Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

What High Oil Prices Mean For The Global Economy

Market participants expect oil prices to remain high through this year with considerable supply constraints—but don’t anticipate diminished demand or refining activity.

The protracted pandemic and war in Ukraine have sent global oil prices on a rollercoaster ride from stability to volatility and back again. After the ICE Brent crude futures price roared to a 14-year high above $130 per barrel on March 7 as international sanctions took effect targeting Russian energy, those prices steadied by April. Now that that petroleum prices are elevating again, expectations for oil demand, fossil fuel spending, and recessionary risks are evolving.

The world is facing an energy crisis "that we have not seen before," Mark Dunand, the head of commodity trading group Mercuria, said today during a panel at S&P Global Commodity Insights’ Executive Petroleum & Energy Conference in London. "The movement is away from globalization to focus more on security of supply and individual capability to build things. I think the indicators are there to say there is a decent chance to see a recession coming in the next 12 to 24 months."

As oil prices stay at around $120 per barrel, compounding supply constraints could create additional challenges for the market.

“The additional worry that we have is simply that the old saying—that the best cure for a high price is a high price—is not working that well because that is only part of the equation,” Ole Hansen, the head of commodity strategy at the Danish investment firm Saxo Bank, said during a June 7 panel at the Executive Petroleum & Energy Conference. “We are not seeing that pick-up in supply that we need" because producers are struggling to ramp up capacity after the pandemic, investors have low appetite for new upstream oil investments due to heightened climate concerns, and the market is confronting growing uncertainty over future oil demand scenarios.

More supplies will need to reach the market to meet the world’s expanding demand for oil.

Raising its forecasts for 2022 global oil demand growth by 200,000 barrels per day on June 3 due to the better-than-anticipated recovery in Southeast Asia and Western Europe and easing COVID restrictions in China, S&P Global Commodity Insights now expects global oil demand to expand by 2.8 million barrels per day this year and by 2.5 million barrels per day in 2023. The forecast assumes an annual average Dated Brent price of $104 per barrel in 2022 and $90 per barrel in 2023.

In new forecasts released on June 7, the U.S. Energy Information Administration expects pandemic pressures and geopolitical uncertainty to propel WTI average prices to $102.47 per barrel and Brent average prices to $107.37 per barrel in 2022, marking more than $4 per barrel in price gains from their previously forecasted expectations. The EIA sees a small increase in oil demand for the year, now anticipating global demand of 20,000 barrels per day from its forecast last month of 99.63 million barrels per day—but simultaneously lowering its global demand forecast for 2023 by 230,000 barrels per day, to total 101.32 million barrels per day.

"We believe that current prices are already impacting economic growth and oil demand,” Toril Bosoni, the head of the International Energy Agency's oil market division, told S&P Global Commodity Insights in an interview on the sidelines of the Executive Petroleum and Energy Conference. "Our forecast shows throughput [refining activity worldwide] increasing 4.7 million barrels per day from a low point in April through to August, and this will support crude demand and crude prices.”

But higher oil prices create the risk that market participants will secure new fossil fuel spending and investment that exacerbates climate risks and delays the global economy’s energy transition to renewable sources.

"My worry is that some people may use Russia's invasion of Ukraine as an excuse for a large scale, new wave of fossil fuel investments,” Fatih Birol, the head of the International Energy Agency, told the World Economic Forum in Davos, Switzerland on May 23, according to S&P Global Commodity Insights. “My worry is it will forever close the door to reach our climate targets ... and it may not be a lucrative investment.”

Today is Wednesday, June 8, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Emerging Markets: Sub-Saharan Africa's Still Down But Not Out

Sub-Saharan Africa is struggling to return to prepandemic economic growth. S&P Global Ratings believes commodity-fueled exports and investments should help reduce external imbalances and boost activity in commodity rich countries, notably Nigeria, Angola, and to a lesser degree South Africa. However, the rising cost of goods and services will hurt households across the region, especially in fuel and food-importing countries.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

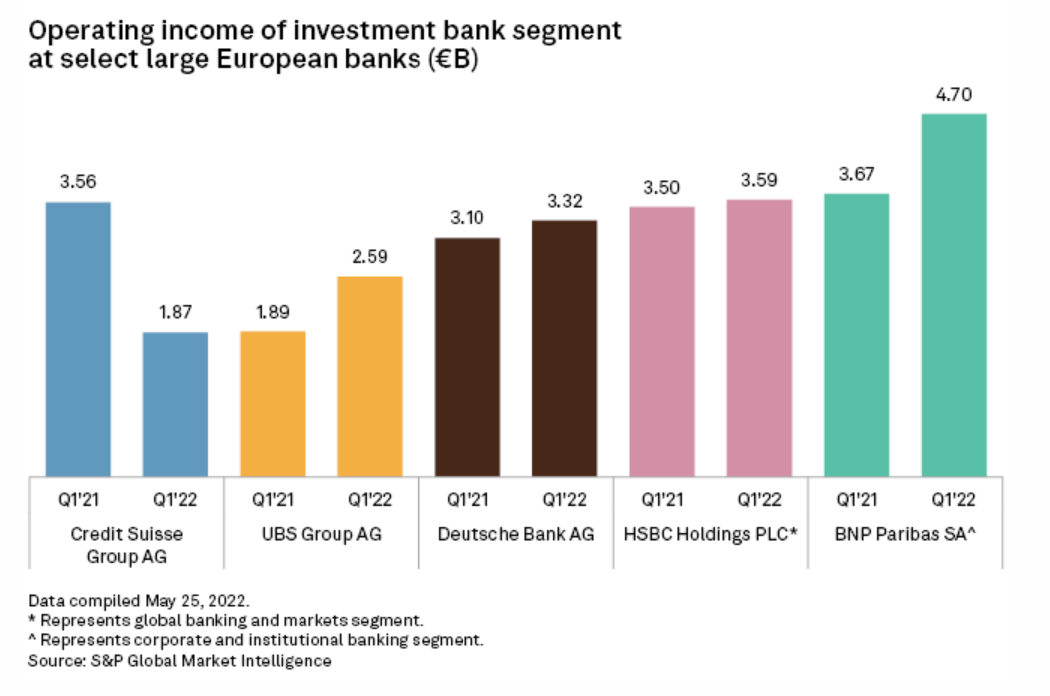

Credit Suisse Risks Losing Business Amid Overhaul – Analysts

Credit Suisse Group AG is in danger of losing investment bank and wealth management business as it goes through cultural and organizational changes. The bank's 2024 strategy should deliver a leaner and lower-risk structure, with a smaller investment bank and more capital allocated to wealth management. Yet, analysts question Credit Suisse's ability to retain clients and market share in these two core areas during the revamp.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Assessing Russia/Ukraine Conflict Scenarios: What Comes Next?

As the Russia-Ukraine military conflict rages on, S&P Global is continuing to assess the related effects on economies worldwide, the ramifications for financial and commodity markets, and the impact on borrowing conditions and credit quality. Against a backdrop of raising interest rates, inflation pressures, and the lingering impacts of COVID-19, the unprecedented situation we find ourselves has heightened challenges facing investors today. Join S&P Global for a comprehensive analysis of varying Russia/Ukraine conflict scenarios during a period of economic uncertainty. Paul Gruenwald, global chief economist at S&P Global Ratings will outline key macroeconomic observations and the possible paths the conflict could take.

—Register for the webinar from S&P Global

Access more insights on global trade >

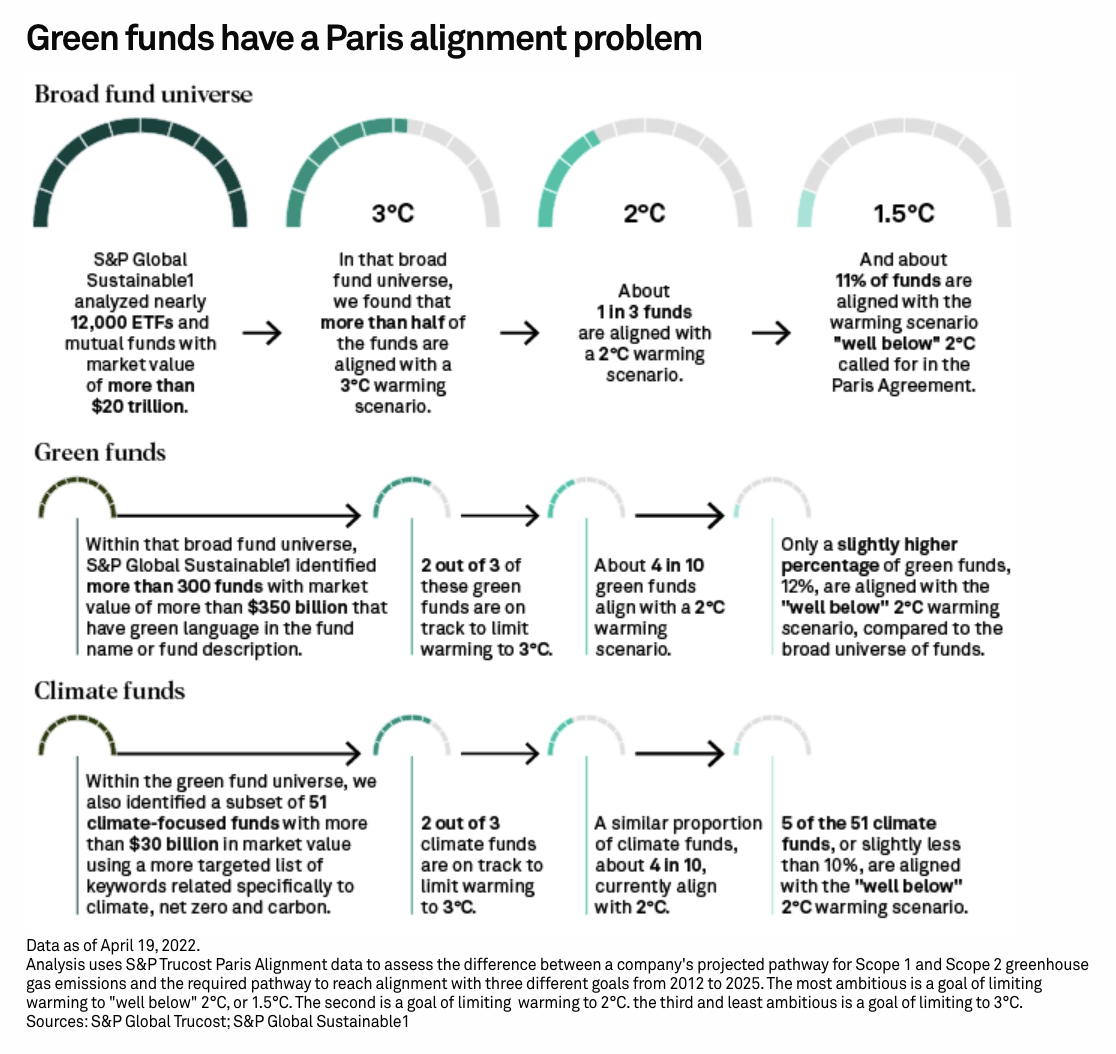

Green Funds Have A Paris Alignment Problem

Equity mutual funds and exchange-traded funds around the world use green language to signal that their portfolios support the energy transition, address environmental concerns, or combat climate change. But wide misalignment with the Paris Agreement goal of limiting global warming is the current reality for most of these funds, according to a new analysis by S&P Global Sustainable1—and this could undermine the eco-friendly or climate-conscious signals they send to investors.

—Read the article from S&P Global Sustainable1

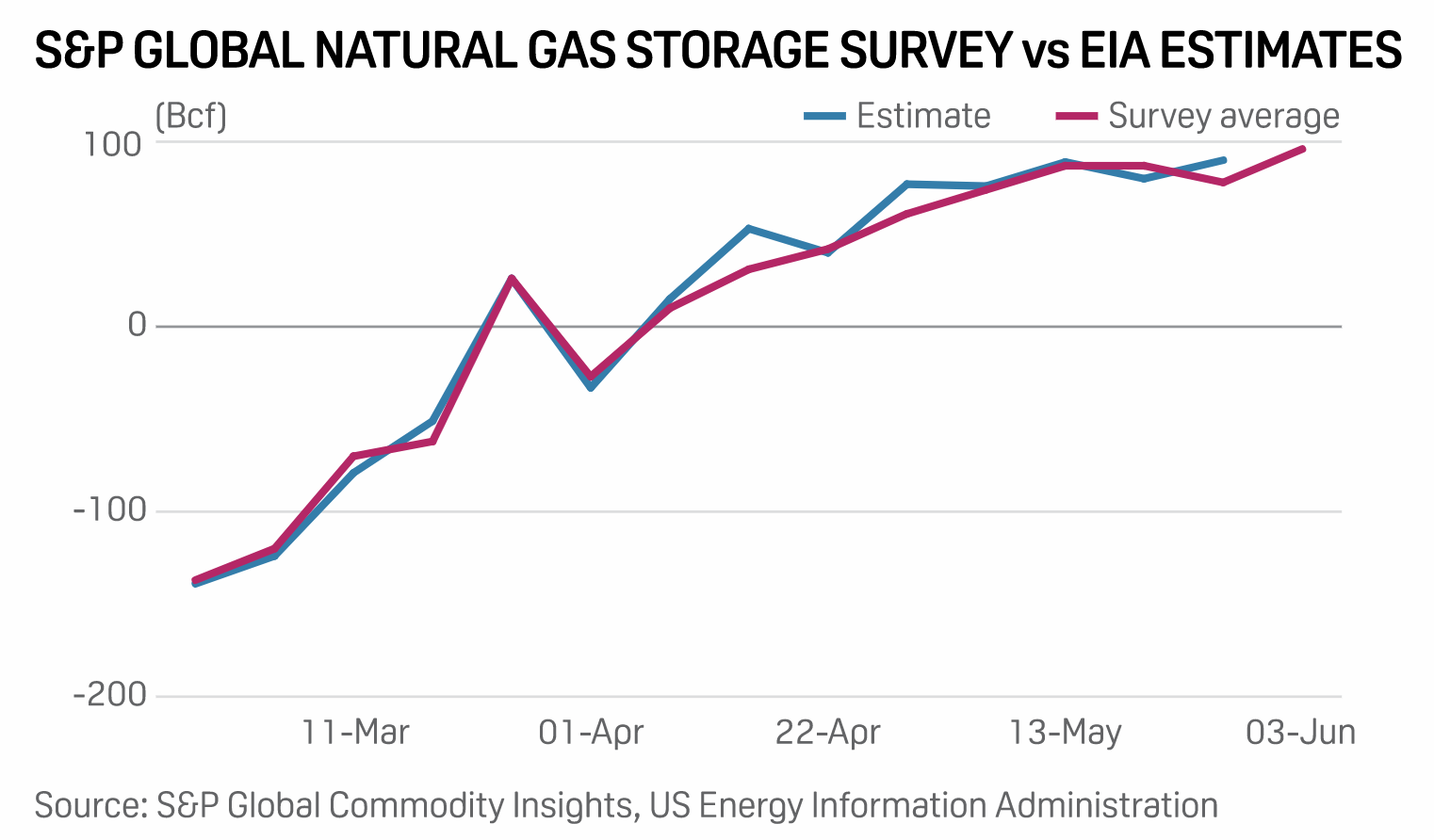

EIA U.S. Gas Storage Report Likely Bullish Again, Though Closer To Average

Milder temperatures last week likely allowed more U.S. natural gas supply to flow into storage, briefly pausing the rally in Henry Hub futures prices ahead of an anticipated ramp in summer gas demand. The U.S. Energy Information Administration this week is expected to report a 96 Bcf injection to U.S. gas storage for the week ended June 3, according to this week's survey of analysts by S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 68: Pride Month - Diversity And Inclusion In Technology

Supporting the communities that make up the modern enterprise requires visibility in ways that many might not have considered. Analyst Marie Froehlicher and Emily Jasper, president of the Global Pride Resource Group, join host Eric Hanselman to explore the path to greater understanding. Organizations have to understand that, unlike other corporate metrics, DEI perspectives are dynamic and have to consider language to capture the nuances of the constituencies that make up their community.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence