&P Global Sustainable1 dataset, 92% of S&P Global 1200 companies will have at least one asset highly exposed to physical hazards by the 2050s under a business-as-usual high-emissions scenario.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

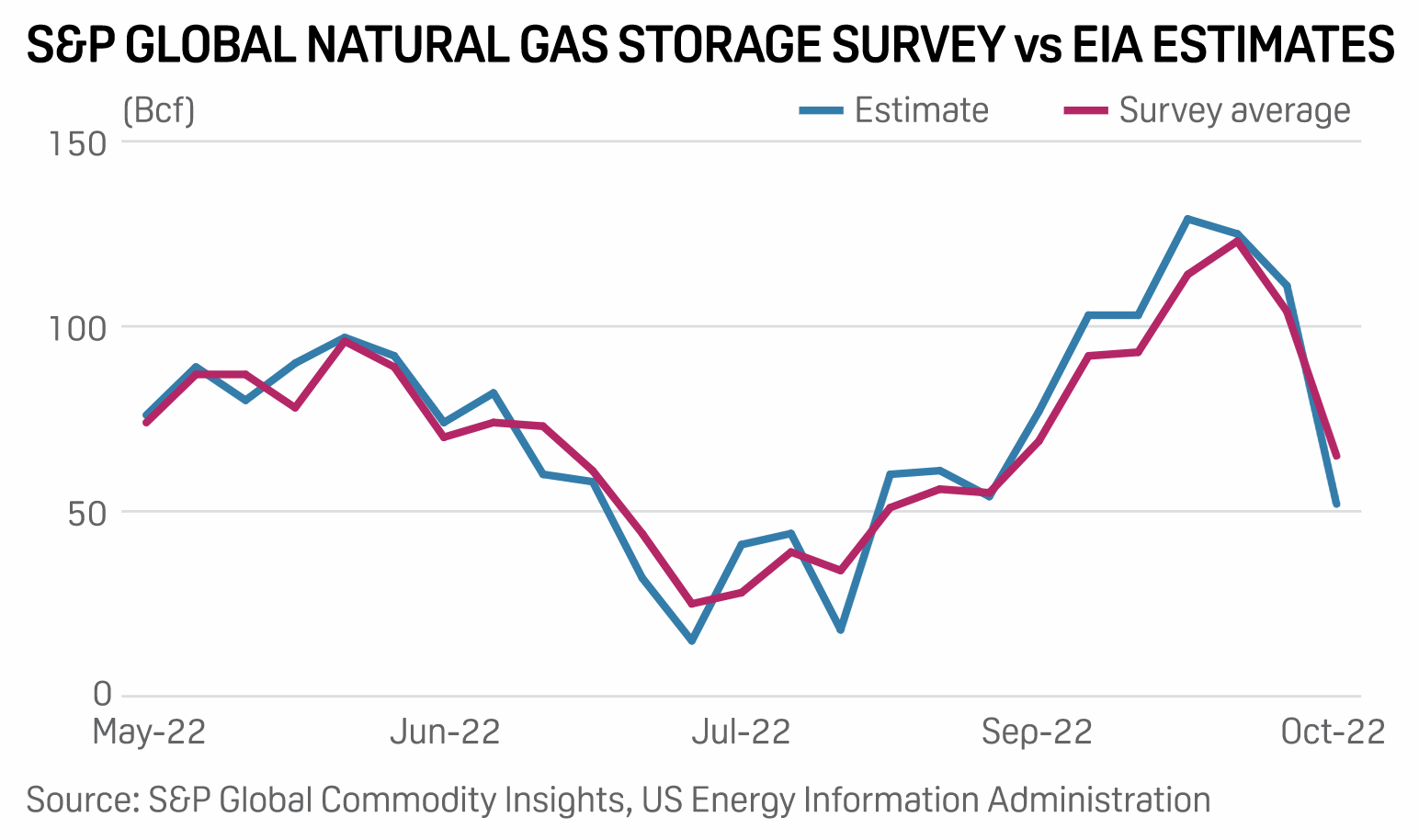

Bullish U.S. Gas Storage Report From EIA Ends Streak Of Triple-Digit Injections

The U.S. Energy Information Administration on Oct. 27 reported a surprisingly bullish 52 Bcf injection to natural gas inventories during the prior week as colder temperatures across the Central and Eastern U.S. fueled a sharp rise in heating demand, tightening the domestic supply-demand balance. Total injection demand during the week ended Oct. 14 undershot the consensus expectation for a 65 Bcf addition to stocks, projected by S&P Global Commodity Insights' survey of analysts.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

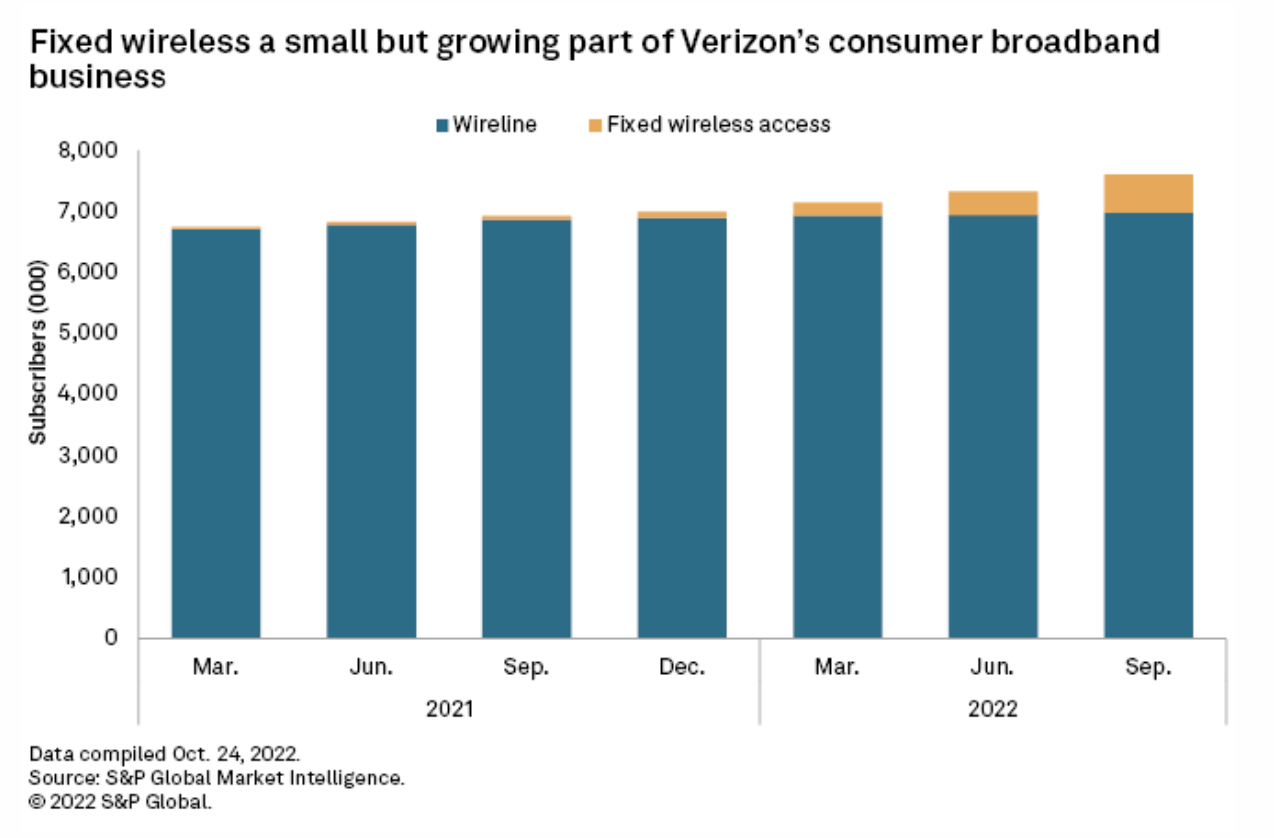

Cable Broadband Business Challenged By Fixed Wireless Expansion

Cable companies had trouble keeping up with the competition in the broadband space in the first half of the year, and strong results from wireless operators may indicate that trend remained unchanged in the third quarter. All eyes will be on broadband adds when Charter Communications Inc. and Comcast Corp. report later this week, said John Fletcher, an analyst at Kagan, a media research group within S&P Global Market Intelligence.

—Read the article from S&P Global Market Intelligence