Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Jun, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Saudis Attempt to Break the Bear with Production Cuts

Oil markets appear to have sprung a leak. While OPEC and its allies, known as OPEC+, have vowed to continue production cuts, and the Saudis have offered further cuts on their already-reduced quotas, global oil prices remain frustratingly low. Part of the issue appears to be demand. Most OPEC+ countries are delivering well below quota, and the continued and increasing production from non-OPEC oil-producing countries appears to be limiting OPEC’s scope of action. As OPEC drives up the price, countries such as the US, Canada, Brazil, Norway and Guyana have sold into the market in greater quantities, which has driven oil prices back down. However, market observers anticipate increased demand in the second half as Chinese consumers hit the road for the first time since the COVID-19 pandemic. Increased demand in the second half may finally be enough to break the bear and give OPEC members the barrel price they have been targeting.

On June 4, Saudi Energy Minister Abdulaziz bin Salman announced that Saudi Arabia would cut oil production by a further 1 million barrels per day. This followed a week of negotiations among OPEC+ member countries. The other OPEC members committed to maintaining previously announced production cuts through the end of 2024, and this led to a modest 1% rally in oil prices.

The announced cuts to production quotas amount to about 4.7 million b/d, which is approximately 5% of global capacity. However, market observers noted that most OPEC+ countries were already underdelivering on their reduced quotas. Nigeria, Angola, Iraq, Azerbaijan and Malaysia are delivering hundreds of thousands of barrels below quota, and Russia is producing almost a million barrels below quota due to ongoing sanctions and the Group of Seven price cap on Russian oil. The reweighting of OPEC+ quotas negotiated in Vienna on June 4 appears to be a recognition that the old quotas exceeded capacity for some OPEC+ members.

Participants in the oil market seem to be waiting on China. The International Energy Agency anticipates that global oil demand will grow by 2.2 million b/d year over year in 2023, with the majority of growth coming from China. Should this growth appear in the second half, market observers believe that an end-of-year target for Brent crude of $100 per barrel is realistic. Current prices are in the low- to mid-$70s for Brent crude.

Asian oil markets took the news of Saudi production cuts in stride, despite warnings that increased demand could lead to higher prices. India and China have been relying on non-OPEC suppliers as a cushion. US crude oil exports have been rising steadily, reaching a high of 4.8 million b/d in March, with Asia consuming the bulk. India and China also retain the option of purchasing discounted Russian crude. Indian refiners imported a high of nearly 2.0 million b/d from Russia, and Chinese import volumes of Russian crude increased 27% year over year for the January-to-April period.

Today is Tuesday, June 13, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

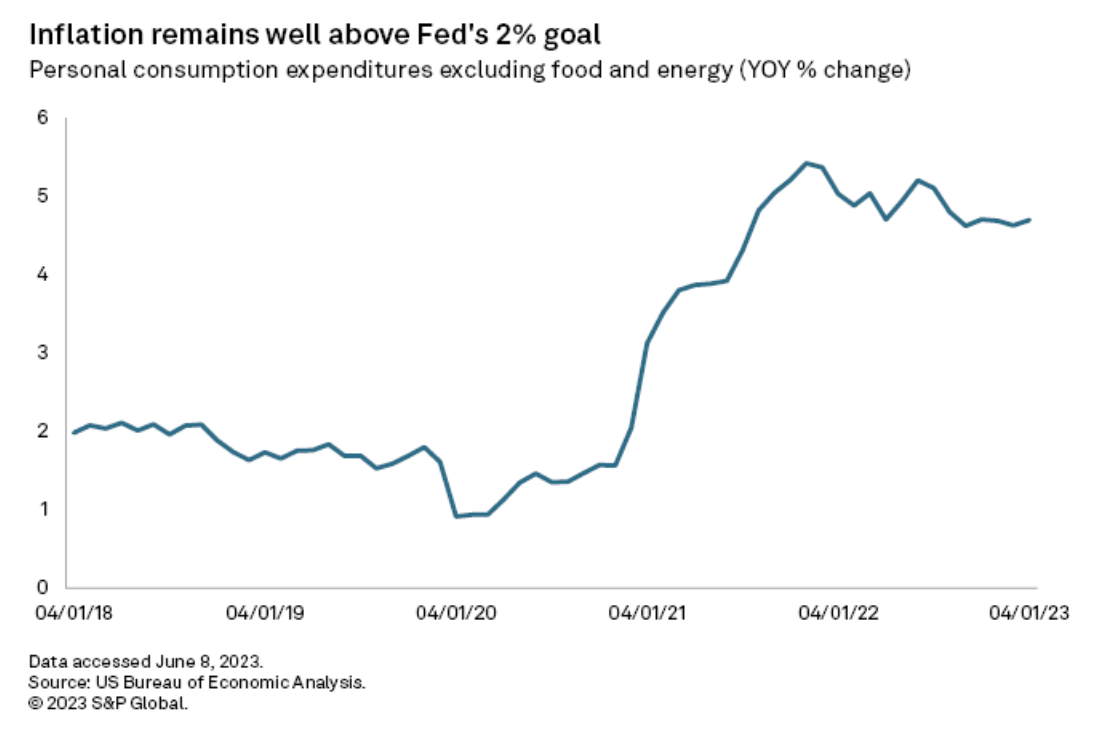

Fed Set To Pause Rate Hikes This Week, Pick Up Again In July

For the first time in 15 months, US Federal Reserve officials are poised to take a break from raising interest rates. After 10 meetings and 500-basis-points' worth of hikes, the rate-setting Federal Open Market Committee will likely pause one of the most aggressive rate cycles in the central bank's history when it concludes its two-day meeting June 14. Still, the potential pause is not likely to last long, with the odds of another increase in July looking strong, and, as Fed Chairman Jerome Powell is expected to stress this week, rate cuts will not even be considered for quite some time.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

European Structured Finance Weathers All The Storms

European securitizations have overwhelmingly proven resilient to several periods of credit stress throughout their multi-decade history, building the track record of a technology that can help fund economic growth and manage risk.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

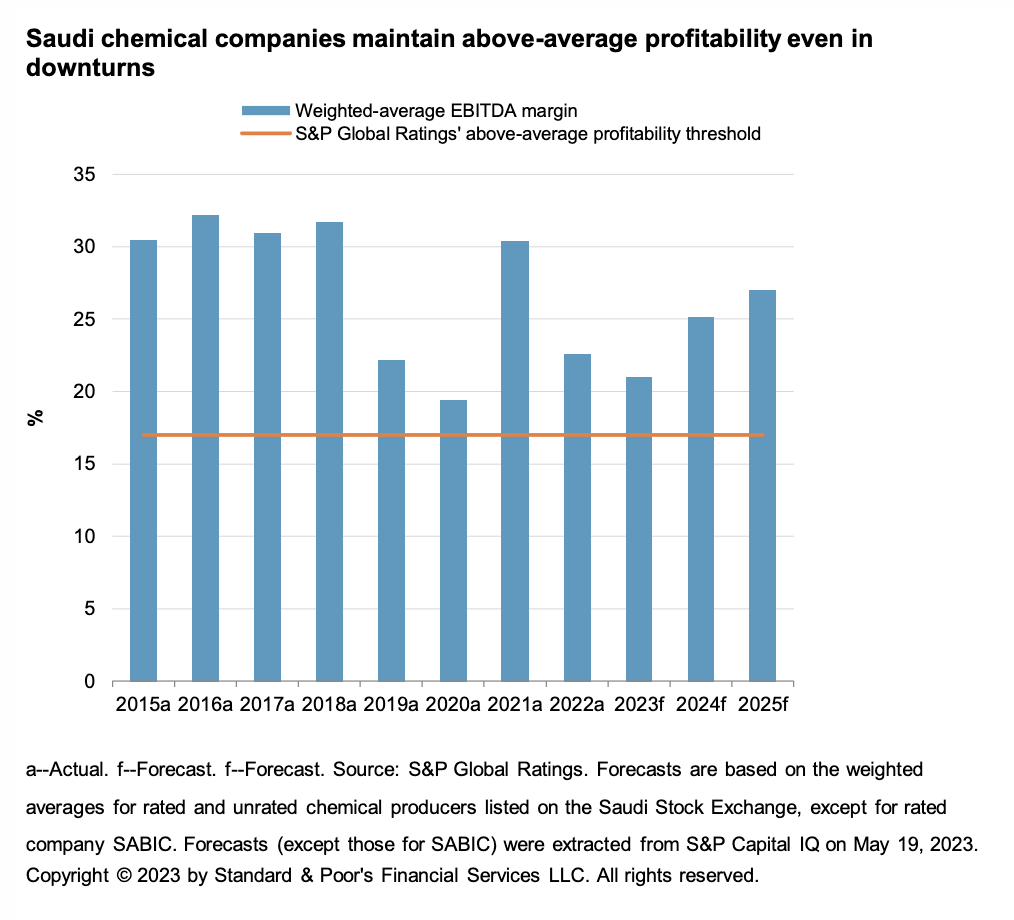

Saudi Chemical Producers' Credit Metrics Can Withstand A Possible Feedstock Price Hike

Chemical producers in Saudi Arabia are bracing themselves for a possible hike in feedstock prices. Media reports of a hike from as early as the fourth quarter of 2023 have been circulating since at least June 2022. Feedstocks such as ethane and propane form the bulk of Saudi chemical producers' operating expenses, making them sensitive to price hikes despite their advantageous position over global peers. However, S&P Global Ratings believes that publicly listed rated and unrated Saudi chemical producers would be able to withstand a potential price hike, with their reported EBITDA margins remaining above 17% and adjusted debt to EBITDA below 1.5x on average.

—Read the report from S&P Global Ratings

Access more insights on global trade >

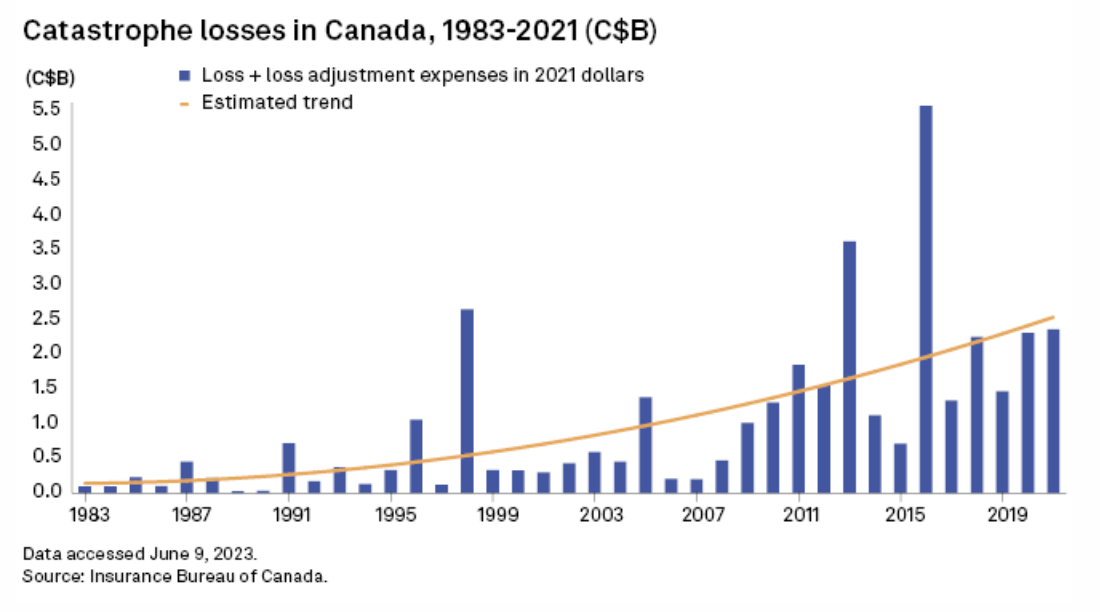

Ongoing Canadian Wildfires Not Expected To Break 2016 Insured Loss Record

While the nigh-apocalyptic images of smoke-drenched New York City made striking headlines last week, insured losses from the wildfires still raging across Canada are not expected to match 2016's record year. Canadian property and casualty insurers' results are likely to come under pressure during the second and third quarter, but losses will remain "manageable" for most companies, according to Marcos Alvarez, global head of insurance at credit rating business DBRS Morningstar.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

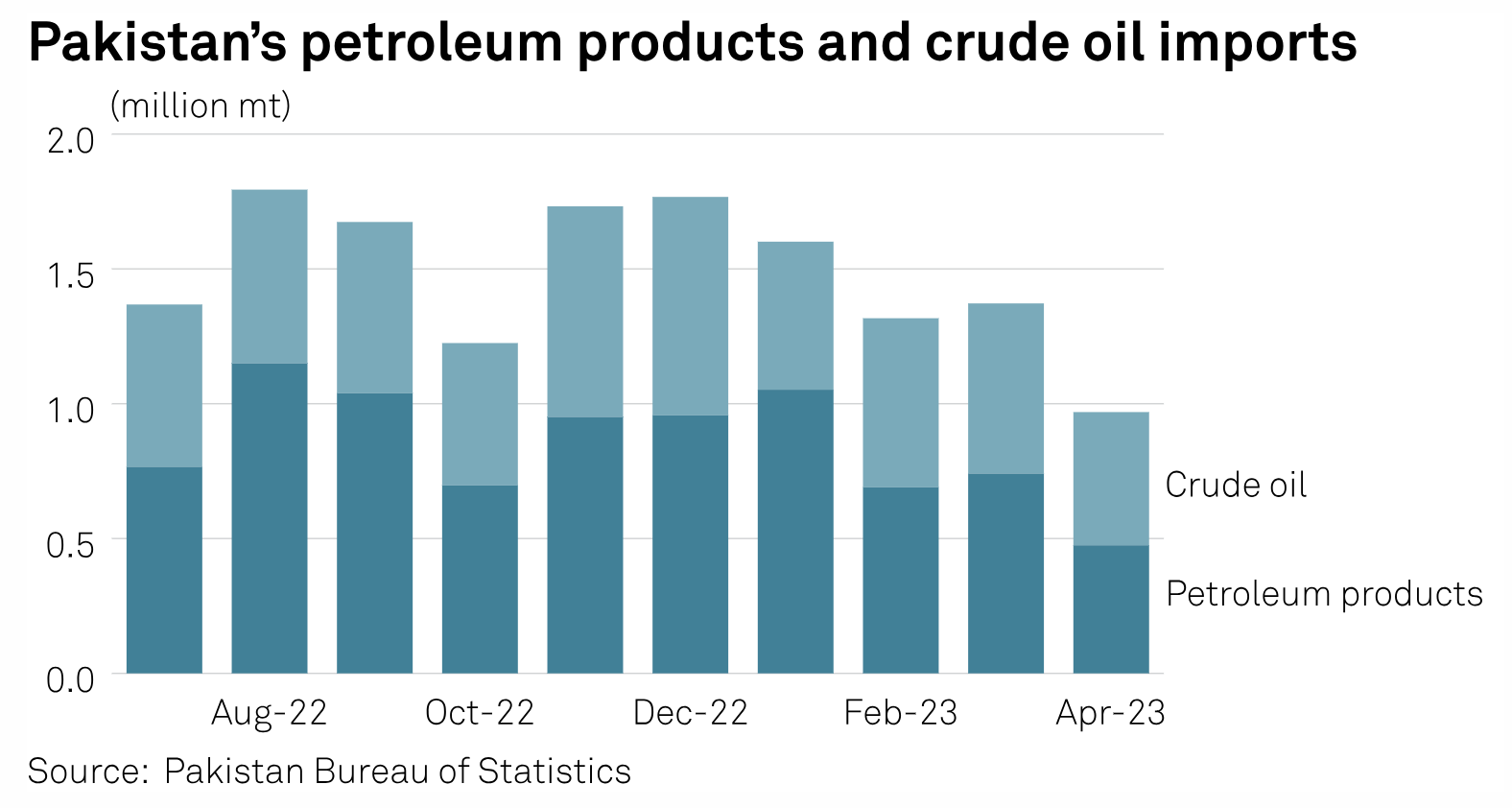

Pakistan Unveils Oil Storage Plan To Soothe Currency, Inventory Woes

Pakistan crafted a proposal to encourage overseas crude suppliers to invest in storage facilities and hold inventories for local use as well as for re-export, a move that can ease the pressure on foreign exchange and ensure adequate domestic oil supplies, analysts and trade sources told S&P Global Commodity Insights. A recent petroleum ministry document showed that since domestic refinery supplies were limited and Pakistan was heavily dependent on imported petroleum products to plug the gap, the move would help to enhance supply access to local oil marketing companies, diversify supply sources and provide freight economies of scale.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: What About Your Friends: A Key Question As Clean Tech Race Heats Up

The Inflation Reduction Act and bipartisan infrastructure law injected an historic level of government funding and tax credits into the clean energy marketplace, but enacting those laws has been far from drama free. Initially, some countries, including allies and trade partners, were left scratching their heads as to what it would mean for them, even spurring talk of a potential "transatlantic trade war" though that rhetoric proved to be overblown. But countries around the world are stepping up their game in response to the US' foray into massive climate and clean energy spending. Akshay Honnatti, the leader of EY's sustainability tax and incentives practice, joined the podcast to discuss initiatives going on in Canada and elsewhere to level the playing field, and how investors are weighing whether to take their clean tech projects to the US or Canada.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Content Type

Theme

Location

Segment

Language