Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Return to Growth in China, With Caveats

For decades, GDP growth in China was the envy of the world. A manufacturing- and export-led economy powered unprecedented economic growth and improved the lives of Chinese citizens. In 2022, restrictions on travel and mobility aimed at controlling the COVID-19 pandemic led to a year of unusually tepid growth. With the lifting of restrictions in 2023, many China experts expect a bounce-back year for the economy. But long-term, secular challenges, including the balance between consumption and savings, geopolitical tensions with major trading partners and concerns around the health of state-owned enterprises and the property sector, may mean the pre-pandemic era of outsized growth has come to an end for China. Today’s modest growth targets could become the new normal.

In early March, China’s National People’s Conference — known as the "Two Sessions" — set a GDP growth target of 5% for 2023. Since Jan. 21, consumer spending in the country’s service sectors has bounced back from the low levels of 2022, when pandemic restrictions were still in place. The growth in consumer spending, combined with the relatively modest GDP target, seems to indicate the government has no immediate plans for monetary or fiscal stimulus, which may impact local government support for state-owned enterprises.

GDP growth in China may prove challenging, given trade tensions and a preference in Chinese households for savings over consumption. Savings play a larger role in the Chinese economy than in the U.S. or Europe. Even under pandemic restrictions, China's household deposits hit an all-time high of 17.9 trillion yuan, or $2.589 trillion, in 2022. Respondents to a recent People’s Bank of China survey indicated that more than 60% of urban savers preferred "more savings," while only 16% preferred "more investment."

While having excess savings appears to be an enviable problem from the perspective of debt-heavy Western economies, the growth of deposits works against the long-term goal of “rebalancing” the Chinese economy. Since the mid-to-late 2000s, China has been attempting to shift its growth model from export-dependent investment in industry to domestic consumption. Despite government efforts to encourage consumption, this rebalancing process has stalled or even reversed in recent years.

Consumption in China, as in the rest of the world, can be achieved through an increase in the disposable income of low- and middle-income households. But a slowdown in property investments and the prospect of trade decoupling with the US has hit these groups particularly hard.

According to S&P Global Ratings, property sales in China fell by nearly 28% in 2022 and will drop by a further 6%-8% this year. Foreign investment in the Chinese property sector may also stall as investors in China's defaulted offshore bonds might have to wait two or more years before recovering funds under workout deals. The investors are unlikely to receive full face value on the debt they hold.

The property sector is not expected to return to the explosive growth of the past, given a declining population. The impact of population decline will affect all aspects of the Chinese economy, from commodities to energy need.

According to Louis Kuijs, chief economist for Asia-Pacific at S&P Global Ratings, “The coming years should reveal to what extent COVID is to blame for changes in China's medium-term trends, and to what extent they are more long-lasting.”

Today is Wednesday, March 29, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

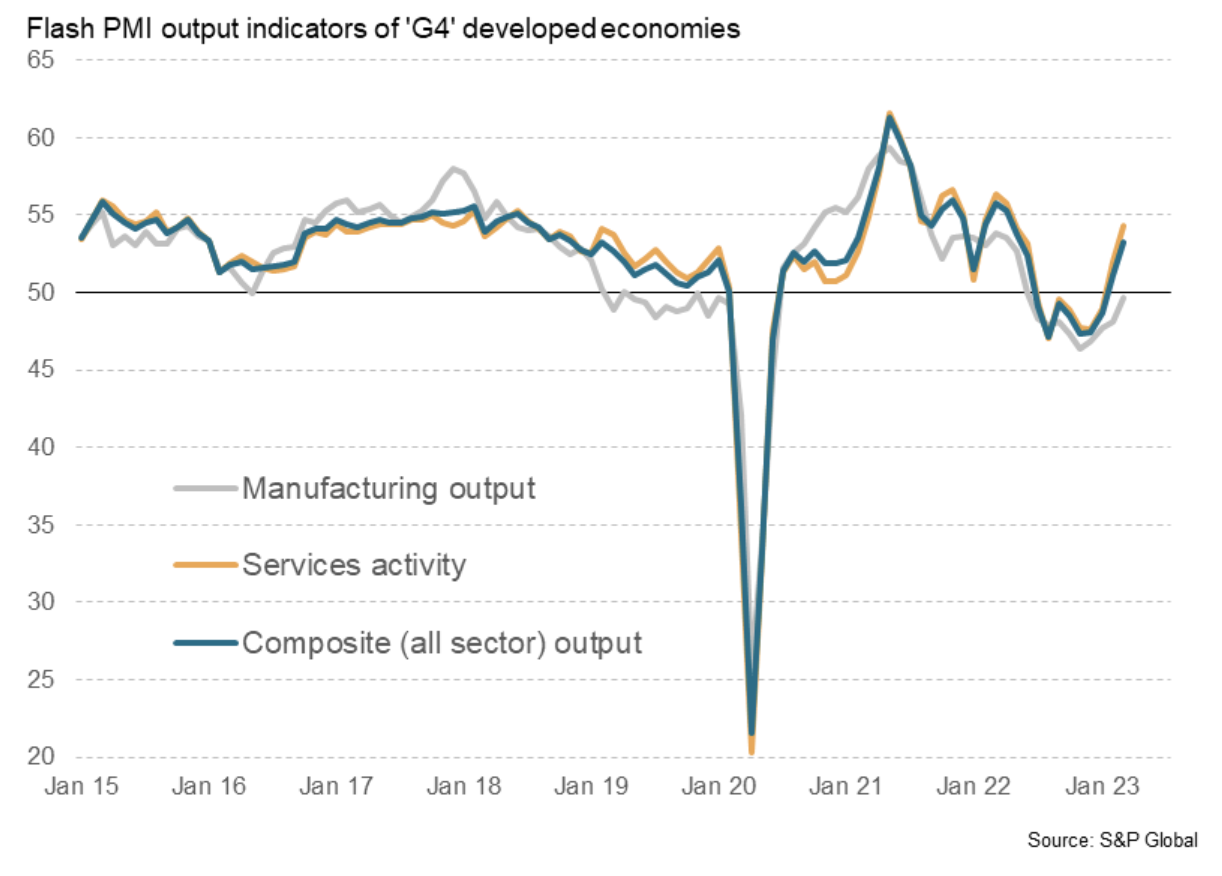

Flash PMI Data Signal Accelerating Developed World Economic Growth In Marc

Business activity rose across the four largest developed world economies (the "G4") for a second successive month in March, according to provisional 'flash' PMI data, the rate of growth accelerating to the fastest since last May. The sustained upturn adds to signs that global recession risks have abated, for the near term at least, contrasting markedly with the gloomy picture presented by the surveys heading into last winter.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Credit Conditions Asia-Pacific Q2 2023: Still Steady, Banking Turmoil Risk Is Moderate Here

A contagion spillover into Asia-Pacific is less likely, though not impossible, given the behavior of liability holders is difficult to predict. S&P Global Ratings believes the region's banks are shielded from the turmoil emanating from recent failures and the rescues of some global peers.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

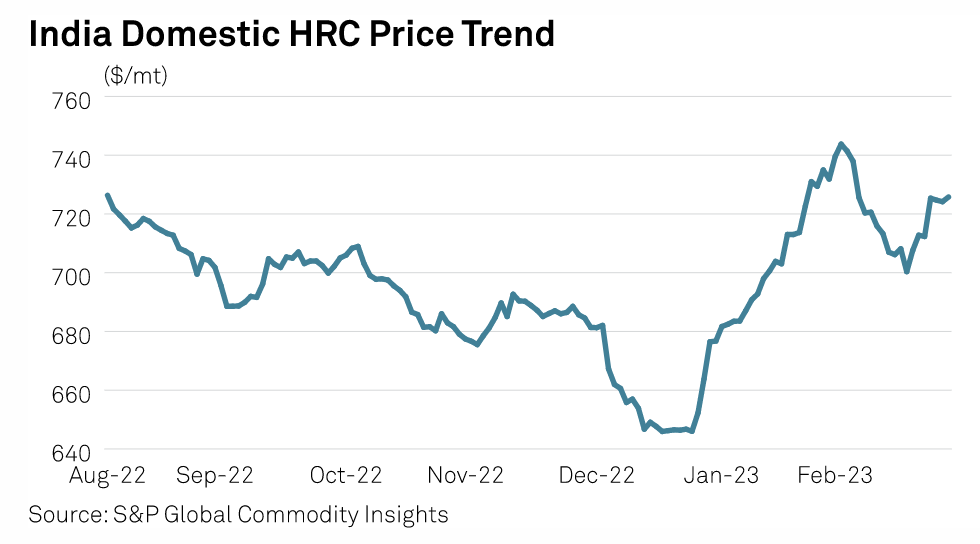

India Likely To Turn Net Steel Importer In FY 2022-2023

India is likely to swing to becoming a net importer of finished steel in the financial year ending March 31, 2023, showed provisional data from the Joint Plant Committee. In the year ended March 31, 2022, India was a net exporter of finished steel, with outflows of 13.49 million mt versus imports of 4.67 million mt. The country's exports of finished steel over April 2022-February 2023 fell 52% on the year to 5.90 million mt while imports rose 29.5% to 5.59 million mt.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

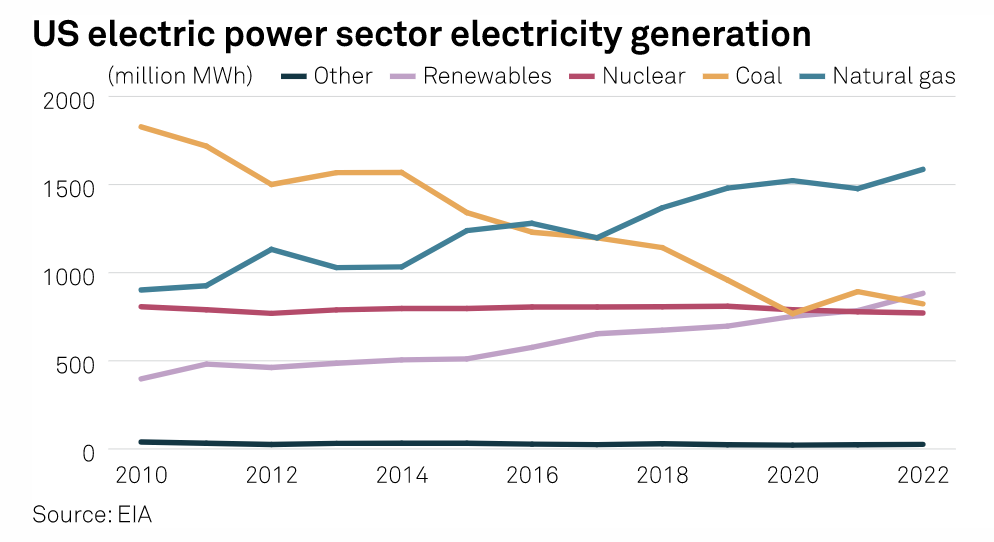

U.S. Renewable Generation Surpassed Coal For The First Time In 2022, Nuclear Second Time

U.S. renewable power generation surpassed coal-fired generation for the first time in 2022 and surpassed nuclear generation for the second time, as wind and solar capacity climbed, the U.S. Energy Information Administration announced March 27. Combined renewables, including wind, solar, hydro, biomass and geothermal, provided 21% of the 4.09 GWh of electric power produced last year across the U.S., compared to 19% in 2021, according to the EIA. At the same time, coal-fired generation's share slipped from 23% in 2021 to 20% in 2022 as a number of coal-fired power plants retired and the remaining plants were used less.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: ‘The Bear Is In Control’ As Oil Market Contends With Banking Crisis Fallout

A global banking meltdown rattled the oil market in recent weeks and sent crude futures plummeting. OANDA senior market analyst Ed Moya was optimistic that relief was in store for the oil sector from the banking turmoil but he also warned of the Jekyll and Hyde nature of the market as risks remain. On the podcast, he discussed the lingering impact the banking crisis would have on energy sector investments and project financing, prospects for intervention by OPEC and implications for U.S. oil production. He also touched on how current market dynamics may impact prices at the pump and U.S. plans for replenishing the Strategic Petroleum Reserve.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

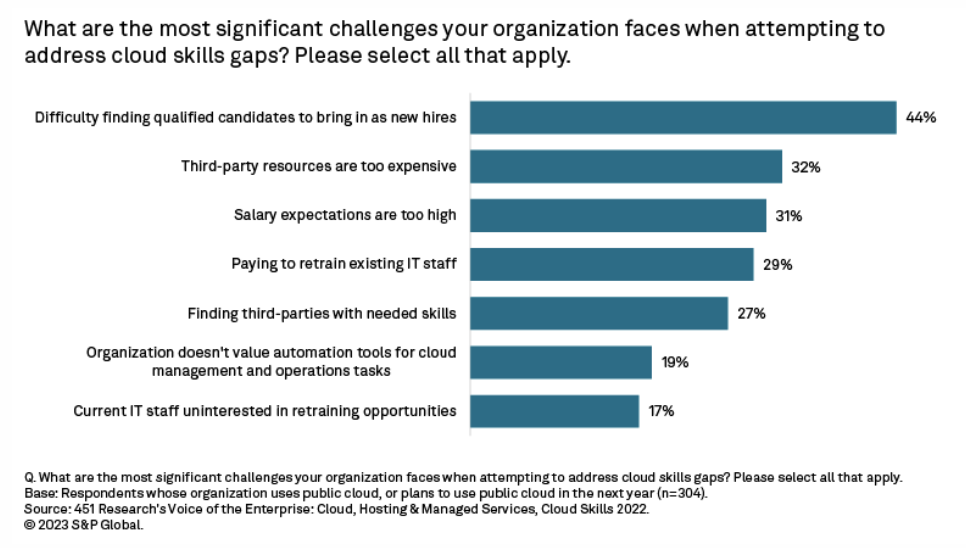

Closing The Cloud Skills Gap: A Perennial Problem For Businesses

With labor and skills shortage remaining a major threat to business performance, it makes sense that the top three places where businesses plan to spend money in 2023 are in hiring and wages (29%); retention, "upskilling" and engagement (22%); and digital transformation including cloud, security and automation (20%). Despite these planned recruitment investments, hiring remains challenging overall. More than 51% of respondents to 451 Research's Macroeconomic Outlook survey said it has been somewhat or very difficult to hire new employees or bring back furloughed employees over the past 12 months.

—Read the article from S&P Global Market Intelligence