Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Jul, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Best of Times for European Banks

As the European Central Bank continues its monetary policy normalization, European banks may be poised for greater profitability—assuming they can weather the eurozone’s economic slowdown.

Amid the pressure of persistent high inflation, the ECB Governing Council last month announced the start of a new era for the eurozone, defined by the end of quantitative easing, its first interest rate hike in 11 years, and the first repayment of the Targeted Longer-Term Refinancing Operations loans provided by the ECB to banks at favorable rates.

While this normalization is expected to be a multiyear process, rising interest rates will make European banks more profitable in the short term, according to S&P Global Ratings. Market participants also believe that European banks are well-positioned to enjoy elevated earnings from the ECB’s interest rate hikes. But the risk of high inflation elevating further, a potential recession, and additional implications from the war in Ukraine are creating storm clouds on the horizon.

“According to our recent survey of 85 large European banks' regulatory disclosures, a 200 basis point increase in interest rates would boost banks' annual net interest income (NII) by an average of around 18% compared to 2021 (excluding Swiss banks),” S&P Global Ratings said in a recent report. “The magnitude of this impact varies greatly, however. U.K. and Italian banks stand to benefit the most from rising rates, followed by Spanish, German, Danish, and Austrian banks, while French and Dutch banks report smaller effects.”

Following the Global Financial Crisis, European banks followed a policy of de-risking that has resulted in healthier balance sheets, reduced capital, and liquidity ratios, and a comparatively better performing book of loans, according to S&P Global Market Intelligence. The ECB’s interest rate hikes will allow European banks to make money from deposits for the first time in years.

"We've now had such an extended time of very low, and in Europe negative, rates, that seeing the end of that is going to be helpful for the banking business," Deutsche Bank CFO James von Moltke told a financial conference on June 9, according to S&P Global Market Intelligence.

Now, U.S. Federal Reserve stress tests show that European banks appear to be more resilient against a severe economic downturn than their U.S. rivals are.

“The actual upside to NII will also depend on two key factors that are unequal across Europe: how far and fast policy rates rise, and the strength of net lending against a weakening economic backdrop. The current high inflationary environment will likely also lead to rising operational and credit costs for banks,” S&P Global Ratings said in the report. “However, with an economic base case that envisages a normalization in inflation in 2023 and a limited rise in unemployment, we expect that rising interest rates will, in general, provide a fillip for European bank profits in 2022 and 2023.”

S&P Global Ratings now expects eurozone growth of 2.6% this year and 1.9% next (from 2.7% and 2.2% in the interim forecasts in May) due primarily to the inflationary environment. The economic uncertainty is leading to an increase in loans and deposits, with French and German banks leading the way. At the same time, capital requirements are falling for many big EU banks due to market integration in the eurozone. And inflation is likely to prompt Europe's large banks to increase provisioning in the months ahead, according to S&P Global Market Intelligence.

"European bank regulators seem comfortable that banks' balance sheets are sufficiently strong and that a deterioration in the credit cycle will not lead to forced recapitalizations and equity dilution," Vincent Vinatier, a portfolio manager at the French firm AXA Investment Managers, told S&P Global Market Intelligence.

Today is Tuesday, July 12, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Credit Trends: Elevated Inflation And Supply Chain Constraints Threaten Potential Credit Improvement

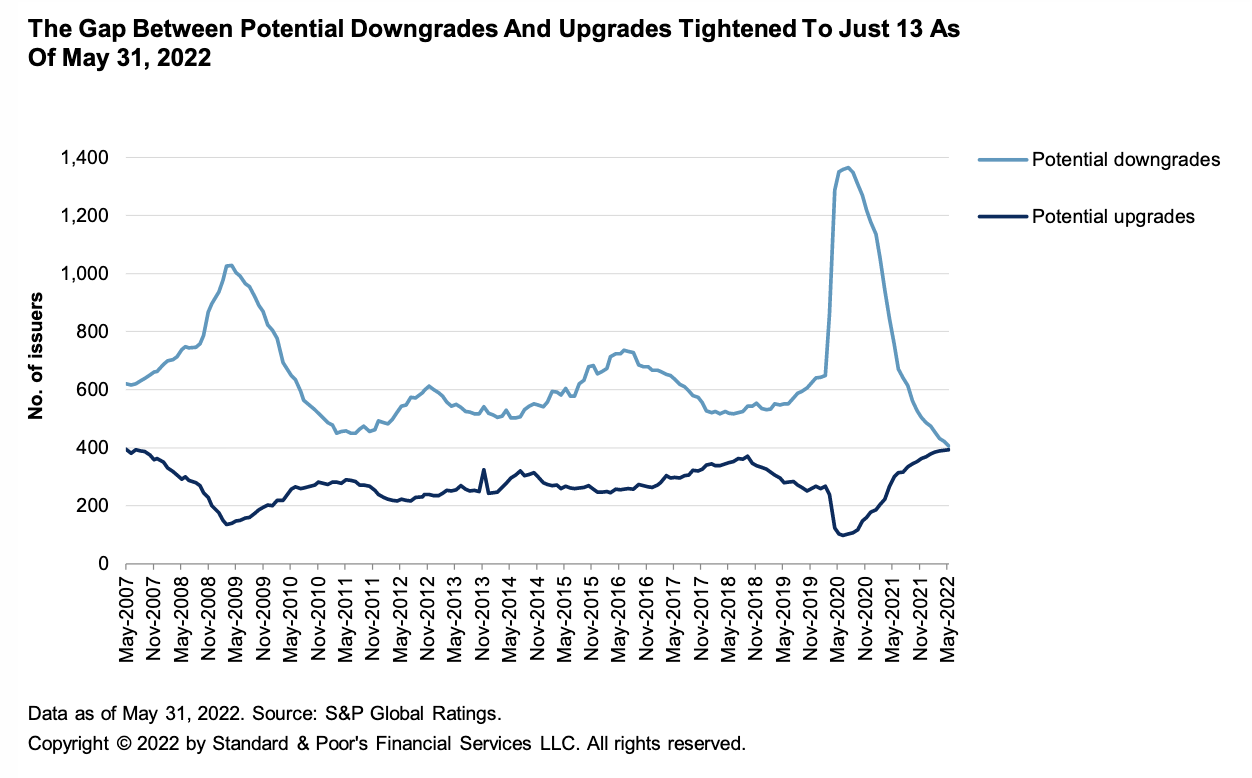

The number of potential downgrades decreased to 406 as of May 31, 2022, from 421 as of April 30, 2022. The tally of potential upgrades increased by two to 393 over the same period. Potential downgrades are defined as corporate, financial, or sovereign issuers rated 'AAA' to 'B-' by S&P Global Ratings with negative outlooks or ratings on CreditWatch negative. Potential upgrades are defined as corporate, financial, or sovereign issuers rated 'AA+' to 'B-' by S&P Global Ratings with positive outlooks or ratings on CreditWatch positive.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Patience Is A Virtue

With the first half of 2022 in the books, commentators have noted that this year’s -20.0% total return for the S&P 500® is the worst January-June result in more than 50 years. Painful as the first six months were, what might they tell us about the rest of the year? History gives us both bad news and good news. Bad news first: the correlation between the past six months’ return and the next six months’ return is vanishingly small. Predictions are problematic.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

Trade Review: Turnaround In Asian Scrap Market In Q3 Hinges On China's Steel Demand

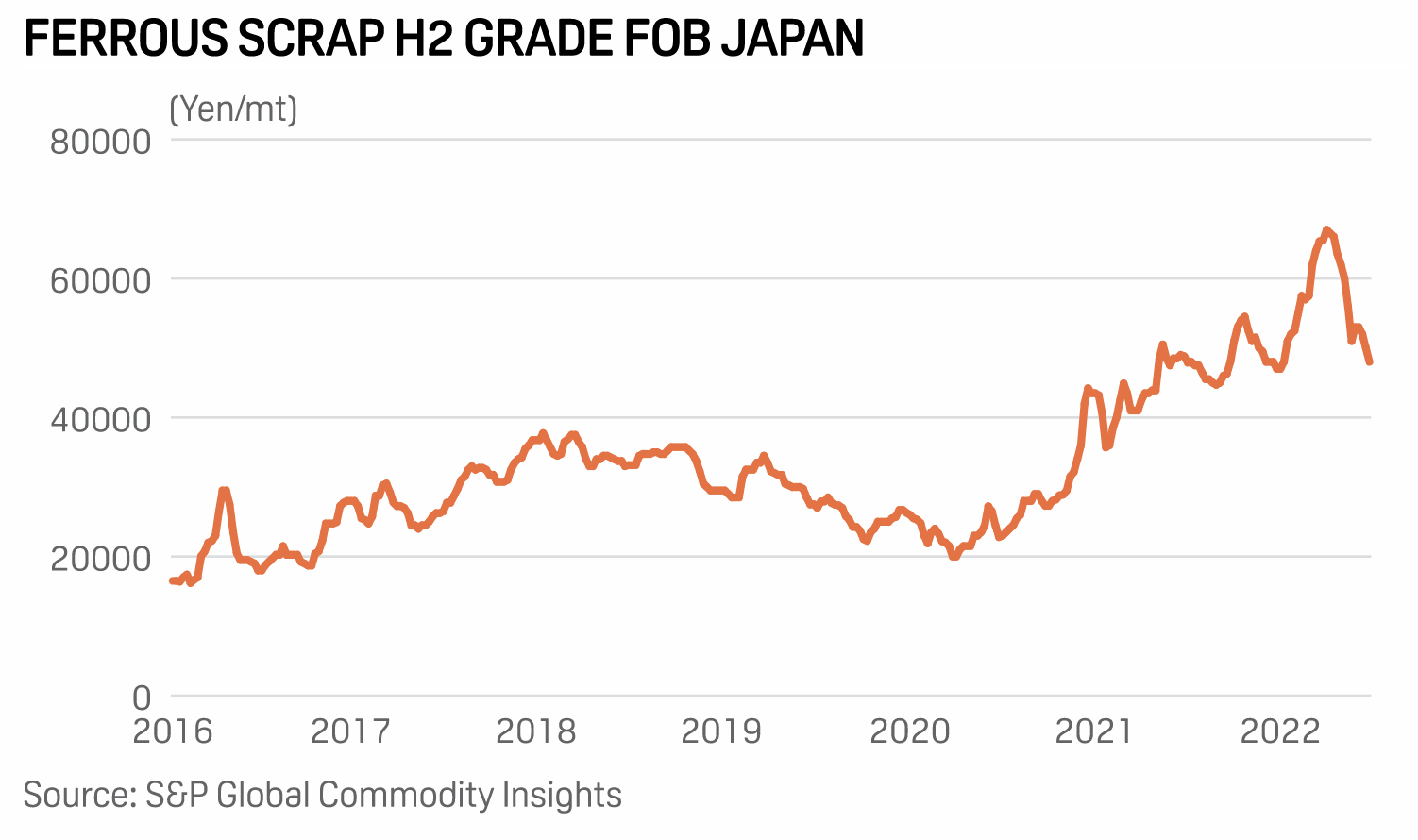

Asian seaborne scrap prices are expected to remain under downward pressure in the third quarter after retreating through Q2 from the multi-year highs reached in the wake of Russia's invasion of Ukraine in late February. Despite the bearish outlook stemming from weak steel demand expectations, market participants said a pickup in China's steel demand and geopolitical tensions were key factors that would decide whether scrap prices could rebound.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Why ESG Experts Say Don’t Let Perfect Be The Enemy Of Good

In the latest episode of the ESG Insider podcast, hosts Lindsey Hall and Esther Whieldon bring you highlights from the GreenFin conference, which convened stakeholders from across the green finance ecosystem. The evolution of ESG data was a big topic at the event and in their interviews with attendees. They talk with Manulife Global Chief Sustainability Officer Sarah Chapman; Nasdaq Global Head of Sustainability Evan Harvey; and Joel Makower, who is chairman and co-founder of GreenBiz Group, the media and events company that hosted the event.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Listen: Can The DOE Spur Carbon Capture Innovation In Time To Aid Climate Crisis?

The International Energy Agency, in its road map for achieving net-zero emissions by 2050, set a near-term target for the deployment of carbon capture capacity at 1.7 billion metric tons by 2030, a level that is more than 40 times the global capacity in 2021. The most significant action the U.S. has taken towards reaching that goal has been to provide funding for various types of carbon management technologies and infrastructure through the bipartisan infrastructure law. Specifically, the bill gives the Department of Energy $12.1 billion for carbon projects. S&P Global reporter Brandon Mulder spoke with DOE's Brad Crabtree, Assistant Secretary for Fossil Energy and Carbon Management, whose office is tasked with allocating that $12 billion to help jumpstart the carbon capture industry.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

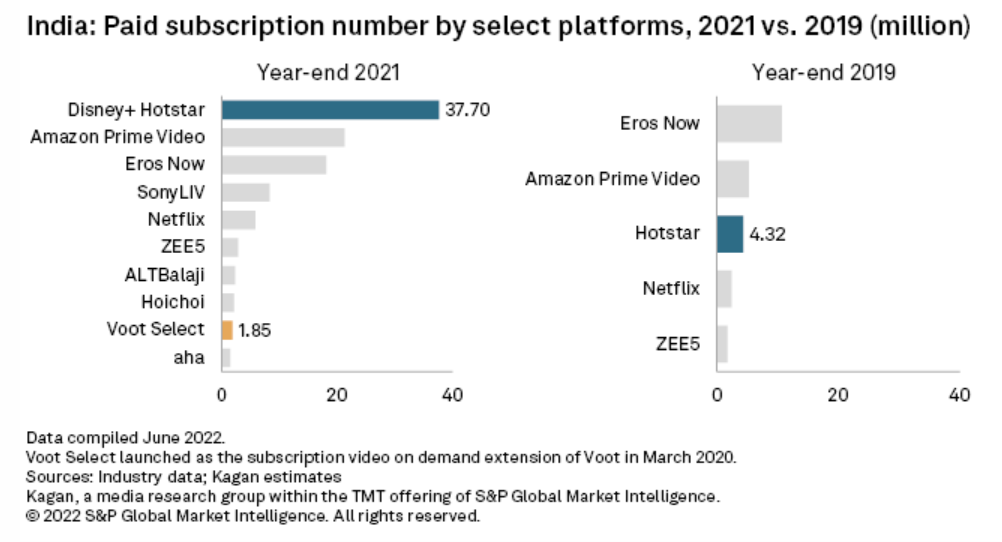

Paramount+ Best Served In A Voot Bundle For India Launch, Analysts Say

Paramount Global's streaming service will face a tough market when it launches in India in 2023, but it could benefit from a ready alliance if it plays its cards right. Paramount Global's CEO Bob Bakish said Paramount+ will launch in India with the aim of bundling with India's Viacom18 Digital Ventures-owned video-on-demand platform, Voot. While he did not clarify if the streaming service will go in as a stand-alone service or not, analysts believe Paramount+ is better off launching as a service within Voot, citing the highly competitive and price-sensitive streaming market in India.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

As the European Central Bank continues its monetary policy normalization, European banks may be poised for greater profitability—assuming they can weather the eurozone’s economic slowdown.

Amid the pressure of persistent high inflation, the ECB Governing Council last month announced the start of a new era for the eurozone, defined by the end of quantitative easing, its first interest rate hike in 11 years, and the first repayment of the Targeted Longer-Term Refinancing Operations loans provided by the ECB to banks at favorable rates.

While this normalization is expected to be a multiyear process, rising interest rates will make European banks more profitable in the short term, according to S&P Global Ratings. Market participants also believe that European banks are well-positioned to enjoy elevated earnings from the ECB’s interest rate hikes. But the risk of high inflation elevating further, a potential recession, and additional implications from the war in Ukraine are creating storm clouds on the horizon.

“According to our recent survey of 85 large European banks' regulatory disclosures, a 200 basis point increase in interest rates would boost banks' annual net interest income (NII) by an average of around 18% compared to 2021 (excluding Swiss banks),” S&P Global Ratings said in a recent report. “The magnitude of this impact varies greatly, however. U.K. and Italian banks stand to benefit the most from rising rates, followed by Spanish, German, Danish, and Austrian banks, while French and Dutch banks report smaller effects.”

Following the Global Financial Crisis, European banks followed a policy of de-risking that has resulted in healthier balance sheets, reduced capital, and liquidity ratios, and a comparatively better performing book of loans, according to S&P Global Market Intelligence. The ECB’s interest rate hikes will allow European banks to make money from deposits for the first time in years.

"We've now had such an extended time of very low, and in Europe negative, rates, that seeing the end of that is going to be helpful for the banking business," Deutsche Bank CFO James von Moltke told a financial conference on June 9, according to S&P Global Market Intelligence.

Now, U.S. Federal Reserve stress tests show that European banks appear to be more resilient against a severe economic downturn than their U.S. rivals are.

“The actual upside to NII will also depend on two key factors that are unequal across Europe: how far and fast policy rates rise, and the strength of net lending against a weakening economic backdrop. The current high inflationary environment will likely also lead to rising operational and credit costs for banks,” S&P Global Ratings said in the report. “However, with an economic base case that envisages a normalization in inflation in 2023 and a limited rise in unemployment, we expect that rising interest rates will, in general, provide a fillip for European bank profits in 2022 and 2023.”

S&P Global Ratings now expects eurozone growth of 2.6% this year and 1.9% next (from 2.7% and 2.2% in the interim forecasts in May) due primarily to the inflationary environment. The economic uncertainty is leading to an increase in loans and deposits, with French and German banks leading the way. At the same time, capital requirements are falling for many big EU banks due to market integration in the eurozone. And inflation is likely to prompt Europe's large banks to increase provisioning in the months ahead, according to S&P Global Market Intelligence.

"European bank regulators seem comfortable that banks' balance sheets are sufficiently strong and that a deterioration in the credit cycle will not lead to forced recapitalizations and equity dilution," Vincent Vinatier, a portfolio manager at the French firm AXA Investment Managers, told S&P Global Market Intelligence.