Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Jan, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Financing Multiple Transitions in an Indebted World

The global economy is confronting multiple transitions — an energy transition, a changing climate, demographic changes and technological upheavals such as those created by generative AI. These transitions will require funding, either to be realized or to mitigate their impact. But global debt is anticipated to rise to $336 trillion by 2030, meaning that debt markets are already inundated. Further debt financing for these transitions may require an expanded market for debt. However, the economies that are most in need of debt financing frequently have the hardest time securing credit, particularly those economies in the Global South. At this week’s World Economic Forum Annual Meeting in Davos, Switzerland, S&P Global will present new research on financing these transitions in an already-indebted world.

Climate financing takes up the largest share of debt for transition. S&P Global estimated that a cumulative $37 trillion of debt — $25 trillion for climate, $7 trillion for digital transformation and $5 trillion for aging — may have to be raised between 2024 and 2030. The cost of transition could push leverage up another 7%. According to S&P Global, absolute debt could grow to $373 trillion between 2023 and 2030, 11% more than the baseline $336 trillion.

Without adaptation, between 3.2% and 5.1% of world GDP could be wiped out by climate hazards annually by 2050 under a range of climate scenarios, according to a recent study by S&P Global Ratings. Under a slow transition scenario, approximately 12% of South Asia’s GDP could be lost annually by 2050 without adaptation. This potential economic loss is three times more than the world average. Sub-Saharan Africa, the Middle East and North Africa follow with about 8% of GDP at risk, while Europe and North America tend to be less exposed with about 2% of GDP at risk.

S&P Global expects emerging markets’ leverage to grow twice as fast as that of mature markets. This is not surprising given that as emerging economies develop, their degree of financialization tends to increase. The baseline projection is for the leverage of emerging markets to grow 12 percentage points to 211%, with emerging markets (excluding mainland China) up 9 percentage points to 133% and mature markets up 7 percentage points to 257%.

By 2035, there will be a significant demographic shift in five East and Southeast Asian economies — Hong Kong, South Korea, Singapore, Thailand and mainland China. There will be more than two additional elderly people for every 10 working-age residents in these jurisdictions, a near doubling on average of their existing elderly population relative to the working-age population. Labor, capital and productivity growth are the three components of long-term growth, so a shrinking supply of labor will pressure real GDP absent other changes. As faster capital accumulation is unlikely to be sustained for a prolonged period, particularly in advanced economies, much will depend on technological development and its impact on productivity. The expected decline in the world’s labor force will therefore need to be offset by, for instance, widespread adoption of AI technologies, to maintain current growth rates.

Today is Tuesday, January 16, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

ASEAN Economic Outlook In 2024

The near-term economic outlook for the ASEAN region in 2024 remains positive, supported by the continued expansion of domestic demand in a number of large Southeast Asian economies. Foreign direct investment inflows are also expected to remain strong, as multinationals continue to diversify their manufacturing supply chains towards Southeast Asian industrialized nations.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

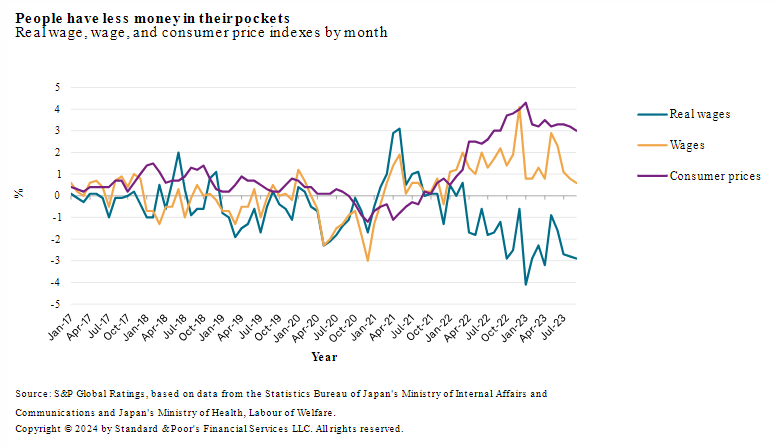

Japan Structured Finance Outlook: Inflation Entrenches?

Eyes are on interest rates and inflation in Japan's securitization market in 2024. S&P Global Ratings expects underlying assets for owner-occupied residential mortgage-backed securities (RMBS), condominium investment RMBS and consumer loan asset-backed securities (ABS) to perform stably. Assets backing apartment loan RMBS, corporate loan ABS and commercial mortgage-backed securities (CMBS) are likely to somewhat underperform.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

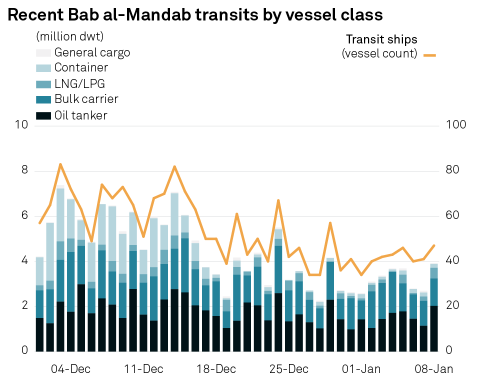

Red Sea Shipping Slumps After US Airstrikes In Yemen Trigger Retaliation Fears

Commercial shipping entering the Bab al-Mandab Strait to exit or transit the Red Sea slumped sharply early Jan. 12, after major shipping bodies urged operators to avoid the Red Sea for up to 72 hours amid risks of retaliatory attacks by Houthi rebels in Yemen following US-led airstrikes overnight. By 1230 GMT, 20 commercial ships had entered the narrow waterway that connects the Red Sea and the Gulf of Aden, down from an average of 38 commercial ships over the same period in the four preceding days, according to S&P Global Commodities at Sea.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

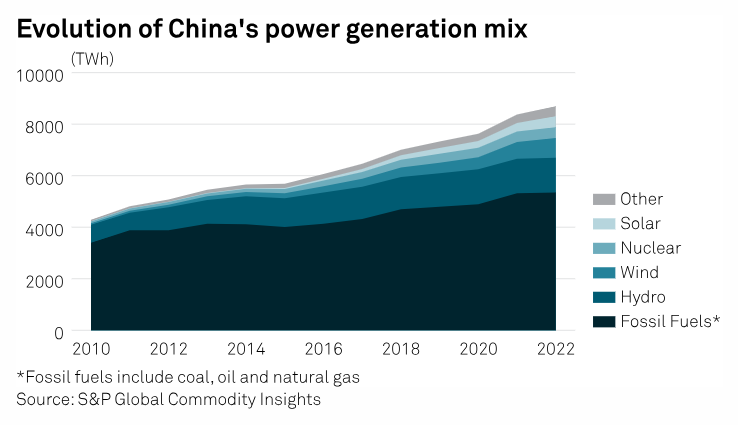

What COP28 Means For China's Future Climate Policies And Strategies

US Special Presidential Envoy for Climate John Kerry's speech at the closing plenary of the UN Climate Change Conference was delivered on behalf of both the US and China, a unique occurrence underscoring a partnership that is becoming increasingly rare between the two nations as geopolitical rivalry escalates. The relationship forged between Kerry and China's former climate envoy Xie Zhenhua in the run up to COP28 was critical in facilitating negotiations at many different levels.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Guyana Oil: The New Crude On The Block

For the first Oil Markets episode of 2024, S&P Global Commodity Insights' oil experts team up across pricing, news and research to provide a fresh look at the crudes everyone is talking about — the new grades from Guyana’s Stabroek Block. Jeff Mower speaks with Ha Nguyen, Felipe Perez and Pat Harrington about how Liza, Unity Gold and Payara Gold are helping drive global production growth outside of OPEC. They discuss production forecasts, how action from Venezuela could affect growing exports and where Guyana’s crude is going. How are emerging refiner preferences affecting the price of the new Guyanese grades? And with turmoil in the Red Sea disrupting trade flows and boosting the price for some crudes in the Atlantic Basin, what is in store for Guyanan oil?

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Industry Credit Outlook 2024: Technology

Global technology rating actions remained negative throughout 2023, continuing the trend that began in the spring of 2022 triggered by the Russia-Ukraine conflict. Although the recessions previously expected in the US and Europe did not materialize, 14% of global tech issuers have negative rating outlooks, the same as at the end of 2022, while only 3% of ratings have positive outlooks, lower than the 5% seen a year ago.

—Read the report from S&P Global Ratings