Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Carbon Capture Experiences Growing Pains

Carbon capture and sequestration weighs heavily on the minds of energy market participants. As countries and companies pursue net-zero goals, carbon capture is emerging as a vital technology. If fossil fuels remain part of the energy mix, particularly in hard-to-decarbonize industries such as steel and cement, then capturing and storing carbon emissions will be a planetary imperative. However, carbon capture and sequestration (CCS) technology that has been proven in the lab is experiencing normal growing pains as it moves to an industrial scale.

Carbon prices have been moving toward record highs, even before Europe’s Carbon Border Adjustment Mechanism comes into effect in 2026. But CCS developers insist that state support will remain necessary because of technology risk, an underdeveloped market and the challenges of growing laboratory technologies to industrial scale. In the U.S., CCS enjoys enhanced support due to the Inflation Reduction Act, with a tax credit of up to $85 per metric ton of CO2 captured. But experts insist further support is necessary because carbon capture represents a pure cost to emitters. Developing a business from CCS requires a company to both capture a reliable stream of carbon emissions and find a way to store them.

On March 6, at the CERAWeek conference by S&P Global, Chevron announced that it would expand its CCS project on the Texas Gulf Coast to increase the project's storage capacity to more than 1 billion metric tons of CO2.

But this project, and others like it, has led to accusations that CCS is merely a greenwashing technology designed to allow oil and gas producers to conduct business as usual. While carbon capture advocates find these arguments frustrating and unscientific, many CCS projects have been designed to capture CO2 so that it can be injected into existing oil wells to extract more CO2-emitting oil from the ground. Most existing industrial-scale CCS projects aid this kind of enhanced oil recovery. Saudi Aramco has been developing the industrial complex of Jubail, Saudi Arabia, as a carbon capture hub with the goal of using CO2 to improve the yield from existing wells.

While some environmental advocates dismiss CCS based on these types of applications, the fact remains that the technology requires industrial-scale projects to prove feasibility and lower costs. Technologies tend to become cheaper over time. According to S&P Global Commodity Insights, costs for carbon capture additions are expected to be reduced by 15%-30% in the next five years as the second generation of projects benefits from knowledge gained in developing the first generation. Despite concerns over their motivations, deep-pocketed oil and gas companies may be necessary partners in developing the technologies that will reduce carbon emissions.

Today is Monday, March 27, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

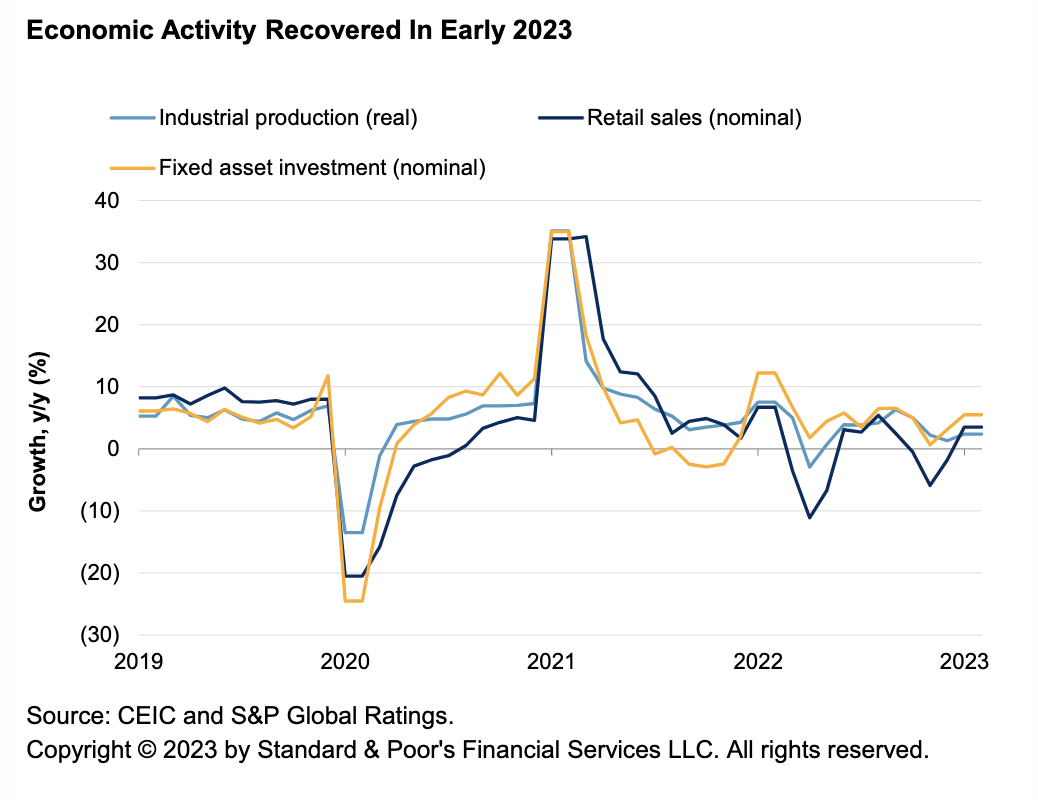

Economic Research: Economic Outlook Asia-Pacific Q2 2023: China Rebound Supports Growth

S&P Global Ratings maintains its cautiously optimistic outlook for Asia-Pacific. China's economy is on track to recover this year. For other economies this will dampen but not offset the hit of slower growth in the U.S. and Europe, the fading impact of domestic re-opening post the pandemic and higher interest rates. S&P Global Ratings expects the region excluding China to grow at 3.8% in 2023, after 4.7% in 2022. In most economies, inflation should decline, although elevated core inflation will prod some central banks to raise rates further. External pressure from rising U.S. interest rates will likely push some others to lift rates further too.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Banking Turmoil, Not Rate Hikes, May Get Fed To 2% Inflation Goal

If the ongoing turmoil in the banking sector worsens, the Federal Reserve will no longer need to hike rates, as tighter credit conditions will bring inflation down toward its 2% target, Fed Chair Jerome Powell said. "We're thinking about that as effectively doing the same thing that rate hikes do," Powell said during his March 22 press conference. "So, in a way, that substitutes for rate hikes."

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

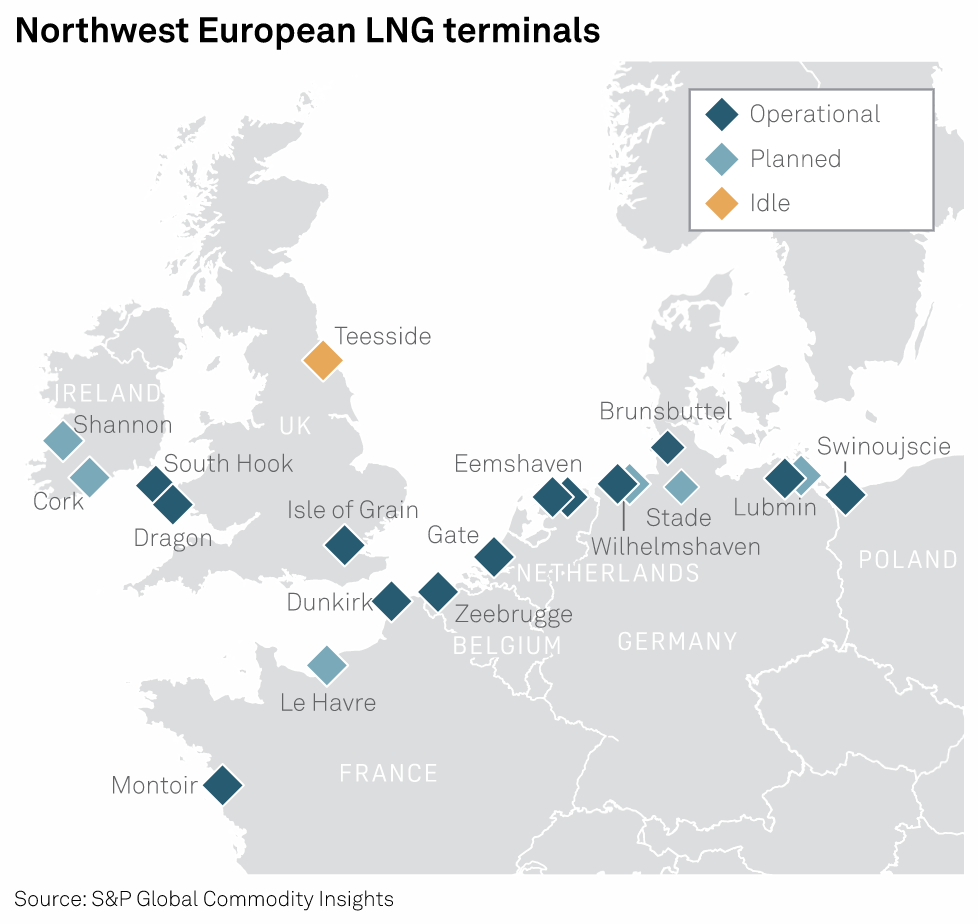

Germany In Talks Over Spare Nord Stream 2 Pipes As Denmark Eyes Object Salvage

The German government is in "confidential" talks with the operator of the Nord Stream 2 gas pipeline system about using spare pipes from the project for a new floating LNG import facility at Lubmin in northeastern Germany. Nord Stream 2 was completed in September 2021 but never started commercial operations despite the two strings of the pipeline being filled with gas in December 2021. There remained spare pipeline not used in the construction of Nord Stream 2 after a shorter route via Denmark was ultimately approved.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

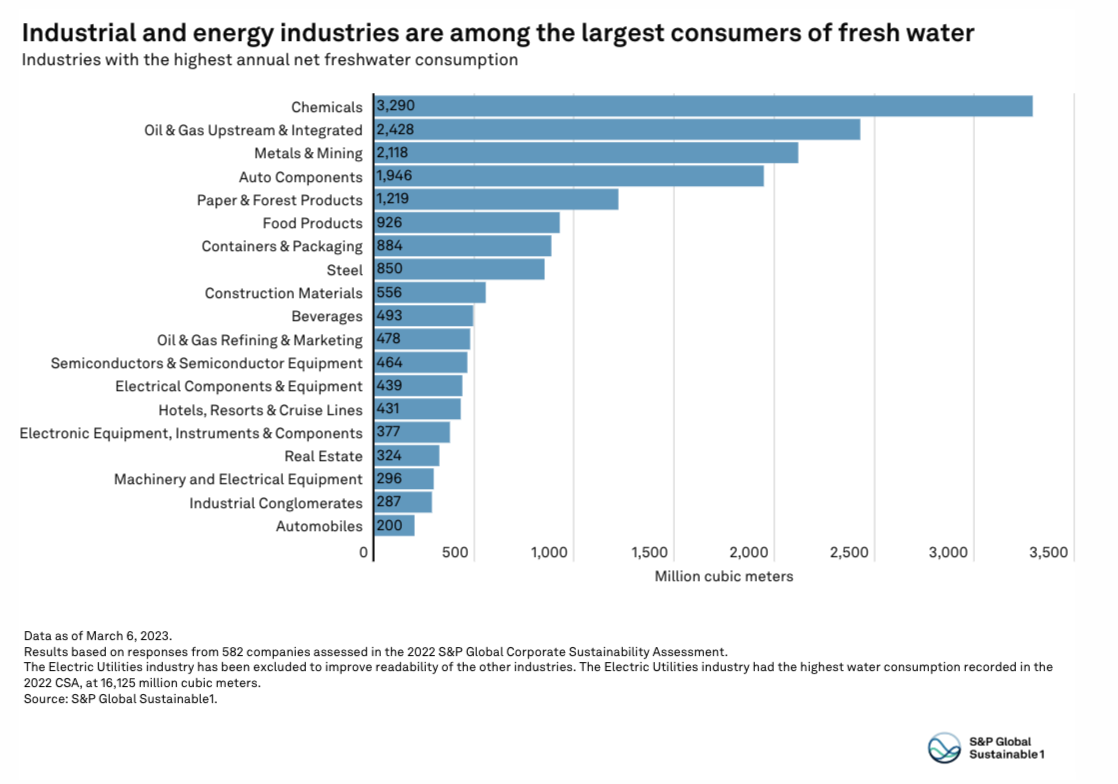

How Global Food Producers Are Responding To Rising Water Stress

Water conservation will become increasingly important over the coming decades as cropland in many of the world’s largest food-exporting countries face exposure to water stress, S&P Global Sustainable1 physical risk data shows. About half of major food and beverage producing companies have a publicly available commitment to sustainable agriculture, which focuses on preserving natural resources such as fresh water; not all of those commitments cover the full scope of their supply chain, according to the 2022 S&P Global Corporate Sustainability Assessment.

—Read the article from S&P Global Sustainable1

Access more insights on sustainability >

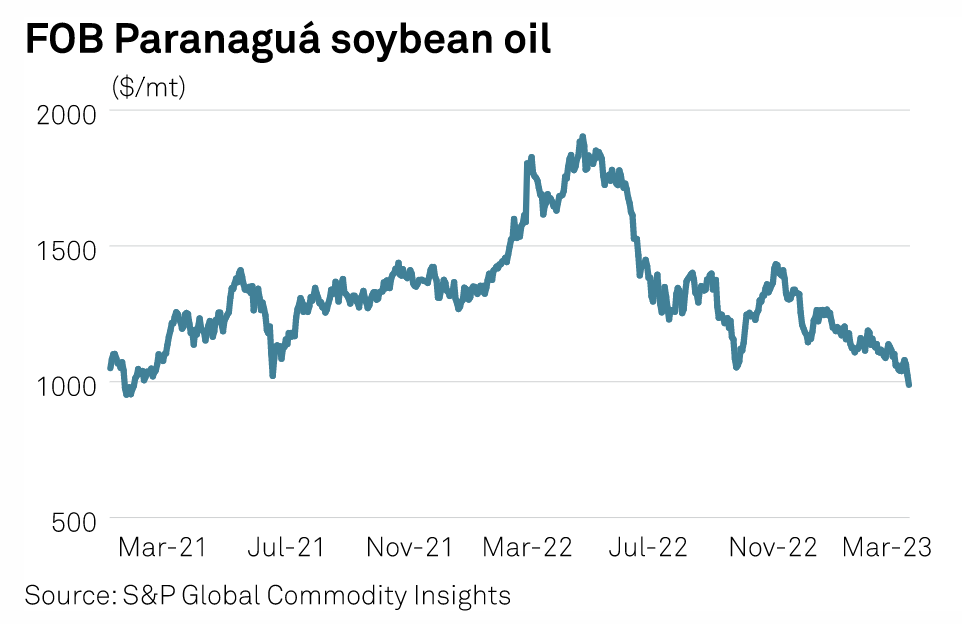

South American Soybean Oil Prices Drop To More Than Two-Year Low

FOB soybean oil cash prices in South American markets have broken the $1,000/mt mark and plunged to a more than two-year low amid falling Chicago Board of Trade futures, thin demand and weakening port differentials. Platts, part of S&P Global Commodity Insights, assessed both Argentinian FOB Up River and Brazilian FOB Paranaguá outright prices at $988.55/mt for May dates on March 22, the lowest level for a front-month loading since Jan. 27, 2021.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

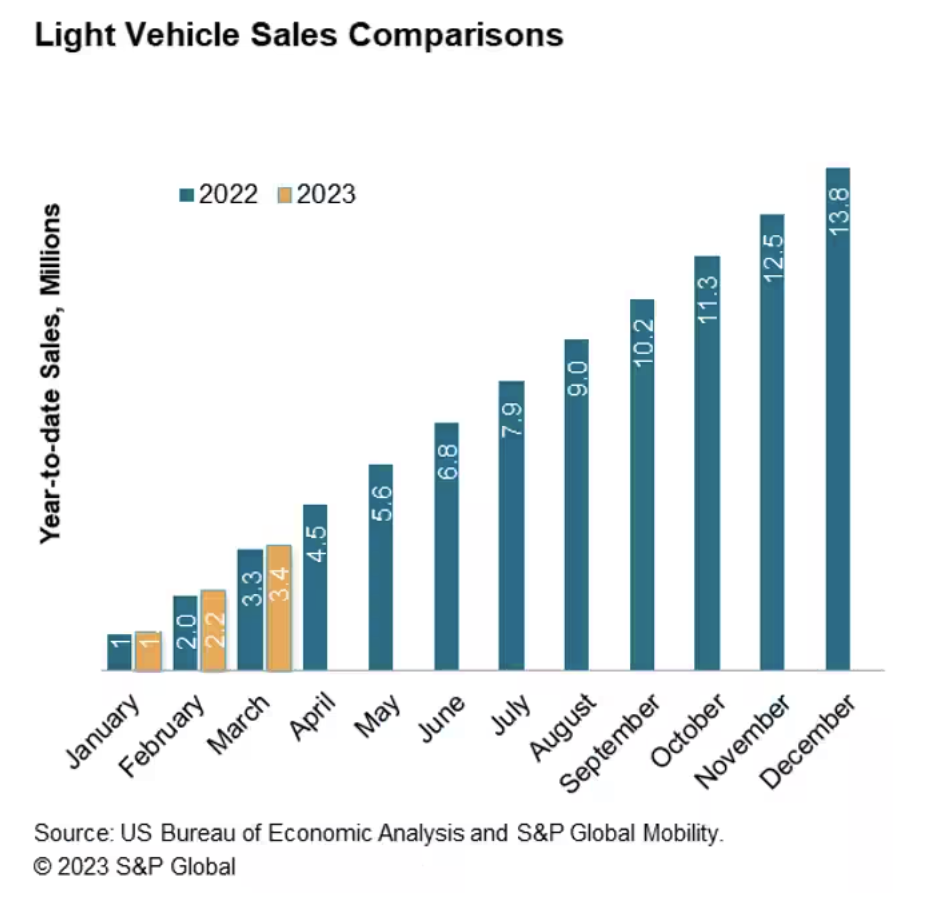

U.S. Auto Sales Sustain Muted Progress In March

With volume for the month projected at 1.27 million units, S&P Global Mobility analysts expect March 2023 to be up more than 11% from the month-prior tally, attributable to three additional selling days. The expected March 2023 volume would be aligned with the year-ago period (with the same number of selling days), reflecting that sales momentum will be difficult to sustain given current economic headwinds and tailwinds.

—Read the article from S&P Global Mobility