Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Energy Markets in Five Quotes

CERAWeek by S&P Global, the world’s premier energy conference, concluded March 10. The annual gathering of energy executives, public and private investors, and government officials from around the world serves as a good way to take the pulse of the global energy markets. These markets are far too complex to capture with a few simple themes, but the following five quotes will give a sense of the issues that were considered the most engaging and pressing for conference attendees.

To begin, John Podesta, special adviser to U.S. President Joe Biden, said the following about goal of the Inflation Reduction Act: “A clean energy economy invented and built in America employing American workers.”

During a CERAWeek panel discussion, someone compared the Inflation Reduction Act to the Russian invasion of Ukraine in terms of their seismic impact on energy markets. The impact of the Inflation Reduction Act will be quite positive for the industry. In fact, a lot of the excitement of the week was attributable to the opportunities the act unleashes for clean tech and green energy. However, there were concerns that the act could also unleash an era of geopolitical competition to control the clean energy technologies of the future.

The second quote was offered by S&P Global’s vice president of energy and global lead of gas, liquefied natural gas and hydrogen, Shankari Srinivasan, who claimed to have heard it on a panel during the conference: “The hydrogen molecule needs a partner.”

By way of explanation, hydrogen readily bonds with other elements such as oxygen or nitrogen. Part of the reason we have different colors to categorize hydrogen is because this characteristic means we can use many different feedstocks to extract hydrogen for energy. But another justification is that bringing hydrogen to market will require partnerships between entrepreneurs, investors, existing energy companies, policymakers and pipeline operators. The Inflation Reduction Act has de-risked hydrogen in many ways, but getting hydrogen to market will ultimately depend on partnerships. Finally, hydrogen supply, when it is achieved at scale, will require a partner in hydrogen demand. There was a lot of discussion during CERAWeek about the need to establish that demand before we go too far down the road of building out hydrogen infrastructure.

Eric Belz, head of private equity for investment firm Engine No. 1, said the following: “The energy transition is being driven by ideology. We live in a world that does want to decarbonize, but we are going to need traditional resources for years to come. This requires a change in the narrative around natural resource systems.”

A topic that came up repeatedly over the course of the week was the need for a balanced energy transition. What balance means in this context is an energy transition that reflects the pervasive reality of traditional energy resources such as oil and natural gas, that is realistic, energy-literate and nonideological. It also means an energy transition that respects the right of the developing world to escape from energy poverty.

Jigar Shah, director of the U.S. Energy Department’s Loan Programs Office, said the following: “Deployment drives innovation.”

Shah was talking about the widespread creation and adoption of clean energy technologies. He expressed frustration with the idea, popular in the press, that technology drives innovation. A lot of green tech is very exciting, but will it scale? Is it reliable? Can it be made cost-efficient? Will the demand meet the supply? As you start to deploy, these questions begin to get answered and you start to see all the myriad ways to make the technology better.

The final quote comes from Jonathan Silver, senior adviser and chair of Apollo Global Management: “Capital deployments requires a set of objectives and a set of returns, with a risk profile on those returns. The objective is clearly to move the sustainability agenda forward, but with a return profile that appeals to private equity.”

The Inflation Reduction Act is one source of funding for the energy transition, but another is the mountain of dry powder from private equity funds. With rising interest rates, credit is becoming a less affordable way to fund large-scale energy projects. Private equity can fill the gaps, particularly since the Inflation Reduction Act has helped to de-risk green tech investments.

Today is Monday, March 13, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week Of March 13, 2023

Another action-packed week follows U.S. Fed chair Jerome Powell's testimony to Congress and the U.S. jobs report, with special attention on the upcoming U.S. inflation figures due for February. The European Central Bank and Bank Indonesia will also update monetary policy, while more China data, including industrial production and retail sales, are anticipated. Other data highlights include U.K. employment numbers, Norway and New Zealand GDP and India's CPI.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Credit Trends: Risk Reshuffle: Loans Could Become Riskier While Bond Investors May Be Too Optimistic

The speculative-grade bond market came of age around the late 1980s or early 1990s. But within the last 20 years or so, leveraged loans have also been a popular funding vehicle for riskier issuers. Despite their difference (longer maturity lengths on average for bonds, floating rate structure for loans), the two asset classes have largely dealt with similar levels of credit risk on the underlying issuers, and as such, have generally had similarly priced spreads over the long-term.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

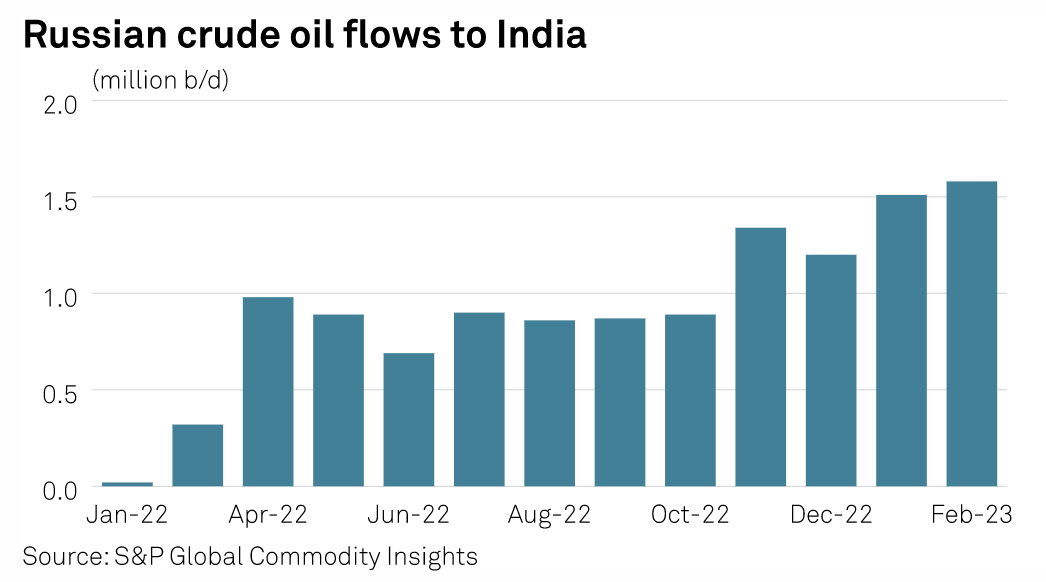

Sudden Spurt Of Russian Crude Flows To India Calls For Better Price Discovery

When a trade flow change comes unforeseen, price transparency becomes the need of the hour for market participants eying a piece of that trade. The Russian invasion of Ukraine in 2022 resulted in significant upheaval for global crude oil markets — both for prices as well as for trade flows. One of the most talked about phenomena for oil markets in the last one year has been the realignment of Indian crude oil flows, with an ever-increasing flow of Russian cargoes into the South Asian country.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Shell Warns Of Ballooning Carbon Costs, Climate Risks To Its Oil, Gas Business

Shell faces spiraling carbon costs in the coming decade due to unaligned net-zero policies and evolving regulations, leading to "significant uncertainty," it said March 9. In its 2022 annual report, the energy company also flagged the risks to its oil and gas business from climate change and the energy transition, admitting that they could have a "material adverse effects" on its earnings, assets, operations and supply chains. These risks could also lead to a spate of legal, regulatory measures, resulting in project delays or cancellations, increased litigation and operational restrictions, Shell said.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

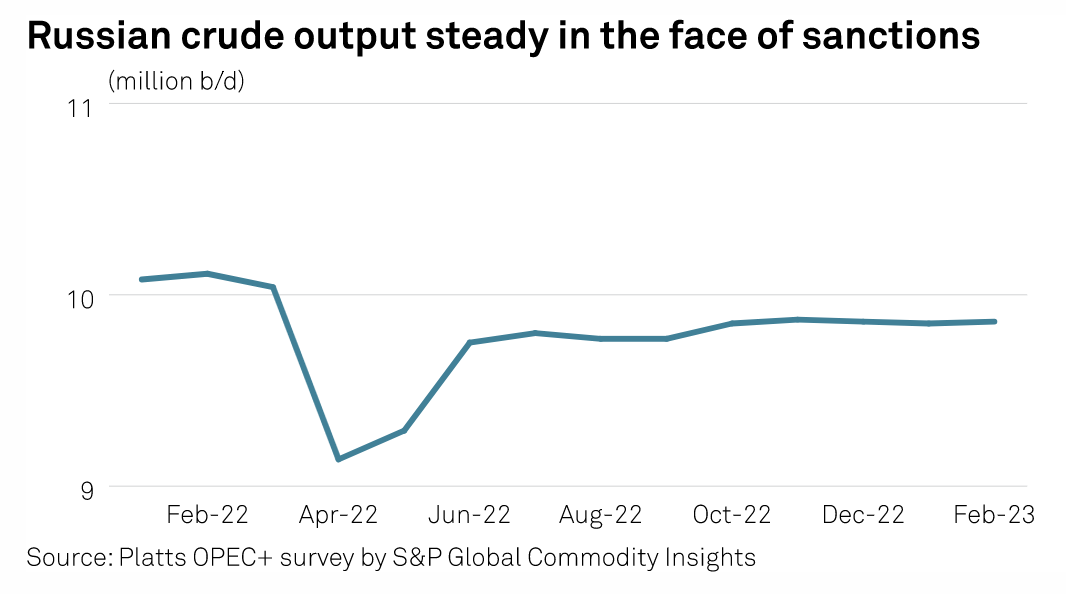

OPEC+ Crude Oil Production Drops In February Despite Uptick In Russia: Platts Survey

The OPEC+ coalition's crude oil production fell by 80,000 b/d in February, the latest Platts survey by S&P Global Commodity Insights found, with volumes dropping in Iraq, Angola and Kazakhstan. The drop came despite a small increase in Russian output of 10,000 b/d to 9.86 million b/d, as the key OPEC ally continued to show resilience to western sanctions targeting its oil sector, though Deputy Prime Minister Alexander Novak has said March volumes are likely to be cut by 500,000 b/d. Overall, OPEC's 13 members pumped 29.03 million b/d, down 60,000 b/d from January, while the bloc's Russian-led partners added 13.64 million b/d, down 20,000 b/d.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

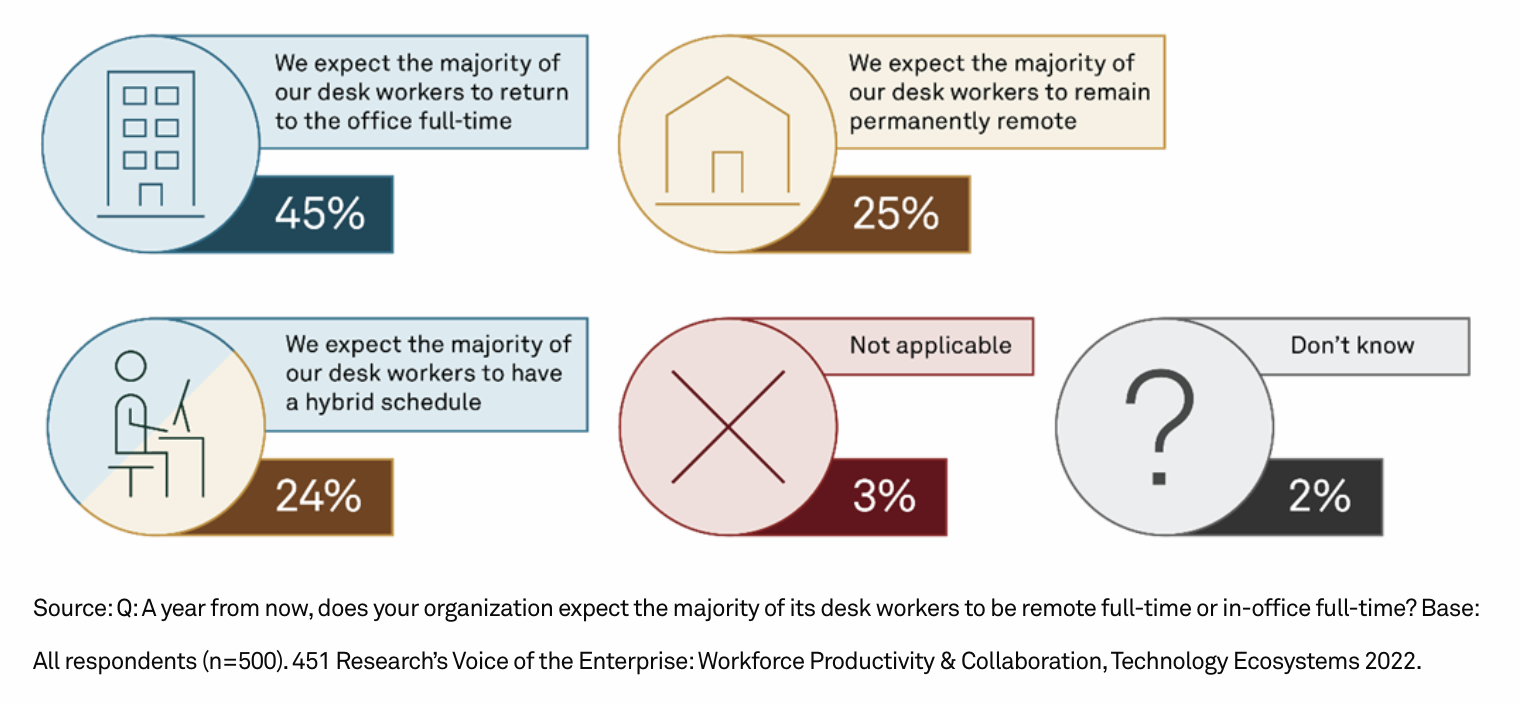

New Challenges Emerge With Shift To Hybrid Work: Survey

Work-life balance difficulties remain a challenge from the beginning of the COVID-19 outbreak, but S&P Global Market Intelligence’s latest survey results signal a shift in focus from short-term human factors — i.e., the impact of lockdowns and remote work on employees in the early days of the pandemic — to an emphasis on adopting a long-term view. These changes reflect a deep transition underway from legacy work practices to new approaches in work planning and execution characterized by increased flexibility, agility and business focus.

—Read the article from S&P Global Market Intelligence