Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Jul, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Catastrophic flooding that devastated parts of Germany, Belgium, and the Netherlands in the past week is the latest incident in a string of global events highlighting the physical effects of climate change.

Intense rainfall overflowed rivers, resulting in deadly flash floods and mudslides that have claimed close to 200 lives and left hundreds of others missing. Disruption spread across commodities industries, spanning metals, oil, petrochemicals, and beyond—damaging key infrastructure and supply chains.

"There are problems everywhere," a German steel mill source told S&P Global Platts on July 19. "The DB Cargo main railhead is in Hagen. Barges can't go [on the Meuse River] because of the high water. Parts of the railway are missing. Trucks were difficult to get; now it's even worse."

The flooding left more than 21,000 people without power in southern Belgium alone at the end of last week. Reconnection still “remain[s] complicated,” local power distributor Ores said in an update on July 18, according to S&P Global Platts. In Germany, providers aimed to restore the mid-voltage grid to communities affected by the conditions. But E.ON Westnetz, the local grid operator in Germany's Rhineland region, said some damage in the hardest-hit areas may take months to fully repair, with emergency measures like back-up generators required to restore short-term supply, according to S&P Global Platts.

German politicians have called for accelerated climate action following the flooding and ahead of the country’s Sept. 26 elections, which could bring forth a coalition with a stronger climate and energy transition mandate. The current German government is considering raising its 2030 solar and wind targets after moving its net-zero goal forward to 2045. The broader EU announced a sprawling package of climate proposals on July 14 targeted to set the bloc on a path to cut cumulative greenhouse-gas emissions by at least 55% before 2030.

Linking the accumulation of heavy rain and heat waves to climate change, North-Rhine Westphalia Prime Minister Armin Laschet said July 15 after visiting impacted communities that "this means that we need more speed with climate protection measures on a European, federal [German], and global level.”

Additional extreme climate events have recently occurred elsewhere with similarly destructive outcomes: Wildfires that raged across California last summer and are burning in Oregon left millions without power, the polar vortex that froze Texas this winter destabilized critical energy infrastructure, and some scientists believe sea level rise could have been a factor in the condo collapse in Florida last month. No longer “black swan” events, the increasing physical risks of climate change are propelling heightened interest in climate risk analytics and greater attention on governments’ climate action.

“Unlike transition risks, which could affect companies anywhere, certain locations are more exposed to physical risks” including floods, water stress, heatwaves, coldwaves, hurricanes, sea level rise and wildfires, Mona Naqvi, global head of ESG capital markets strategy at S&P Global Sustainable1, said in a July 19 commentary. “Investors now have tools to align with a scenario that may mitigate the most catastrophic impacts, build portfolio resilience, and, ultimately, achieve our goal of obtaining net zero emissions by 2050.”

Today is Wednesday, July 21, 2021, and here is today’s essential intelligence.

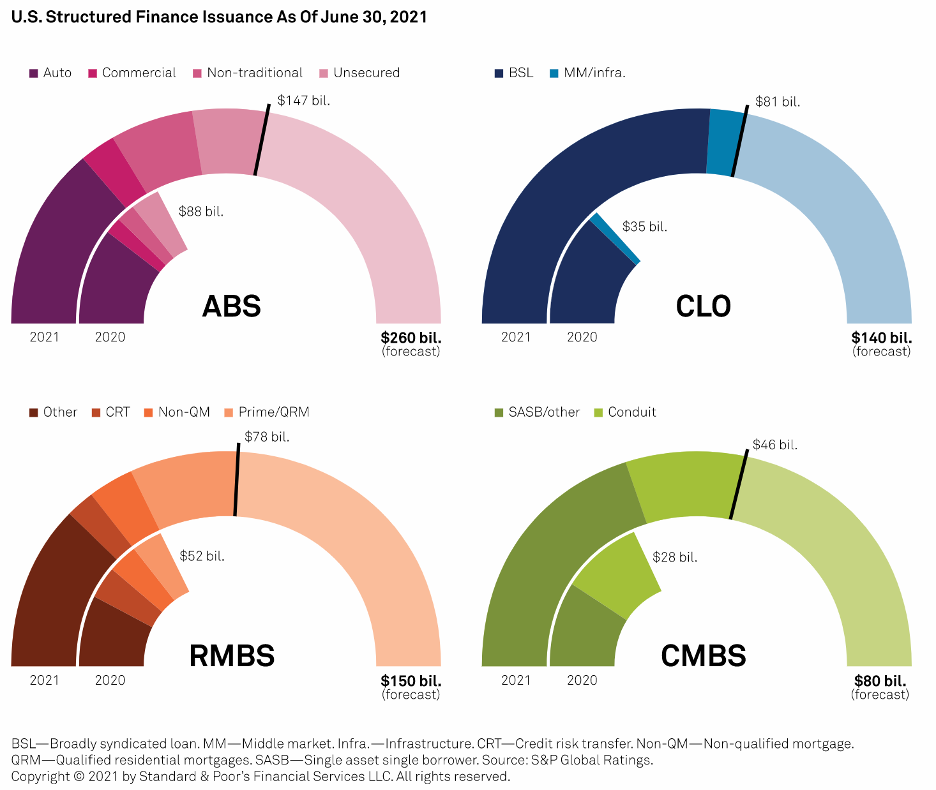

Global Structured Finance Midyear Outlook 2021: Issuance Forecast Raised to $1.4 Trillion

Global structured finance new issuance volume increased 60% year over year to approximately $685 billion in the first half of 2021.

—Read the full report from S&P Global Ratings

Leveraged Finance: U.S. Leveraged Finance Q2 2021 Update: Credit Metric Recovery Shows Sector, Rating, And Capital Structure Mix Disparities

The second half of 2021 began on an encouraging note for speculative-grade borrowers. Accelerating economic recovery has fueled optimism; transactions across the credit spectrum were executed on the perception that business operating conditions and results will continue to improve.

—Read the full report from S&P Global Ratings

Industry Top Trends Midyear 2021: Resilience, Recovery, Risks

The outlook for North American and European corporate sectors has improved sharply. Upgrades are outpacing downgrades by a factor of three to one. All sectors have seen their net outlook bias (a downgrade risk indicator) improve this year.

—Read the full report from S&P Global Ratings

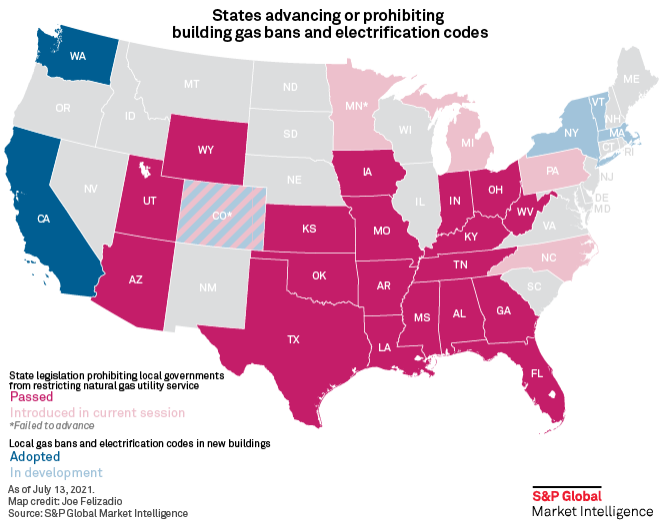

Gas Ban Monitor: Building Electrification Evolves As 19 States Prohibit Bans

Local building electrification measures expanded and evolved in the first half of 2021, as the policy also percolated to the federal and international stage. Meanwhile, state laws prohibiting natural gas bans bolstered a growing firewall that now stretches across most of the southern U.S. and from the Rockies to the Midwest.

—Read the full article from S&P Global Market Intelligence

Midstream Sector's ESG Push Under Spotlight For Q2 Earnings

Many pipeline companies in the midstream sector have been focusing on projects and initiatives designed to quantify, reduce or capture carbon emissions along the gas value chain, but the market is looking to see whether developers can make additional revenue from these efforts while keeping costs down.

—Read the full article from S&P Global Market Intelligence

UK Environmental Committee Launches Inquiry Into Curbing Aviation, Shipping Emissions

The UK parliament's Environmental Audit Committee (EAC) launched July 20 an inquiry into how the government can reach net zero emissions by 2050 for the UK's share of international aviation and shipping. Aviation and shipping account for 10% of UK greenhouse gas emissions and, on current trends, aviation will be the largest emitting sector by 2050, which the government is looking to tackle as part of its net-zero 2050 strategy.

—Read the full article from S&P Global Platts

U.S. Democrats Propose Carbon Emissions Border Tax

US Democrats have unveiled legislation that would levy a fee on imported carbon-intensive goods, including steel and aluminum, following a move by the EU to implement a similar policy. The legislation, announced by Sen. Chris Coons and Rep. Scott Peters July 19, would establish a border carbon adjustment (BCA) on polluting imports.

—Read the full article from S&P Global Platts

Listen: Midstream Investors to See If Commercial Pickup In Natural Gas, LNG Translated to Q2 Bottom Line

S&P Global Platts senior natural gas writer Harry Weber, S&P Global Market Intelligence senior midstream finance reporter Allison Good and Platts managing editor for Americas LNG Luke Stobbart discuss current trends in the North American midstream sector as operators of gas pipelines and LNG export terminals prepare to release financial results for the second quarter of 2021.

—Listen and subscribe to Commodites Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language