Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Mar, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

As U.S. coronavirus cases start to stabilize, and COVID-19 vaccinations increase across the country, the world’s biggest economy will soon enjoy an additional shot in the arm. President Joe Biden is set to sign the historic $1.9 trillion American Rescue Act, passed by the House of Representatives on March 10, on Friday.

"The most important component is to get Americans back working,” Georgetown University Professor of Finance Rohan Williamson told S&P Global Market Intelligence. “And to get them back working, you have to take care of COVID."

The huge stimulus package provides direct assistance for small businesses, municipal governments, and individual taxpayers. The $1,400 payments for those who earn less than $75,000 annually, or $150,000 for couples, will likely boost e-commerce spending, benefitting big-name retailers like Amazon, Walmart, Target, and Best Buy, as consumers begin to feel more confident about the current conditions of the crisis.

"Maybe they're willing to go out to eat, travel, buy a new Apple Watch," Katie Thomas, who leads the internal think tank Kearney Consumer Institute at the management consulting firm Kearney, told S&P Global Market Intelligence. "You're starting to see the upticks again in apparel and beauty as people kind of get excited to get dolled up and go out again.”

The recovery may be felt in the second half of this year and appears to have pre-emptively slowed corporate bankruptcies. Last month, 34 companies filed for bankruptcy protection, down from the 46 in January and markedly lower than the 2020 single-month peak of 70 in June. In total, 80 companies have gone bankrupt this far this year, according to S&P Global Market Intelligence data.

"There's not a burning need to pull the plug and file a bankruptcy," Joseph Malfitano, the founder and managing member of the M&A advisory firm Malfitano Partners, told S&P Global Market Intelligence. "For a lot of retailers, they can kind of wait it out and see what this reopening kind of looks like and see if they get a big bounce."

The challenge remains in the jobs market. While 379,000 jobs were created in February, the U.S. labor market is 9.5 million jobs behind its pre-pandemic peak. S&P Global Economics estimates that the current jobs market is 11.7 million jobs below its pre-pandemic 12-month trend, and that the unemployment rate is closer to 9% than the 6.2% headline figure.

“While we might have turned a corner, the U.S. still faces a bumpy road to recovery, with many people left on the side of the road,” S&P Global Ratings Chief U.S. Economist Beth Ann Bovino said in a report this week. “We do not expect policy to shift meaningfully in the short term, since the shortfall of employment from the peak pre-COVID-19 level remains substantial.”

Today is Thursday, March 11, 2021, and here is today’s essential intelligence.

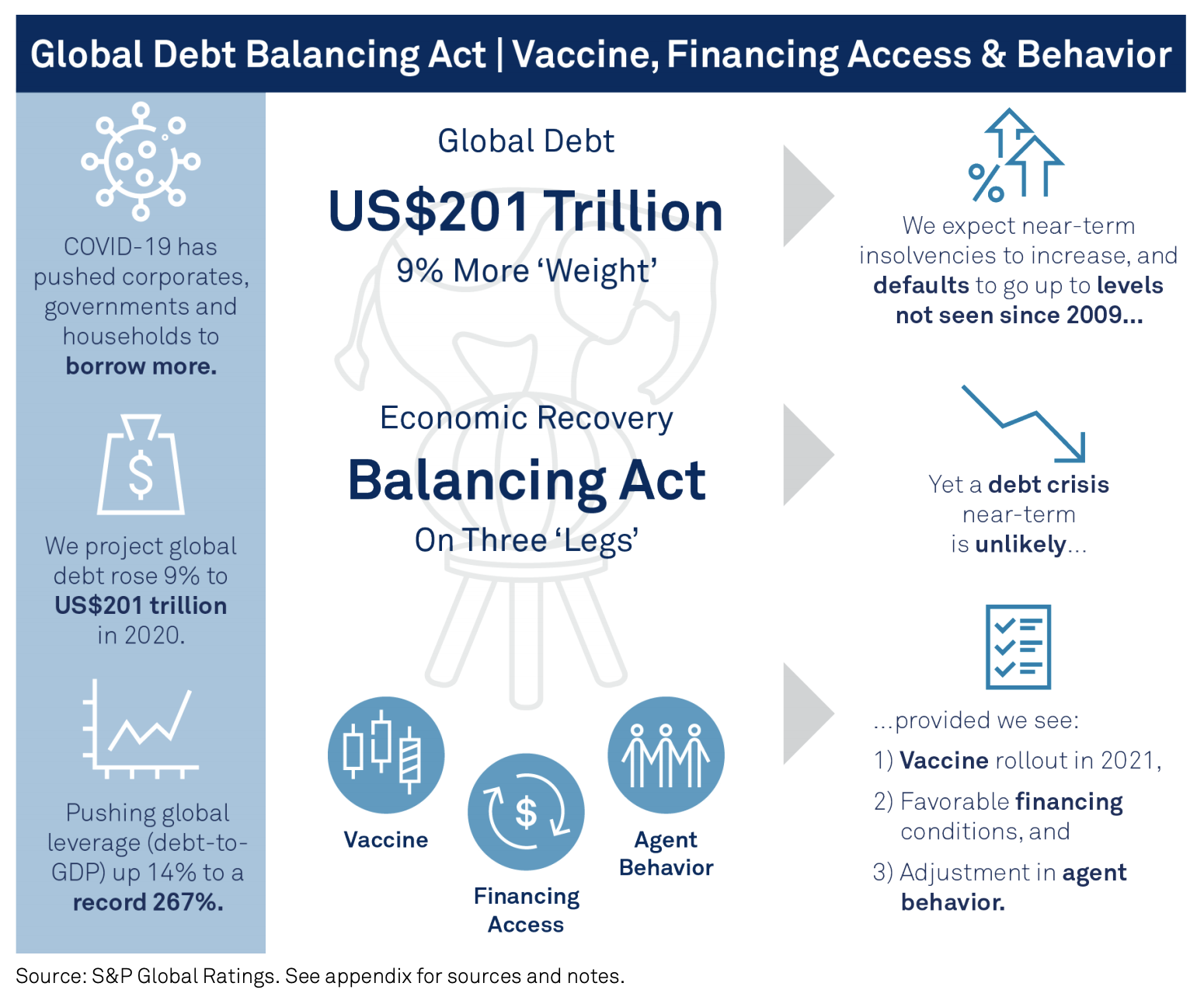

Global Debt Leverage: Near-Term Crisis Unlikely, Even As More Defaults Loom

S&P Global Ratings estimates global debt to have hit a record $201 trillion by end-2020, equivalent to 267% of GDP. But a near-term debt crisis is unlikely given the continuing recovery of the global economy.

—Read the full report from S&P Global Ratings

Credit Trends: The U.S. Distress Ratio Is Down Nearly 90% Since March

The U.S. distress ratio fell for the 11th consecutive month, hitting 4.0% as of Feb. 22, 2021—the lowest in almost 10 years—from 4.3% as of Jan. 29. U.S. composite spreads tightened generally and for issuers rated 'CCC' and below.

—Read the full report from S&P Global Ratings

Default Risk For U.S. Hospitals Falls From 2020 Peak Despite Lingering Challenges

Default odds for U.S. hospitals and other segments of the healthcare industry have fallen since their 2020 peaks during the early days of the coronavirus pandemic, though questions around labor costs and cash flow continue to challenge healthcare facilities.

—Read the full article from S&P Global Market Intelligence

Investors Turn To Value Stocks As Borrowing Costs Increase For Growth Giants

Investors are turning away from the technology stocks that fueled a decadelong surge in equities as a rise in borrowing costs and recovering U.S. economy encourages a shift from the dominant growth trading strategy into value stocks.

—Read the full article from S&P Global Market Intelligence

Australian Buy-Now-Pay-Later Industry May Need Regulation to Inspire Confidence

Australia's "buy-now-pay-later" players may need more regulation to protect customers after the point-of-sale credit industry has grown rapidly in recent years, helped in part by an absence of oversight, experts say.

—Read the full article from S&P Global Market Intelligence

Resilient Earnings and High Provision Coverage Position Latin American Banks Well To Face Tough Conditions

Latin American banks have been able to handle the pandemic-related crisis in relatively good condition so far, supported by their resilient profitability and their robust regulatory capital.

—Read the full article from S&P Global Ratings

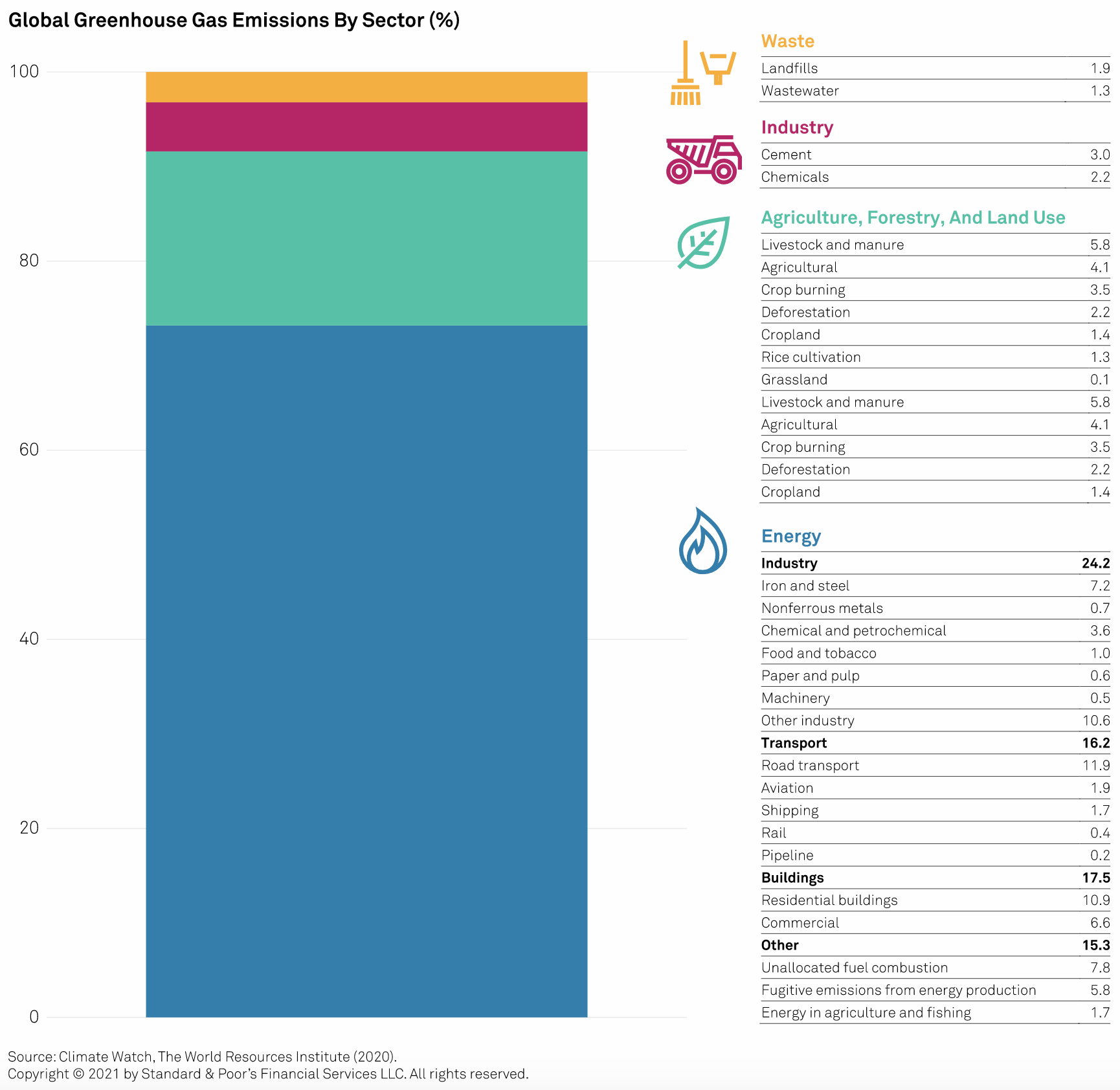

Transition Finance: Finding A Path To Carbon Neutrality Via The Capital Markets

S&P Global Ratings believes transition finance, including issuance, could contribute up to $1 trillion per year to the economy as companies in hard-to-abate sectors, which were previously absent from the sustainable debt market, raise capital and use the proceeds for activities that help them reduce their carbon footprint.

—Read the full report from S&P Global Ratings

Supranational Banks' New ESG Goals May Boost Private Investment In Green Finance

Multilateral development banks in Europe have new criteria and higher medium-term targets for green and sustainable investments, which is likely to have a knock-on effect on the wider market and draw more private capital to green finance.

—Read the full article from S&P Global Market Intelligence

Hydrogen Project Leaders Testing Integration Ahead Of Regulations: Experts

Hydrogen project leaders are testing different ways to integrate hydrogen into the gas network, and trying to demonstrate if their methods will work ahead of the expected regulations, panelists said at a virtual summit March 10.

—Read the full article from S&P Global Platts

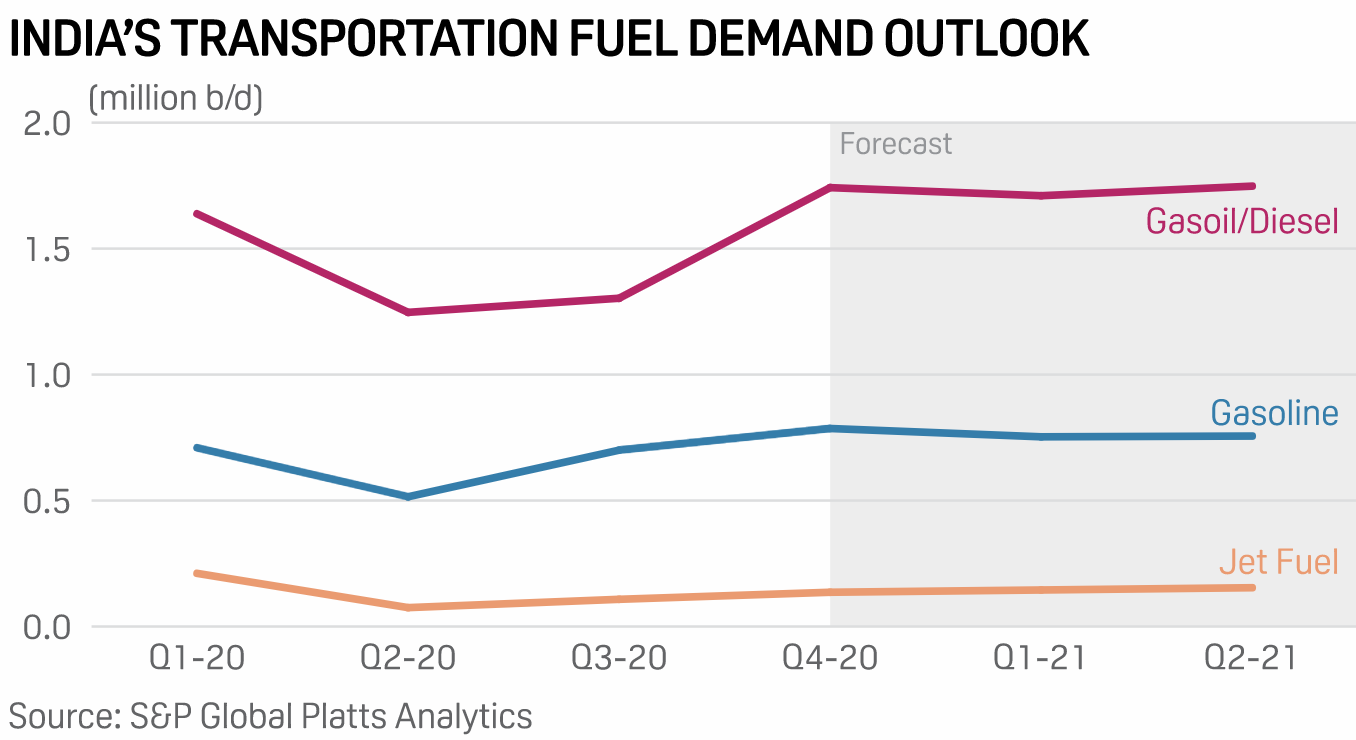

India's FY2021-2022 Transport Fuel Consumption To Remain Expansionary As COVID-19 Fears Ease

India's domestic consumption of transportation fuels is expected to grow robustly between April 2021 and March 2022, as focus on the country's economic expansion returns to center stage, after COVID-19 fears ease.

—Read the full article from S&P Global Platts

Iron Ore Shipments Fall 11% On Month In Feb, Fueling High Prices

Iron ore shipments by Rio Tinto, BHP, Vale, Fortescue Metals Group and Roy Hill in Australia, along with Saldanha port in South Africa, fell 11.2% month on month in February but were up 3.3% year on year, according to S&P Global Platts' trade flow software, cFlow.

—Read the full article from S&P Global Platts

U.S. EIA Lifts Forecasts For 2021-22 Natural Gas And Power Consumption

Higher forecasted crude oil prices and an assumptions of an improved US economic outlook prompted the Energy Information Administration March 9 to boost its forecasts for natural gas production and consumption, despite the February freeze that crimped production in the first quarter of 2021.

—Read the full article from S&P Global Platts

Asia's Fragile Recovery Path Can Ill Afford Oil Upheaval, Price Gyrations

Asia may have heaved a sigh of relief that a drone attack in Saudi Arabia left crucial oil infrastructure unscathed, but analysts told S&P Global Platts supply disruptions and high prices stemming from escalating geopolitical risk can choke the feeble economic recovery the region is witnessing after a pandemic-hit year.

—Read the full article from S&P Global Platts

OPEC+ Seeks 'Fair' Oil Price, Saudi Foreign Minister Says In Meeting With Russian Counterpart

Saudi Arabia and Russia pledged to continue cooperation on the OPEC+ production cut agreement, as Saudi foreign minister Prince Faisal bin Farhan said March 10 the group is aiming for a "fair" price for crude oil.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language