Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The ‘Search for Yield’ Bites Back at Private Markets

During the extended decade of lower-for-longer interest rates, many investors, especially institutional investors, reexamined their allocations to fixed-income assets. With yields driven down on some instruments below the rate of inflation, a search for more yield motivated many investors to explore booming private markets. Now, as interest rates creep upward, the yield on fixed-income instruments has improved, and the cost to finance many private market transactions has also increased. While private markets look to have won a permanent place in the allocations of institutional investors, a dip in private equity fundraising and valuations is entering its second year.

In the run-up to 2021, private equity fundraising was easier. Multiple firms announced increasingly larger funds, and the amount of dry powder in the market became a point of concern for unrealistic valuations. But fundraising got harder in 2022, and 2023 looks to continue that trend. More than three-quarters of the private equity executives who participated in S&P Global Market Intelligence’s 2023 Private Equity Outlook Survey said they expect fundraising to remain as challenging as it was last year or to grow more difficult. In addition, 45% of respondents indicated they think conditions will deteriorate, and private market experts do not anticipate a turnaround for fundraising until at least 2024.

“Because the interest rate environment has gone up so much in the last year or so, many people are now buying Treasury bills or other fixed-income instruments because the yield is pretty good,” David Rubenstein, co-founder of The Carlyle Group, said during a recent interview with S&P Global Ratings Senior Director Joe Cass. “And so, I suspect that the private market part of one’s overall investment portfolio is probably down a little bit.”

With higher interest rates affecting the cost of capital, transaction values and volumes are both down in 2023, according to data from S&P Global Market Intelligence. Private equity entries for February were down 57% year over year.

Sovereign wealth funds, like other institutional investors, appear to have lost their taste for private equity deals. The value of deals with sovereign wealth fund investment fell by almost half last year. In 2022, the 11 deals that involved sovereign wealth fund investment totaled $39.03 billion, compared with $74.36 billion across 10 deals a year earlier.

Even in this challenging environment, some private market transactions have experienced relative growth. Yields on private credit, for example, remain attractive despite higher interest rates. Private credit is funding more private equity-backed take-private transactions. According to S&P Global Market Intelligence, the percentage of take-private deals as a share of all private equity deals has doubled to about 40% in 2023.

Rubenstein, with his long experience in the ups and downs of private markets, remains philosophical about the current headwinds: “Overall, I would say that private markets are likely to outperform public markets again.”

Today is Tuesday, March 28, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week Of March 27, 2023

After the Fed meeting and March flash PMI releases, a series of economic data takes over as the highlights to watch amid increasing financial market stress. This includes the U.S. core PCE data, eurozone inflation and early PMI figures out of some APAC economies. A number of central bankers will also be making appearances across the week, including Fed members, and their comments are expected to be closely watched for further insights into how financial stability could detract from the inflation focus.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

This Week In Credit: Contemplating The Next Move

Stable early Monday morning pricing in the banking sector provides hope but no guarantee of a less volatile week ahead. The U.S. Federal Reserve and Bank of England each signaled last week that their tightening cycles could be near an end, but it is a complicated picture. Inflation remains well above target, but market turmoil has triggered a tightening of credit conditions for now at least.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

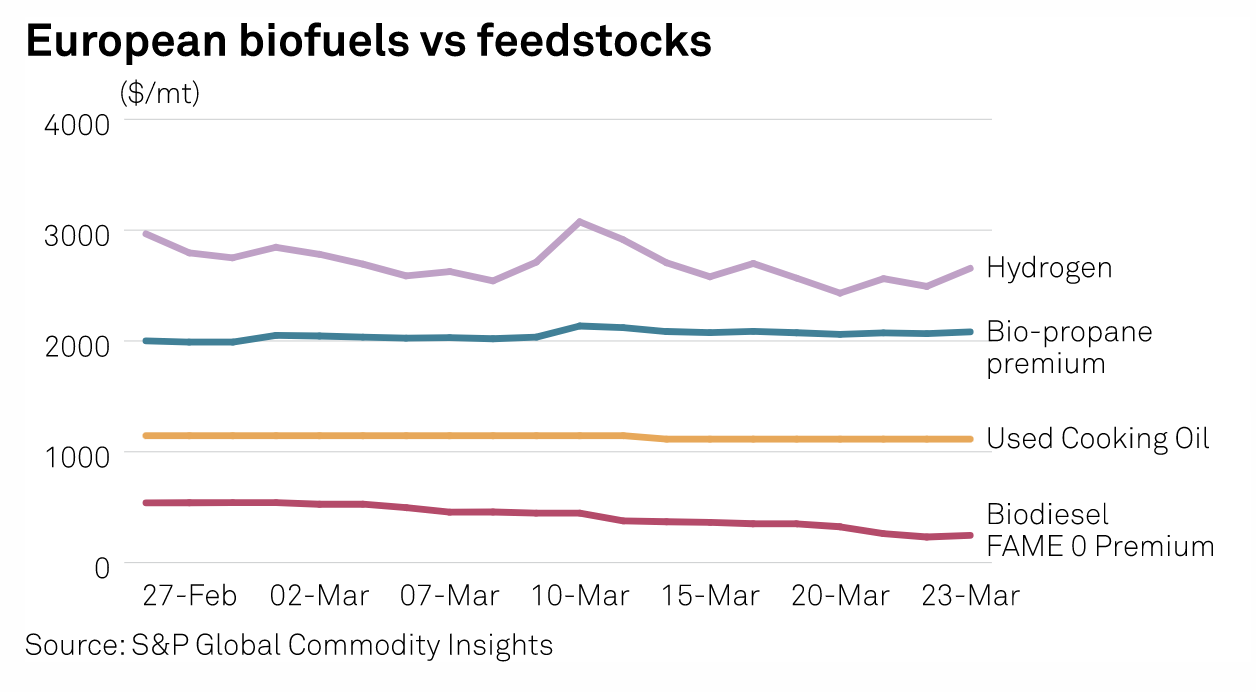

Feedstock Volatility, High Prices Weigh On European Biofuels Markets

European feedstock volatility has stalled the supply growth of biofuels and resulted in high prices that have dampened demand for bio-diesel and bio-propane, according to fuel distributors in Europe. Platts, a part of S&P Global Commodity Insights assessed the bio-propane market at $2,610.50/mt or a $2,082/mt premium to the conventional CIF NWE large cargo assessment on March 23. This was up from $2,583.25/mt or a $2,066/mt premium from the previous day but down from a $2,087/mt premium from the previous week.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

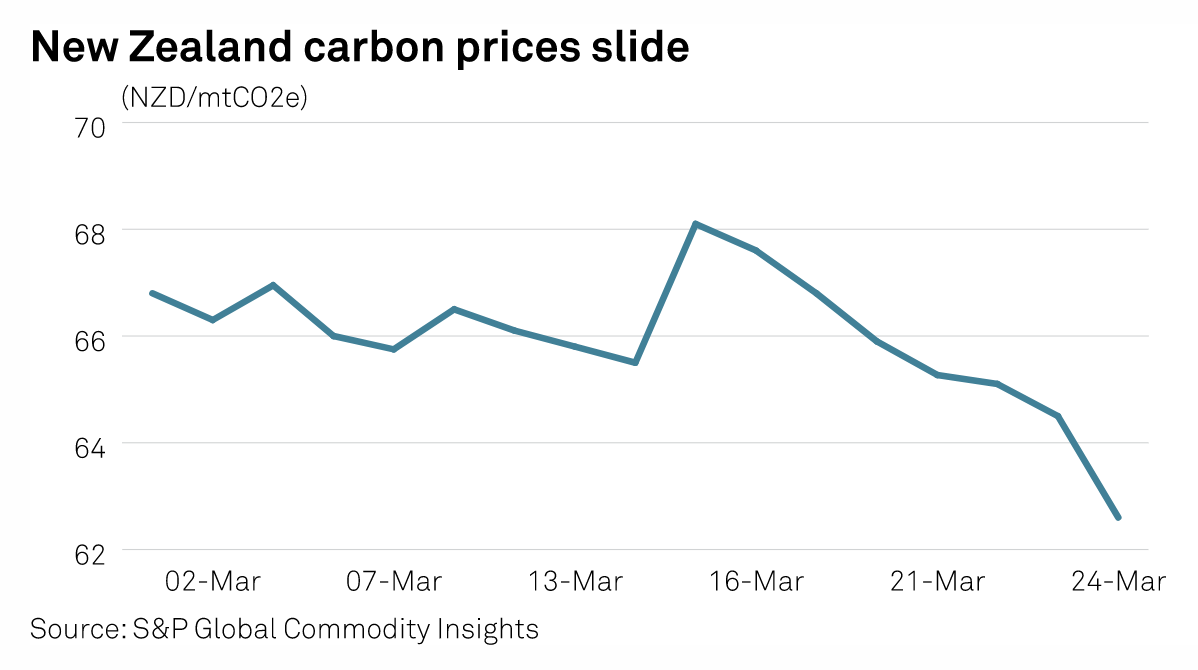

New Zealand's Carbon Allowance Unit Prices Slump To 18-Month Low, Market Cautious On ETS Review

Prices of New Zealand Units, or NZUs, the country's emission trading carbon allowance unit, dropped to 18-month lows March 24 after a short-lived jump from a failed auction on March 15, while uncertainty over regulatory changes to the system cast a pall on the market, sources told S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Visualizing Corporate Renewables Contracted In The US And Around The World

Nearly 78% of tracked renewable energy contracted by U.S. corporations is situated in the U.S., but procurement in the rest of the world — particularly in India and Europe — is rising fast. Compared against the U.S., capacity inventoried across 15 non-U.S. markets in the S&P Global Market Intelligence 2023 corporate renewables report showed larger increases year over year.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

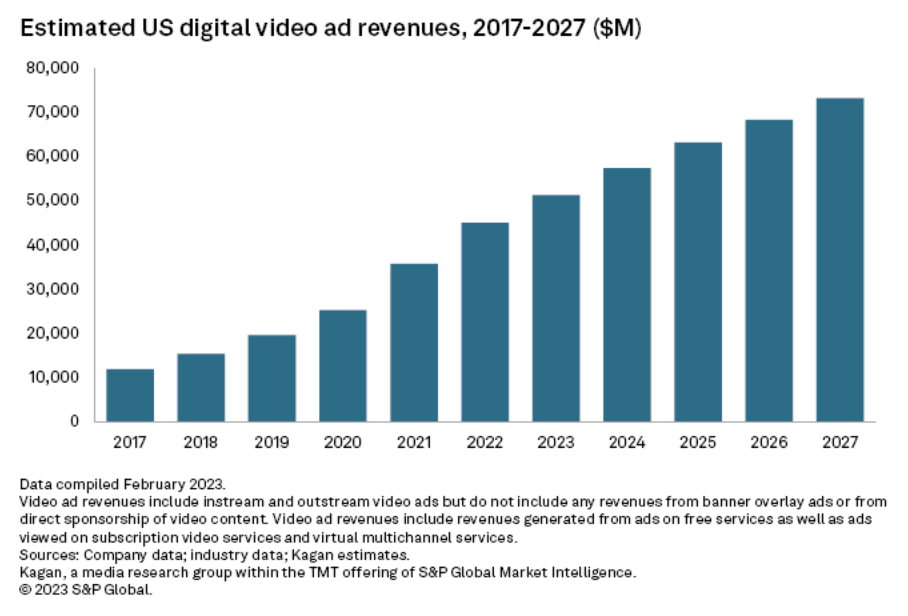

U.S. Video Ad Revenue Projections Through 2027

Digital video advertising revenues in the U.S. are poised for steady gains in coming years even as macroeconomic headwinds could gust well into 2023. We estimate that total U.S. video ad revenues could top $73 billion by 2027, benefiting from the broader shift of advertising spend migrating to digital formats and from consumers embracing streaming video services.

—Read the article from S&P Global Market Intelligence