Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 Jun, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Weaker Growth in Asia Attributed to Slowdown in US and EU

A predicted recession in the US and EU keeps getting delayed by another quarter. But news of the unexpected resilience of these economies appears not to have reached Asia, where lower export numbers are attributed to an economic slowdown in the US and EU. The supposed slowdown is difficult to find in the macroeconomic data — GDP numbers continue to outperform expectations, real wages are up and unemployment is down. Inflation remains stubbornly persistent, but that is evidence of an overheated economy, not a slowdown.

Rajiv Biswas, Asia-Pacific chief economist for S&P Global Market Intelligence, suggested in a recent article about Vietnam’s economy that “the economic slowdown in the US and EU, which together account for 42% of Vietnam's total goods exports, has resulted in a significant weakening in exports during the first four months of 2023, with Vietnam's total goods exports declining by 13% [year over year].”

Vietnam is not the only market where lower exports are being attributed to an economic slowdown in the US and EU. Singapore’s slowing GDP growth rate was attributed to weak demand in the important export markets of these economies. A decline in first-quarter 2023 GDP growth in Taiwan was also attributed to weak electronics demand in the US, EU and mainland China. In China, weak demand in the US and EU due to high inflation and interest rate hikes was the main obstacle to the strong return of Chinese exports.

The question naturally arises: How weak is demand in the US and EU? Surprisingly, the answer is that demand looks quite strong. In the US, orders for durable goods increased 1.1% month over month in April. This is consistent with an estimated 1.2% year-over-year increase in consumer spending for 2023, according to S&P Global Ratings. According to S&P Global Market Intelligence, the nominal trade deficit for the US widened in April by $13.4 billion to $77.6 billion, reflecting an increase in imports. The EU economy has also been unexpectedly resilient. Although some countries in the eurozone have fallen into recession, the EU is expected to experience positive GDP growth in 2023.

Demand remains healthy in the US and EU, but Asian exports are undeniably declining. There could be several explanations. One reason is that inventory levels in the US and EU are returning to pre-pandemic levels. During the supply chain disruptions of the past three years, many retailers in the US and EU were forced to maintain larger inventories in warehouses to avoid shortages on store shelves. As supply chains have normalized, retailers have attempted to “sell down” their inventories. This would temporarily reduce their dependence on imports from Asia and lead to smaller orders.

The other reason is that ongoing geopolitical tensions may be leading US and EU firms to look for suppliers closer to home. While it is unclear how effective concepts such as “nearshoring” or “friendshoring” are on global trade, this could account for an increased trade deficit in the US with falling exports from Asia.

Today is Monday, June 26, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Listen: The Essential Podcast, Episode 87: Sri Lanka 2.0, Catching Up With Talal Rafi

Talal Rafi, economist and management consultant at Deloitte, expert member of the World Economic Forum and regular columnist for the International Monetary Fund returns to the podcast to give us an update on what's happening in Sri Lanka. The Essential Podcast from S&P Global is dedicated to sharing essential intelligence with those working in and affected by financial markets. Host Nathan Hunt focuses on those issues of immediate importance to global financial markets — macroeconomic trends, the credit cycle, climate risk, ESG, global trade and more — in interviews with subject matter experts from around the world.

—Listen and subscribe The Essential Podcast from S&P Global

Access more insights on the global economy >

Crypto CeFi And DeFi Must Strike A Balance To Thrive

Although crypto technology promises a decentralization of the financial system, most adoption so far has taken place through centralized finance (CeFi) intermediaries. The failure of several CeFi entities in 2022 highlighted their risk management weaknesses, governance issues and the contagion risks between CeFi entities. In contrast, decentralized finance (DeFi) protocols largely weathered the storm, with minimal loan losses on the major collateralized lending platforms and continued growth in the use of decentralized exchanges. Yet DeFi still carries risks, and the lack of a regulatory framework and know-your-client/anti-money-laundering functionality hinders its adoption by traditional financial institutions.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Global VLCC Freight Points Downward As Saudi Crude Production Cuts Bite: Sources

The rise in freight rates seen through June for Very Large Crude Carriers could be coming to an end, market sources said in the days leading up to June 22, as the onset of fresh cuts in Saudi crude production began to weigh on market sentiment. Despite weak economic data, China has cranked up crude buying in recent weeks before the latest Saudi-led bout of output cuts from OPEC+, a coalition of OPEC and other oil producers, take effect. The increase in crude buying supported freight, bolstering VLCC rates from the Middle East to China.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

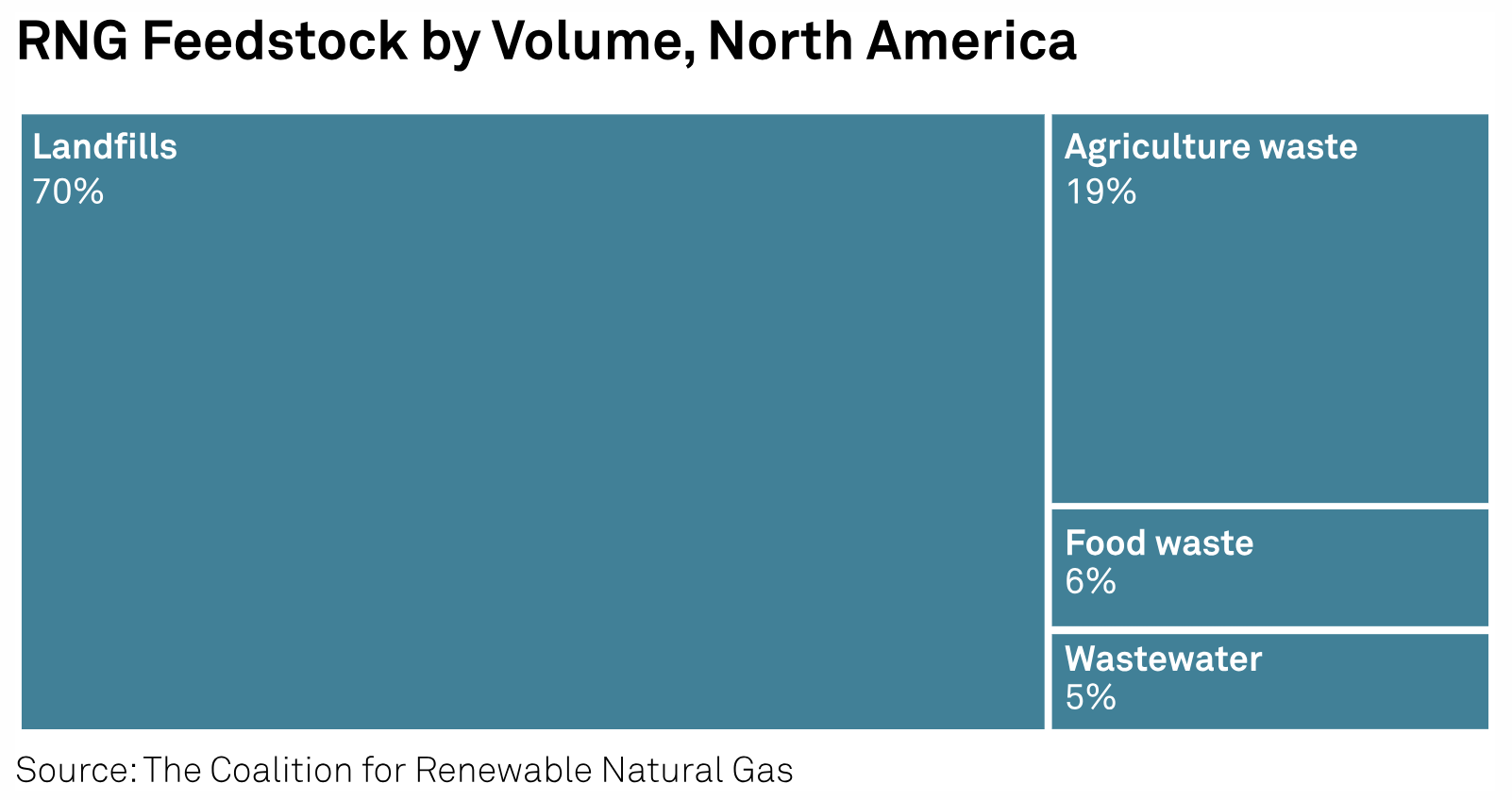

Viridi Energy, American Organic Energy to collaborate on food waste-to-RNG project

Viridi Energy, a renewable natural gas platform, has partnered with American Organic Energy to develop one of the largest food waste-to-RNG projects in the US, the company said June 22. The landmark facility will produce RNG and fertilizer from food waste diverted from landfills in the New York City metropolitan area. The anaerobic digestion facility, located in Yaphank, New York, is expected to convert approximately 210,000 mt of waste each year, which equates to the total annual food waste of Dallas, Texas.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

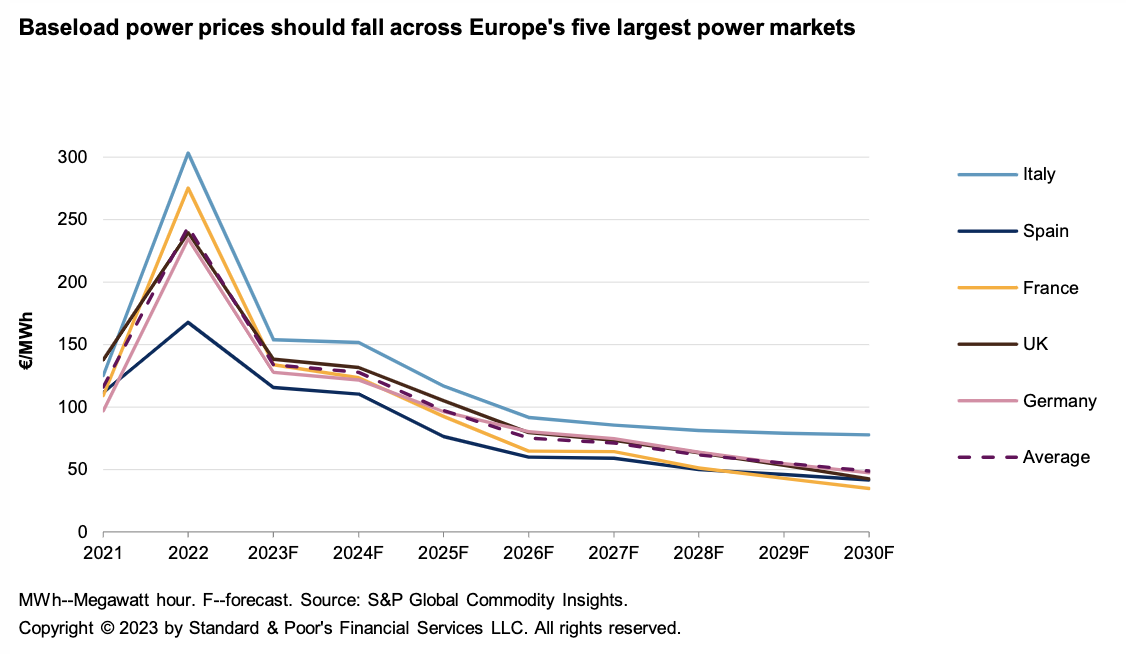

Europe's Utilities Face A Power Price Cliff From 2026

Wholesale power prices will remain at or above historically high levels of 100€ per megawatt hour before falling considerably from 2026, when wind and solar begin to dominate the power mix. Power generators' management of the energy transition will be dictated by decisions that balance investment in renewables, the creation of financial headroom and investor returns. Solar and wind power generators could mitigate the impact of lower and more volatile prices by adding storage solutions and hydrogen production. Failing that, renewable investments and the energy transition could be delayed, resulting in higher power prices for longer.

—Read the report from S&P Global Ratings

Access more insights on energy and commodities >

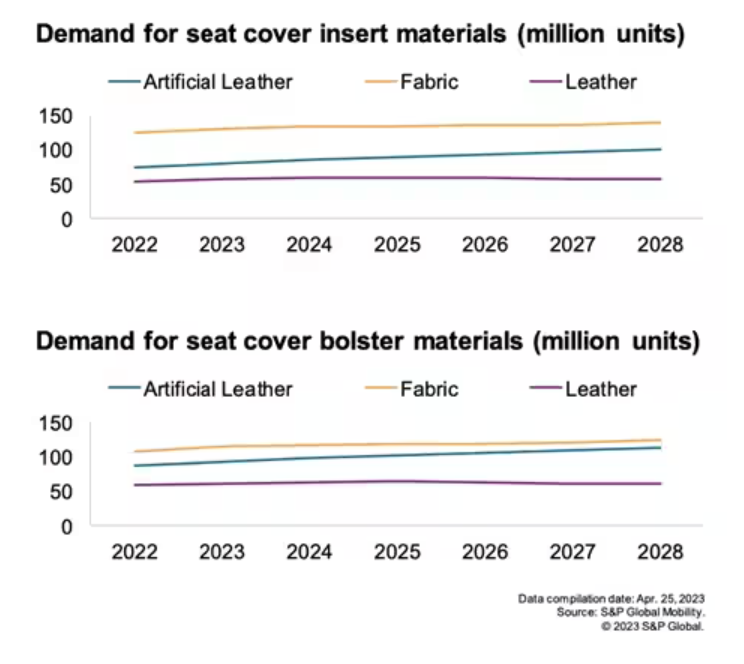

How EV Platforms And Technology Could Transform Auto Interior Design

Electrification is driving the greatest paradigm shift in the automotive industry in more than a century. Modern battery electric vehicle (BEV) powertrains are changing the way cars, trucks and SUVs are designed, engineered and manufactured. And one of the biggest changes will be noticed by consumers the moment they sit inside their new electric vehicle.

—Read the article from S&P Global Mobility

Content Type

Segment

Language