Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Feb, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The world’s lack of lithium supply threatens to shrink demand for electric vehicles in the short-term and even derail the energy transition over the long-term.

While the global metals and mining industry has leaned into its role within the energy transition, years of capital constraints and underinvestment pose risks to supply that needs to meet roaring demand for rare earth metals and minerals now and in the future. In particular, demand for lithium—used as a key component in electric vehicles and energy-storage systems—is accelerating as more companies and countries act on their net-zero ambitions, and is likely to increase in coming years. However, mining companies are confronting new conditions—a global supply crunch of key metals and minerals that has threatened to upend battery supply chains and inflationary pressures with corresponding soaring metals prices—that could pose challenges to the energy transition.

The low investment in new lithium supply in recent years could stimulate a structural deficit throughout the coming decade, according to an S&P Global Platts analysis. Demand for lithium is expected to skyrocket to 2 million metric tons by 2030, but supply is likely to fall short. Even if all planned global lithium projects are executed within the decade, their output will still be 220,000 metric tons short of the amount needed.

In the near-term, even nine new and restarted lithium projects worldwide that could bring about 355,000 tons of lithium carbonate capacity online by the end next year would leave the market tight, according to S&P Global Market Intelligence. This forecast found that the global economy could be 50,000 tons short of lithium carbonate equivalent by 2025.

"The lack of investment in lithium capacity over the past five years will extend the supply shortage,” Joe Lowry, president of the consulting firm Global Lithium, told S&P Global Platts. "Even well-capitalized major lithium companies have struggled to meet their expansion targets … New producers have seen their project timelines extended in many cases due to COVID and related supply chain issues, along with their learning curves OEMs and battery producers that assumed market forces would ensure adequate battery raw materials are finally taking note of the supply-demand issue—but much too late to solve the problem in the near to mid-term."

"Commissioning of new and restart projects, as well as the expansion of existing operations, will be much needed to keep pace with unprecedented demand growth," S&P Global Market Intelligence said in its recent analysis.

Recent lithium-market turbulence in China—the world’s fourth-largest provider of the critical mineral---and the European Union, where decisive climate action is spurring record demand for electric vehicles, has added additional complexity. Across both economies, electric vehicle sales accounted for nearly 20% of new car sales in China and more than 25% in the E.U. in recent months, according to S&P Global Platts.

Short-term disruptions in China are provoking long-term problems. To improve air quality during the Beijing Winter Olympic and Paralympic Games, scheduled for Feb. 4-March 13, China has curbed lithium production in Hebei and Shandong as part of its antipollution measures, according to S&P Global Market Intelligence. Market participants anticipate imports and exports of lithium carbonate to and from China to rise significantly this year due to the power battery industry’s rapid expansion. But 80% of respondents to S&P Global Platts 2022 China Battery Metals Outlook survey expect China's average battery-grade lithium carbonate prices to swell above $39,354 per metric ton (Yuan 250,000 per metric ton), nearly 316% higher from what it was at the start of 2021. Lithium prices this high could potentially curb downstream demand.

Market changes in the eurozone have thrown approximately one-third of European lithium production into jeopardy. The Serbian government revoked permits for the Australian mining company Rio Tinto Group’s Jadar lithium project on Jan. 20 over community and environmental opposition, dealing a potentially deadly blow to the $2.4 billion project that would’ve been the fourth-largest producing mine, according to S&P Global Market Intelligence.

"It certainly doesn't help when we're already in a shortage and we need to see as much investment as possible go into lithium in order to meet future demand growth," Seth Goldstein, a senior equity analyst focused on lithium at Morningstar, told S&P Global Market Intelligence of the revocation of Rio Tinto's licenses. "Government opposition to big projects with the potential to become a large-scale resource like the Rio Tinto project will increase the amount of time it will take for supply to catch up."

Today is Wednesday, February 2, 2022, and here is today’s essential intelligence.

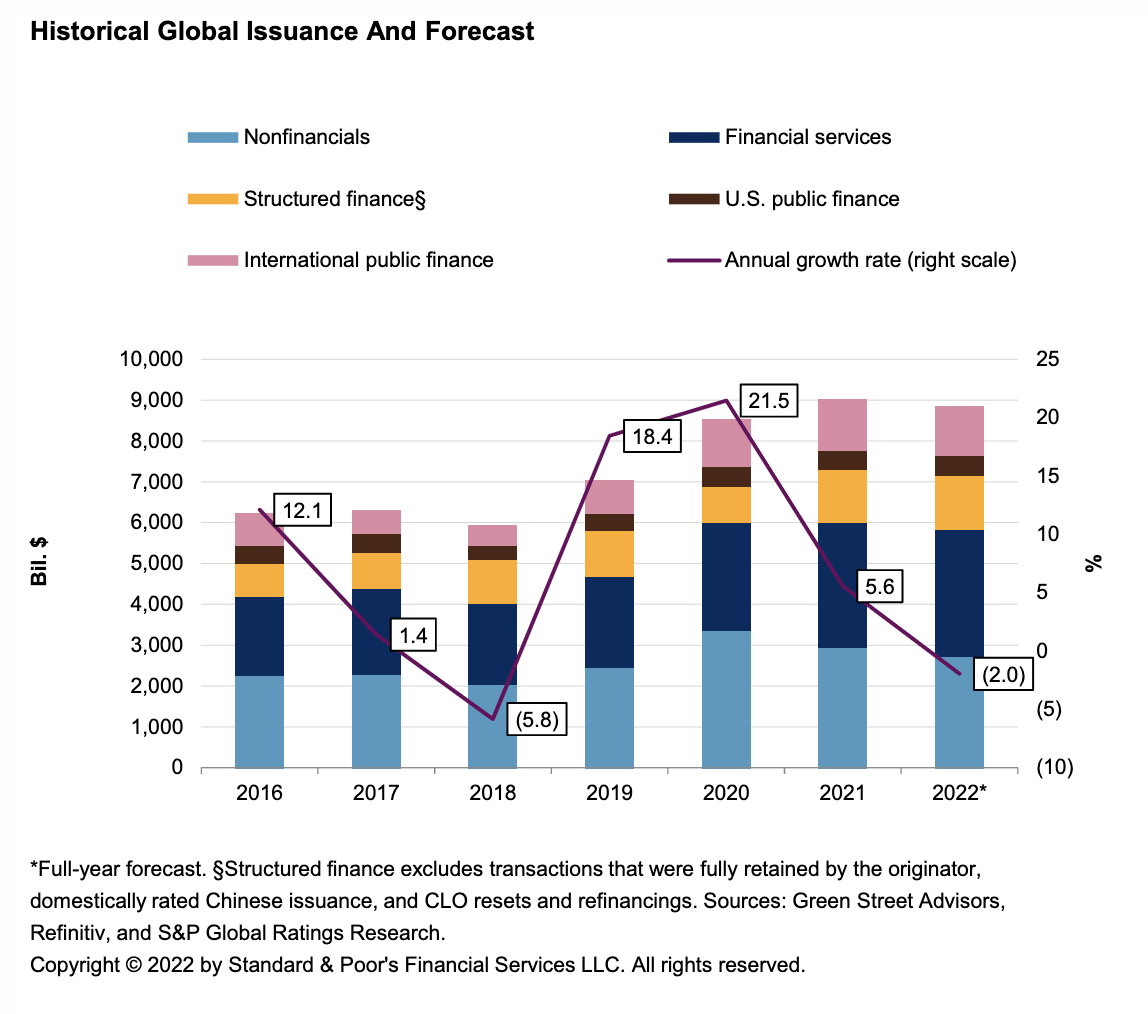

Credit Trends: Global Financing Conditions: Bond Issuance Looks Set To Contract 2% This Year As Monetary Policy Tightens

After a strong showing in the fourth quarter, global bond issuance finished 2021 up 5.6% from 2020's heady total, to $9 trillion. S&P Global Ratings expects global bond issuance to contract 2% in 2022—consistent with a return to pre-pandemic economic activity, though risks weigh to the downside. The main risk to S&P Global Ratings’ forecast is whether the Fed responds too aggressively in fighting inflation, in turn resulting in interest rate spikes, a market freeze, or declining economic activity and earnings. Other uncertainties include global elections, pandemic developments, and geopolitical risks.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

Analysts Brace For Volatile 2022 As S&P 500 Ends Worst Month Since March 2020

Investors got a rude awakening in January as the S&P 500 hit a record high, fell into a correction, and then briefly rallied before ending the month down 5.3%, a sign that equities will be far more choppy in 2022 than they were in 2021. The S&P 500 fell 9.8% from its all-time high settlement on Jan. 3 to its Jan. 27 settlement, its lowest close since Oct. 4. While the S&P 500 did rally about 4.4% in the last three trading days of January, the 5.3% decline marked the index's worst month since March 2020 and its worst January since 2008.

—Read the full report from S&P Global Market Intelligence

Access more insights on capital markets >

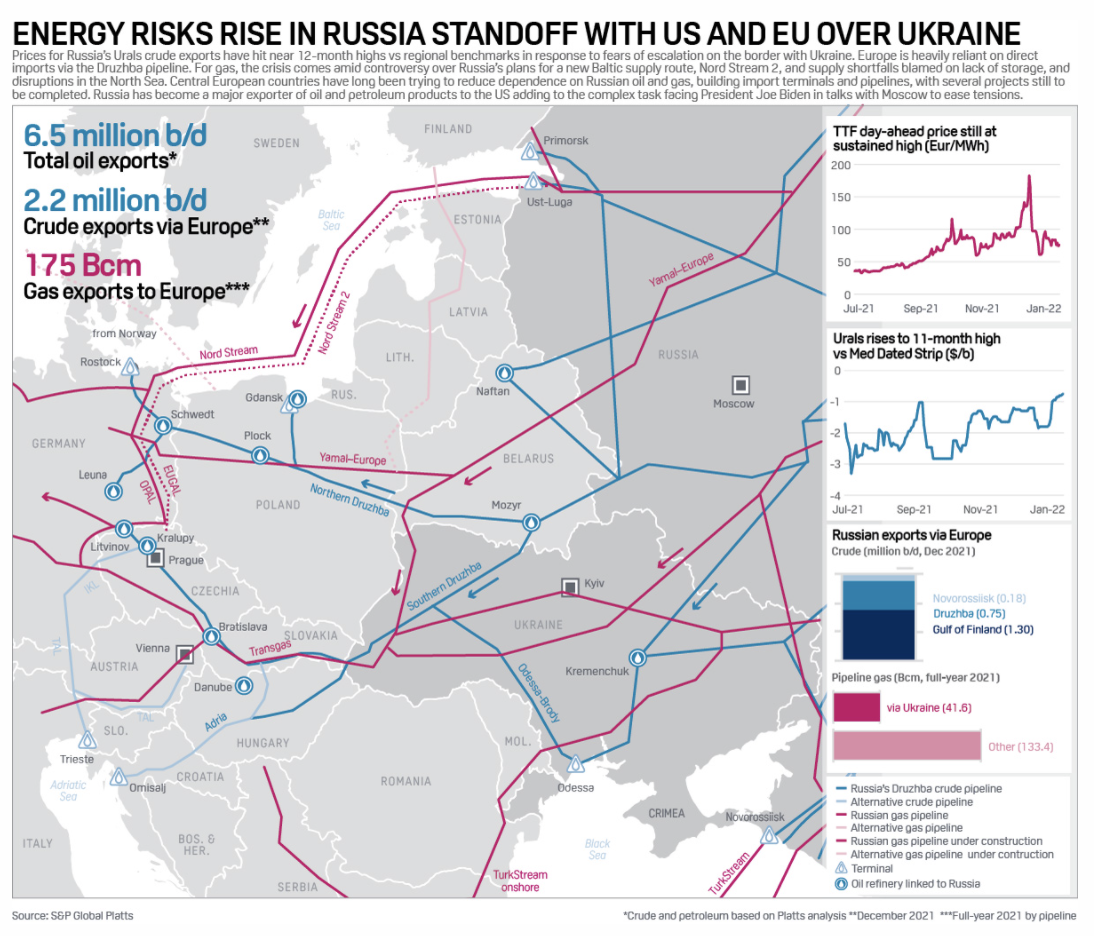

Fuel For Thought: Persian Gulf Energy Producers Caught In The Middle Of New World Order

Geopolitics has jumped ahead of market fundamentals at the beginning of 2022 as the major driver behind higher global oil and gas prices. Fears of a confrontation between the U.S.-led NATO powers and Russia over the future of Ukraine have helped to push crude above $90/b. With concerns growing over dwindling global spare capacity, major producers in the Gulf region find themselves once again in a key position to ensure global demand is met by ample supply.

—Read the full report from S&P Global Platts

Access more insights on the global trade >

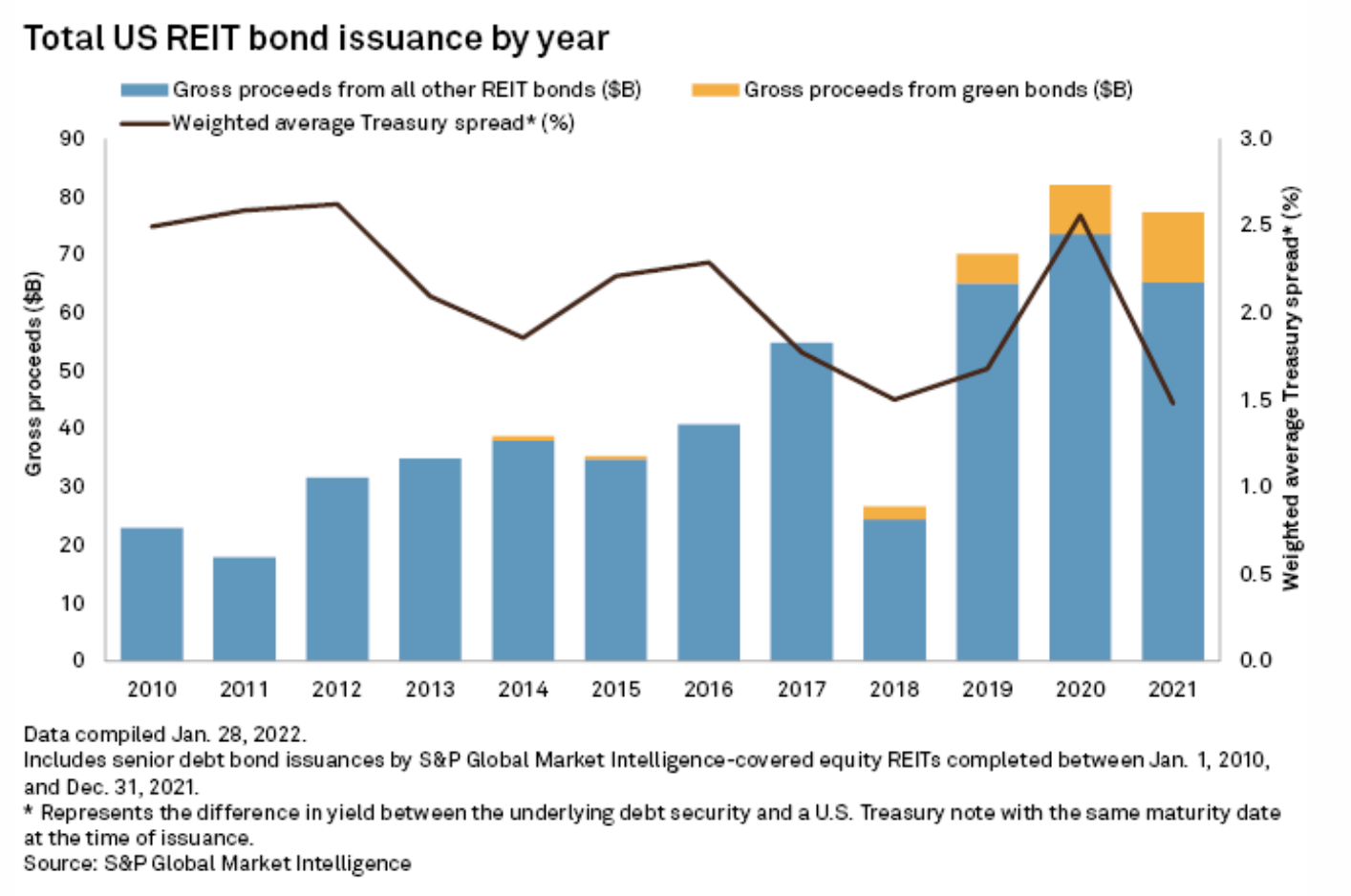

Green Bond Issuance By U.S. REITs Grew In 2021

While green bonds still represent a small percentage of capital raising activity, they have been continually rising in popularity over the past four years, widening the potential buyer pool for REIT securities and serving as an avenue for REITs to tap into investors looking for sustainable-oriented investments. Fourteen REITs utilized green bonds in 2021 as a way to raise capital for ESG initiatives, resulting in aggregate gross proceeds of nearly $11.97 billion.

—Read the full article from S&P Global Market Intelligence

Listen: U.S. Tries To Fill Gap As Ukraine Crisis Threatens European Gas Supplies

The Russia-Ukraine standoff has significant implications for the global gas and LNG markets, given Europe's reliance on Russian supply. It's peak winter demand season, and European gas inventories have been falling daily. Gas in storage stands at about 40% full, versus 53% full at the same time a year ago. Platts Atlantic LNG senior editor Harry Weber spoke with Charif Souki, executive chairman of U.S. liquefaction terminal developer Tellurian, about the current state of the LNG market and whether the U.S. dialogue can make a difference.

—Read the full report from S&P Global Platts

Access more insights on energy and commodities >

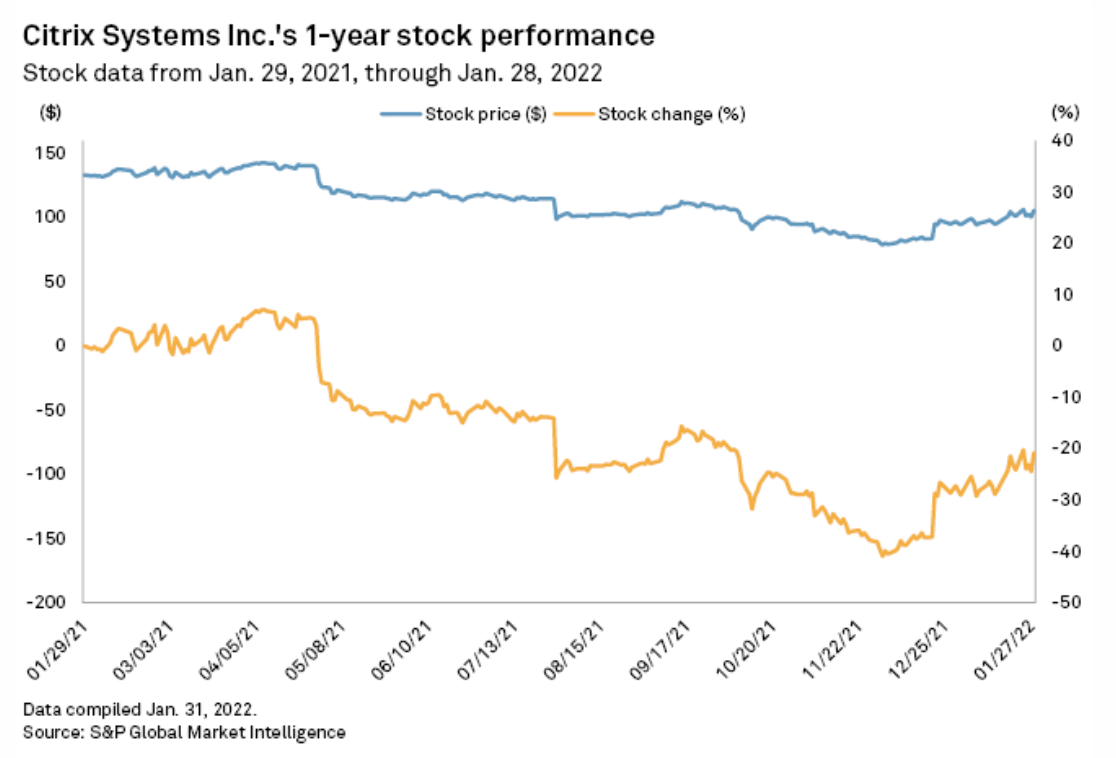

Premium Valuation A Moving Target In $16.5B Citrix Acquisition

The $16.50 billion deal to acquire enterprise software company Citrix Systems Inc. represents the largest acquisition on record for buyers Vista Equity Partners and Evergreen Coast Capital Corp., as well as a liquidity event for Citrix investors after a volatile year on the market. The two private equity firms agreed Jan. 31 to pay $104 per share of Citrix, representing a 1.5% discount from the company's Jan. 28 closing price. However, Citrix shares have outperformed broad market and sector-specific indexes since late December 2021 when media reports indicated an imminent sale.

—Read the full article from S&P Market Intelligence

Access more insights on technology and media >

Written by Molly Mintz.

ry Metals Outlook survey expect China's average battery-grade lithium carbonate prices to swell above $39,354 per megaton (Yuan 250,000 per megaton), nearly 316% higher from what it was at the start of 2021. Lithium prices this high could potentially curb downstream demand.

Market changes in the eurozone have thrown approximately one-third of European lithium production into jeopardy. The Serbian government revoked permits for the Australian mining company Rio Tinto Group’s Jadar lithium project on Jan. 20 over community and environmental opposition, dealing a potentially deadly blow to the $2.4 billion project that would’ve been the fourth-largest producing mine, according to S&P Global Market Intelligence.

"It certainly doesn't help when we're already in a shortage and we need to see as much investment as possible go into lithium in order to meet future demand growth," Seth Goldstein, a senior equity analyst focused on lithium at Morningstar, told S&P Global Market Intelligence of the revocation of Rio Tinto's licenses. "Government opposition to big projects with the potential to become a large-scale resource like the Rio Tinto project will increase the amount of time it will take for supply to catch up."

"This was set to be the biggest producing lithium project in Europe," George Miller, a lithium analyst at the research firm Benchmark Mineral Intelligence, told S&P Global Market Intelligence. "It's going to really damage the pipeline for lithium production within Europe."