Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Jul, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

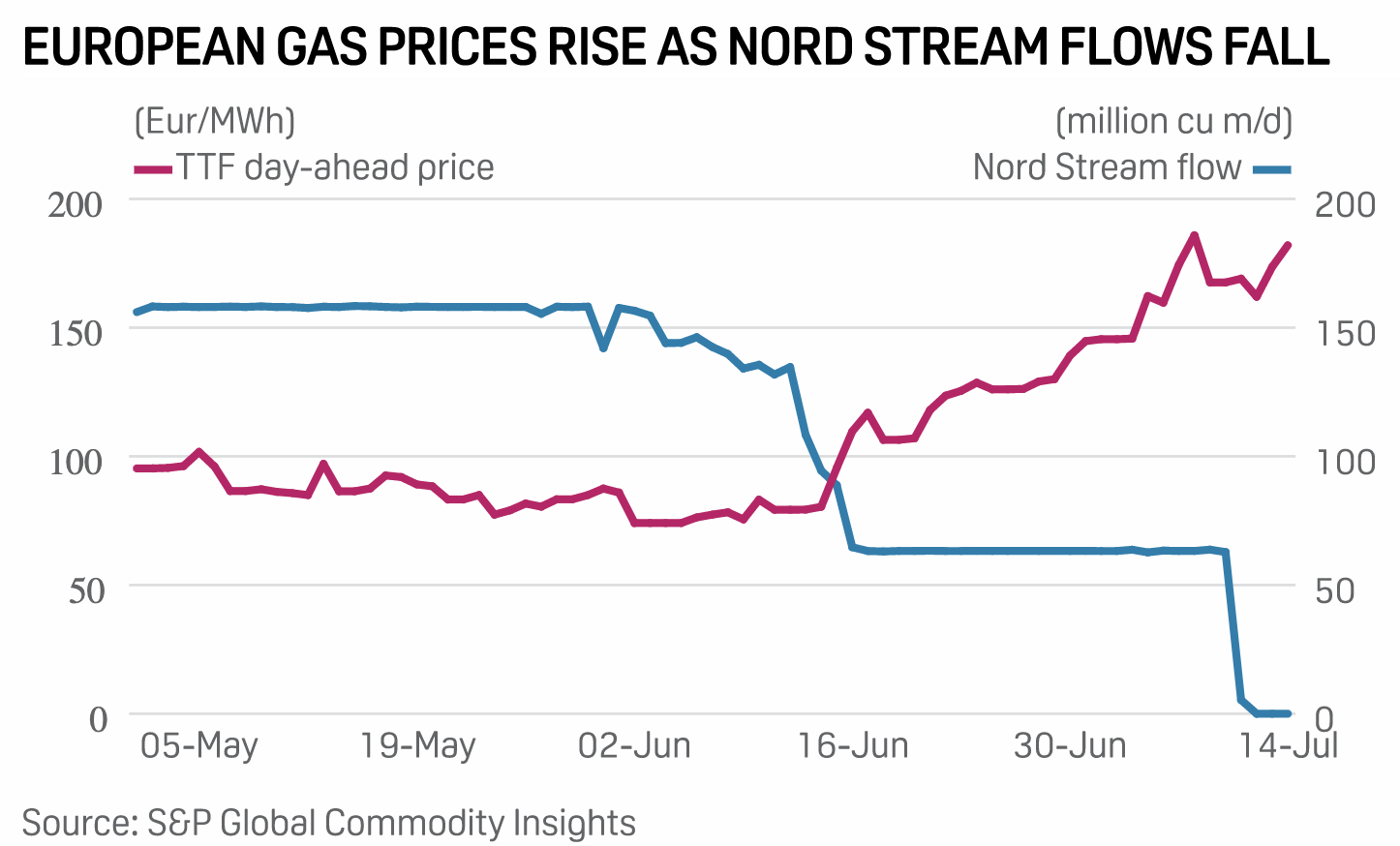

With Nord Stream Uncertain, Are European Energy Markets and Russia Headed for Divorce?

As tensions escalate between the EU and Russia due to the war in Ukraine and resulting sanctions, European economies have been making efforts to reduce their reliance on Russian natural gas.

Just two days before Russia began its military offensive in Ukraine, Germany on Feb. 22 suspended the certification process for the Nord Stream 2 pipeline, which was intended to extend the pipeline to carry Russian natural gas to Germany through the Baltic Sea and increase the amount of natural gas available for the European market. The cancellation has left Europe dependent on the original Nord Stream 1 pipeline, launched in 2011. Europe will be closely watching whether the Nord Stream 1 gas pipeline resumes operations following its scheduled end to a planned annual maintenance shutdown on July 21, according to S&P Global Commodity Insights.

Russia was the single biggest supplier of natural gas to Europe last year, accounting for over 40% of demand for everything from home heating during the winter to energy production for heavy industry, according to S&P Global Commodity Insights. But geopolitical tensions between the government of Russian President Vladimir Putin and EU members states have put the continuation of this relationship in peril. With Russian supplies curtailed and numerous EU states triggering emergency gas plans, the European gas market has entered the third quarter in a precarious position.

In recent months, Russia has appeared to leverage the limited capacity of Nord Stream 1 to create turmoil and uncertainty for European allies of Ukraine. In June, Russian gas flows hit new lows after the Russian natural gas company Gazprom cut supplies via the pipeline over a dispute about whether payment could be made in rubles, according to S&P Global Commodity Insights. Gazprom cut supplies to just 40% of capacity on June 16 due to claimed maintenance issues. And deliveries were completely halted for annual maintenance on July 11, which is expected to take 10 days and end this week. Market participants fear that Russia may not resume natural gas deliveries on July 21 as expected.

If the Nord Stream pipeline faces issues installing a turbine, “Nord Stream will either not start up—which is the most likely scenario if they are getting ready to install the turbine—or will start at the same level as before the maintenance," Jonathan Stern, distinguished research fellow from the Oxford Institute for Energy Studies told S&P Global Commodity Insights today. “At that point, Nord Stream should be back to full capacity and if it isn't this will add credibility to those who say that the whole turbine story is a pretext for the Russian government and Gazprom putting pressure on European gas supplies."

With supply concerns paramount, European markets have been searching for new sources of natural gas, including LNG from the U.S. and Qatar and natural gas from Azerbaijan.

EU gas storage sites are currently only 64% full, despite the anticipated need for them to be 90% full should Russia cut natural gas supplies in the late autumn, according to the International Energy Agency. European nations could face possible energy rationing this winter if there is a full cut-off of Russian gas exports, Shell CEO Ben van Beurden suggested at the Aurora Energy Spring Forum on July 14.

Uncertainty regarding Russian intentions has driven natural gas prices to all-time highs, with prices up 420% year-over-year, according to Platts price assessments from S&P Global Commodity Insights.

"It would be unwise to ignore [Russian President Vladimir Putin's] threats. He is able and willing to weaponize energy," Mr. van Beurden said, according to S&P Global Commodity Insights.

IEA Executive Director Fatih Birol this week encouraged a five point plan for Europe to prepare for additional Russian natural gas uncertainty—proposing that the EU should introduce auction platforms to incentivize EU industrial gas users to reduce demand, minimize gas use in the power sector, enhance coordination among gas and electricity operators across Europe, bring down household electricity demand by setting cooling standards and controls, and harmonize emergency planning across the EU at the national and European level, according to S&P Global Commodity Insights.

Today is Tuesday, July 19, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

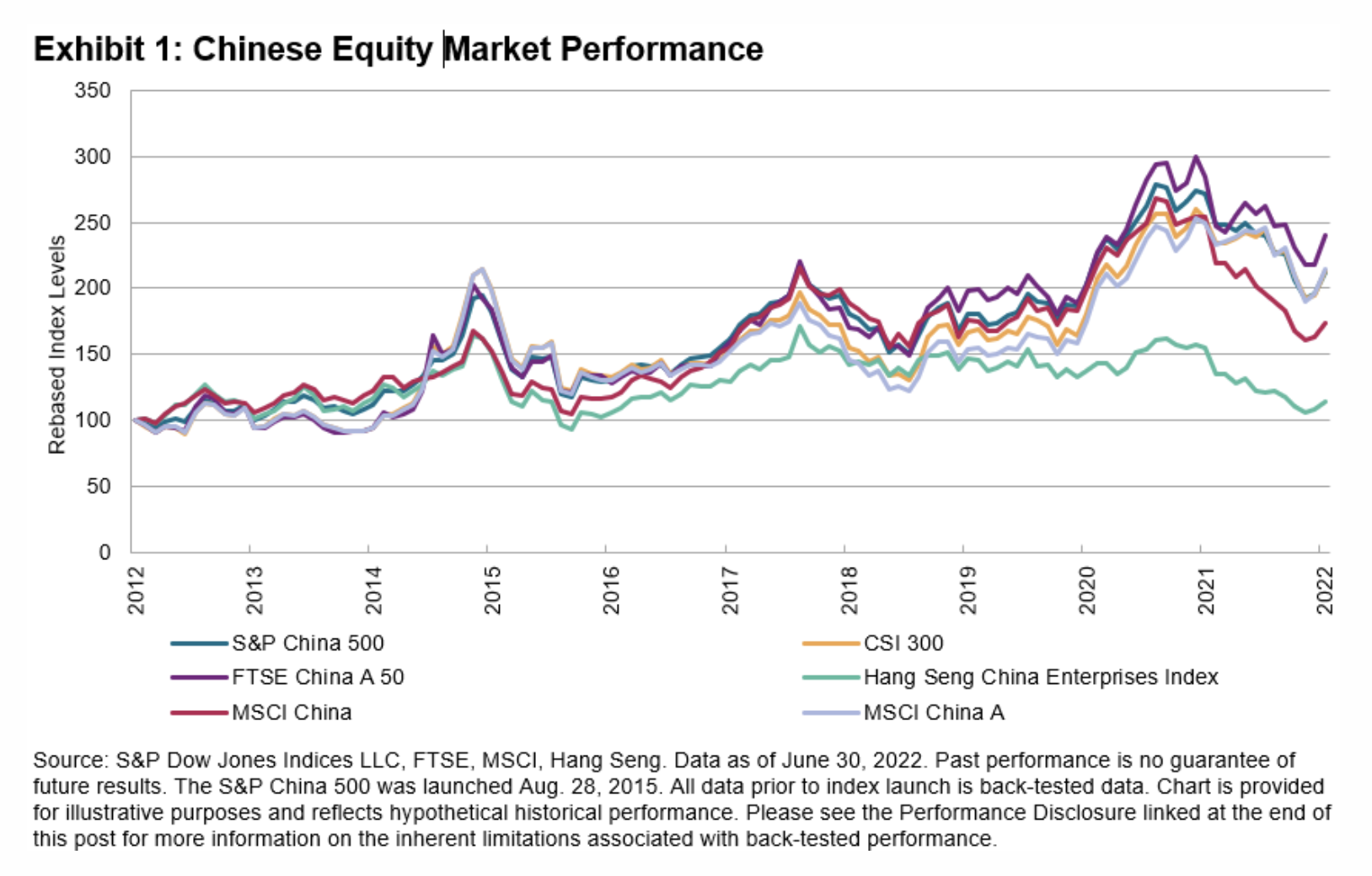

The S&P China 500 Added 2.8% In Q2 2022, As China Equities Held Up During A Broad Global Sell-Off

The S&P China 500 bucked the trend of a broad market downturn, posting a 2.8% gain for Q2 2022. In terms of sectors, Consumer Discretionary and Consumer Staples grew nearly 15% each over the quarter, while the Industrials and Energy sectors were also additive to performance. The S&P China 500 outperformed the broader S&P Emerging BMI and S&P Developed BMI, which declined 10.3% and 16.3%, respectively.

—Read the article from S&P Dow Jones Indices

Access more insights on the global economy >

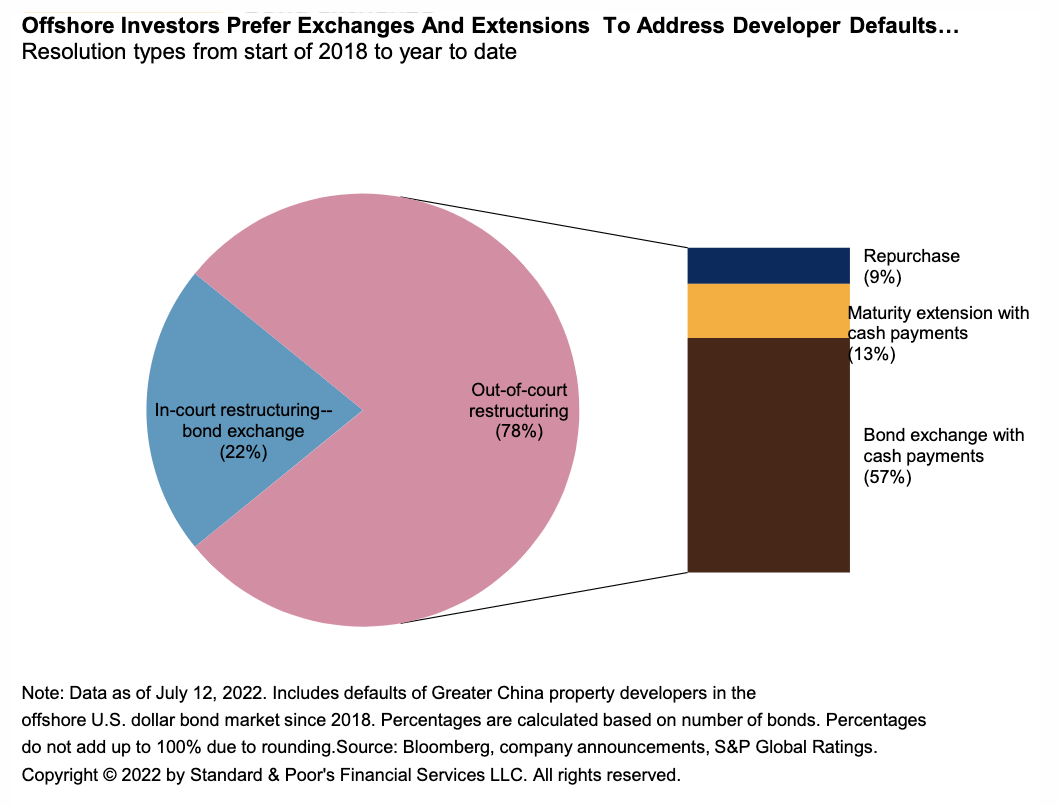

Credit FAQ: China's Defaulted Developers Are Running Out Of Time To Exchange And Extend

The end of the beginning is at hand for China developer defaults. In the first stage, firms asked investors to exchange or extend defaulted bonds, to buy some time until the property market recovers. In the next stage, S&P Global Ratings assumes investors will lose patience for such deferrals, especially if home sales do not soon recover. S&P Global Ratings believes that developers' liquidity risk will evolve into insolvency risk if the sales recovery stalls. It assumes debt extensions only serve to buy time, and do not fundamentally resolve developers' excess leverage.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Russia's Gazprom Formally Requests Siemens For Turbine Release Documentation

Russia's state-controlled Gazprom has formally requested that Germany's Siemens provide documentation to show it is possible to return to Russia a key turbine for the Nord Stream gas pipeline, Gazprom said July 16. Canada has granted a "time-limited and revocable" permit for Siemens Canada to allow the return of repaired Nord Stream turbines to Germany, but Gazprom has said it has not yet seen documentation confirming the decision.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

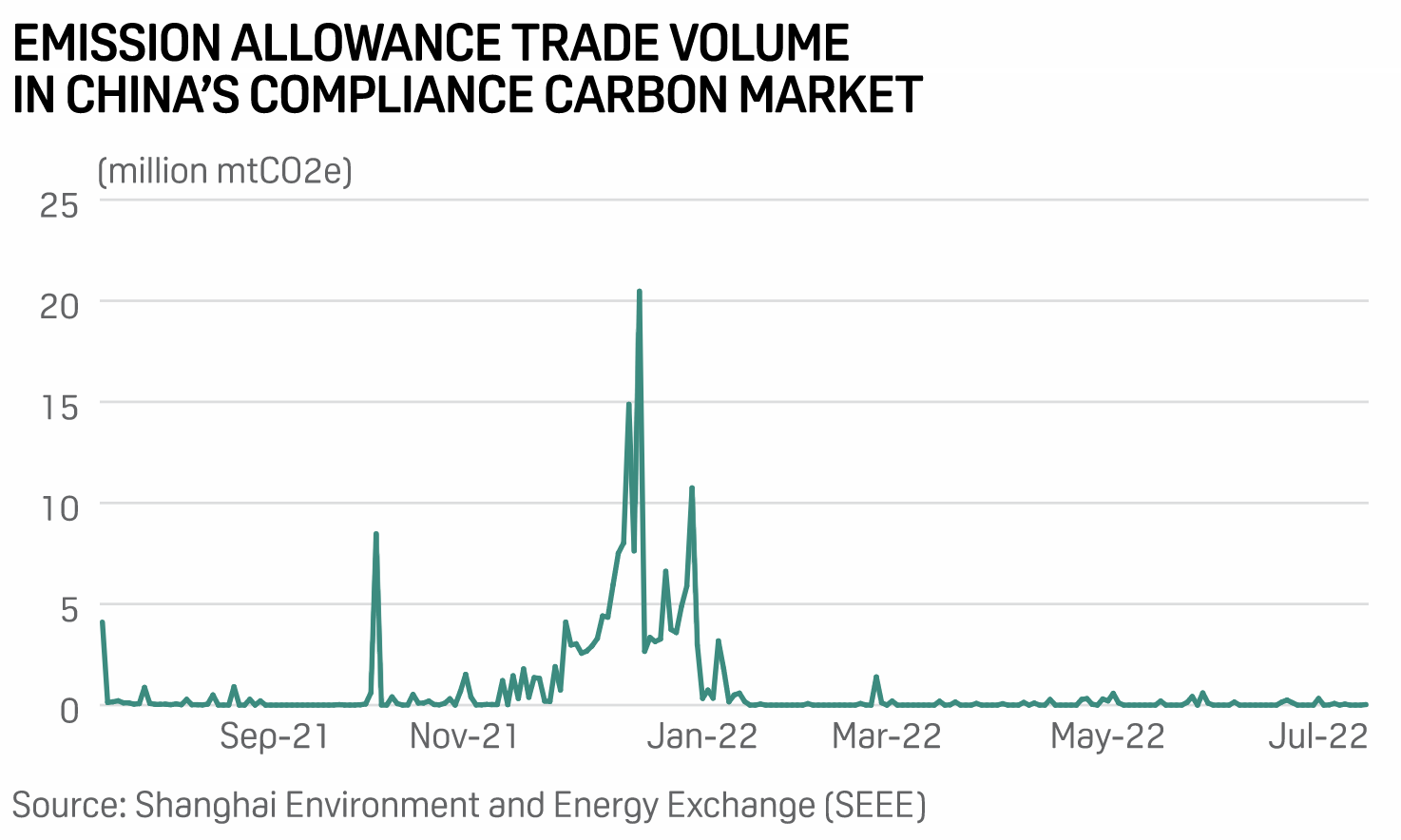

Global Turbulence Slows Expansion Of China's Compliance, Voluntary Carbon Markets

Overarching concerns about the economy, a global energy crisis, and a COVID-19 resurgence have slowed China's push to expand its carbon market, and industry experts expect the pace of growth to continue to decelerate until conditions improve. So far, Beijing has delayed the announcement of several key policies in both the compliance and voluntary carbon markets, such as the enrollment of new industrial sectors into the national carbon market and the relaunch of the domestic China Certified Emission Reductions, or CCERs, mechanism.

—Read the article from S&P Global Commodity Insights

Listen: Will Biden Return From Saudi Arabia Empty-Handed?

U.S. President Joe Biden just wrapped up a trip to the Middle East with a closely watched visit to Saudi Arabia. His national security director signaled that the success of his oil diplomacy will be judged in the coming weeks, not immediately. So will OPEC+ agree to increase production at its Aug. 3 meeting to help ease global prices? Ellen Wald, president of Transversal Consulting and senior nonresident fellow at the Atlantic Council's Global Energy Center, spoke with senior editor Meghan Gordon about the debate around Saudi Arabia's spare oil capacity, U.S.-Saudi relations, and how Russia likely loomed over the talks.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Automotive Growth Pockets In A Constrained World

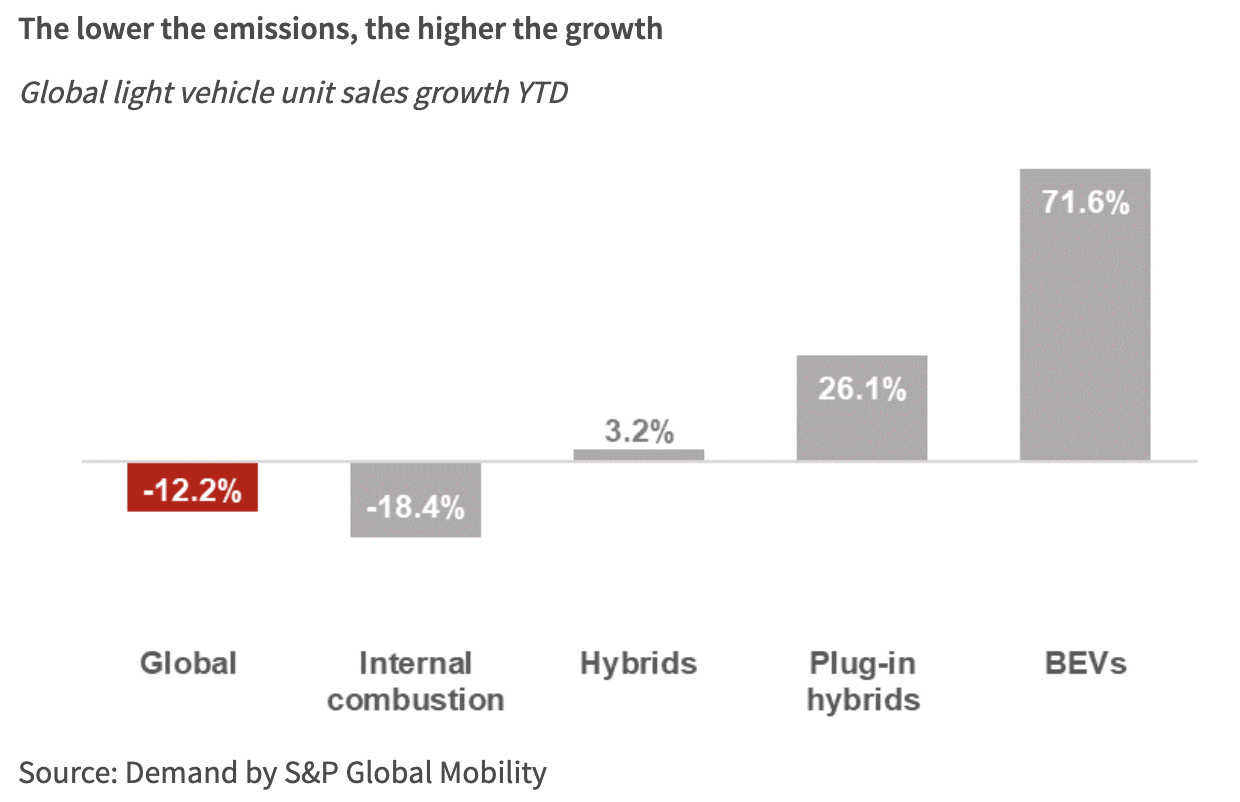

Global sales of new light vehicles have declined 12% during 2022 up to and including June, to 35.3 million units. Though semiconductor shortages continue to constrain overall market volumes, there are nonetheless pockets of very robust growth, notably low emissions vehicles and the gsreater China market.

—Read the article from S&P Global Mobility