Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Jun, 2021

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

A craze for content has sent media companies into a consolidation race and social media platforms courting creators with monetization.

Deal-making has increased as U.S. media companies scurry to snatch up and consolidate content makers. In May, 104 media and telecommunication services sector deals were announced with disclosed transaction values, up notably year-over-year from the 68 announced in May 2020, according to an S&P Global Market Intelligence analysis. Some film companies like Lionsgate have tried to stay outside the fray of the consolidation, and some market participants have raised eyebrows over the speed of deal-making. But the two biggest mergers and acquisitions—Amazon’s move to buy MGM Studios for $8.45 billion and AT&T’s plans to merge its Discovery and Warner Media assets into one conglomerate for $43 billion in cash—indicate how rapidly technology and media are transforming. As telecommunications companies shed their media units elsewhere in the market, the information technology sector saw a 120.2% year-over-year increase in deal volumes in May, totaling approximately 229 transactions, according to another S&P Global Market Intelligence analysis.

Amazon’s first foray into movie studios could be just the beginning of the tech behemoth’s content expansion. "It wouldn't surprise me at all if they were looking at other properties, other studios as well," Dan Romanoff, an analyst with the financial services firm Morningstar, told S&P Global Market Intelligence, adding that he expects Amazon to purchase additional film studios considering the consolidation seen across the media industry. "If Amazon wants to remain a relevant player in live streaming video, they have to expand their content library. They have done a nice job producing some material in house, but frankly, it just wasn't enough."

M&A deals like the combination of AT&T Inc.'s Warner Media and Discovery could also be the foundation for creating with and accessing different types of content. "If you have one of those platforms, why wouldn't you be stepping back and asking what else you could use to aggregate and distribute on it? I think it's entirely possible that those platforms that have very attractive customer bases and a large number of hours of engagement a day can ultimately aggregate other types of content and distribute them," AT&T CEO John Stankey said May 24 at the J.P. Morgan Global Technology, Media, and Communications Conference, according to S&P Global Market Intelligence. "I think it will be a natural point if you have a wireless subscription to possibly get some things aggregated at a discount in the new form of bundling moving forward.”

Social media companies may be able to diversify their business models and boost user engagement by capturing the competition for paid content from influencers and creators, analysts told S&P Global Market Intelligence. Short-form video application TikTok, legacy site Facebook, and video platform YouTube are expanding and exploring broader monetization opportunities for content creators.

Other digital entities are disrupting the monetization conversation, too. Apple Inc. last week launched a subscription-based version of its Apple Podcasts application to allows creators and publishers to set their own pricing. Analysts told S&P Global Market Intelligence that the move can help the company seize more market share in the audio and podcasting ecosystem and from competitors like Spotify.

"Apple has shown [that] their users are willing to be monetized and willing to pay for stuff," Rob Kniaz, founding partner of the venture capital firm Hoxton Ventures, told S&P Global Market Intelligence, explaining that Apple's push into premium podcasting is a natural extension for the company as it seeks growth beyond products such as the iPhone and other core hardware and services offerings. "I think Apple is trying to get ahead of the curve and take advantage of a growing sector of the media space that's still somewhat emergent."

Today is Tuesday, June 22, 2021, and here is today’s essential intelligence.

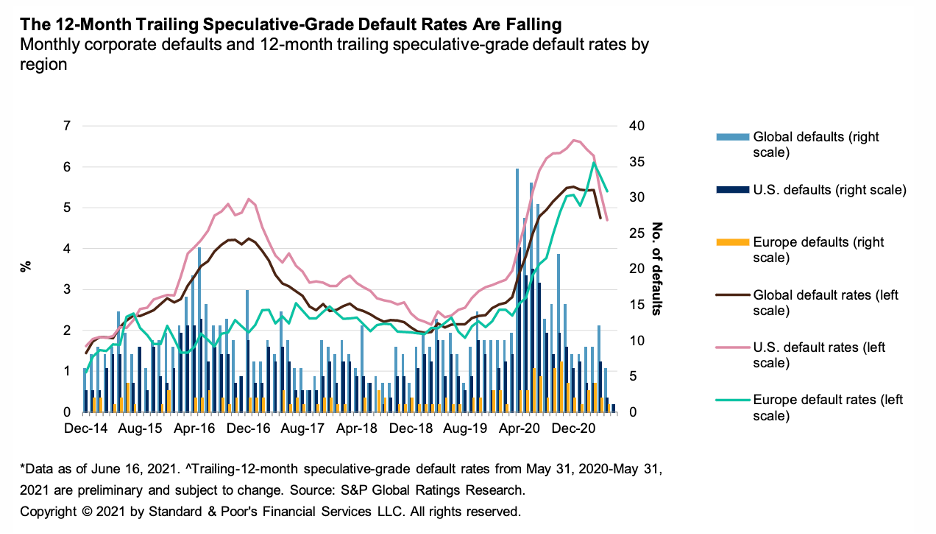

Default, Transition, and Recovery: 2021 Corporate Defaults to Date are Nearly 60% Lower Than They Were In 2020

With no defaults last week, the 2021 corporate default tally remained at 45, 59% lower than the number of defaults at this point in 2020. By sector, the oil and gas, consumer products, and media and entertainment sectors lead defaults so far with seven, six, and five, respectively.

—Read the full report from S&P Global Ratings

Let’s Go Shopping: Retail Sales to Stay Strong Outside of Home Improvement

Monthly retail sales reported by the U.S. Census Bureau declined in May but a closer look reveals a more nuanced picture of spending patterns with unexpected resilience in pockets and emerging weakness in others.

—Read the full report from S&P Global Ratings

Scenario Analysis: How the Next Downturn Could Affect U.S. BSL CLO Ratings

Despite significant downgrades to the ratings on U.S. broadly syndicated loan (BSL) issuers in 2020 due to the pandemic, CLOs backed by these loans showed relatively modest rating changes.

—Read the full report from S&P Global Ratings

AMC Shares on Wild Ride, Despite Valuation Warning Signs

AMC Entertainment Holdings Inc. cannot lose. Or, at least, that seems to be the feeling among many investors. Rising out of the ashes of the pandemic, AMC has issued more and more stock in an attempt to iron out a crumpled balance sheet. Since the opening of 2021, the company's share count has gone from just over 200 million outstanding to over 500 million. While that would typically result in a dilutive impact on a firm's share price, AMC's stock price has soared over 2,500% in that time.

—Read the full article from S&P Global Market Intelligence

The Good Days of Yesteryear

With the S&P/TSX Composite Index up 16% YTD through June 17, 2021, the Canadian equity market seems to have put the pandemic in the rearview mirror. In this environment, predictably, the S&P/TSX Composite Low Volatility Index underperformed, up 11% over the same period.

—Read the full article from S&P Dow Jones Indices

India's Vegetable Oil Traders Hold Back as Volatility In Palm Oil Futures Intensifies

India's vegetable oil traders have been holding back from conducting new business amid wide swings in palm oil markets in the first three weeks of June, following news of a potential changes in taxation and biodiesel mandates, as well as mixed supply and demand data, market sources told S&P Global Platts.

—Read the full article from S&P Global Platts

FEATURE: Rice Bucks Pandemic Trend for Soaring Food Prices

While the delicate networks which make up the global food supply chain have been rocked by the fallout from the coronavirus pandemic, most notably lockdowns and freight shortages, rice prices have largely fallen since last year, bucking the trend for sharply higher food prices.

—Read the full article from S&P Global Platts

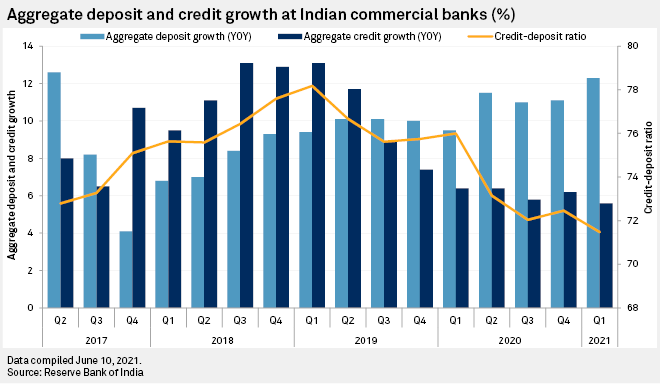

Indian Banks' Credit Growth to Improve Only Gradually as Pandemic Drag Lingers

Credit growth at India's commercial banks is likely to recover gradually in 2021, rather than quickly, as the country emerges from a deadly wave of COVID-19 and struggles to vaccinate the world's second-biggest population, analysts said.

—Read the full article from S&P Global Market Intelligence

Listen: In Move to Cleaner Energy Economy, Power Sector Falling Behind In Digital Transformation

Market dynamics and ambitious decarbonization goals set by the Biden administration are driving a transition away from fossil fuels and toward more renewable energy and electric vehicles. Consumers and investors are also expressing new expectations for sustainability and a cleaner energy economy. Utility executives have acknowledged a need for new digital technologies and a digitally savvy workforce, but a new survey by Ernst & Young found that the utility sector is falling behind in this digital transformation. Nearly 90% of utility executives say they do not have enough workers with the right skills to take advantage of digital technologies, and many lack a plan to proceed. S&P Global Platts spoke with Ryan Levine of Ernst & Young about the report and what it means for the power sector going forward.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

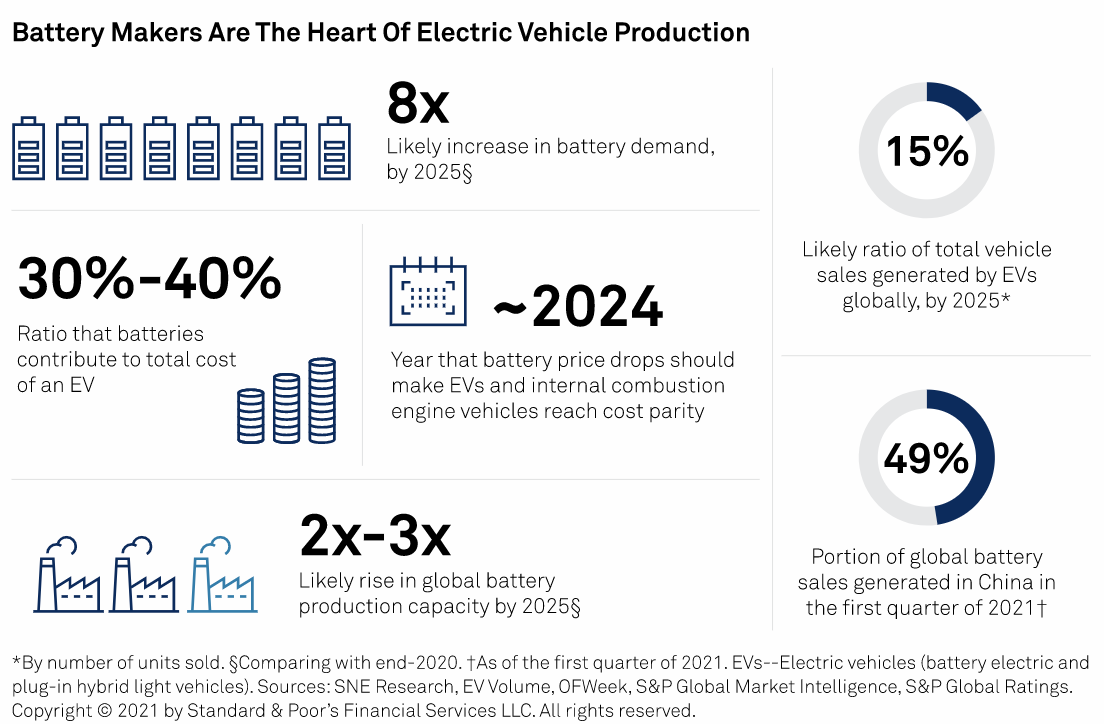

High-Flying Battery Makers Have Much to Win and Lose

Governments see electric vehicles as key to carbon cutting. This is driving up the sales of the firms that make the batteries that power this transport. S&P Global Ratings believes the world's biggest battery producers face substantial upside and downside risks to ratings. While their growth opportunities are significant, they will need to navigate fast-moving technology, heavy expenditure, geopolitical forces shaping trade lines, and environmental strains.

—Read the full report from S&P Global Ratings

China's Initial Carbon Prices to Balance Growth Needs With Long-Term Climate Goals

China's carbon market that starts trading in June is more likely to resemble a marathon with long-term goals rather than a 100-meter dash focused on immediate heavy-handed regulations to curb emissions, according to experts who have helped designed the system.

—Read the full article from S&P Global Platts

ESG Financing Takes Flight In North American Oil, Gas Pipeline Sector

Enbridge Inc.'s sustainability-linked bond framework could represent the next frontier in pipeline sector finance as investors look for management teams to deliver on environmental, social and governance commitments, industry observers and credit rating experts said.

—Read the full article from S&P Global Market Intelligence

Energy-Hungry Bitcoin Poses Questions for ESG-Conscious Institutions

Investment in bitcoin creates a dilemma for environmental, social and governance-conscious institutional investors due to the huge amounts of energy the mining process consumes. The bitcoin network's energy consumption is roughly the same as that of the Netherlands and a large portion of it is powered by coal.

—Read the full article from S&P Global Market Intelligence

State-Level Scrutiny Around Amazon May Ramp Up Amid Warehouse Injury Report

A recent report released by the Strategic Organizing Center, or SOC, a Washington, D.C.-based coalition of four labor unions representing more than 4 million workers, found that Amazon warehouse employees had 5.9 serious injuries per 100 workers in 2020 that required workers to either miss work or be placed on light or restricted duty — a rate nearly 80% higher than all other employers in the warehousing industry in 2020.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Americas, June 21-25: U.S., World Powers Resume Talks with Iran

In this week's Market Movers Americas, presented by Luke Stobbart: Negotiations with Iran resume after election; US feedgas utilization trends lower on maintenance; Americas crude complex boosted by fundamentals; refined products cracks drop with RINs/

—Watch and share this Market Movers video from S&P Global Platts

Chevron Offshore Oil and Gas Platforms Shut In Ahead of Gulf of Mexico Storm

Chevron temporarily shut in production June 18 from two offshore Gulf of Mexico oil and gas platforms and evacuated some staff, ahead of a weather system that was expected to strengthen into a tropical storm and make landfall in southeast Louisiana.

—Read the full article from S&P Global Platts

Biden's Venezuela Policy In Holding Pattern After Maduro Outlasts Sanctions Pressure

After Venezuelan President Nicolas Maduro outlasted the Trump administration's maximum sanctions pressure, US President Joe Biden will have to decide whether to offer Venezuela limited sanctions relief or more, amid calls from the left in Congress for humanitarian relief.

—Read the full article from S&P Global Platts

FERC Reverses Opt-Out Stance for Demand Response Participating In DER Aggregations

The Federal Energy Regulatory Commission June 17 backed off of a prior decision tied to its landmark rule opening wholesale power markets to aggregations of distributed energy resources, reversing its determination that state opt-out rules for demand response resources do not apply to those types of aggregations.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language