Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Russia’s Crude Exports Expand As Global Energy Crisis Deepens

The global economy’s divestment from Russia has disrupted more than 10% of global oil flows—but the energy superpower continues to export the commodity to unbegrudging buyers.

Russia's attack on Ukraine has spurred unprecedented sanctions from Western economies and their allies that continue to upset global commodity markets, most notably by restricting Russian oil supply that accounts for nearly 13% of total oil exports, according to S&P Global Commodity Insights. However, Russian seaborne crude exports remained at three-year post-pandemic highs in the first half of June as China and India gulp up the former Soviet superpower’s petroleum. Russian Deputy Prime Minister Alexander Novak announced today that the country’s oil exports grew 12% in the first five months of 2022.

"The U.S. has already banned imports of Russian crudes, and with the European Union in the process of doing so, that has left Asia as the only major outlet for those crudes," Lim Jit Yang, adviser for oil markets at Platts Analytics of S&P Global Commodity Insights, said. “As a result, Asian buyers should have the upper hand in terms of pricing.”

The evolving market dynamics come as the outlook for oil supply grows more worrisome. The International Energy Agency warned this week that global oil supply could struggle to match demand in 2023 due to Russia’s constraints, OPEC+’s production buffers, and China’s needs following its COVID lockdowns. The OPEC producer coalition said this week that crude demand is likely to rise while Russia’s production will fall by year-end.

Market participants expect that Russia’s oil exports will expand, and the country will be able to circumvent sanctions imposed by the EU prohibiting eurozone operators from insuring and financing the seaborne transport of Russian oil to third countries by turning to providers in other regions eager to step in. Other market participants believe that alternative approaches to energy sanctions on Russia could punish the aggressor for its invasion of Ukraine while also stabilizing the global oil market.

“There are always ways for cheap crudes to come in, especially when they remain competitive even after taking into account freight and insurance," a crude trader with a Chinese state-owned oil company told S&P Global Commodity Insights, explain China and India are likely to take more Russian crudes, while Europe could import more Middle Eastern barrels.

Today is Friday, June 17, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Listen: The Essential Podcast, Episode 63: India Unleashed — Necessary Reforms For An Emerging Economic Superpower

Dr. Ajay Chhibber joins the Essential Podcast to talk about India's path to becoming an upper middle-income country, the necessary reforms that will unleash the country's potential, and the challenges that yet hold it back. The Essential Podcast from S&P Global is dedicated to sharing essential intelligence with those working in and affected by financial markets. Host Nathan Hunt focuses on those issues of immediate importance to global financial markets—macroeconomic trends, the credit cycle, climate risk, ESG, global trade, and more—in interviews with subject matter experts from around the world.

—Listen and subscribe to The Essential Podcast from S&P Global

Access more insights on the global economy >

Listen: Take Notes: How The Australian Rmbs Sector’s Resilience To Monetary Tightening Will Be Tested

Credit analyst Erin Kitson joins the latest episode of Take Notes to discuss the Australian RMBS sector's likely resilience to rising interest rates in the country due to inflationary pressures. They do deep dives on a scenario analysis performed to explore borrower sensitivity to rising interest rates, the fixed-rate phenomenon in the sector, property prices, unemployment, geographic diversity, and ratings performance.

—Listen and subscribe to Take Notes, a podcast from S&P Global Ratings

Access more insights on capital markets >

Russia Seaborne Oil Exports At 3-Year Highs Despite Sanctions Shake-Up

Russian seaborne crude exports remained at post-pandemic highs in the first half of June as India and China continued to snap up discounted supplies despite tightening Western sanctions on Moscow. Compared to pre-war levels in January and February, Russia's shipped crude exports from June 1-15 rose by 576,000 b/d to average about 3.88 million b/d, according to preliminary data from shipping analytics provider Kpler. The latest export flows, which are up from 3.81 million b/d in May, put Russia's seaborne crude exports at the highest since May 2019.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Crunch Time For EU Carbon Market Reform As Legislators Finalize Negotiating Positions

Attempts to overhaul the EU Emissions Trading System have entered a crunch period as the European Parliament and European Council aim to finalize their negotiating positions by the end of June. The EU Parliament rejected draft legislation proposed by lawmakers in its plenary vote on June 8 but is preparing for a second vote on June 22. EU ETS revisions are being considered against a backdrop of very high energy prices, surging inflation, and a military conflict on Europe's eastern flank. S&P Global Commodity Insights' Frank Watson and Michael Evans take a deep dive into the key elements in the negotiations and why they matter for carbon prices and other energy commodity markets in Europe.

—Listen and subscribe to Future Energy, a podcast from S&P Global Commodity Insights

Listen: Premium Gasoline Comes At A Cost

In this episode of the Oil Markets Podcast, light ends pricing editors Sarah Hernandez and Jordan Daniel and U.S. clean products manager Matthew Kohlman discuss the record-high gasoline prices that are impacting drivers across the U.S. They discuss historically low inventories, how a shortage of octanes is driving up prices for premium grades, what the outlook is for gasoline demand, and prices through the rest of the summer.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

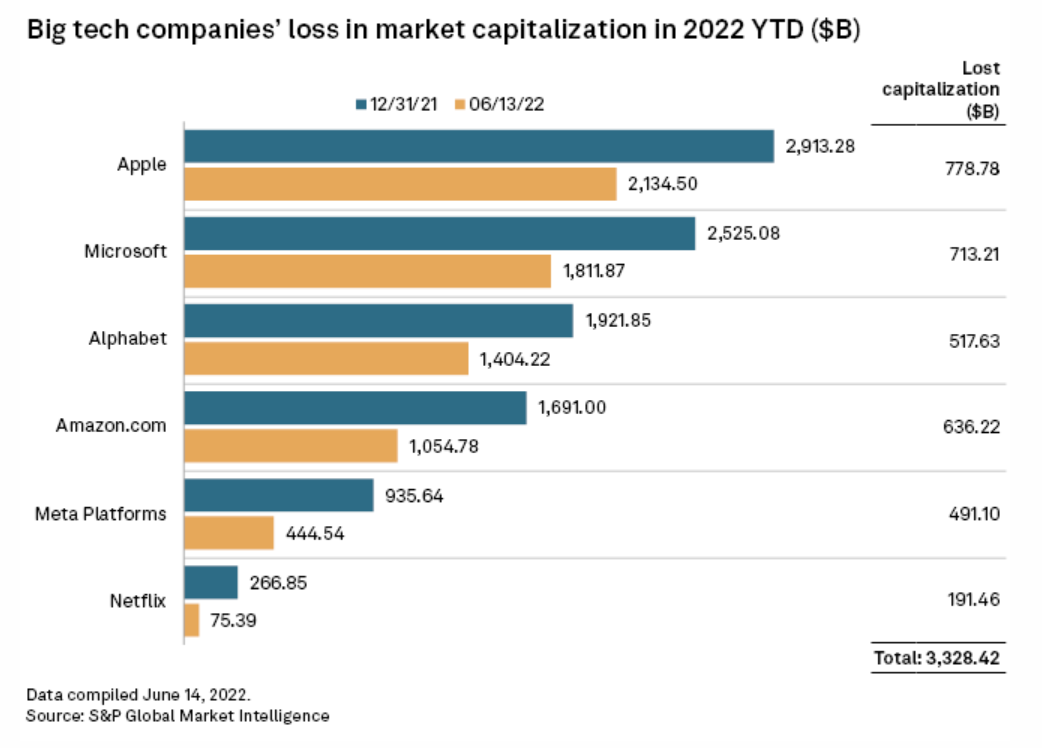

Top Tech Stocks Have Lost $3 Trillion In Market Cap In 2022

For years, large-cap technology stocks seemed invincible. Then came 2022. Year to date through June 13, Microsoft Corp. and the FAANG stocks—the historically prized basket of Facebook-operator Meta Platforms Inc., Apple Inc., Amazon.com Inc., Netflix Inc., and Google-parent Alphabet Inc.—have shed $3.328 trillion combined.

—Read the article from S&P Global Market Intelligence