Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Mar, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Good News for the Global Economy, With Caveats

Optimism is disincentivized for economists. When an economist predicts recession and contraction, they are quickly forgiven when reality exceeds their expectations. No one minds unexpected good news. But when an economist predicts growth and sunny days ahead, anything less than total accuracy is ridiculed. Economics has unfortunately earned its nickname “the dismal science” by being, well, dismal. It’s no wonder that when economists share good news, they mix in dire warnings of impending disaster. Old habits die hard.

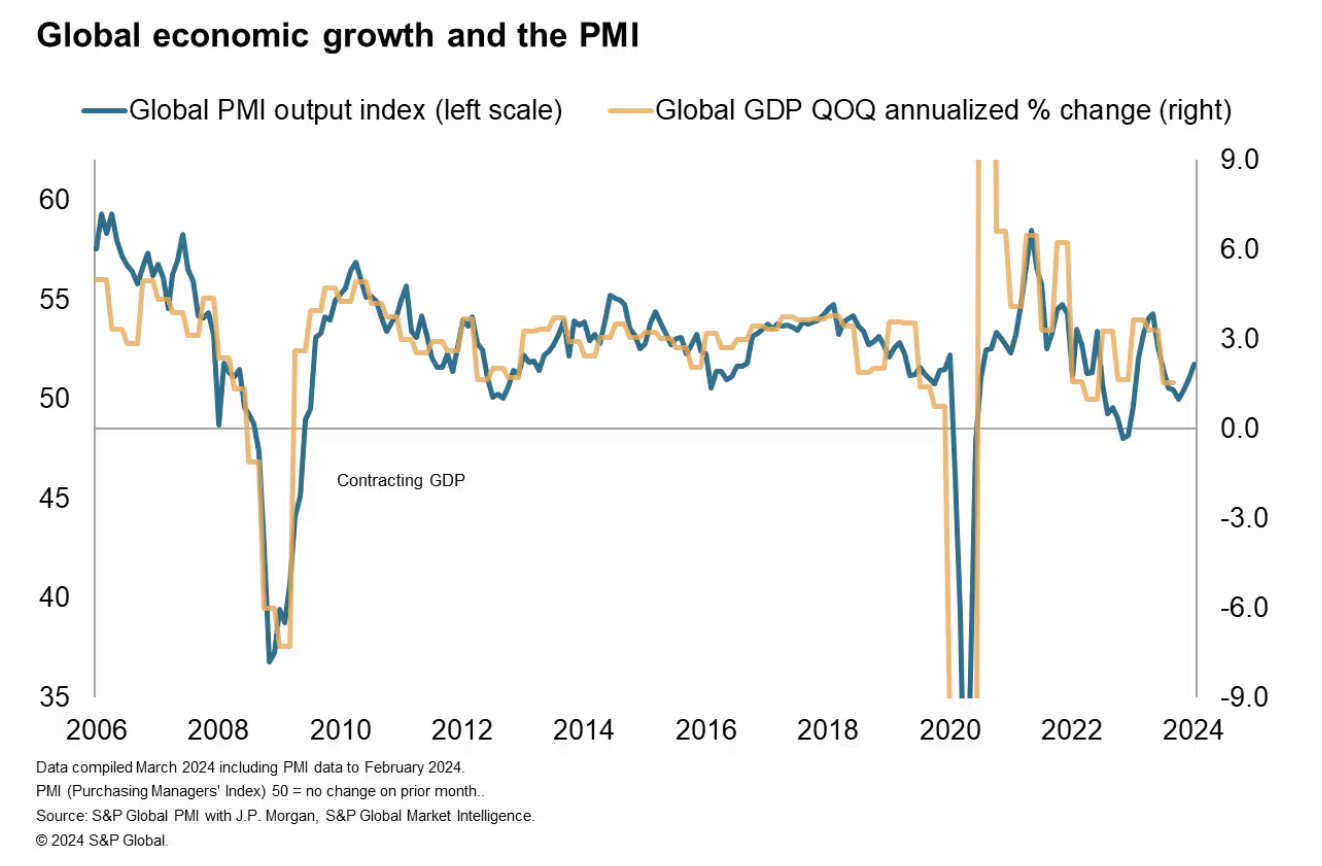

It seems possible that the global economy might be doing okay. The forecast for global GDP has been revised upward by S&P Global Market Intelligence to 2.5% from 2.3%. If the economic surprise of 2023 was the persistence of inflation, then that of 2024 has been the persistence of growth in the face of higher interest rates. Forecasts for the US, Canada, the eurozone, the UK and Russia have all been revised upward.

In November, S&P Global Ratings Chief Economist Paul Gruenwald predicted growth, albeit asynchronized, across major markets. Persistent strength in labor markets was responsible for much of this growth. Consumer spending on services was a strong factor in driving lower unemployment rates since services tend to be labor intensive. The continued strength of labor markets supported the narrative of a soft landing for the global economy, according to Gruenwald.

A soft landing for the global economy would require inflation rates to shrink to target rates of about 2% while GDP maintained growth or at least did not contract too much. Central bankers set higher interest rates to reduce inflation, but there is always the danger that they may be too effective and tip the global economy into recession.

Of course, good economic news always contains the seeds of bad economic news. The stickiness of labor markets and spending on services indicate demand growth that is too strong. This is contributing to the slow decline in inflation rates. When more people are making more money, their demand for goods and services drives up prices. In economies such as Canada and the eurozone, where demand growth has been weaker, inflation rates have come down more quickly.

Part of the reason growth has remained persistent is that markets expect interest rates to fall over the course of 2024. S&P Global Ratings has predicted that any lowering of interest rates by the US Federal Reserve will come in June. However, serious disruptions to global supply chains could cause inflation to spike again and delay rate changes until 2025. At the top of the list of threats to global supply chains are geopolitical disruptions, including the war in Ukraine, the Israel-Hamas war, Houthi attacks in the Red Sea and tensions in the South China Sea. If these disruptions intensify, fewer goods will reach consumers, and prices will climb for what remains.

Today is Monday, March 11, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week of March 11, 2024

US inflation and activity data will be some of the highlights in the week, while the UK also releases monthly output and labor market reports. Additionally, final GDP and inflation data will be due from major developed economies alongside a series of tier-2 data across the globe. S&P Global also releases key findings from its latest Business Outlook surveys for major developed economies, and the US Investment Manager Index on Tuesday. This will be followed by the GEP Global Supply Chain Volatility Index.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

The February 2024 Rebalance Of The S&P 500 Low Volatility Index

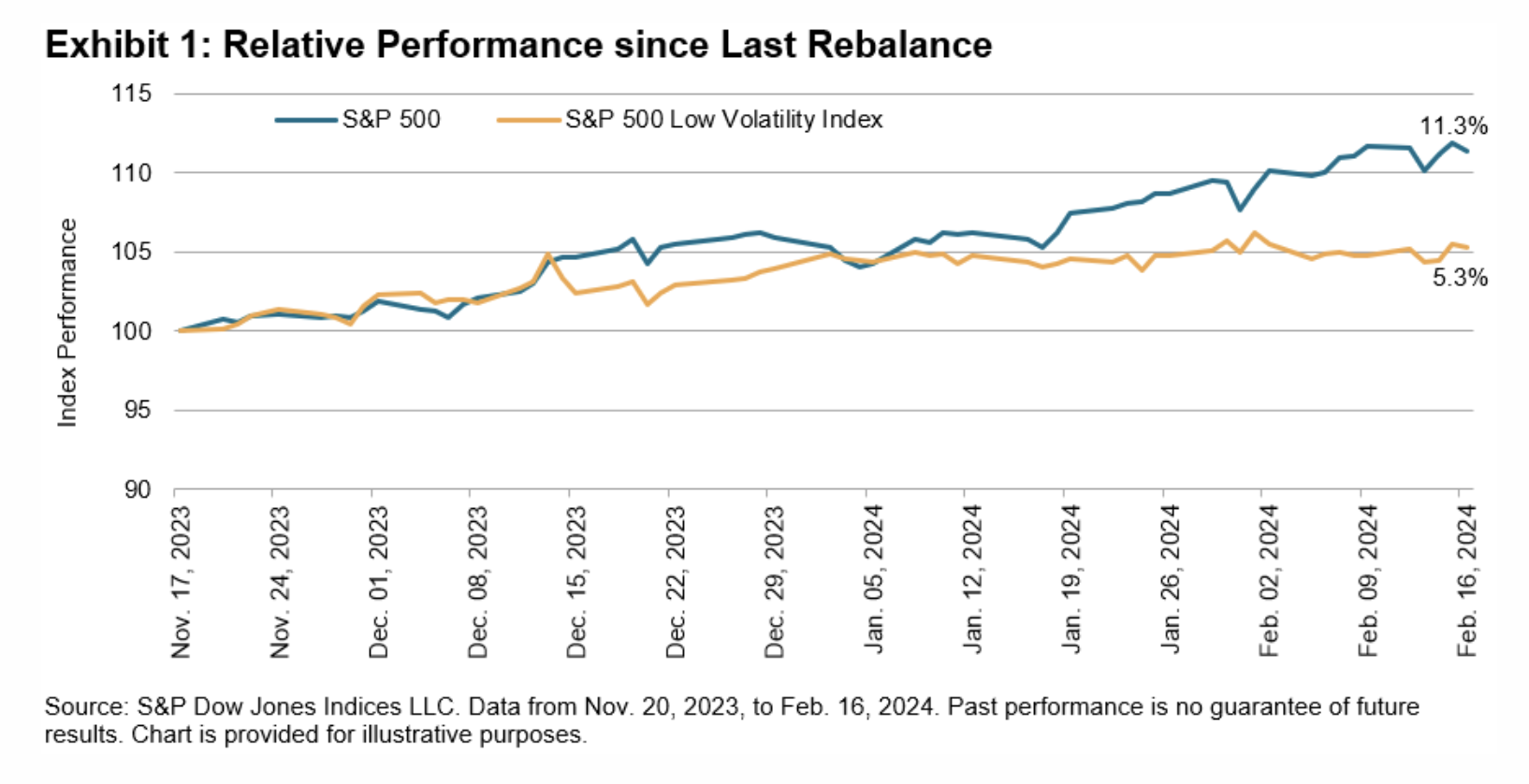

Since the previous rebalance for the S&P 500® Low Volatility Index on Nov. 17, 2023, and its most recent on Feb. 16, 2024, the S&P 500 delivered a stunning 11.3% return. During this period, the S&P 500 Low Volatility Index was up 5.3%, strong by historical standards, albeit underperforming the S&P 500. As has been the trend recently, the S&P 500 Low Volatility Index historically tends to underperform during periods of low volatility for the S&P 500. Over this period, the annualized daily standard deviation for the S&P 500 was just 10.1%.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

Trade Downturn Continues To Ease In February

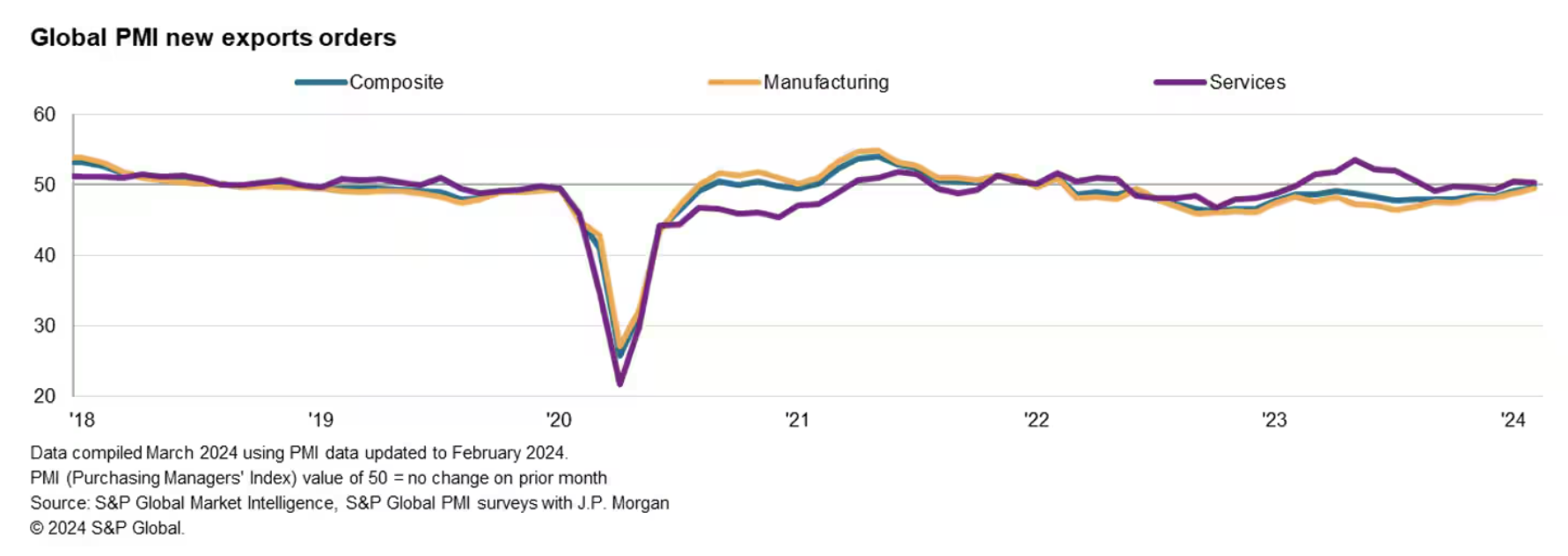

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a further deterioration of global trade in February, thereby extending the current sequence of decline to two years. That said, the rate of contraction eased for a second straight month to the weakest seen over this period. The seasonally adjusted PMI New Export Orders Index posted 49.6, up from 49.2 in January, rising slightly above the series average.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Forces Shaping The Future Of Energy

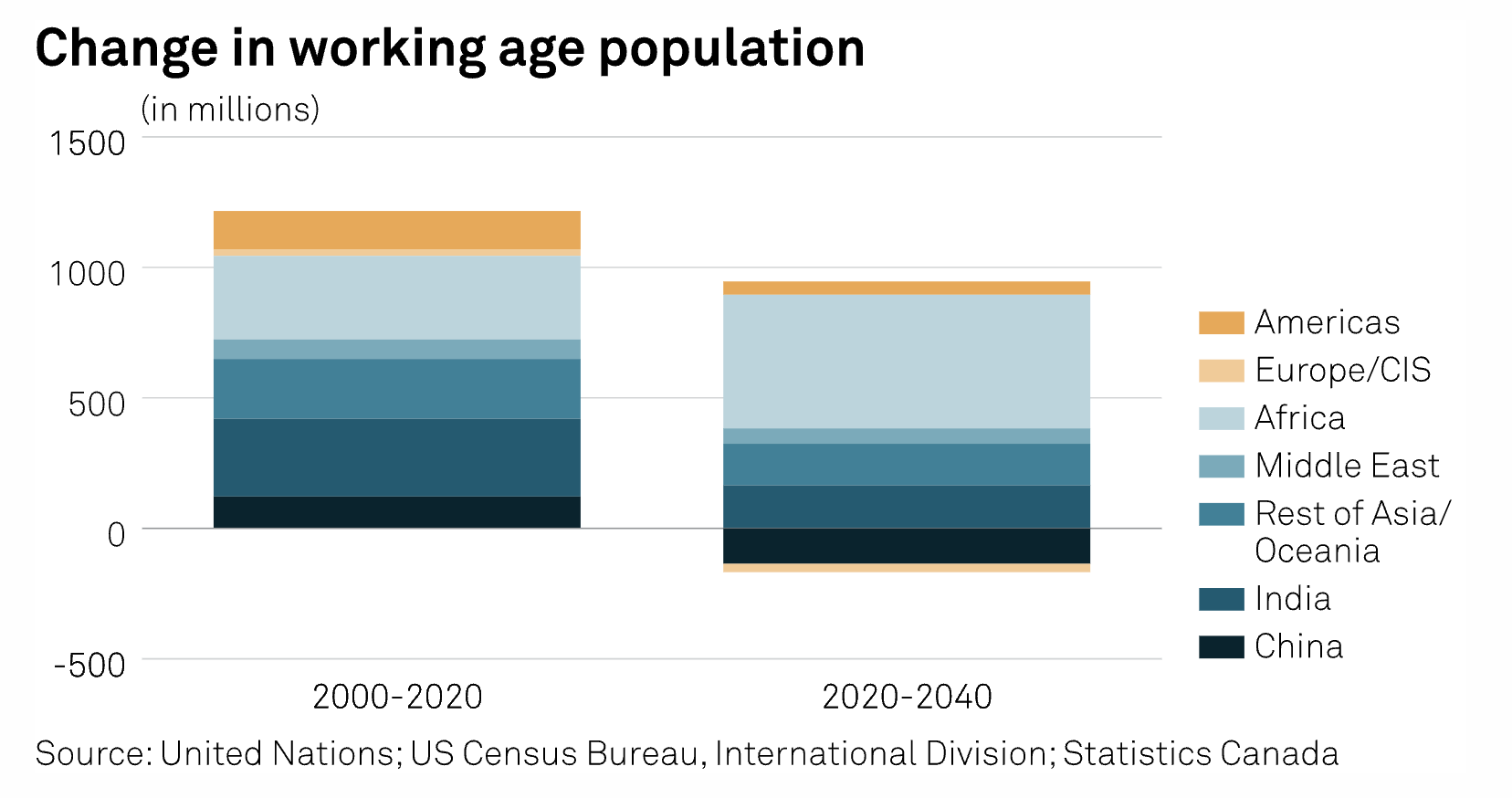

The world has seen record-setting investment in energy amid slowing overall demand growth, a trend likely to continue in the years ahead. But why are companies pumping more money into chasing demand that won't be there? It may seem like a contradiction, but those funds are needed to align with the transformative shift in future global energy supply, trade and consumption patterns. There are three distinct forces, each influencing one another, shaping the future of energy: demographics, energy decarbonization and geopolitical rivalry.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: A North Sea Tale: Diving Into UK Oil And The Dated Brent Benchmark

Once a global powerhouse of crude production, the UK’s North Sea region saw its oil output decline accelerate to 12% in 2023, according to official data from the UK’s Department of Energy Security and Net Zero. The new figures come as the UAE’s Taqa revealed to S&P Global Commodity Insights that it plans to cease production at the Cormorant oil fields in 2024, a key component of Brent grade. In this episode of the Platts Oil Markets podcast Joel Hanley is joined by Nick Coleman, senior editor for oil news, and Sam Angell, senior editor covering the North Sea crude market, to discuss the outlook for North Sea oil production and the latest developments surrounding the global oil benchmark Platts Dated Brent.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: MediaTalk | Season 2 Ep.3: Sports Rights and Streaming Wrongs for Pay TV

In this episode, MediaTalk Host Mike Reynolds speaks to S&P Global Market Intelligence Kagan Analyst Scott Robson, who specializes in TV networks. Scott shares his thoughts on the evolving pay TV business as sports rights and viewers shift to streaming services — and what these trends mean for traditional cable networks. The pair take on the media rights negotiations for the NBA and just how big of an increase the league could get. Continuing with sports, Scott weighs in on the upcoming streaming joint venture from Fox, Disney and Warner Bros. Discovery, as well as the ongoing Diamond Sports bankruptcy proceedings. Finally, he touches on the ongoing speculation around further consolidation among US media giants.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Language