Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Chinese Equities No Longer Follow the Herd

For a long time, China was seen as an export-driven economy with markets that closely tracked those of its major trading partners in the West. However, China’s equities market has increasingly diverged from European and U.S. equity benchmarks. With widening divergence across gross domestic product, equities and private markets, China is setting its own course, with markets partly decoupled from those in the West.

In the past 10 years, the Chinese equity market has grown in size and importance. Chinese equities have also become increasingly accessible to global investors, who are no longer confined to investing in offshore listings to gain exposure to Chinese markets. By the end of 2022, China's total equity was valued at $11 trillion, with 75% of that listed onshore. The Chinese A-share equity market is the world’s second largest, just behind that of the U.S. share market.

While most of the world’s stock market indices have been strongly correlated since the COVID-19 pandemic started, China’s markets have charted their own course. Both onshore- and offshore-listed Chinese equities have outperformed developed and emerging market stocks. The S&P China Broad Market Index outperformed the S&P 500 by 42% in the three months to Jan. 31. The decoupling of Chinese equity performance relative to other markets has made Chinese equities attractive to some investors.

“One may think adding more volatile assets such as China or emerging market equities to a developed or U.S. equity portfolio would increase risk,” wrote Sean Freer, director of global equity indices at S&P Dow Jones Indices. “However, given the low correlations, the optimal portfolio mix may actually reduce risk.”

Part of the reason for Chinese equities’ asynchronous performance is China's economic growth accelerating as it exits COVID-19 controls. Even in 2022, when many COVID-19 controls were still in place, the Shanghai and Shenzhen stock exchanges, the main venues for listing in mainland China, led all other markets in global initial public offerings, according to S&P Global Market Intelligence data. The Chinese equity market outperformed due to looser monetary policies in China, which outbalanced the effects of COVID-19 controls.

Despite this outperformance, private equity and venture capital investment in China fell sharply in 2022 relative to the U.S. and Europe. Many of the same geopolitical shifts and trade issues that contributed to the unusual success of Chinese equities last year also made investors wary of speculative investments in Chinese technology companies.

Today is Tuesday, February 28, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

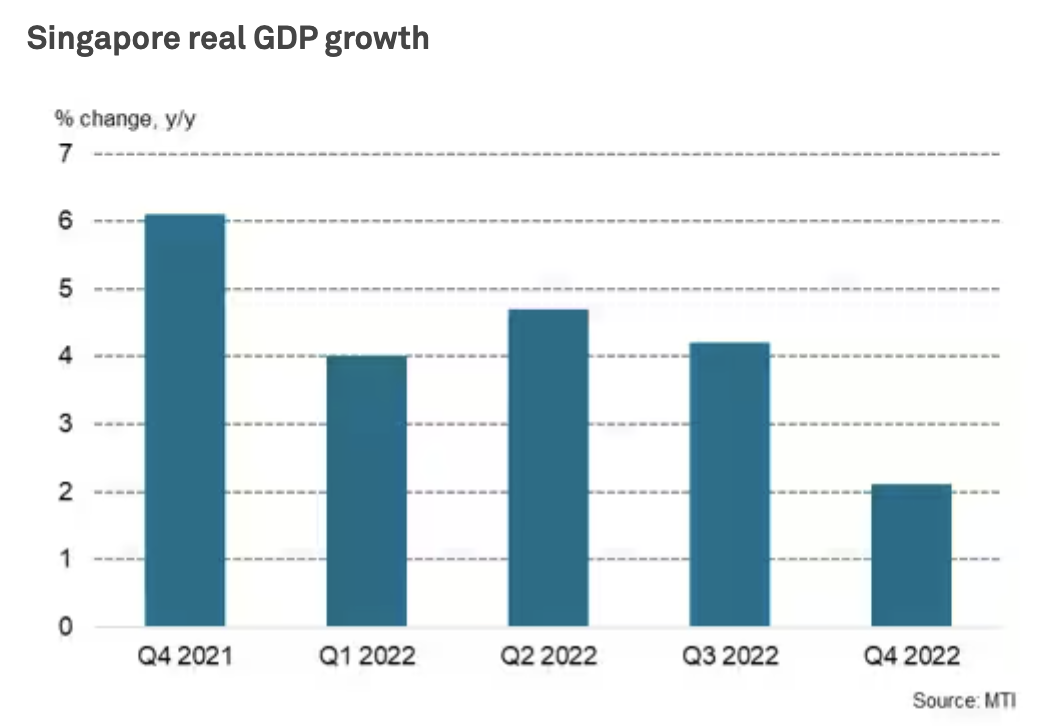

Singapore Budget 2023 Highlights Impact Of Demographic Ageing

The Singapore economy recorded GDP growth of 3.6% year-on-year in 2022, with quarterly growth momentum having moderated to 2.1% y/y in the fourth quarter of 2022. Singapore's Ministry of Trade and Industry has maintained its GDP growth forecast for 2023 in the range of 0.5% to 2.5%. The fiscal deficit for 2023 is expected to narrow to just 0.1% of GDP, after an estimated deficit of 0.3% of GDP in 2022.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

This Week In Credit: Markets Take A Turn For The Worse (Feb. 27, 2023)

An air of pessimism — or arguably just a more realistic tone — has surfaced across markets. Recent data releases point toward more persistent inflation, and widening yields suggest higher for longer rates. Positive credit pricing momentum has now reversed after a lull in recent weeks. There were fewer week-on-week rating actions last week, somewhat evenly balanced between positive and negative but with a concentration of negative actions in consumer-reliant sectors.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

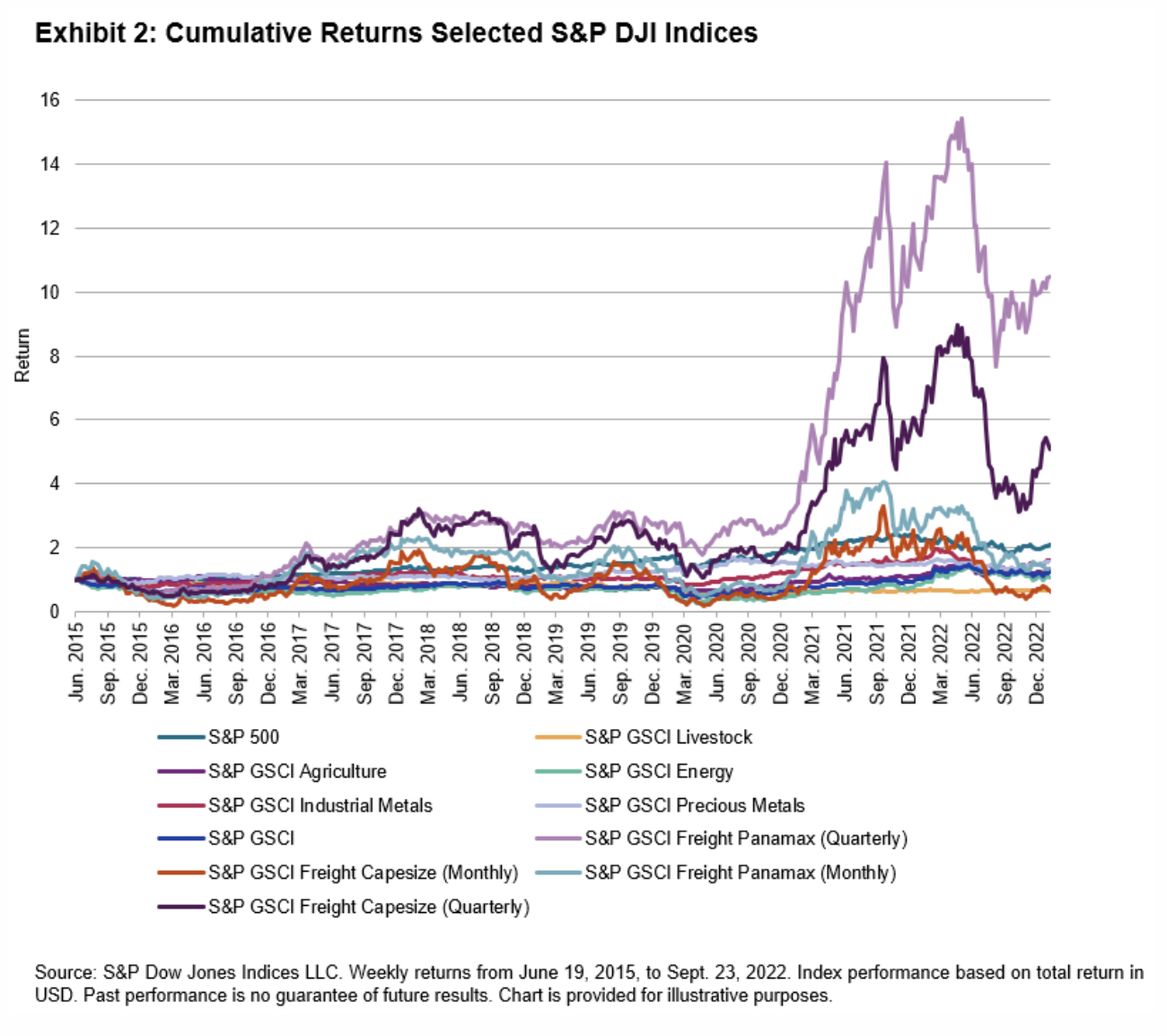

S&P GSCI Shipping Indices In Portfolio Management

Freight rates have historically enjoyed higher average returns and are more volatile compared to equity, fixed income and other commodities. Interestingly, Panamax freight rates are more volatile than the prices of the commodities they typically transport (mostly agricultural commodities and industrial metals). Monthly and quarterly freight rates have similar statistical properties, reflecting the common fundamentals that drive the market and each sector.

—Read the article from S&P Dow Jones Indices

Access more insights on global trade >

Listen: Will There Be Turbulence Or Clear Skies For Sustainable Aviation Fuel?

The Biden administration is working to reduce US aviation emissions by 20% by 2030 and achieve net-zero emissions for the sector by 2050. To meet this goal, the administration launched the Sustainable Aviation Fuel Grand Challenge to catalyze the production of at least 3 billion gallons of sustainable aviation fuel (SAF) per year by 2030 and 35 billion gallons per year of SAF by 2050. Gevo is currently the third largest worldwide supplier of SAF and has committed to delivering 1 billion gallons per year of SAF and other renewable fuels by 2030. Gevo CEO Patrick Gruber joined the podcast to discuss the policies and market dynamics needed for the significant boost in SAF production envisioned by the administration. He also addressed pain points to deploying SAF projects and sought to debunk some false narratives surrounding the SAF industry.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

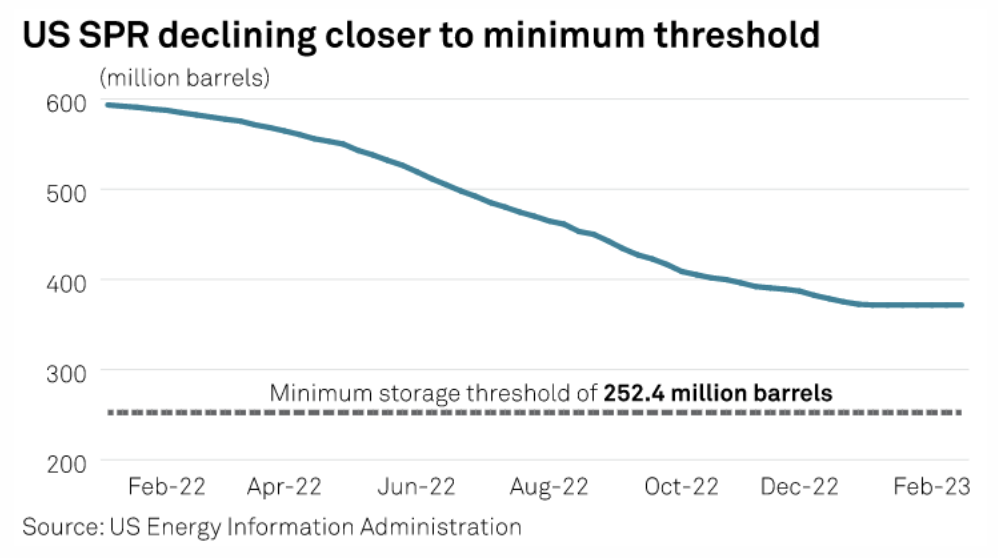

Biden Faces 'No Good Options' To Keep Gasoline Prices In Check

U.S. President Joe Biden promised he would lower prices at the pump, which have eased since topping $5/gal last summer, but the president will face new challenges and limited options if domestic fuel prices surge again as Russia has shown no signs of ending its war with Ukraine. U.S. gasoline prices averaged $3.38/gal the week ended Feb. 20, down $1.63/gal from their mid-June 2022 peak, according to the Energy Information Administration. But as the Russia-Ukraine war enters its second year, more price spikes and supply dislocations are possible.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

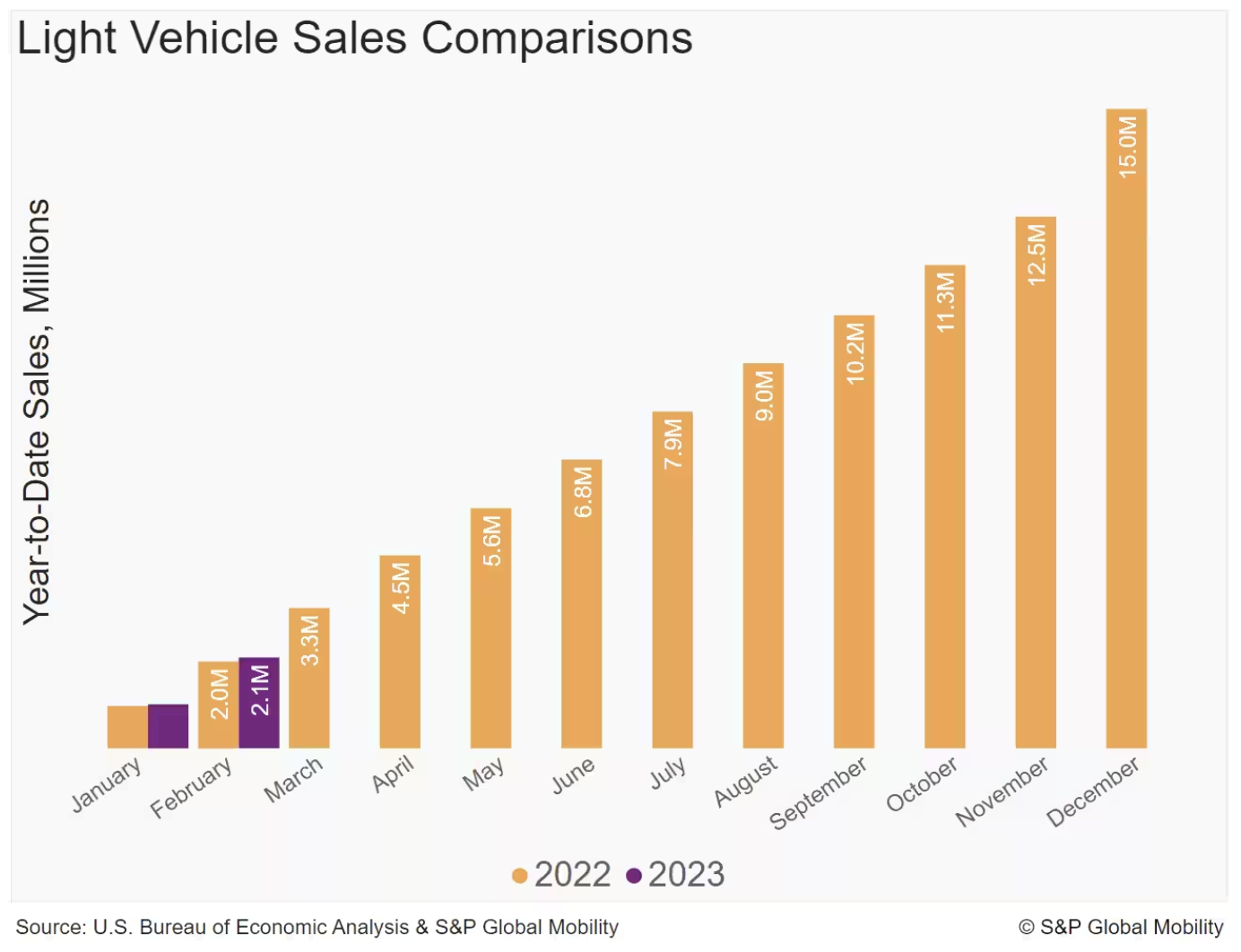

February 2023 US Auto Sales Holding The Line

With U.S. light vehicle sales volume for the month projected at 1.1 million units, S&P Global Mobility expects February 2023 to represent year-over-year growth of 5%, the seventh consecutive month of y/y volume improvement. The tally would also be up more than 6% compared to January volumes. February 2023 U.S. auto sales are estimated to translate to an estimated sales pace of 14.4 million units (seasonally adjusted annual rate: SAAR), a marked decline from the month-prior figure, although the underlying sales rate, as represented by the daily selling rate metric, should advance mildly.

—Read the article from S&P Global Mobility

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek