Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 May, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Positive Prospects for Islamic Finance

While the global economy braces for a slowdown over the next couple of years, Islamic finance looks set for steady growth.

Islamic finance, which operates in compliance with sharia, or Islamic law, is a rapidly expanding segment of the global financial market. It has been on the upswing in recent years, with assets managed by sharia-compliant financial institutions crossing the $3 trillion mark in 2022. From 2023 to 2024, this sector is projected to grow at a rate of about 10%, according to an S&P Global Ratings report.

The S&P Global BMI Shariah index rose 3.5% and the Dow Jones Islamic Market World Index increased 3.4% during the first quarter, outperforming conventional benchmarks. This outperformance was mainly spurred by increased exposure to IT stocks within Islamic indexes, which were up 22.6% in the first quarter, and the lack of exposure to conventional banks and financial services, which experienced turmoil during the period.

The Islamic finance market's upward trajectory was buoyed mainly by growth in banking assets. The Gulf Cooperation Council countries, particularly Saudi Arabia and Kuwait, accounted for 92% of the increase in Islamic banking assets in 2022. Although Saudi Arabia is poised for an economic slowdown due to reduced oil production, the country is set to remain a major growth contributor to the Islamic finance industry. In Southeast Asia, Islamic banking is forecast to see an uptick of about 8% in the next couple of years, even as Malaysia and Indonesia face an economic slump. Generally modest growth in banking assets is expected in Egypt and Turkey despite pressure on the Egyptian pound and depreciation of the Turkish lira.

The issuance of sukuk — an Islamic finance certificate akin to a bond — is also a major driver. Although new issuances are predicted to drop in 2023, they will continue to exceed maturing sukuk. Issuance volumes are expected to come from corporates, particularly in countries implementing transformation initiatives such as Saudi Arabia's Vision 2030. Issuers with elevated capital requirements, including in Egypt and Turkey, will likely turn to the sukuk market.

Notwithstanding its growth pace, Islamic finance is still finding its footing globally and is hindered by structural weaknesses. Given its high concentration in the Middle East and Southeast Asia, S&P Global Ratings views Islamic finance as more “a collection of local industries rather than a truly globalized sector.” Greater standardization, partly through the digitalization of sukuk issuance, is needed to widen Islamic finance’s geographical and market appeal.

"If sukuk became an equity-like instrument, we believe that investor and issuer appetite, as well as pricing mechanisms, would likely change significantly," S&P Global Ratings said in its report.

Sustainability-linked sukuk issuance also remains limited, though Islamic and sustainable finance are naturally aligned. To be sharia-compliant, financial institutions must share the risks and rewards of a transaction with their clients. Sharia prohibits excessive interest, uncertainty of payout, gambling, speculation and investment in forbidden industries such as alcohol and tobacco. These principles share some links with environmental, social and governance considerations.

“We believe that this will change, and we expect to see higher volumes of sustainability-linked sukuk as issuers try to meet investor demand and core Islamic finance countries seek to reduce their carbon footprint and support the global energy transition,” S&P Global Ratings analysts said.

Today is Wednesday, May 17, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

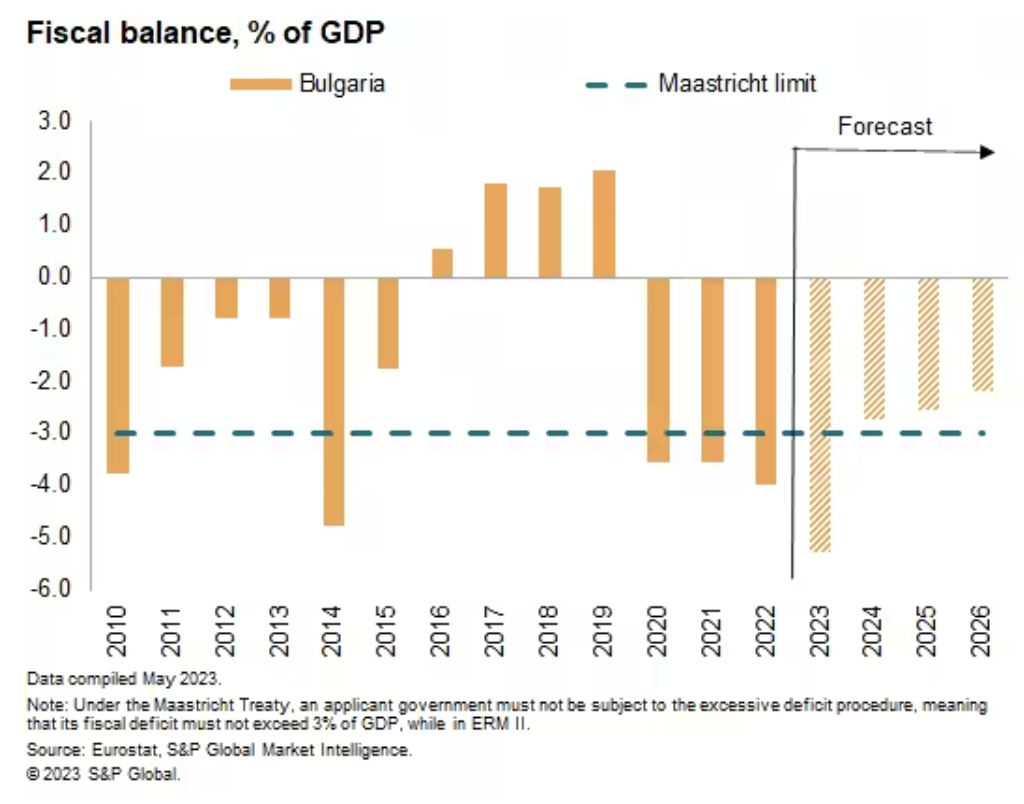

Euro Adoption: After Croatia, Who's Next?

Following Croatia's accession on Jan. 1, 2023, seven out of 27 EU member states are yet to adopt the euro. While some, such as Bulgaria, would like to join but do not fulfill the convergence criteria, others, such as Hungary, Denmark and Sweden, lack the political willingness. Overall, S&P Global Market Intelligence expects the current seven non-eurozone EU countries except Denmark and Sweden to join the currency union between 2026 and 2040, but it is political will rather than Maastricht criteria that will determine the timeline.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

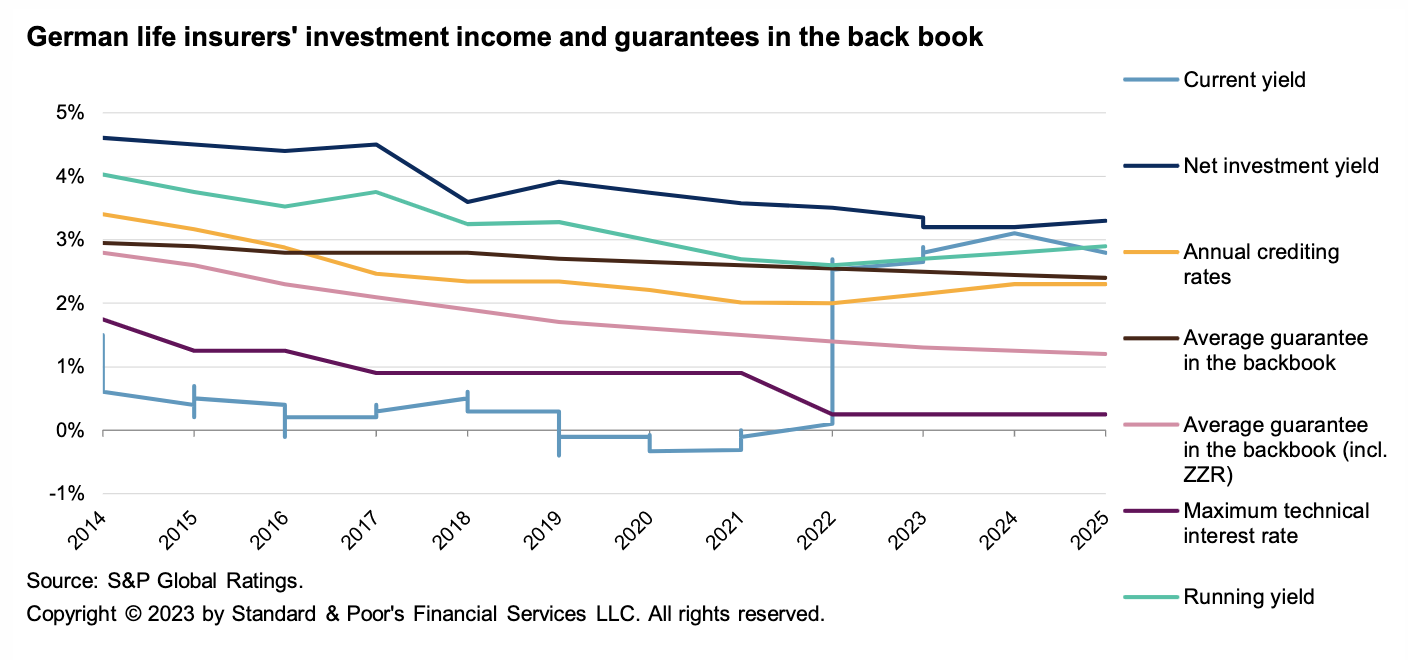

Rising Interest Rates Are A Double-Edged Sword For German Life Insurers

After suffering from ultra-low interest rates over the past decade, German life insurers now face new challenges. On the one hand, higher rates will mean a rise in net investment yields, while on the other the sector's exposure to unrealized losses and less-liquid assets may present risk, coupled with pressure on business volumes. As a response to the ultra-low and partly negative interest rate environment, in the past few years the sector and legislation reacted with several measures to withstand the pressure.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

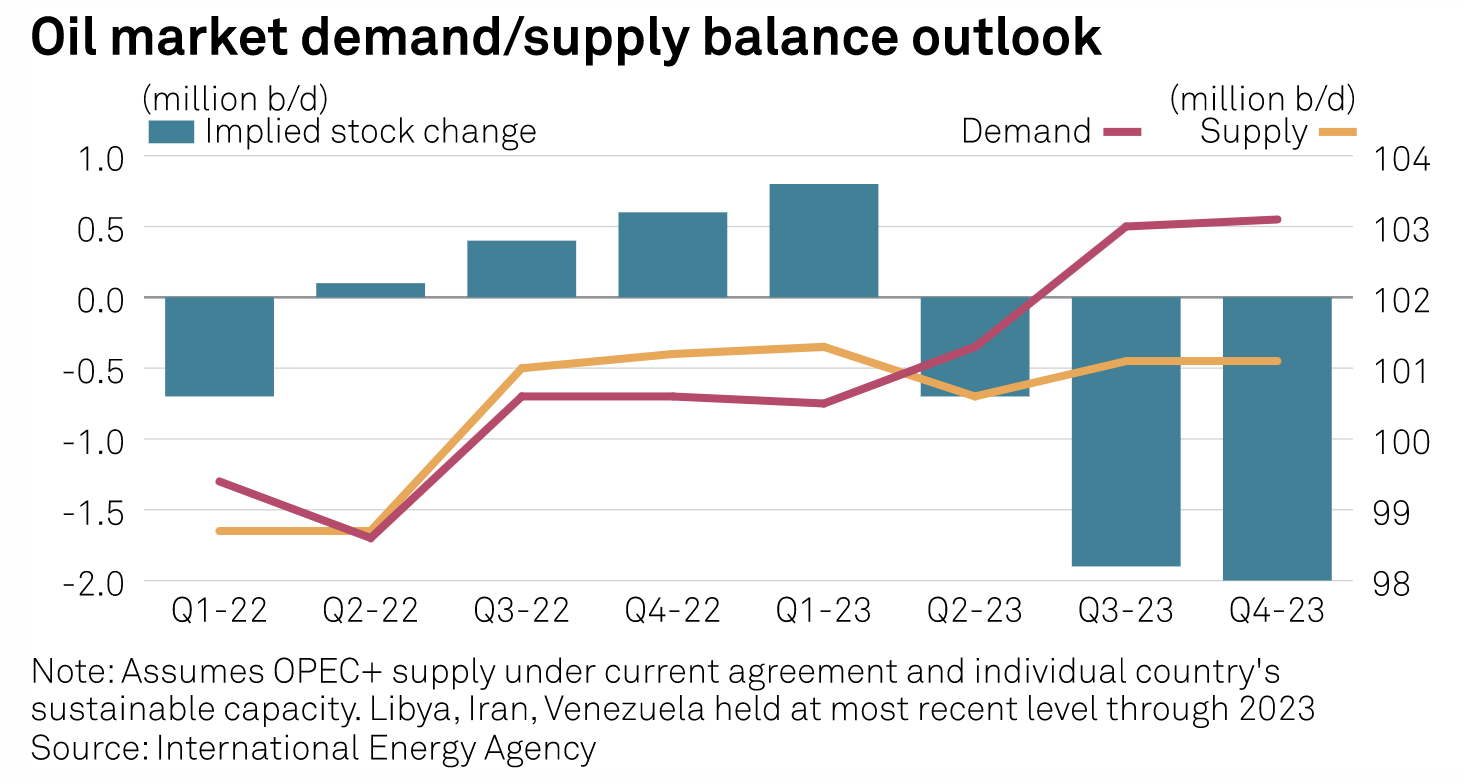

IEA Raises 2023 World Oil Demand Growth Forecast On Chinese Travel Revival

Global oil demand is set to expand faster than expected this year to reach 102 million b/d, with the most recent Chinese mobility data showing the country's economy continues to rebound from pandemic lows, the International Energy Agency said May 16. The IEA now expects global oil demand to grow by 2.2 million b/d year on year in 2023, some 200,000 b/d higher than last month's report, to 102 million b/d, it said in its latest monthly oil market report.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Governance: Taking A Close Look At The ‘G’ In ESG

While no universal definition of governance exists, elements included in all definitions are heavily influenced by one defining thing: at its core, governance relates to the process of undertaking smart short- and long-term decisions for an organization. Focusing on governance through the lens of credit risk, a narrower definition can be derived. Governance should include issues related to: a) how an enterprise is managed, b) its relationships with shareholders and stakeholders, creditors and others, c) its ownership structure and d) how internal procedures and policies create or mitigate risks.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

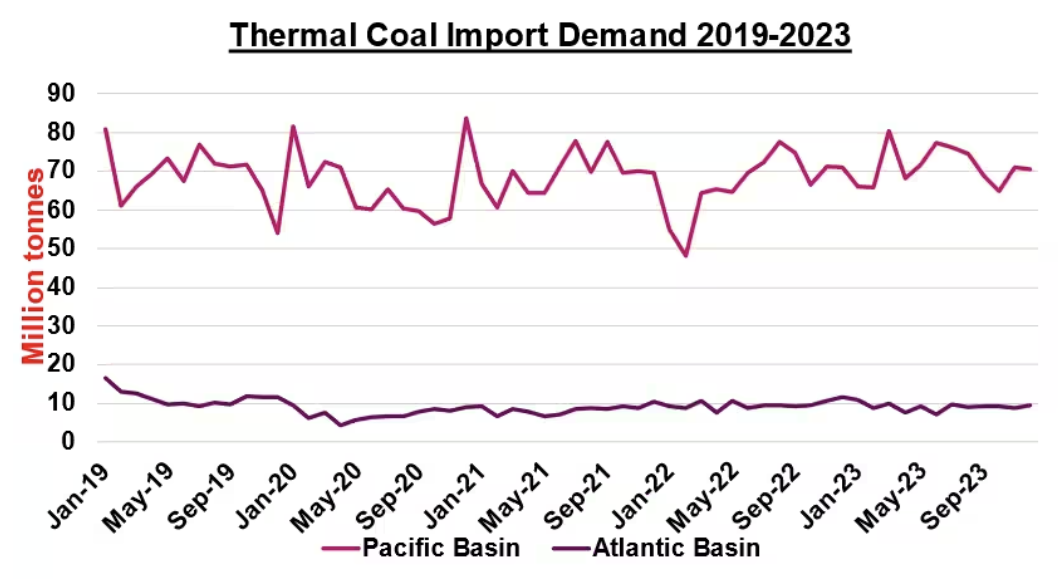

Summer 2023: Global Thermal Coal Supplies Target Pacific Basin Demand As Atlantic Basin Appears Well Stocked

S&P Global Commodity Insights has updated its International Thermal Coal Market Forecast, May 5, 2023. In Asia, the recent heat wave and restocking efforts for summer power demand is supporting Pacific Basin thermal coal prices. Although prices remain low in the Asian spot market, demand is slowly beginning to appear among buyers in China and India and smaller spot buyers. Global thermal coal prices remain under pressure and have moderated to end 2021 levels prior to the Russia-Ukraine war. The decline in global spot thermal coal prices is boosting the ability of smaller, more predominantly spot thermal coal buyers in Asia to increase coal generation to meet near-term demand (versus the limits of 2022 due to prices).

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 116: Securing Digital Experiences

The modern digital business is wrestling with how to balance competing concerns across data management, privacy and security. Sheryl Kingstone, Paige Bartley and Justin Lam return to the podcast to look at how organizations are addressing them with host Eric Hanselman. Data is needed to improve customer and employee experience, but regulations are imposing restrictions on its use. At the same time, data security concerns are driving the adoption of new technologies. What’s a business to do?

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Content Type

Location

Language