Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 May, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

What Will Happen Next For Europe’s Gas Crisis?

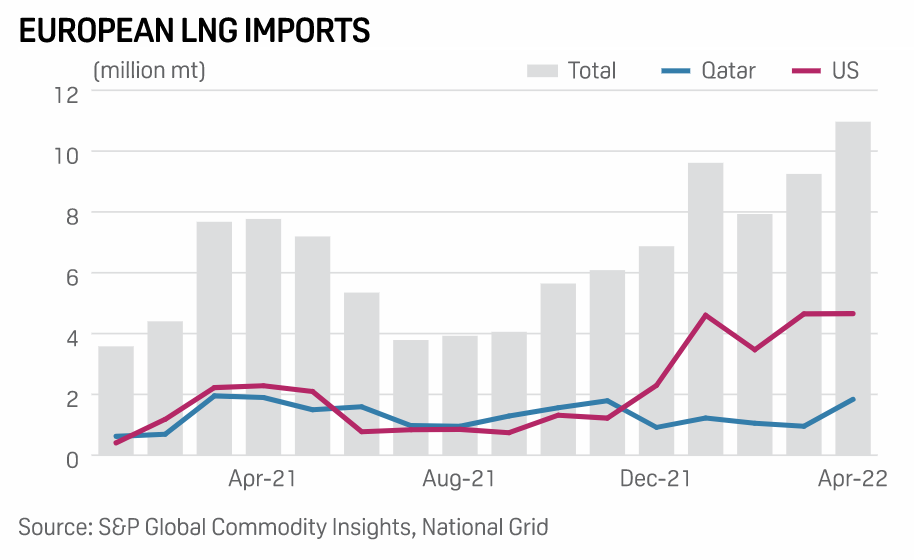

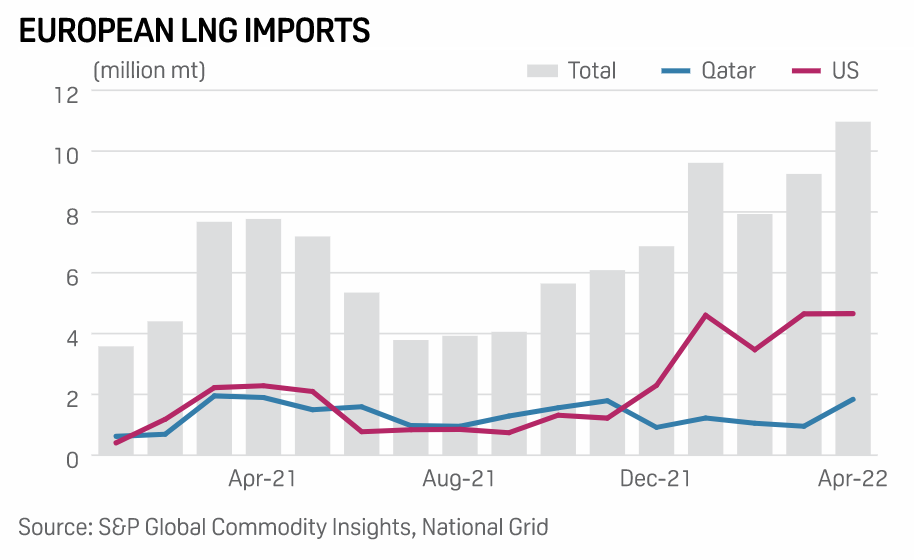

In the latest development in Europe’s evolving energy crisis, Ukraine suspended flows of Russian natural gas through its pipeline system to Europe—sending prices soaring, reinforcing the region’s need for more liquified natural gas supplies, and compounding concerns about the continent’s energy security.

Marking the first time that Ukraine declared any reduction of gas flows to Europe since Russia invaded its country on Feb. 24, the state-owned gas grid operator GTSOU stopped accepting and allowing for the transport of Russian gas through its system starting May 11. This affects the nearly one-third of Russia's Ukrainian gas transit passing through the Novopskov compressor station on the Soyuz pipeline, which enters Ukraine at GTSOU’s Sokhranivka entry point on the border with Russia, according to S&P Commodity Insights. Natural gas prices subsequently spiked across Europe, escalating market volatility.

This is the latest event in a series of trials and tribulations for the European Union, which depends on gas imports—90% of its supply, of which approximately 32% comes from Russia.

“The sanctions on Russia have precipitated a renewed conversation around sources of energy reliance and the pace of the energy transition,” IHS Markit, now part of S&P Global, said in recent research. “Whether and how to delink supply chains [and] whether and how to ensure commodity security are now top of the global agenda.

But as the bloc seeks to phase out Russian fossil fuels over the next six months before eliminating its reliance by 2027, Russian gas exports to Europe via its four main corridors—Nord Stream, Yamal-Europe, Ukraine, and the TurkStream string—have stayed at levels higher than in January and February but have started declining since March, according to an S&P Global Commodity Insights analysis. Russia’s Gazprom suspended natural gas supplies starting April 27 to European countries that refused to pay their contracts in rubles, which would be a direct violation of sanctions. Most recently, Moscow on May 11 sanctioned Gazprom subsidiaries across Germany in retaliation to the EU’s actions against Russia.

Having suffered from high energy prices for months before the Russia-Ukraine war began, LNG has emerged as a key source of flexibility for the European market as the conflict continues to cast a shadow of uncertainty over the future of Europe’s energy security. Another S&P Global Commodity Insights analysis found that Europe’s soaring natural gas prices have resulted in the strongest supply response from global LNG sources that the region has ever seen. In particular, U.S. market participants have expressed strong desires to reinforce their position in order to meet Europe’s needs, according to S&P Global Market Intelligence. Japan and the EU announced on May 12 its plans to support each countries’ LNG supplies and efforts to reduce reliance on Russia for energy.

"LNG is on everybody's mind these days," Chevron Chairman and CEO Michael Wirth told investors on April 29, according to S&P Global Market Intelligence. "It's important [in] meeting Europe's needs. It's important [in] delivering a lower carbon energy system globally. And we see this strong market here in the near term."

To date, S&P Global Ratings has taken more than 200 ratings actions on financial and nonfinancial corporates, sovereigns, and international public finance public entities citing the Russia-Ukraine conflict, commodity prices, or both as direct or indirect factors driving the decision.

Today is Friday, May 13, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

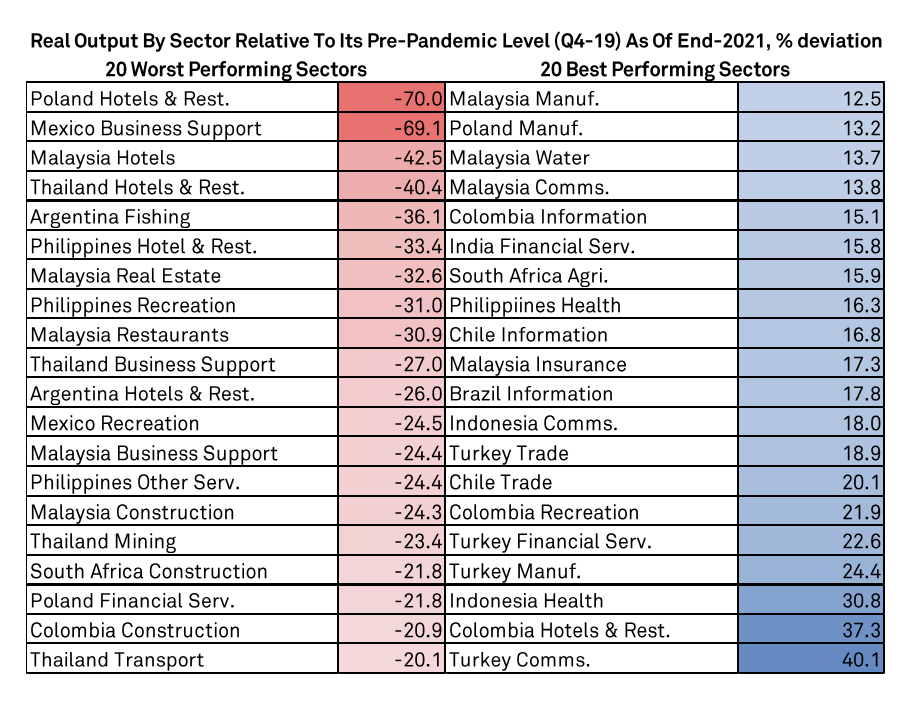

Economic Research: Emerging Markets: Where Is The Slack At The Sector Level?

Emerging Markets are facing a challenging period as they navigate through tighter monetary policy in the U.S., the repercussions of the Russia-Ukraine conflict, and the impact of COVID-19-related lockdowns in China. Those dynamics threaten to set back the economic recovery from the pandemic downturn, which in most EMs is far from complete as those new challenges emerge.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Listen: Take Notes: Private Equity Collateral Fund Obligations In 2022

The latest episode of Take Notes brings Chris Plumb and Jie Liang to discuss Private Equity CFOs, including the recent Astrea 7 transaction. Disruptions from the COVID-19 pandemic led to temporary performance fluctuations in the outstanding Astrea transactions S&P Global rates. Rising rates and market volatility may affect returns on the underlying private equity assets in the near term.

—Listen and subscribe to Take Notes, a podcast from S&P Global Ratings

Access more insights on capital markets >

U.S. Natural Gas, LNG Future Brightens On Demand Shifts, Quest For Supply Security

Expectations are building among U.S. oil and gas executives that the European gas crisis will accelerate the next supercycle of U.S. LNG export projects, supporting their companies' growth ambitions. LNG companies during the most recent earnings reporting season highlighted a flood of commercial deals for U.S. LNG in recent months as supporting the buildout of new production capacity, especially as demand in Europe surges following Russia's invasion of Ukraine.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Interview: U.K.'s National Grid Targets Hydrogen Network Build From 2026

National Grid aims to start linking industrial clusters in the U.K.'s northeast with dedicated hydrogen pipelines before the end of the decade, the transmission company's Project Director for Hydrogen, Antony Green, told S&P Global Commodity Insights in an interview May 11. Construction of Project Union could start in 2026, with a first phase completed by 2028, he said.

—Read the article from S&P Global Commodity Insights

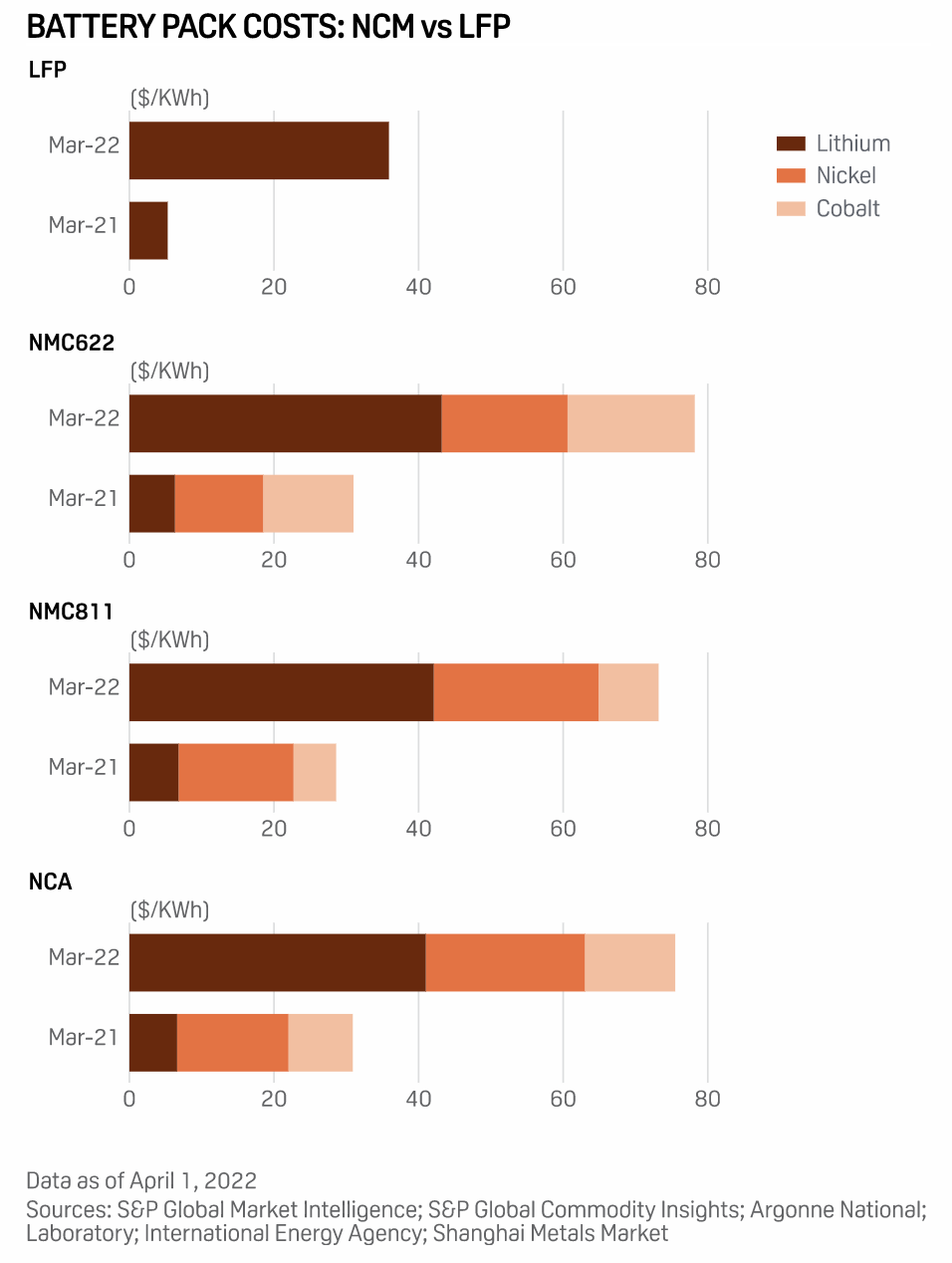

Is LFP Still The Cheaper Battery Chemistry After Record Lithium Price Surge?

Steep rises in battery raw materials prices since the start of 2021 are causing speculation over either demand destruction or delays and have led to the belief that automotive companies could shift preferences for their electric vehicles. The lowest-cost pack has always been lithium-iron-phosphate, or LFP. Tesla has been using LFP for its China-made entry-level models since 2021. Other carmakers such as Volkswagen and Rivian also announced they will use LFP in its cheapest models.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Southeast Asia's Telcos To Look To Tower, Tech Deals As 5G Rollout Costs Add Up

Southeast Asia telcos will likely step up tower sales to help pay for 5G upgrades and make further tech investments as the sector settles down after a wave of operator mergers. Shedding towers is a straightforward way for operators to raise cash for debt reduction and costly 5G investments because the masts appeal to investors, such as pension funds seeking long-term assets with steady revenue streams. That demand saw about 14,000 towers change hands in Indonesia alone last year, while Malaysian operator U Mobile Sdn. Bhd. is now considering a $120 million sale, according to Bloomberg News.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

Declining global growth on the back of the Russia-Ukraine conflict and a slowdown in China are weighing on the domestic debt-carrying capacity of frontier markets in Africa. Sizable nonresident positions in some local bond markets, such as in Egypt, Ghana, and South Africa, boost liquidity, but often at the expense of increased sensitivity to current shifts in global monetary policy. Where nonbank financial institutions are well developed (most clearly in South Africa), some sovereigns possess additional buffers against external volatility. Many African sovereigns enter this challenging post-pandemic period with high existing domestic debt stocks and large refinancing requirements.