Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Jun, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Battery Metals and the Limits of Thrifting

With electric vehicle adoption reaching unprecedented levels this year, shortages of certain battery metals, including cobalt, lithium, manganese and nickel, appear to be on the horizon. Already, prices for these metals have increased, even though they seem to have momentarily backed off from 2022’s record highs. In addition, mining and processing of battery metals is centralized in a few countries such as the Democratic Republic of Congo, Russia and China. EV manufacturers have begun to worry about reliable supplies of these strategic metals in an era of increased geopolitical conflict. This is forcing battery and EV manufacturers to look for alternative technologies. In the industry, replacing rare or expensive materials with cheaper or more accessible materials is known as “thrifting.” The question facing the industry is whether thrifting is achievable and, if so, what the performance implications for batteries are when thrifting is applied.

According to S&P Global Commodity Insights, passenger EV sales are expected to reach or exceed 30 million units by 2027. Batteries account for between 30% and 50% of an EV’s production costs.

There are three competing technologies for the EV batteries market — lithium-iron-phosphate (LFP), nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum compositions. These battery types do not perform equally. Despite some performance issues, LFP batteries appear to be gaining traction in the market. In 2021, LFP batteries made up 26% of the market. In 2022, that number jumped to 34%. LFP batteries are cheaper than NMC batteries because they don't contain nickel and cobalt. In China, which leads the world in EV adoption, LFP batteries account for 64.1% of output.

Automakers have been behind the move to LFP from NMC batteries. But costs for lithium and cobalt remain high. Battery-makers who continue to produce NMC batteries are working to reduce cobalt content in favor of nickel and manganese. But nickel prices are increasing, and nickel supply is precarious. Russia, a major global nickel producer, has been subjected to sanctions following the country’s invasion of Ukraine, imperiling global nickel supplies.

Several Chinese battery manufacturers are attempting to tackle high lithium prices with mass-produced sodium-ion batteries. Replacing lithium with sodium causes some performance issues, giving EVs with sodium-ion batteries a shorter range. But for some consumers, a short-range, less expensive vehicle may have appeal.

Today’s EV batteries use a liquid electrolyte to hold a charge. But some battery manufacturers are looking at solid-state technology, which uses sulfur or silicon. A solid-state battery is something of a holy grail for EVs, since these batteries would be lighter, more stable and better at holding energy.

EV manufacturers are racing to lock down supplies of battery metals and battery manufacturing. Many have chosen to invest directly in new battery chemistries, mining, refining and manufacturing. With unprecedented demand for battery metals and limits on how much thrifting can achieve, there may not be enough of these metals to go around.

Today is Wednesday, June 14, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

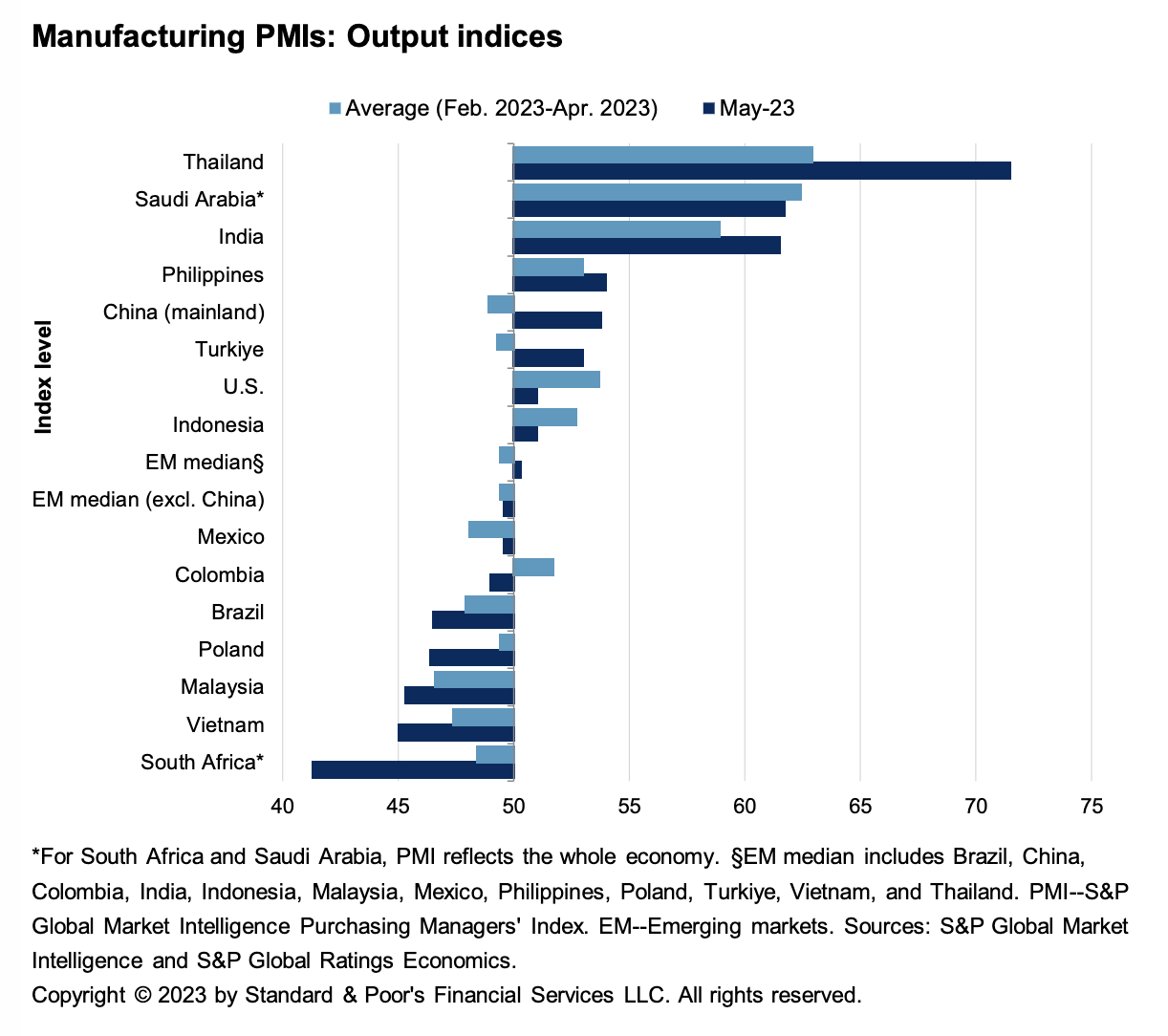

Economic Research: Emerging Markets Real-Time Data: Service Sector Resilience Buoys Economic Activity

Economic activity in the emerging markets (EM) has continued to exceed expectations since our last publication according to the latest EM high frequency indicators. Indeed, service sector activity has been holding up remarkably well. The performance of the industrial sector, on the other hand, has been mixed across EM countries. In China, the latest high frequency indicators offered a mixed picture following a better-than-expected first-quarter GDP print. Credit posted double-digit growth in the first four months of this year on favorable base effects, but the flow of credit (specifically, new yuan loans) did slow in April. And while domestic economic activity picked up in April, it was less than what markets had expected. Sluggish import data in China also indicated a lack of domestic demand.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

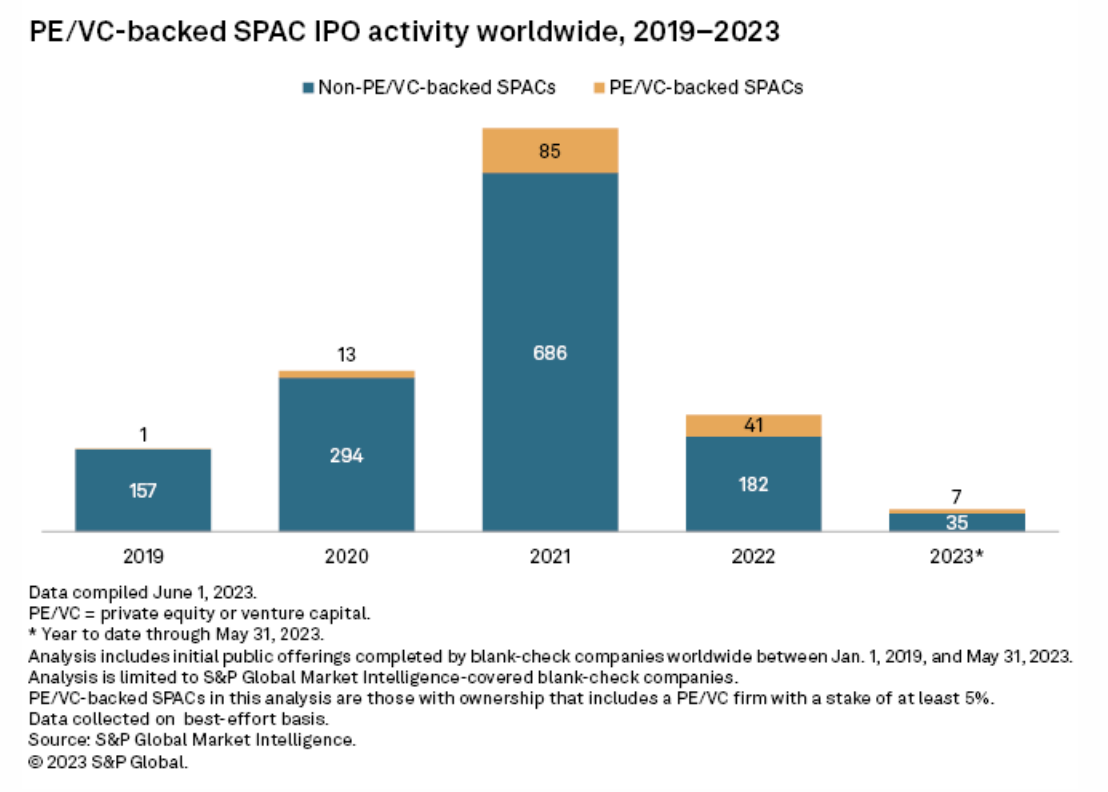

Private Equity's Role In SPACs Grows As Market Shrinks

Private equity took on a larger role in the market for special purpose acquisition companies even as the number of so-called blank-check companies contracted sharply in the wake of the 2021 SPAC boom. More than 18% of SPACs that held an initial public offering in 2022 were backed by private equity, up 7 percentage points from 2021 and 14 percentage points from 2020, according to an S&P Global Market Intelligence analysis that tracked SPACs with at least 5% ownership by a private equity or venture capital firm. In the first five months of 2023, as some SPAC activity shifted to Asia from North America, nearly 17% of all SPAC IPOs globally were private equity-backed SPACs.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

MSC Building Shipping Fleet Suitable For Multi-Fuel Future

MSC Group is building a fleet capable of running on multiple types of marine fuels in the shipping sector's low-carbon transition, which will be driven by regulatory and customer requirements, a company executive told S&P Global Commodity Insights. Maritime transportation, which accounts for 2%-3% of the world's greenhouse gas emissions, generally relies on oil-based fuels as energy sources, and industry participants said a new generation of low- and zero-emission fuels are required to decarbonize the sector.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

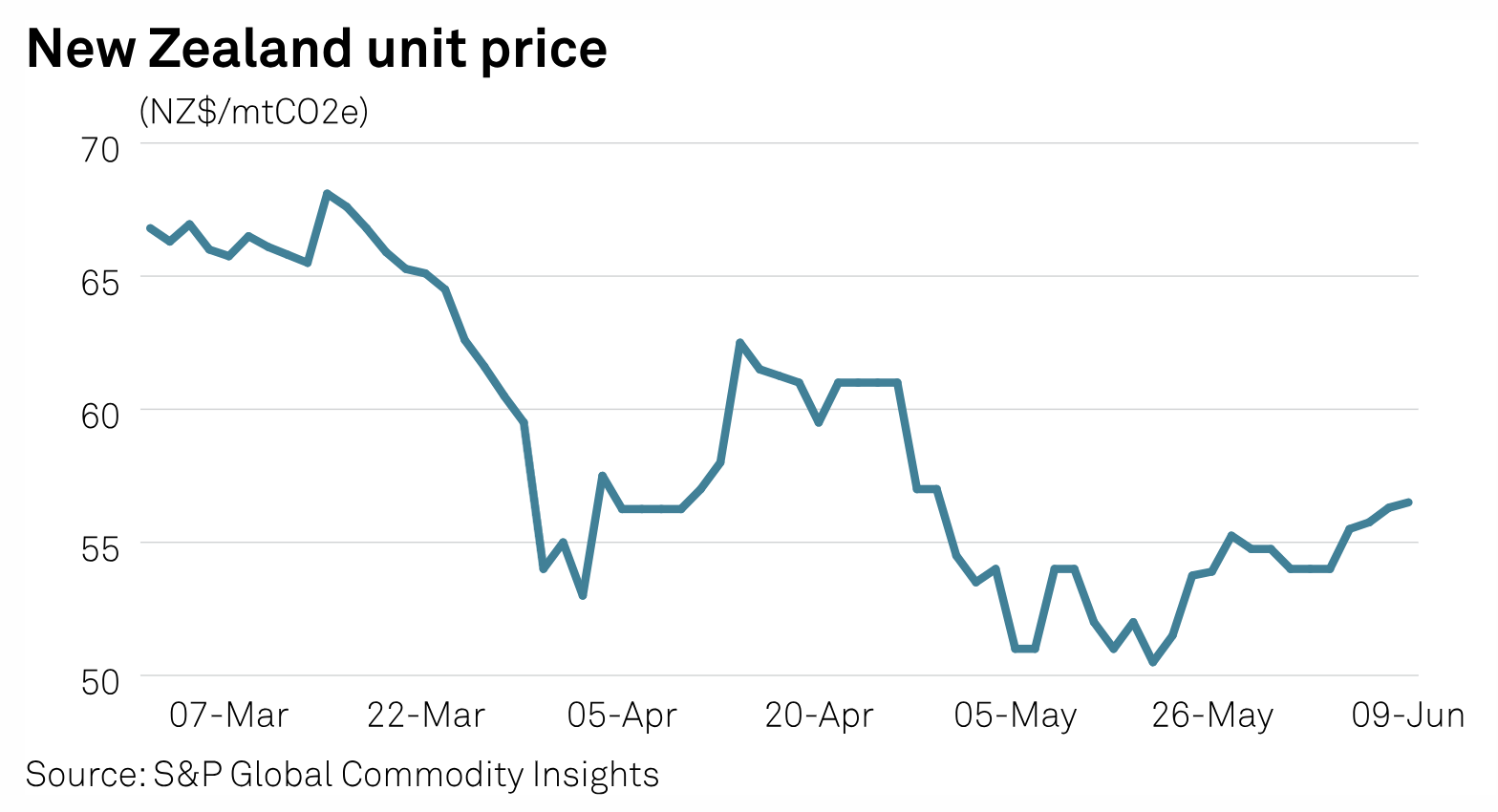

Expanding Carbon Forestry Unearths New Problems For New Zealand

New Zealand, home to Asia Pacific's oldest emissions trading system, is facing an unenviable challenge of managing an accelerating growth in carbon-based forestry underpinned by a jump in carbon price in 2022. The island country in the southwestern Pacific Ocean has seen an uptick in land being diverted for the development of exotic forests. Around 86% of the registered forests in the country's ETS are exotic, with the remaining 14% being indigenous, according to data from the government.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

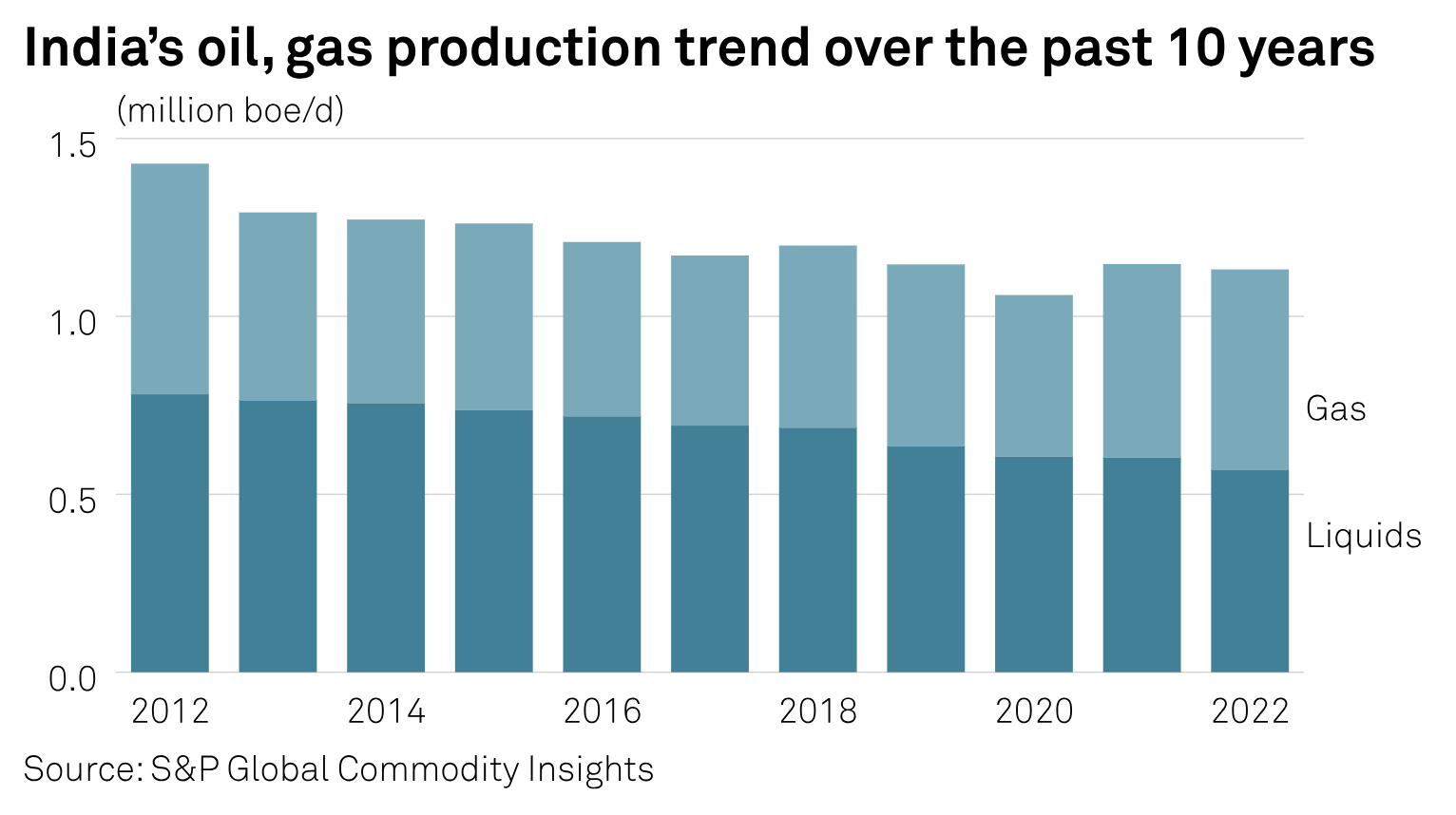

India's Unwavering Appetite For Oil, Gas Needs Bigger Upstream Push, Says Puri

India will need to pursue an aggressive upstream policy to ensure energy security as the bulk of the demand will come from the oil and gas sector in the foreseeable future, despite the transition to cleaner fuels changing the energy landscape, petroleum minister Hardeep Singh Puri said. While India is undertaking an ambitious journey of energy transition which should culminate in the country achieving "net-zero carbon" by 2070, it is also imperative that accessibility and affordability aspects of energy remain intact, he said at an award function organized by the Federation of Indian Petroleum Industry late last week.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Ep38: Mary Pryshlak on Generative AI in Credit Research, & How To Manage 130 Investment Professional

Mary Pryshlak, head of investment research at Wellington Management, joined Alexandra Dimitrijevic, global head of research and development at S&P Global Ratings, and host Joe Cass on this episode of Fixed Income in 15. Discussion focused on the potential role of Generative AI in credit research, leadership experiences from Alexandra and Mary and books that have fundamentally changed our guests' lives.

—Listen and subscribe to Fixed Income in 15, a podcast from S&P Global Ratings

Content Type

Location

Segment

Language