Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Jun, 2020

By S&P Global

The fall of Chesapeake Energy Corp.— which pioneered fracking in the U.S. and played a monumental role in solidifying the country’s status as an energy powerhouse before filing for Chapter 11 bankruptcy protection on Sunday—suggests that the future of energy amid the coronavirus crisis may swing toward sustainable sources.

The Oklahoma City-based oil and gas company said it had amassed nearly $9 billion in debt, suffering $8.3 billion in losses in the first quarter of this year due to the downturn’s effect to the industry. At the end of last year, it held $9.5 billion in debt. Under the leadership of co-founder and former chief executive officer Aubrey McClendon, who was ousted from the company in 2013, Chesapeake amassed more than $20 billion in debt. In May, its current CEO, Doug Lawler, abandoned the company’s full-year outlook and wrote down its oil and gas assets by $8.5 billion this year due to the pandemic’s implications.

“We are fundamentally resetting Chesapeake’s capital structure and business to address our legacy financial weaknesses and capitalize on our substantial operational strengths,” Mr. Lawler, said in a June 28 statement.

Chesapeake said its bankruptcy filing aims to slice $7 billion of its debt, secure $925 million in debtor-in-possession financing, shore up its balance sheet, and ultimately build a more “sustainable” business.

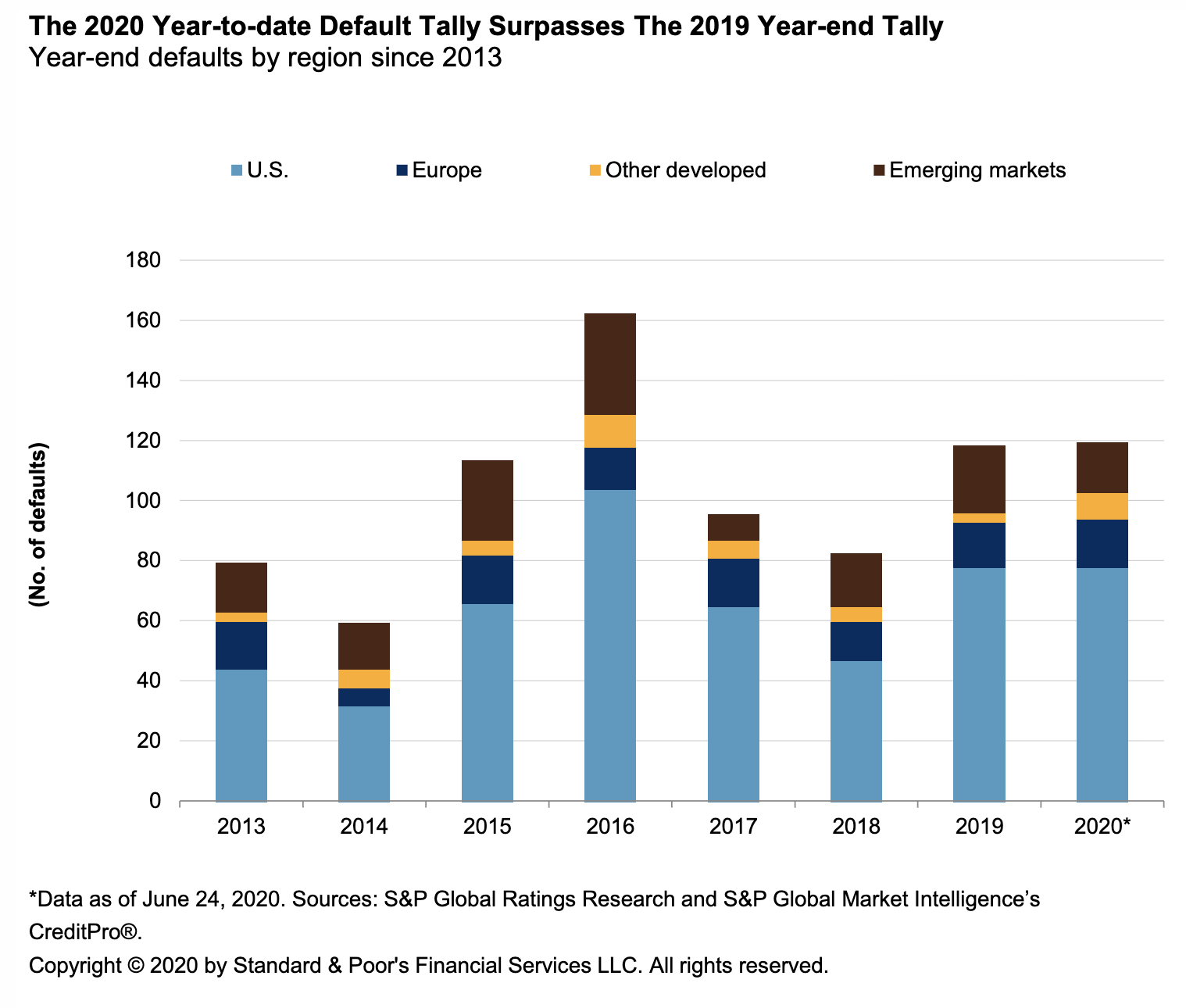

Last week, the total number of global corporate defaults for this year reached 119, surpassing the full-year 2019 tally—with the oil and gas sector taking the lead, accounting 19 defaults in six months, according to S&P Global Ratings.

While only time will tell how one of the U.S.’s largest fracking firms will carve out a viable model, new projections by S&P Global Platts Analytics show that global CO2 emissions from energy consumption will likely plateau this decade before declining starting in 2035.

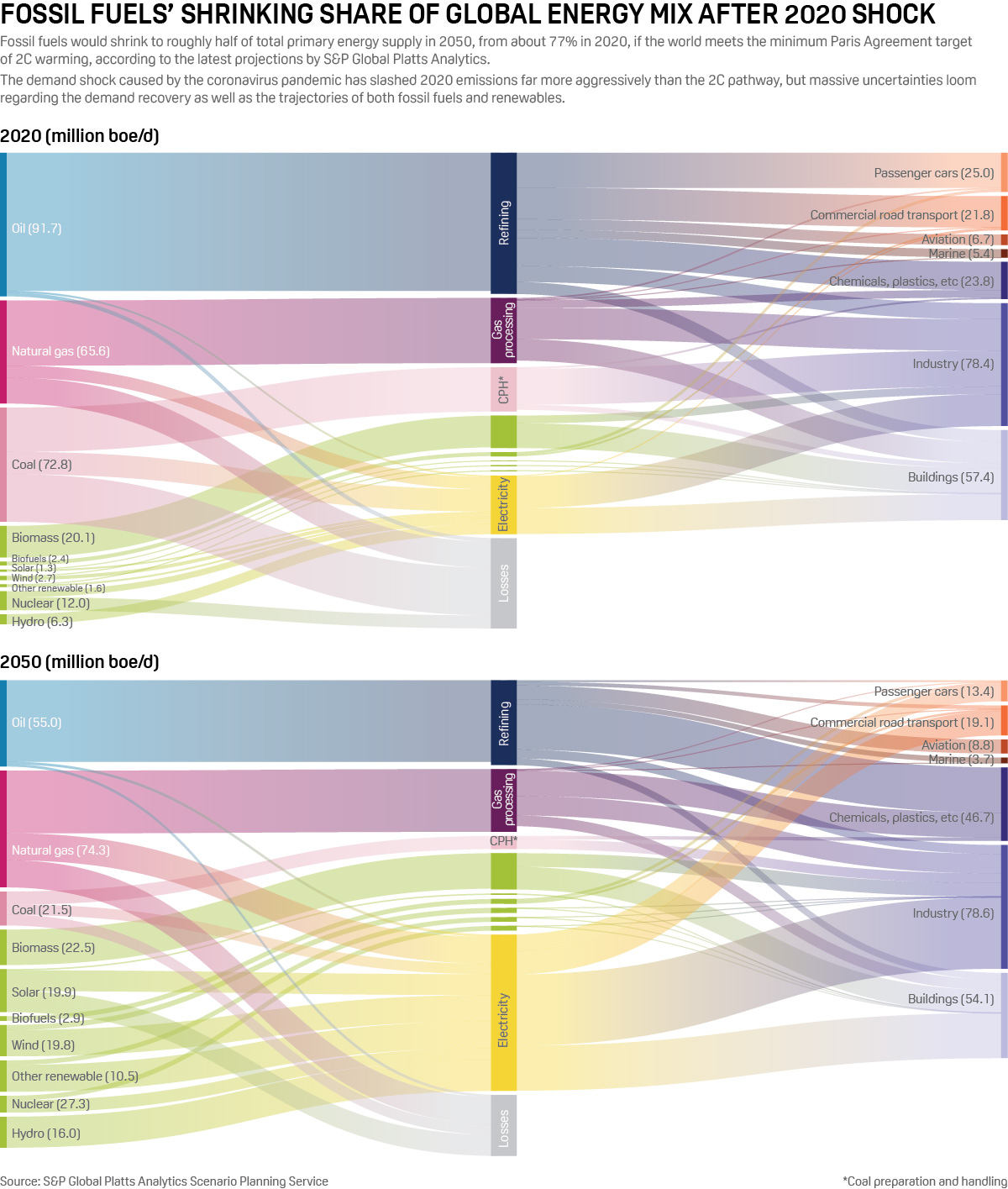

Fossil fuels’ share of the global energy mix will likely expand until 2025, as the world recovers from the global health crisis’ economic effects. According to S&P Global Platts Analytics Scenario Planning Service’s projections of the post-pandemic economic recovery, global CO2 emissions will likely return to 2018 levels by 2022, after which growth in emissions will flatten to 0.2% a year before peaking in 2032. Eight years later, “by 2040, emissions [will] remain around 3 gigatonnes above 2020 levels, as abatement efforts are offset by the continued use of coal for power generation in Asia's growth economies,” the scenario showed.

Still, five years from now, renewable energy will likely become increasingly cost-competitive and grow faster across the long-term than fossil fuels over the long-term, according to S&P Global Platts Analytics. Fossil fuels could shrink to approximately half of the world’s total primary energy supply in 2050, from about 77% this year, if the world meets the minimum Paris Agreement target of 2°C warming.

"The fact that CO2 emissions stop growing is a remarkable feat, considering continuous economic and population growth over the long-term," Dan Klein, Platts Analytics' head of scenario planning, said. “Renewables will be the fastest-growing source of energy over the long-term, more than doubling current production by 2040. However, this high level of renewables growth is not expected to cover all of the world's energy demand growth over this period, and growth in fossil fuel demand will be required."

If the global economy is sluggish to recover from the pandemic, the arrival of peak oil demand may have accelerated by more than a decade with demand for crude oil and overall fossil fuels potentially peaking permanently last year, according to a Boston Consulting group report released last week. A rapid V-shaped recovery could restore fossil fuel demand with a weakened energy sector by 2022, but a slowed U-shaped economic recovery could signal that fossil fuel demand has passed its peak.

In the immediate term, the International Energy Agency forecasts global energy demand will fall 6% this year, with fossil fuels affected more than non-fossil fuels.

Today is Monday, June 29, 2020, and here is today’s essential intelligence.

Default, Transition, and Recovery: 2020 Corporate Defaults Surpass The Full-Year 2019 Tally

The 2020 global corporate default tally has jumped to 119 after 10 issuers defaulted since our last report. In just over five months, the 2020 corporate default tally has surpassed the full-year 2019 total of 118 defaults, led by the U.S. with 78 defaults so far this year. Both Europe and other developed regions have seen a considerable increase in defaults compared with previous years and have either matched or surpassed their full-year tallies in 2017, 2018, and 2019.

—Read the full report from S&P Global Ratings

Economic Research: Asia-Pacific Losses Near $3 Trillion As Balance Sheet Recession Looms

S&P Global Ratings expects the COVID-19 pandemic to leave lasting scars on Asia-Pacific, with the extraordinary measures needed to shore up economies leading to higher debt, weaker balance sheets, and less appetite for spending in the future. Investment is likely to stay sluggish, especially in the private sector; and even if state-owned enterprises spend more, we still anticipate less productive capital, lower potential output, and a permanent 2%-3% shrinkage of most economies compared to the pre-COVID trend. We project Asia-Pacific's economy will contract by 1.3% in 2020 but show 6.9% growth in 2021, implying $2.7 trillion of lost output over these two years, even assuming broad containment of the coronavirus. We still see China's economy expanding 1.2% in 2020 before growth surpasses 7% next year. The largest downward revision of our growth estimates is for Japan, where we now expect a 5% contraction in 2020 as consumers save more. India's economy will also shrink 5% this year as lockdowns compound underlying vulnerabilities, followed by a rebound next year.

—Read the full report from S&P Global Ratings

Banking Industry Country Risk Assessment Update: June 2020

This article presents updates to S&P Global Ratings' views on the 88 banking systems that it currently reviews under its Banking Industry Country Risk Assessment (BICRA) methodology. S&P Global Ratings also presents government support assessments, as well as economic and industry risk trends, for those banking systems.

—Read the full report from S&P Global Ratings

Brazil's mortgage market shows resiliency during coronavirus pandemic

Low interest rates, attractive property prices, and a 43 billion reais credit line from state-run lender Caixa Econômica Federal have kept Brazil's housing credit market afloat during the pandemic, although industry experts expect disbursements in 2020 to decline. The Brazilian Association of Real Estate Credit and Savings Entities, or ABECIP, which, prior to the pandemic, had forecast 32% growth for total real estate credit portfolios for the year, has drastically reviewed that forecast to a decline of 7% from 2019 levels. But the credit sector, and mortgages in particular, have so far remained resilient in Latin America's biggest economy.

—Read the full article from S&P Global Market Intelligence

Equity capital market issuance on track for strong Q2 following May record

Equity capital market issuance has surged in the second quarter of 2020 versus the prior three months as global volumes hit a year-to-date high in May and continued to grow in June, S&P Global Market Intelligence data shows. The aggregate amount of ECM offerings, excluding convertibles and private placements, totaled $75.32 billion in May, more than three times higher than April's $23.80 billion. As of June 24, aggregate global offerings reached $58.67 billion for the month, already more than double April's total.

—Read the full article from S&P Global Market Intelligence

Platts Carbon Emissions Playbook maps climate change challenge

A post-pandemic economic recovery would see global CO2 emissions return to 2018 levels by 2022, according to Platts Analytics Scenario Planning Service, whose data and forecasts are visualized here. After 2022, growth in CO2 emissions essentially flattens to 0.2% a year before peaking in 2032. By 2040 emissions remain around 3 Gt above 2020 levels, as abatement efforts are offset by the continued use of coal for power generation in Asia's growth economies. The largest incremental emissions reductions will be realized in power sector decarbonization and alternative transport fuels in the OECD.

—Read the full article from S&P Global Platts

The Evolution Of Sustainable Investing Rewards

Answering to investors’ growing demand for robust and comprehensive ESG metrics, the S&P Global ESG Scores were made accessible to the global investment community on 18th May 2020 – in the midst of a global crisis that has seen large outflows from mainstream funds and inflows into sustainable investments as global sustainability indices have outperformed traditional market benchmarks. The outperformance of the Dow Jones Sustainability Indices (DJSI) over one, three- and five-year time horizons highlights the ability of the SAM Corporate Sustainability Assessment (CSA) to select outperforming companies. Investors can access S&P Global ESG Scores derived from the CSA for the first time to discover meaningful investment signals and build better portfolios. Companies continue to value the CSA as a key tool to benchmark and communicate their corporate ESG performance.

—Read the full report from S&P Global Market Intelligence

Listen: Mapping out hydrogen's role in Asia's energy transition

As the push towards clean fuels intensifies, many alternate energy sources are figuring in discussions among policy makers in Asia, as they prepare for energy transition. One fuel that has garnered a lot of attention is hydrogen. From finding low-cost production methods to creating a transparent price discovery mechanism, hydrogen has a few challenges to overcome to make bigger inroads into leading Asia-Pacific markets, says Edgare Kerkwijk, Board Member of the Asia-Pacific Hydrogen Association, in an interview with S&P Global Platts Senior Editor Sambit Mohanty.

—Listen to Commodities Focus, a podcast from S&P Global Platts

Interactive infographic: Fossil fuels' shrinking share of global energy mix after 2020 shock

Fossil fuels would shrink to roughly half of total primary energy supply in 2050, from about 77% in 2020, if the world meets the minimum Paris Agreement target of 2C warming, according to the latest projections by S&P Global Platts Analytics. The demand shock caused by the coronavirus pandemic has slashed 2020 emissions far more aggressively than the 2C pathway, but massive uncertainties loom regarding the demand recovery as well as the trajectories of both fossil fuels and renewables.

—Read the full article from S&P Global Platts

S&P Global Platts' new waterborne USGC benchmark targets flaws in Cushing-based WTI

S&P Global Platts aims to set a new US crude benchmark after the historic NYMEX WTI negative pricing event in April that was triggered by landlocked storage concerns in Cushing, Oklahoma. The new Platts American GulfCoast Select (AGS) launched on June 26 focuses on Permian Basin crude set for export and is designed to better reflect pricing after a hodgepodge of Houston-based or waterborne assessments released in the last few years never truly caught on. Platts AGS will represent the value of waterborne light, sweet crude loading FOB US Gulf Coast, 15 to 45 days ahead. A key goal is to avoid such pricing distortions that sometimes arise from Cushing, which is more than 500 miles from Texas export hubs.

—Read the full article from S&P Global Platts

Argentina extends, tightens lockdown; puts fresh damper on oil demand, production

Argentina has extended a 99-day-old economic lockdown for three more weeks to try to contain a surge in coronavirus cases, including by tightening restrictions on people's movements in densely populated parts of the country, a decision seen as cutting oil demand and production that had been recovering from a low in April. "We are going to take a more severe step: we are going to ask everyone to isolate themselves at home and only go out to look for provisions that are necessary for everyday life," President Alberto Fernandez said June 26 in a pre-recorded address. "The coronavirus is that invisible enemy that you never know when you will finish defeating him."

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language