Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Mar, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

China Builds Out EV Supply Chains While Europe and the US Dither

Supply chains are never static. But the supply chain for the automotive industry is undergoing a transformation as new technologies and new geopolitical alignments threaten industrywide disruption.

While some continue to treat the transition to electric vehicles as if it were doubtful, China has moved quickly to establish leadership across the EV supply chain. Debates over the relative merits of EVs and internal combustion engines miss the geopolitical significance of China’s manufacturing advantage for critical minerals, batteries and EV parts. European attempts to control the influx of relatively inexpensive Chinese-manufactured EVs are continuing to develop, while the US lags in raw materials, battery production, and EV manufacturing and infrastructure.

In anticipation of S&P Global’s TPM24 conference, taking place March 3–6 in Long Beach, Calif., a group of researchers at S&P Global launched the latest report in the Look Forward series, this time focusing on the state of supply chains in 2024. Because supply chains are critical to the global economy, the Daily Update will focus on different aspects of this report throughout the week. Today’s update will look at “Deep Dive: Electric vehicles and batteries.”

China has successfully carved out a leadership position across the EV supply chain in a stunningly short period of time. China exported 1.47 million vehicles in the 12 months to Oct. 31, 2023, according to S&P Global Market Intelligence. That represented 34% of all exports by value, up from 30% in the same month a year earlier and 2% in 2019. China’s share of all global exports of lithium-ion batteries increased from 44% to 68% between 2019 and 2023. China’s dominance in the manufacture of all types of batteries and all raw materials for batteries is large and growing. By 2030, China will control at least 70% of battery and raw material production. In many cases, such as cobalt and graphite, that advantage is projected to be over 80% of the market. With an expected shortfall in the supply of lithium forecast as early as 2027, this dominance will almost certainly favor Chinese manufacturers.

The Biden administration has used legislation to try to encourage the development of a domestic mining and manufacturing industry that can compete with China. The Inflation Reduction Act of 2022 was intended to secure raw materials, processing and manufacturing of critical minerals for EVs, among other goals. However, given China’s advantage, significant questions remain about the security of US automobile supply chains. China’s recently announced decision to control the export of gallium, germanium and graphite could set a precedent for battery-makers that rely on Chinese lithium and Chinese-processed cobalt and nickel.

The European Commission recently announced an investigation into Chinese subsidies of its EV industry. The balance of trade between China and the EU in the automotive sector flipped between 2016 and 2023. The EU moved from a net exporter of automobiles to the Chinese market to a net importer of Chinese vehicles, mostly EVs. As the investigation into Chinese government support for the Chinese EV industry continues, there is the possibility of tariffs on Chinese EVs. If those tariffs were introduced, China could respond by restricting the export of Chinese batteries and battery metals to Europe.

Today is Friday, March 1, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

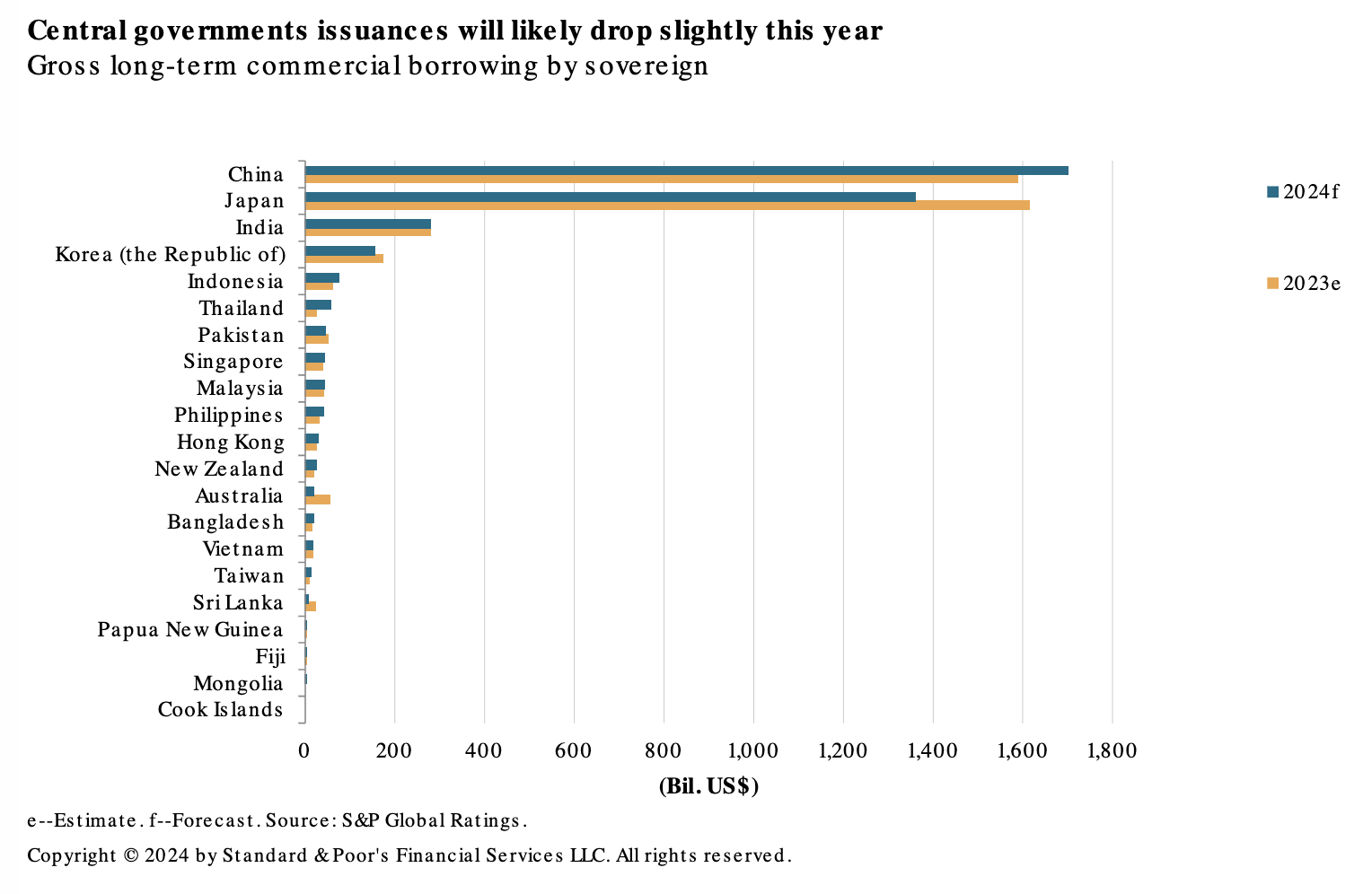

Sovereign Debt 2024: Asia-Pacific Central Government Borrowing Stabilizes At Close To US$4 Trillion

After climbing since the outbreak of COVID-19, Asia-Pacific sovereign borrowing should stabilize in 2024. S&P Global Ratings expects the region's long-term commercial borrowing to amount to US$3.9 trillion this year, after an estimated US$4.1 trillion in 2023. Smaller 2024 issuances out of Japan account for much of the decline. Australian and Korean governments are among the major sovereigns that we anticipate will borrow less than in 2023. Pakistan and Sri Lanka, currently under IMF programs, should also borrow less than in 2023.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

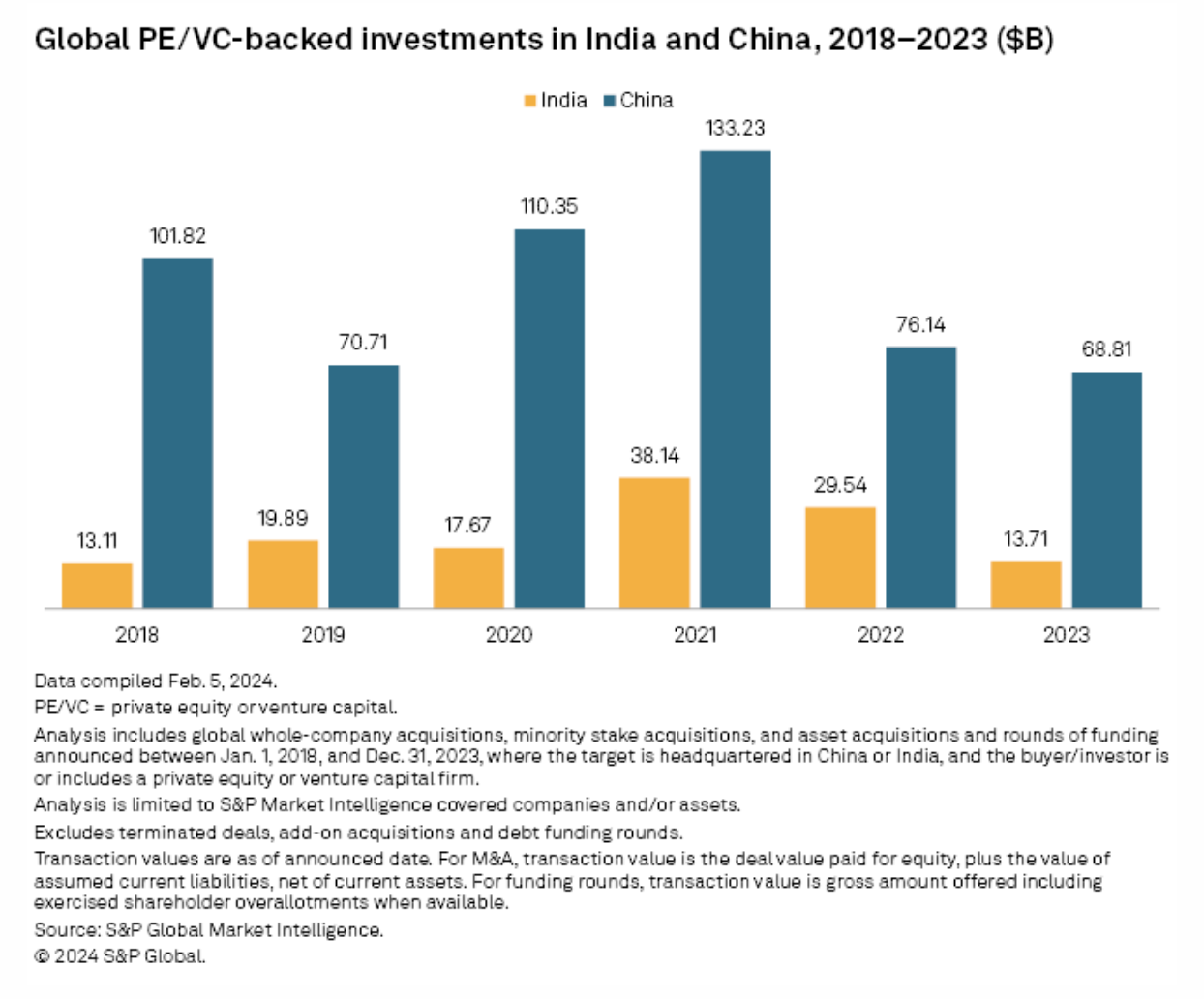

Private Equity Entries In India, China Drop In 2023

Two of Asia-Pacific's largest economies saw a fall in private equity-backed investment value in 2023. India recorded a 53.6% year-over-year drop in private equity-backed investments to $13.71 billion in 2023, outpacing the decline in deal value in China, according to S&P Global Market Intelligence data. Transaction value in China, the region's largest economy, stood at $68.81 billion in 2023, down 9.6% from the prior year.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

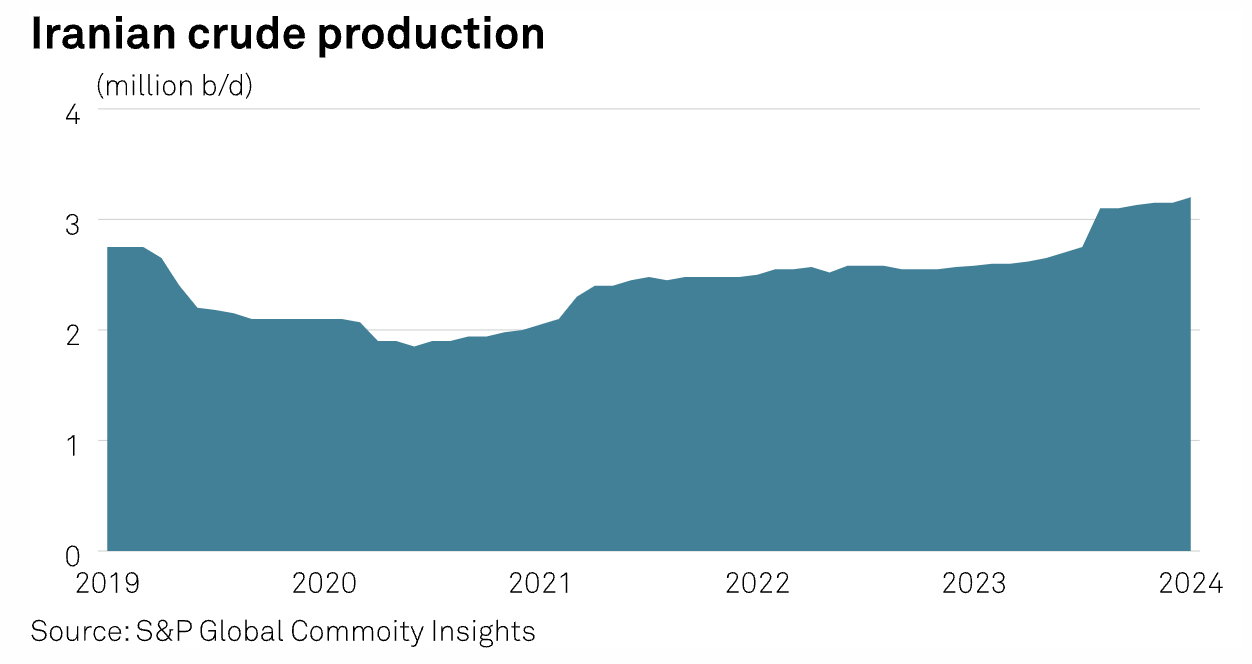

US Sanctions Oil Tankers, Targeting Iranian Funding For Russian, Houthi Arms

The US Department of Treasury Feb. 27 outlined a set of new sanctions targeting Iran's support of Russia and the Houthi rebels, including new sanctions on two oil tankers that Treasury alleges have helped fund Iran's military activities. The measures are targeted to Iran's involvement with regional terror groups and Russia's military supply chains, said Rachel Ziemba, adjunct senior fellow at the Center for a New American Security.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

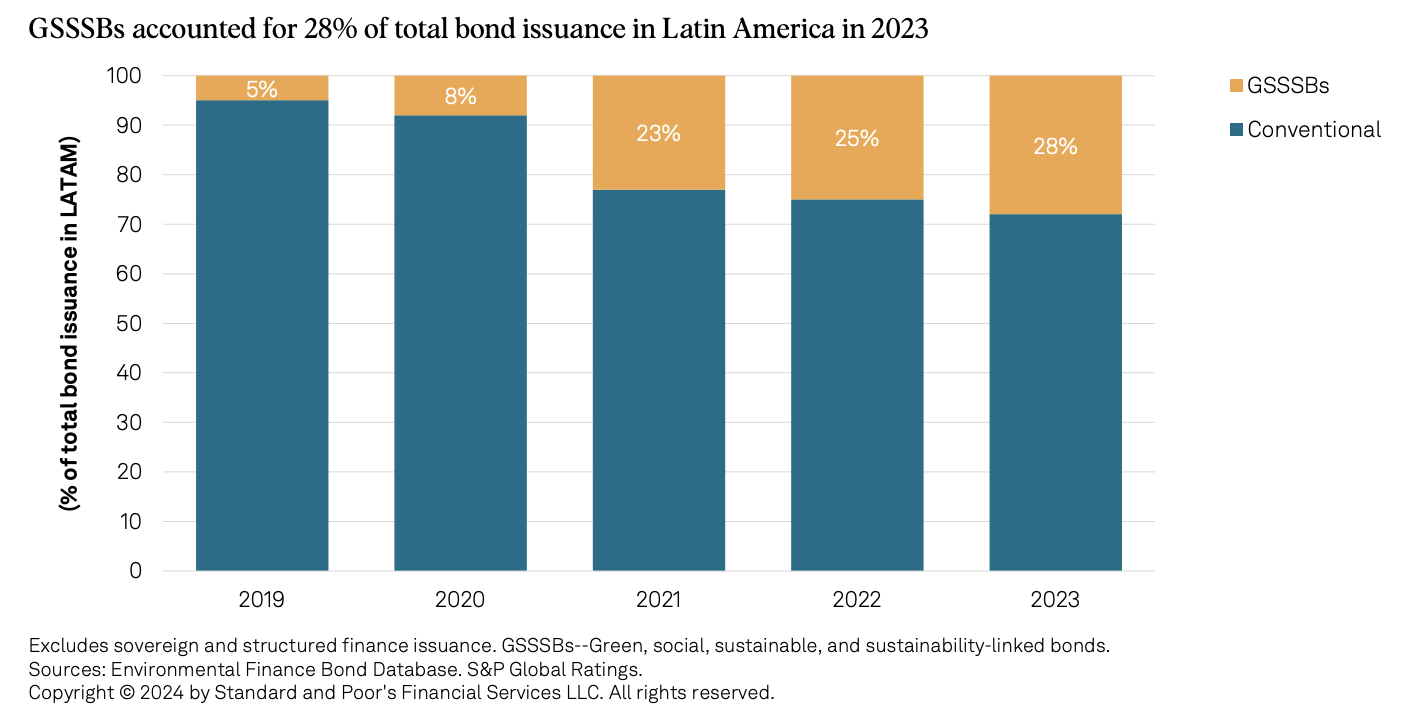

Sustainability Insights Research: Latin American Sustainable Bond Issuance To Rise In 2024

Sustainable bonds could increase to more than 30% of Latin America's total bond issuance this year, showing resilience to fluctuations in the bond market over the past three years. S&P Global Ratings estimates issuance of green, social, sustainability and sustainability-linked bonds (GSSSBs) in Latin America will reach $45 billion to $55 billion in 2024, with Brazil, Chile and Mexico likely remaining the market leaders, particularly through issuance of sustainability and sustainability-linked bonds.

—Read the article from S&P Global Ratings

Access more insights on sustainability >

Listen: What's In Store For Specialty Chemicals?

Jennifer Abril, president and CEO of Socma, the US trade association for specialty and custom chemical makers, joins the podcast to discuss how the year is looking for companies in the sector. Topics include a topsy-turvy 2023, the likely end of destocking, interest in AI and Socma's advocacy agenda for 2024.

—Listen and subscribe to Chemical Week, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

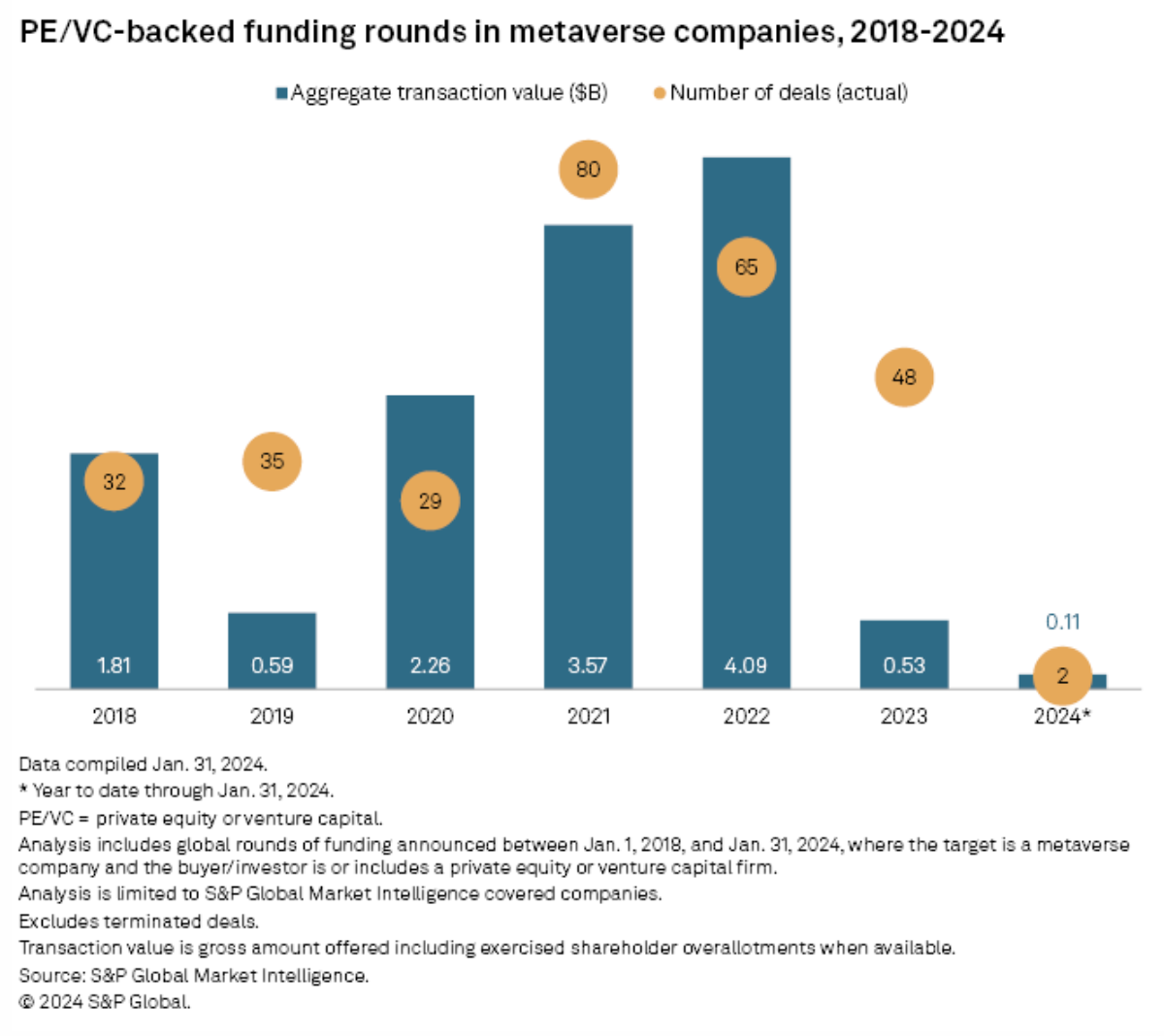

Venture Capital Funding For Metaverse Dries Up

Global private equity and venture capital investments in metaverse companies slowed significantly in 2023 as technological setbacks challenged the metaverse's potential and investors fled to generative AI company deals. Funding rounds involving 278 metaverse companies tracked by S&P Global Market Intelligence Kagan raised roughly $530 million in 2023, down 87% from $4.09 billion of investments in 2022.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Language