Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Jan, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Houthi Attacks in Red Sea Impacting Supply Chains and Inflation

At the northern end of the Red Sea, the Suez Canal carries about 10% of global seaborne trade, serving as a vital shortcut between the countries of the Middle East and Asia and Europe. At the southern end lie the Bab-el-Mandeb strait and the Gulf of Aden, natural bottlenecks in the Red Sea shipping lanes that border Yemen’s coasts. The Houthi are an Iran-backed militant organization that has fought wars against both the Yemen government and later a Saudi Arabia-led coalition and that considers Israel an enemy. Following the Oct. 7 attack in Israel by Hamas and the subsequent invasion of Gaza by Israeli armed forces, the Houthi have begun attacking ships using the Red Sea shipping routes in stated solidarity with the Palestinian people in Gaza. These attacks have become progressively more disruptive to international trade and may cause a return of higher inflation as shippers must search for alternative routes or markets for their goods.

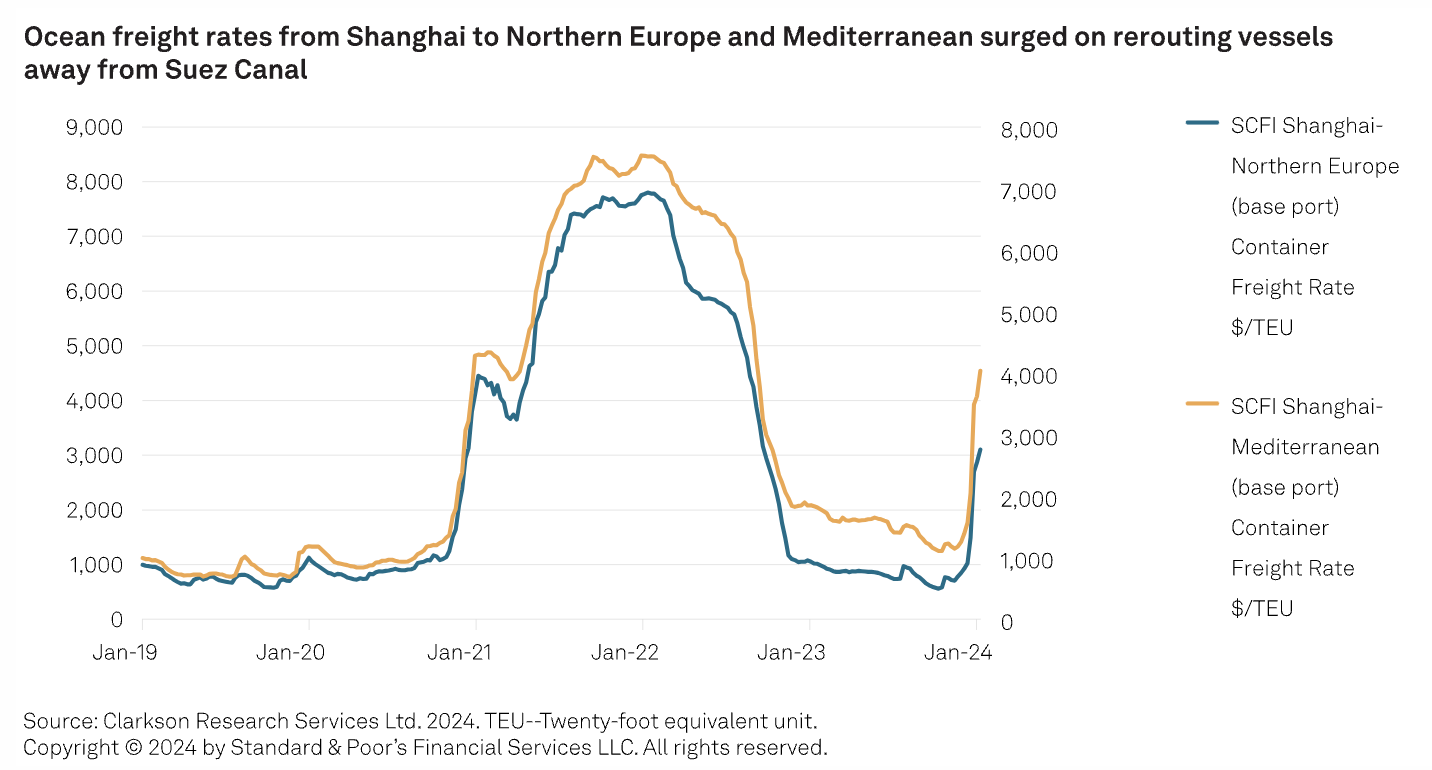

According to S&P Global Ratings, the impact of Houthi drone and missile attacks on Red Sea shipping traffic has been substantial. Containership tonnage in the Red Sea dropped more than 80% in the second half of December 2023 as many shippers elected to take the extra 10 days to traverse the Cape of Good Hope, voyaging around Africa. Container freight rates surged almost 300% with announced rate hikes of $6,000-$7,000 per 40-foot-long container. S&P Global Ratings suggested that these additional costs could reinvigorate inflation in many affected markets.

The US Central Command has ordered a series of retaliatory strikes against Houthi targets in Yemen. However, Houthi militants have responded by escalating their own attacks, hitting the US-owned and -operated bulk carrier M/V Gibraltar Eagle in the Gulf of Aden on Jan. 15. The US designated the Houthi militants as a specially designated global terrorist group, allowing the government to apply sanctions. However, the US has allowed for exceptions to the sanctions for fuel, food and medicines to minimize the impact on Yemeni civilians.

While the Houthis appear to be avoiding attacks against ships carrying oil and LNG from OPEC and its allies, many of these ships are avoiding the Red Sea altogether. Qatari LNG tankers, after pausing short of the Red Sea shipping routes for several days, have rerouted to Spain’s Canary Islands via the Cape of Good Hope.

Many Asian economies, which have become large consumers of discounted Russian crude, are beginning to reconsider their oil policies due to the attacks in the Red Sea. Japan's NYK Line, one of the world's largest ship operators, has halted the passage of its ships through the Red Sea. South Korea, which buys most of its crude from Middle Eastern countries, has been largely unaffected by the attacks. European oil imports have fallen 20% in January, primarily impacting imports from Saudi Arabia, India and Kuwait.

Today is Monday, January 22, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week Of January 22, 2024

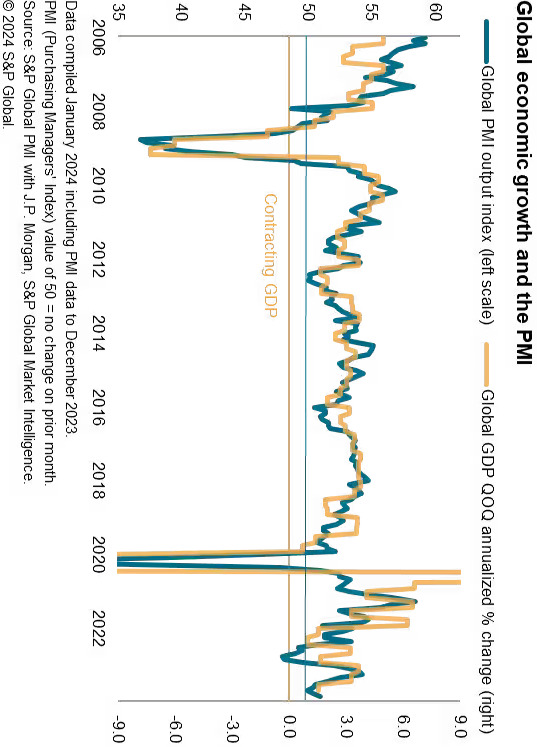

Central bank meetings in the eurozone, Canada and Japan will be the highlights through the week as the market looks for hints of monetary policy changes. The first set of flash PMI surveys for 2024 will also be released on Wednesday, providing insights into economic conditions across major developed economies. Additional economic data will be in abundance, including the release of US Q4 GDP, core PCE figures and various inflation updates across the globe. US earnings will also add to a busy week for the markets.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

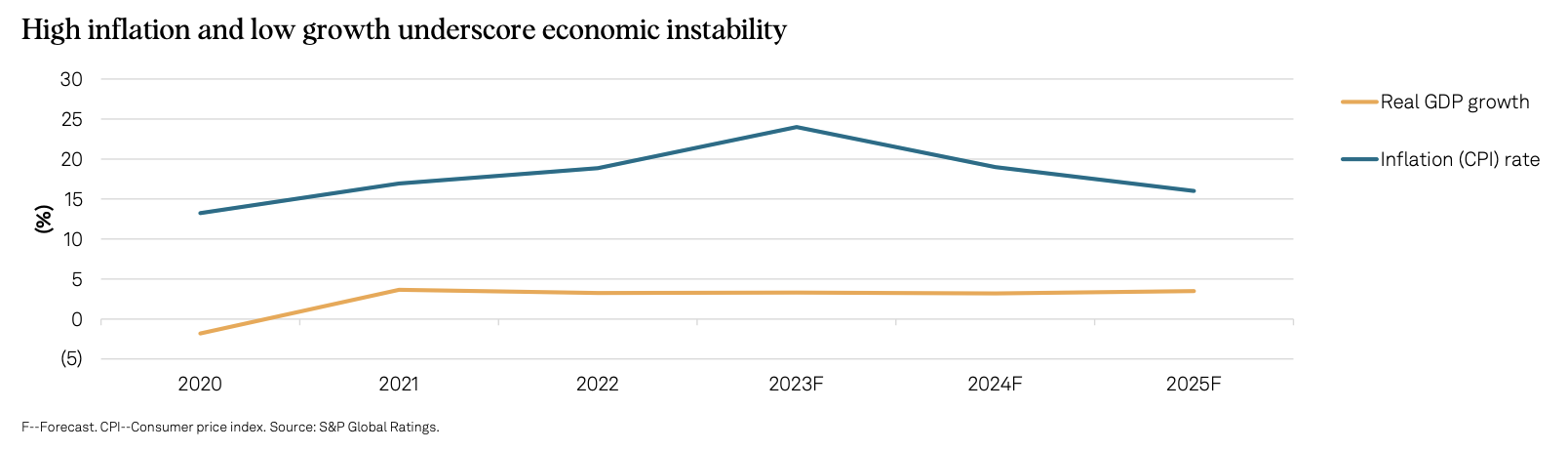

Nigerian Banking Outlook 2024: Banks Stand Firm Amid Macroeconomic Pressures

Nigerian banks stand firm amid macroeconomic pressures. Despite persistent macroeconomic pressures, including a weakening Nigerian naira, S&P Global Ratings thinks that the Nigerian banking sector’s positive net open position and strong earnings will mitigate the negative impact of currency movements on banks' capital adequacy ratios. However, it does not exclude the possibility of individual small banks breaching their minimum regulatory requirements.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

CreditWeek: How Will The Red Light In The Red Sea Affect Supply Chains And Inflation?

The Houthi attacks on shipping in the Red Sea represent a worrying step toward escalation of the conflict in the Middle East. But while the effects on supply chains and inflation may cause some dislocation in the short-term, S&P Global Ratings believes they will largely be manageable — barring the extreme tail risk of a regional war leading to the weaponization of energy against the West via restrictions on oil and gas tankers' rights of passage through the Strait of Hormuz.

—Read the report from S&P Global Ratings

Access more insights on global trade >

Listen: Geothermal: Applying Oilfield Technology To Advance Emissions, Resilience Goals

Geothermal energy uses heat from the earth to, among other things, generate electricity and heat or cool buildings. S&P Global Commodity Insights experts Travis Hagler and Matthew Turner join EnergyCents with hosts Hill Vaden and Sam Humphreys to discuss the opportunity for geothermal technology to generate continuous, low-carbon power and outline some of the challenges that need to be overcome before the technology reaches commercial scale.

—Listen and subscribe to EnergyCents, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

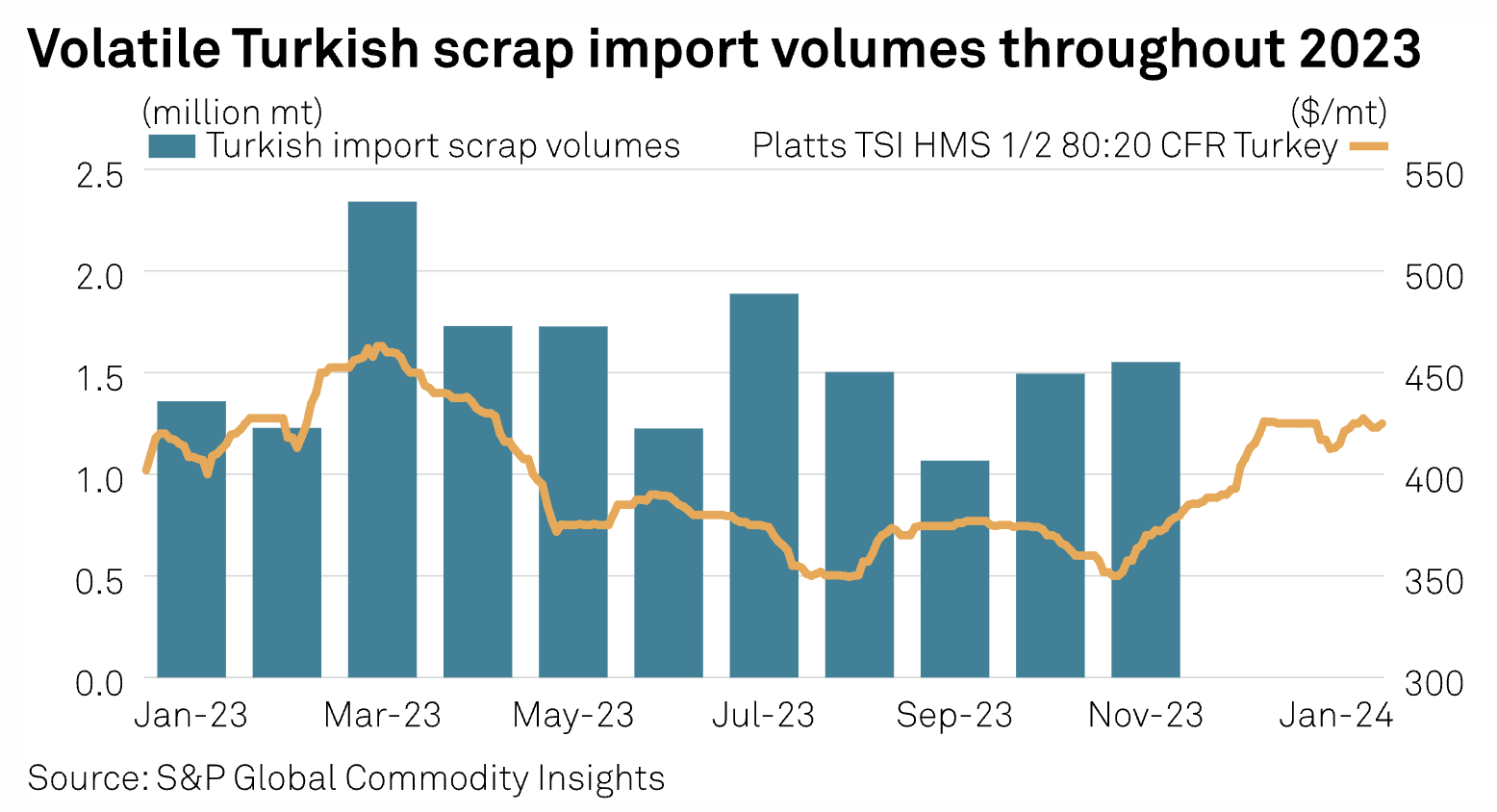

Turkish Mills Likely To Face Firm Scrap Prices In Early 2024

Market participants largely expect Turkish deepsea import scrap prices to remain steady in the first quarter of 2024, with seasonally tight supply and elevated freight costs likely to keep offers firm in the near-term despite periods of limited demand. Platts, part of S&P Global Commodity Insights, assessed Turkish bulk imports of premium heavy melting scrap 1/2 (80:20) at $422/mt CFR Jan. 17.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Europe: 5 Key Media Trends To Watch In 2024

European media industry participants are facing several key decisions in 2024 that could determine their future success and viability as streaming competition continues to pressure the traditional TV industry. While growth in streaming subscriptions is expected to slow down this year, hybrid business models are taking off and a bigger share of net customer additions is expected to come from ad-supported subscription tiers. Many media companies are weighing free, ad-supported TV (FAST) options, with broadcasters, multichannel operators and content owners entering the FAST market.

—Read the article from S&P Global Market Intelligence