Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Jul, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Carbon Markets Defy The Downward Trend

Warning signs continue to flash red for a global economy gripped by rampant inflation, new COVID variants, and declining asset prices. But voluntary carbon markets continue to outperform market expectations.

Despite the war in Ukraine and ominous signs of a potential recession, carbon credits continue to increase in value. Carbon traders see voluntary carbon markets’ resilience against the backdrop of this year’s deteriorating market conditions as a sign that this market is reaching a new level of maturity and sophistication, according to S&P Global Commodity Insights. This positive performance follows the demand optimism seen last year. In 2021, the value of voluntary carbon markets exceeded $1 billion for the first time, according to the industry group Ecosystem Marketplace. S&P Global Commodity Insights’ Platts CEC, the first carbon price assessment launched on Jan. 4, 2021, surged 900% over the year.

“A key instrument in the world’s ability to combat climate change and accomplish the energy transition from fossil fuels to electrification, the voluntary carbon marketplace will likely continue to gain importance while providing price discovery and ease of transacting for many market participants who want to verify their reduction of tons of CO2 equivalent,” Jim Wiederhold, an associate director of commodities and real assets at S&P Dow Jones Indices, said in a recent report announcing the S&P GSCI Global Voluntary Carbon Liquidity Weighted, which is the first-to-market benchmark for the current performance of global voluntary carbon futures markets.

The growth of voluntary carbon markets could be boosted—or confounded—by the patchwork of regulations and certifications created by government entities, exchanges, and private partnerships.

"Are companies going to stick to their climate commitments in this period of economic volatility, economic uncertainty and inflationary environment? The evidence says yes," Rich Gilmore, CEO of the carbon investment firm Carbon Growth Partners, said during Xpansiv's July 12 quarterly review and outlook of the voluntary carbon market, according to S&P Global Commodity Insights. “Unlike cryptocurrency or Bitcoin, the carbon market is underpinned by existentially important intrinsic demand for the end use of the product—a carbon credit exists to be retired … Our view is that there is stable and growing demand for carbon credits to be used as an emissions reduction tool."

In efforts to instill more public confidence in the voluntary carbon market and carbon credits, Amazon is aiming to establish a new brand of carbon credits known as the ABACUS Verified Carbon Unit in partnership with carbon trading researchers at the University of California Berkeley, The Nature Conservancy, and other non-governmental organizations and carbon consultancies. The ABACUS label would create a higher standard specifically for agroforestry and reforestation carbon projects and eliminate the knock-on effects that carbon projects can have in creating unintended emissions elsewhere, according to S&P Global Commodity Insights.

Activities that reduce emissions from deforestation and forest degradation are addressed in voluntary carbon markets under the REDD+ certification, which issues carbon credits to developers that can prove to have achieved set results in forest protection. But carbon markets are beset with confusion over the differences between jurisdictional REDD+ projects, which depend on government support, and standalone REDD+ projects, which are privately led initiatives, according to S&P Global Commodity Insights.

In Europe, the commodities exchanges AirCarbon Exchange and European Energy Exchange last month announced its partnership with U.K.-based Net Zero Markets to create a global reference price for voluntary carbon credits. But the European Parliament last month also voted against a reform package that sought to realign the bloc’s carbon market with its 2030 net-zero goal to cut greenhouse gas emissions by 55% below 1990 levels. Meanwhile, in Asia, the Hong Kong Exchanges and Clearing Limited announced the launch of the Hong Kong International Carbon Market Council on July 5, with the intention to develop an international carbon market with cross-border trading.

Tax credits are one of the primary mechanisms through which carbon capture projects attract funding. But due to political polarization and different tax regimes globally, market participants have questioned whether these tax credits are durable enough to finance more ambitious carbon capture projects.

"My fear is that every country starts a slightly different accounting mechanism, a slightly different way to do it," Renat Heuberger, chief executive of the carbon brokerage and project developer South Pole, said in a recent interview with S&P Global Commodity Insights. "So far the voluntary carbon market was essentially not really affected by much policy change because, as the name indicates, it's a voluntary market, not a compliance market … So, the risk is that the well-functioning voluntary markets could actually even be stopped or blocked by governments who would like to create clear rules, but face capacity and bureaucratic constraints that lead to ongoing discussions without approving anything.”

Today is Friday, July 15, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

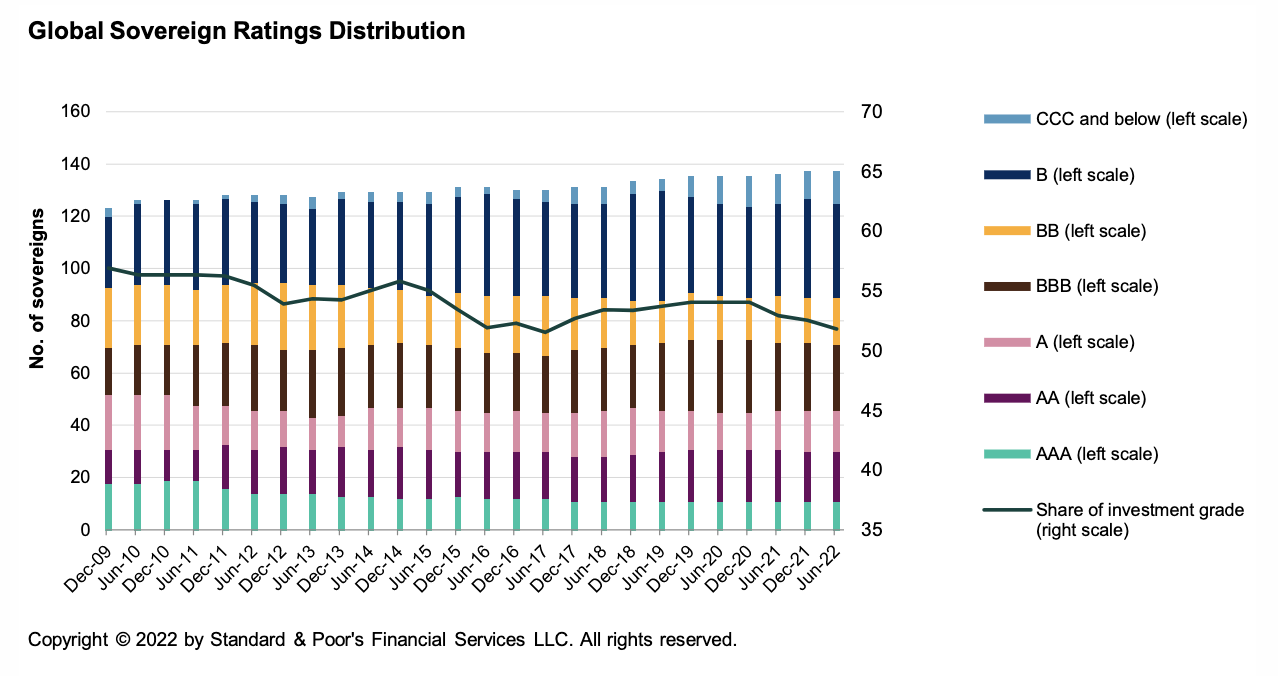

Global Sovereign Rating Trends Midyear 2022: Geopolitical Risks And Surging Inflation Wear On The Post-Pandemic Recovery

The post pandemic economic recovery continues to slow and is now further at risk because of increasing geopolitical conflicts, global inflation, and interest rates. After posting solid 6% growth in 2021, we expect global economic growth to slow in 2022 to 3.6% and 3.5% in 2023. That said, rising global inflation is pressuring central banks to increase interest rates to bring it under control. However, the evolving nature of the factors pushing inflation up are increasing the risk of recession.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

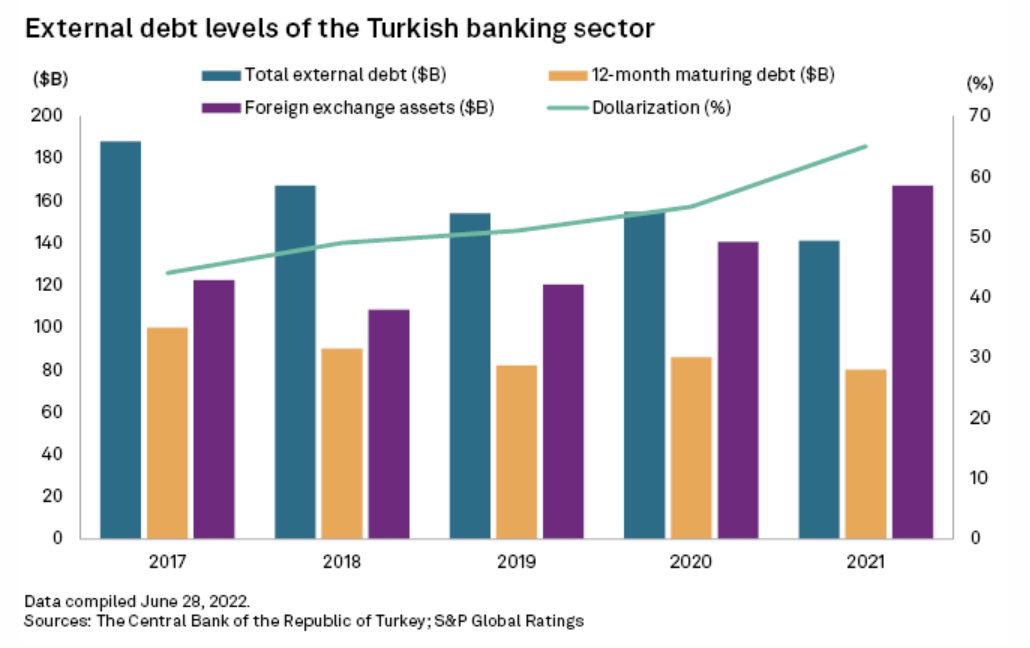

Turkey's Banks Face Liquidity Crunch As Investors Shy Away

Turkish banks are facing a liquidity crunch amid rising global interest rates, a situation that could accelerate an outflow of investor capital, analysts said. As major central banks around the world tighten monetary policy, the liquidity available for emerging markets will become scarcer and more expensive, raising refinancing risks for Turkey's banks, according to S&P Global Ratings.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

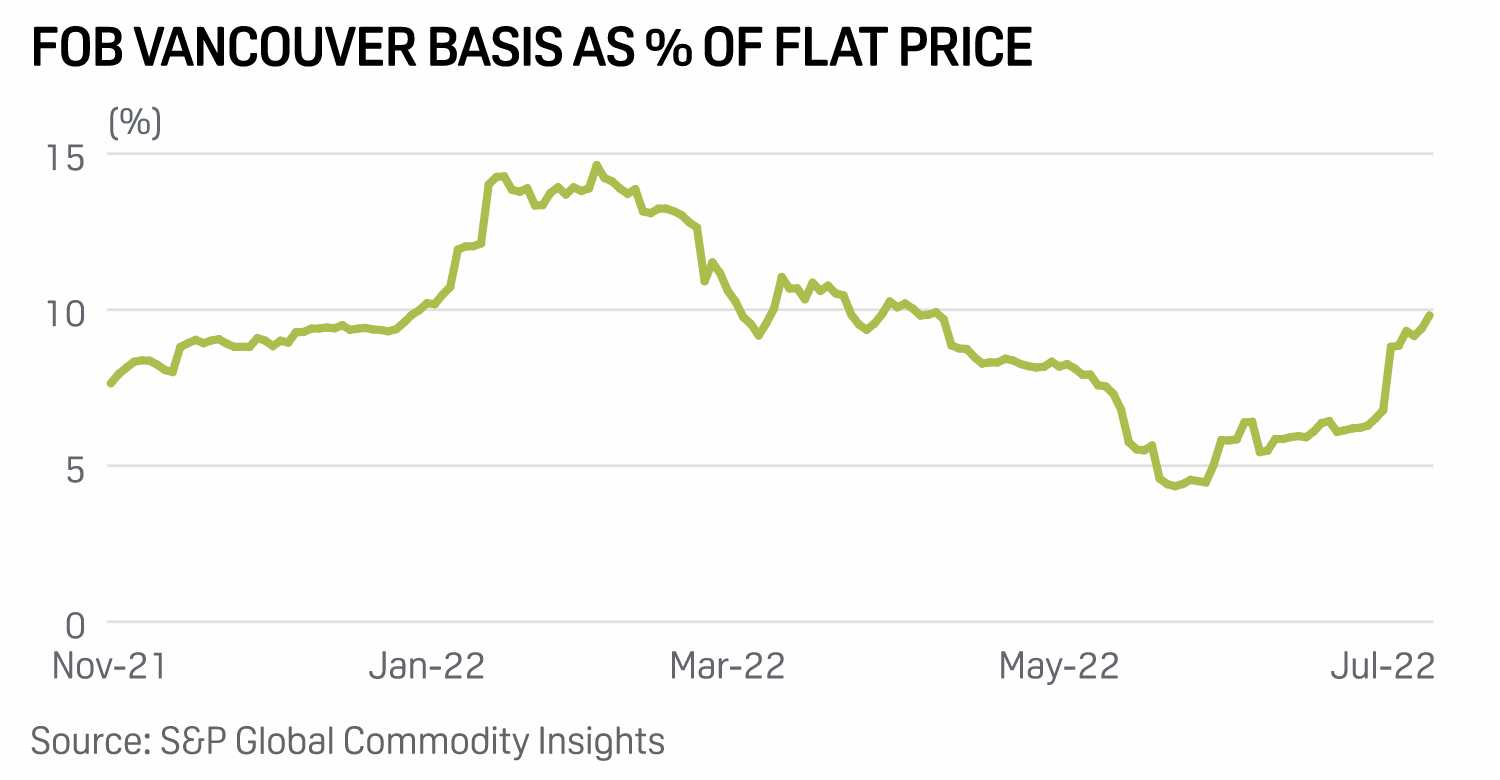

Canadian Wheat Takes On Bigger Role In Combating Food Security Issues Amid Ukraine War

Uncertainty about where the world will get its wheat, as the Ukraine war persists, opens the door for Canada to take on a larger role in ensuring global food security. The Ukraine war has raised concerns on future export operations from the European region and increased expectations for Canadian exports in marketing year 2022-23 (August-July). This comes after several years of Canada's share of the global export market shrinking amid increased exports from Black Sea producers.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Despite Global Economic Volatility, Carbon Markets Remain 'Stable And Growing'

While volatility and uncertainty has hampered the global economy through the first half of 2022, one asset class that has managed to outperform expectations is carbon credits – a sign that the voluntary carbon market is reaching a new level of maturity and sophistication, carbon traders say. A basket of factors has mired the global economy through the first six months of the year -- Russia's invasion of Ukraine and the resulting energy crisis, rising interest rates prompted by high inflation, and post-pandemic recovery strains.

—Read the article from S&P Global Commodity Insights

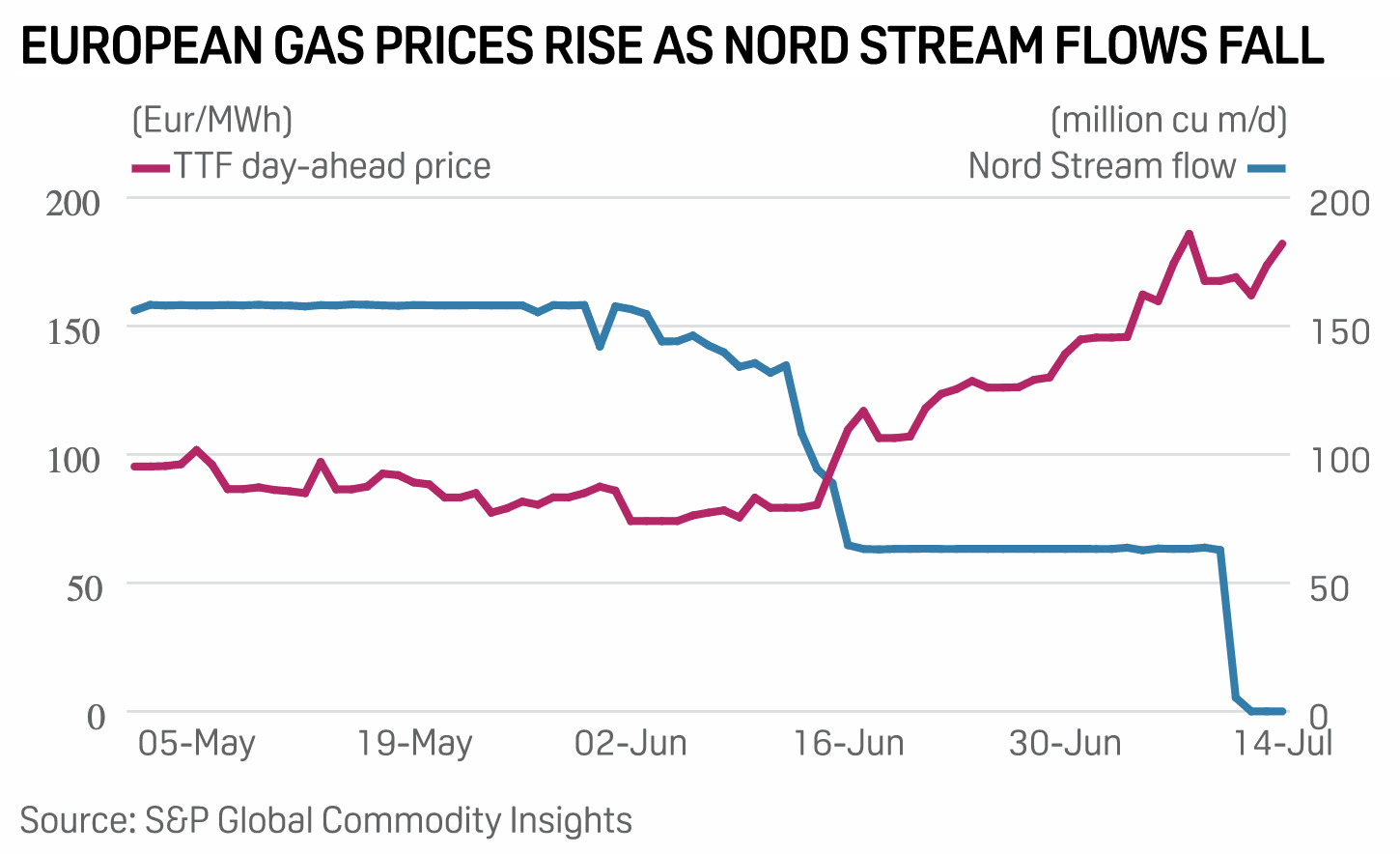

Shell CEO Warns Of Possible Energy Rationing This Winter In Europe

Europe may be facing energy rationing this winter, Shell CEO Ben van Beurden said July 14 at Aurora Energy's spring forum in Oxford. Russian gas supply curtailments have left much of Europe short of gas at a time when storage is usually refilled ahead of winter, fueling concerns of shortages in the coming winter. The EU has warned that a full cut-off in Russian gas flows to Europe cannot be ruled out.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Tech Stability Wobbles On Rocky Macroeconomics Despite Anticipated Supply Chain Relief

Despite supply chain constraints, the U.S. technology sector has performed well in 2022. Information technology (IT) spending, which is highly correlated with the global GDP growth rate, is healthy, and tech issuers have benefited from higher sales and improving margins. However, risks abound from a deteriorating macroeconomic environment, geopolitical events and their impact on supply chains, and pervasive inflationary pressure in many parts of the globe.

—Read the report from S&P Global Ratings