Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 Mar, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

After the depths of last year’s deal-making dearth, private equity is ready to re-emerge.

PE investors across Asia-Pacific, North America, Latin America, Europe, and the Middle East and Africa have an overwhelmingly bullish outlook for their industry this year and are energized to invest the sizable amount of capital that was left on the table in 2020, according to S&P Global Market Intelligence’s fourth annual survey of private equity and venture capital professionals.

Nearly 70% of the investors surveyed believe investment activity will improve this year. Information technology, healthcare, and the consumer sectors—which have been transformed and taken on greater importance during the coronavirus crisis—rank as the three most appealing areas.

Overall, PWC expects PE to accelerate growth in global alternative assets under management to $21.1 trillion by 2025, marking a jump of more than 50% from the $13.9 trillion under management last year.

The outlook is evident in recent activity. As of March 10, global packaging companies in the consumer and pharmaceuticals space had already enjoyed robust private equity transactions. European PE investors are eyeing another intersection of those top sectors—healthcare information and technology—as a prime opportunity for growth. Broadly, data from the financial information firm Prequin found that aggregate European private equity healthcare deal value for January-February totaled $5.1 billion, marking a jump from $1.4 billion seen in the entire first quarter of 2020.

Healthcare remains a "fundamentally attractive sector," and "with the additional effect of technology, I think we see still a lot of attractive investment opportunities also in the short term," Anja Bickelmaier, co-head of healthcare at the private equity firm Triton, told S&P Global Market Intelligence.

Asia-Pacific has established itself as a hot deal-making market for PE investors, due in part to the surge of blank-check companies debuting in the region.

"Private equity firms continue to raise record funding and grow rapidly in the region, with [special purpose acquisition companies] potentially adding to the momentum,” Miranda Zhao, Natixis' head of M&A for Asia-Pacific, said, according to S&P Global Market Intelligence, adding that the recovery across the global mergers and acquisitions market could increase attention for the region’s attractive markets and growth opportunities. “All these factors should position Asia-Pacific as a fast-growing M&A market in the coming years.”

SPACs are also seen by market participants as benevolent for PE investing in energy and commodities companies.

For the mining industry, "any time you have another source of capital for the sector, it's a good thing," Douglas Silver, a veteran in mining private equity and former portfolio manager at the alternative investment management firm Orion Resource Partners, told S&P Global Market Intelligence.

SPACs are "creating more exit alternatives for private equity and other private capital investors around companies that fit in the energy transition broadly," George Bilicic, vice chairman and global head of Power, Energy and Infrastructure investment banking at the financial services firm Lazard, said during the S&P Global Market Intelligence Power and Gas M&A Symposium. "A positive dynamic of the SPAC phenomenon is it's assisting in the gathering of capital to support these energy transition companies and pulling forward or taking capital needs off the table, arguably, which facilitates the implementation of business plans including in some companies that are more binary risks from a technology perspective."

Environmental, social, and governance (ESG) factors are on the minds of many investors. Of the firms surveyed by S&P Global Market Intelligence, 40% said that they are planning to work on improving their portfolio companies’ ESG standards.

Global investors will need to keep pace with those in Europe, where private equity firms have already embedded ESG into their deals. Effective this month, European PE and venture capital firms are required to report on their sustainability strategy under the Sustainable Finance Disclosure Regulation. All of the ESG-linked financings newly completed in the European leveraged loan space have been private equity-backed, according to S&P Global Market Intelligence.

Today is Friday, March 26, 2021, and here is today’s essential intelligence.

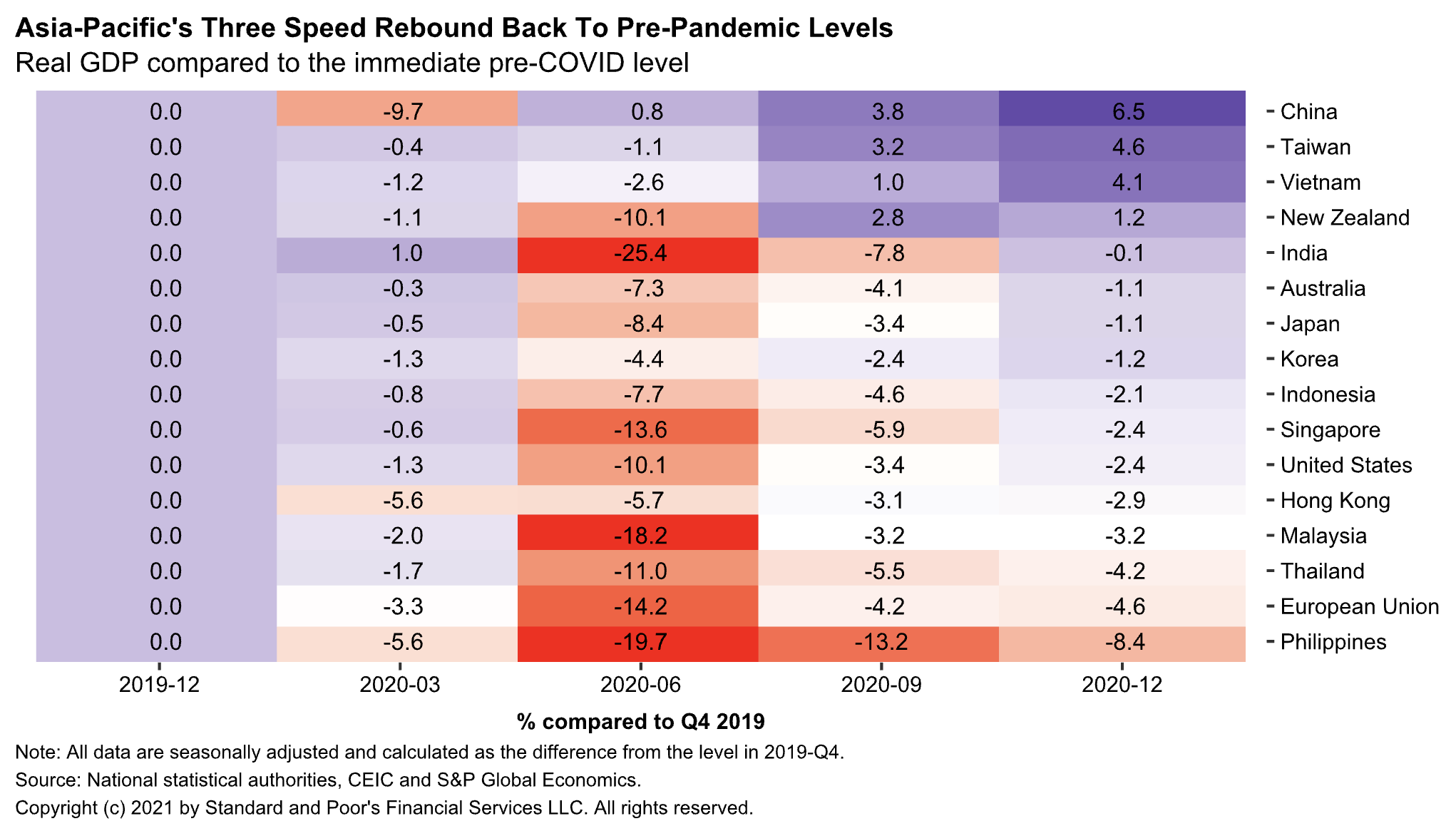

Economic Outlook Asia-Pacific Q2 2021: Three-Speed Recovery Will Benefit From Faster Global Growth

S&P Global Ratings upgraded growth forecasts for Asia-Pacific to 7.3% for 2021 from 6.8% previously. A faster-than-expected global vaccine rollout, a large dose of U.S. stimulus, and upside surprises in trade and manufacturing push our forecasts higher and offset recent weakness in household spending. S&P Global Ratings expects consumers to power the recovery later in 2021 as gradual vaccine coverage lifts confidence and spending on services, creating jobs and boosting incomes.

—Read the full report from S&P Global Ratings

Economic Outlook Europe Q2 2021: The Path To A Strong Restart

S&P Global Ratings now forecasts the eurozone to grow 4.2% this year and 4.4% in 2022. S&P Global Ratings made small revisions factoring in a higher degree of business and consumer adaptation to COVID-19 restrictions, a gradual vaccination rollout, and strong external demand. Favorable financing conditions in the eurozone underpin the revised baseline forecast. Weaker economic fundamentals and the ECB's commitment to monetary accommodation are shielding long-term eurozone interest rates against the rise in U.S. yields.

—Read the full report from S&P Global Ratings

Biden To Unveil Infrastructure Package Next Week

The next major initiative for President Joe Biden's administration will be an infrastructure package to rebuild both physical and technological infrastructure across the US, with Biden set to announce details of the plan at an event in Pittsburgh next week, Biden said during his first press conference with media at the White House March 25.

—Read the full article from S&P Global Platts

High Container Freight Rates Leave Commodity Traders Scrambling For Alternatives

Commodities across the metals, petrochemicals and agriculture sectors that typically ship in container vessels are increasingly turning to dry bulk vessels and other modes of transport as container freight costs soar, market sources told S&P Global Platts March 25.

—Read the full article from S&P Global Platts

Risk-Adjusted SPIVA Year-End 2020 Scorecard: No Evidence to Support Superior Risk Management Skills of Active Managers

The Risk-Adjusted SPIVA Year-End 2020 Scorecard shows that the significant level of volatility and positive returns of the broad U.S. equity market in 2020 did little to help the case for active managers’ performance. After adjusting for risk, most actively managed domestic funds across market-cap segments underperformed their benchmarks on a net-of-fees basis over mid- and long-term investment horizons. Even on a gross-of-fees basis, the number of outperforming segments declined over time; small-cap value and real estate funds were the only two categories that outperformed their benchmarks over the 20-year period.

—Read the full article from S&P Dow Jones Indices

Mexican Payroll Loan Reform Opens The Door To A More Transparent Business Model For The Industry

Payroll deductible loans' (PDLs) presence in the consumer segment in Mexico has grown over the last decade and they've had lower default rates than traditional consumer loans. Although PDLs' credit risk is lower than other retail products by nature, payroll discount lending within nonbank financial institutions (NBFIs) has had notable operating vulnerabilities in the past because they rely on the transfer of funds from the employer to the payroll loan company.

—Read the full report from S&P Global Ratings

Mexican Airlines Face A Bumpy Path To Takeoff

The COVID-19 pandemic caused airline passenger traffic in Mexico to drop by about 51% in 2020, severely damaging airlines' financial health. S&P Global Ratings believes weak passenger traffic could drive strategic changes to boost profitability, including a greater focus on leverage, cutting costs, and postponing capital investments.

—Read the full report from S&P Global Ratings

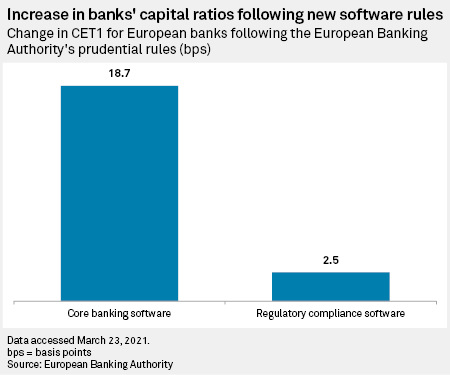

BoE's Likely Split From EU Over Bank Capital Rules Could 'Disadvantage' UK Banks

The Bank of England is expected to refuse to follow the European Union's loosening of bank capital rules in its first significant post-Brexit divergence, but this could put an extra burden on U.K. banks, according to analysts.

—Read the full article from S&P Global Market Intelligence

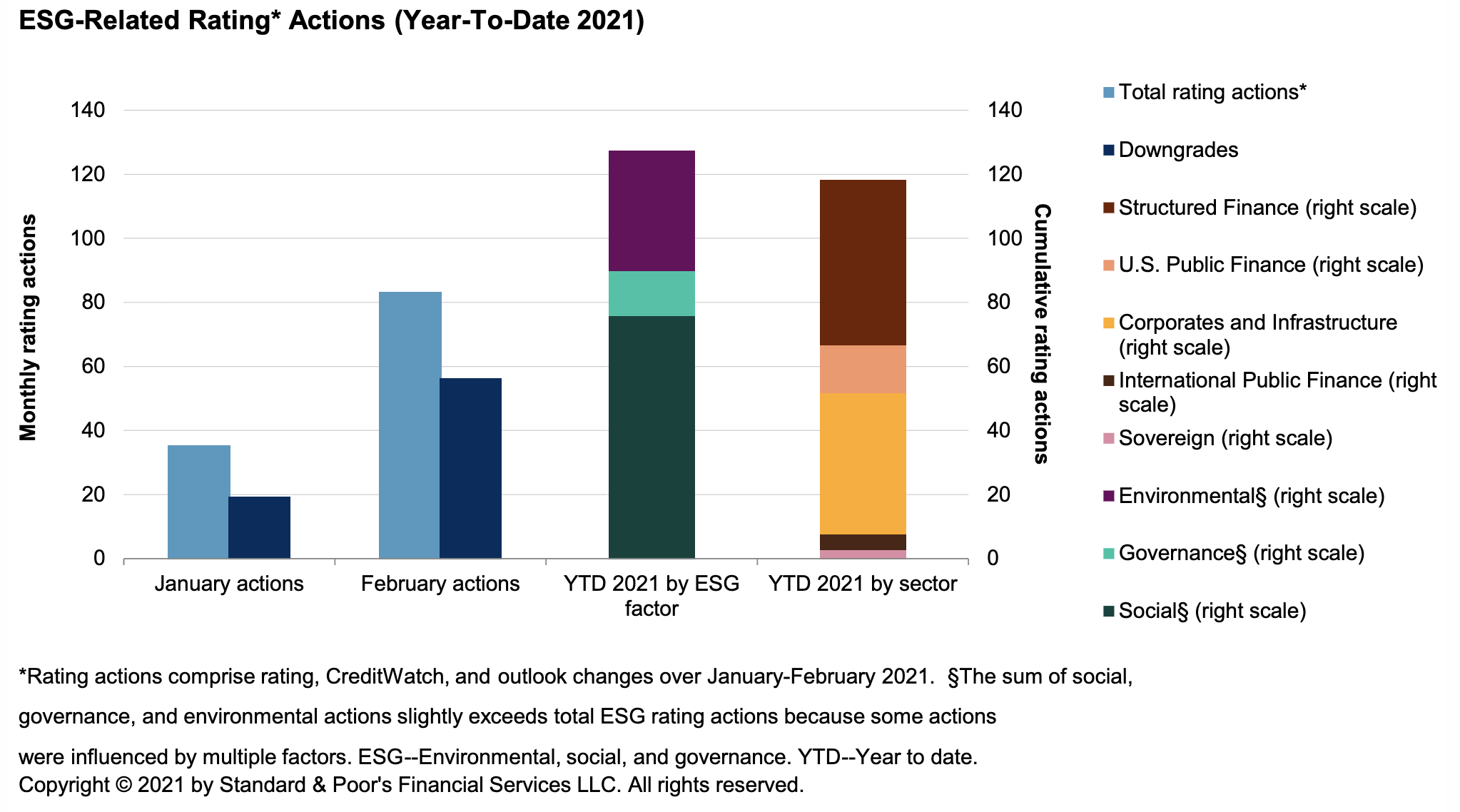

The ESG Pulse: Texas Storm Highlights Need For Preparedness

Environmental, social, and governance (ESG)-related rating actions over the first two months of 2021 totaled 118, of which 75 were rating downgrades.

—Read the full report from S&P Global Ratings

COVID-19 Has Shown That Decarbonization Goals Are Achievable

Sir David Attenborough is right. If we can act in 2021 it will make all the difference, but the world seems laden by rhetoric. The stickiness of hydrocarbons is huge, but if COVID-19 has taught us anything it is that change is possible and it needs to be led by the hydrocarbon and energy industry itself as well as consumers, backed up by strong government-led policies and incentives. Despite the tremendous growth of renewables, S&P Global Platts Analytics' most plausible scenario points to fossil fuels still accounting for half of the energy mix in 2050.

—Read the full article from S&P Global Platts

No Clear Winner Among Many Bunker Fuel Options For Decarbonization: Experts

Shipping's decarbonization goals need immediate action but choosing a winner from among the various alternative fuels is difficult as they come with their own set of advantages and limitations, with no one-size-fits all approach holding good anymore as impending environmental regulations loom, industry experts said at a virtual event held March 23 and March 24.

—Read the full report from S&P Global Platts

As EU Green Taxonomy Takes Shape, Social, Harmful Investments Under Discussion

In an interview, Nathan Fabian—chairperson of the European Platform on Sustainable Finance and chief responsible investment officer at the United Nations-backed Principles for Responsible Investment—told S&P Global Market Intelligence about upcoming developments in the taxonomy regulation.

—Read the full article from S&P Global Market Intelligence

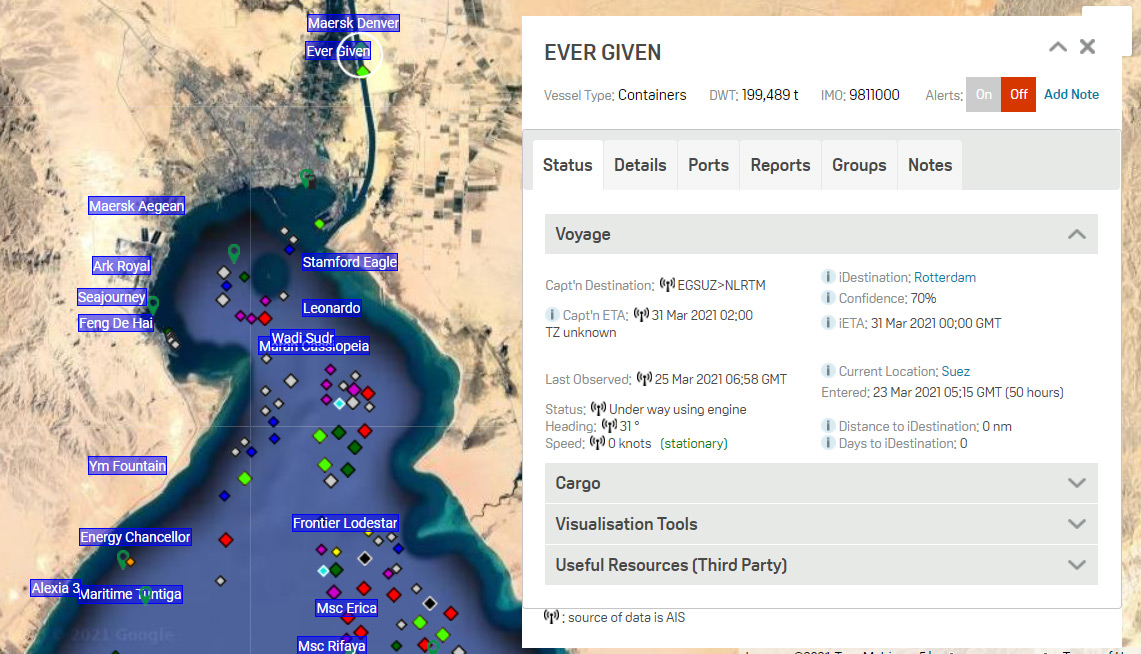

Oil Trade Braces For Long Delays As Suez Canal Closure Likely To Last Days

The reopening of the Suez Canal is now likely to take several days, market watchers told S&P Global Platts March 25, as around 40 oil and LNG tankers have piled up to transit one of the world's most critical commodity chokepoints.

—Read the full article from S&P Global Platts

ERCOT Forecasts Sufficient Capacity To Meet Demand This Spring, Summer

The Electric Reliability Council of Texas on March 25 released resource adequacy assessments for this spring and summer, showing sufficient generation would be available under expected conditions despite a forecast for record-breaking summer power demand that may dim scarcity pricing prospects.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Segment

Language