S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Diversity, Equity, & Inclusion

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Diversity, Equity, & Inclusion

S&P Global — 1 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

War Threatens Trade in the Black Sea

Since the time of the czars, Russian leaders have seen the Black Sea as “a Russian lake.” The sea is Russia’s only outlet to the warm-water ports of the Mediterranean, a buffer between the Russian homeland and the volatile countries of the Middle East, and the maritime key to the country’s geopolitical strategy. Russia’s invasion of Ukraine has once again underlined the sea’s importance — and has disrupted exports of grain from Ukraine.

Ukraine is among the world’s biggest exporters of wheat — with Russia and the U.S. in first and second place, respectively — but exports virtually halted after Russia invaded the country Feb. 24, 2022. The shutdown contributed to soaring prices and a food crisis in 2022: 349 million people faced “acute food insecurity” across 79 countries, according to the World Food Programme, a 22% increase from 2021.

The Black Sea Grain Initiative, brokered by the United Nations and signed by Ukraine, Russia and Turkey on July 22, 2022, allowed the resumption of shipments from the key Black Sea ports of Chornomorsk, Odesa and Yuzhny/Pivdennyi. Russia briefly dropped out of the agreement in late October 2022, charging that Ukrainian drones had attacked civilian ships, but the deal was renewed Nov. 19, 2022, for another four months.

Still, grain shipments have remained low, falling to 611,000 tonnes during the week of Jan. 2, 35% below the previous week and well below historical averages. Shipments have recovered somewhat since, reaching 893,874 tonnes in the Jan. 15-23 period. But wartime pressures, including the suspension of war risk coverage in Ukraine and Russia for shipping-related liabilities by some major insurers, will continue to limit exports of wheat, corn, soya and other foodstuffs in 2023.

Under the Black Sea Grain Initiative, each ship leaving Ukraine must be inspected. As of early January, there were only three inspection teams, each capable of conducting two to three inspections a day. Many involved in the trade believe that Russian officials are impeding ship traffic from Ukraine, according to S&P Global Commodity Insights.

"I have the impression that [Russia] uses any excuse possible to slow down the [inspection] process," one trader of Ukraine grain said.

Russia’s war in Ukraine has also disrupted the ethanol market in Europe, along with Ukraine’s once-mighty steel industry.

“With Ukraine's steel production infrastructure destroyed, idled or under Russian control, the Black Sea export market is unlikely to return to prewar patterns any time soon and prices in the region will predominantly reflect Russian exports for the foreseeable future,” wrote Wojtek Laskowski, S&P Global Commodity Insights’ team lead for Europe, the Middle East and Africa steel markets, on Jan. 4.

Ukrainian steel production totaled 6.16 million tonnes from January to November 2022, down nearly 70% from 2021, according to data from the World Steel Association. Major steelworks including Azovstal in Mariupol have been destroyed, and ArcelorMittal Kryvyi Rih, one of the main suppliers of pig iron in Ukraine, idled its blast furnaces after a missile attack last December.

Whatever the outcome of the war in Ukraine, Russia’s aim to control trade in the Black Sea will be undiminished. “Moscow sees the Black Sea region as vital to its geoeconomic strategy to project Russian power and influence in the Mediterranean, protect its economic and trade links with key European markets, and make southern Europe more dependent on Russian oil and gas,” said a prewar report from the Carnegie Endowment for International Peace.

Today is Wednesday, February 1, 2023, and here is today’s essential intelligence.

Written by Richard Martin.

Key Themes 2023: What We're Watching

S&P Global Ratings believes 2023 will begin as a journey through intensifying credit pressures, leading to (if all goes well) more stable financing conditions by year-end. Against this backdrop, it will be closely watching how market participants confront credit headwinds, deal with reshuffling capital flows, navigate geopolitical uncertainty, seek energy and climate resilience and manage crypto and cyber disruption. The capacity of these trends to instantly disrupt our interconnected world — and the credit markets that underpin it — is evident.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

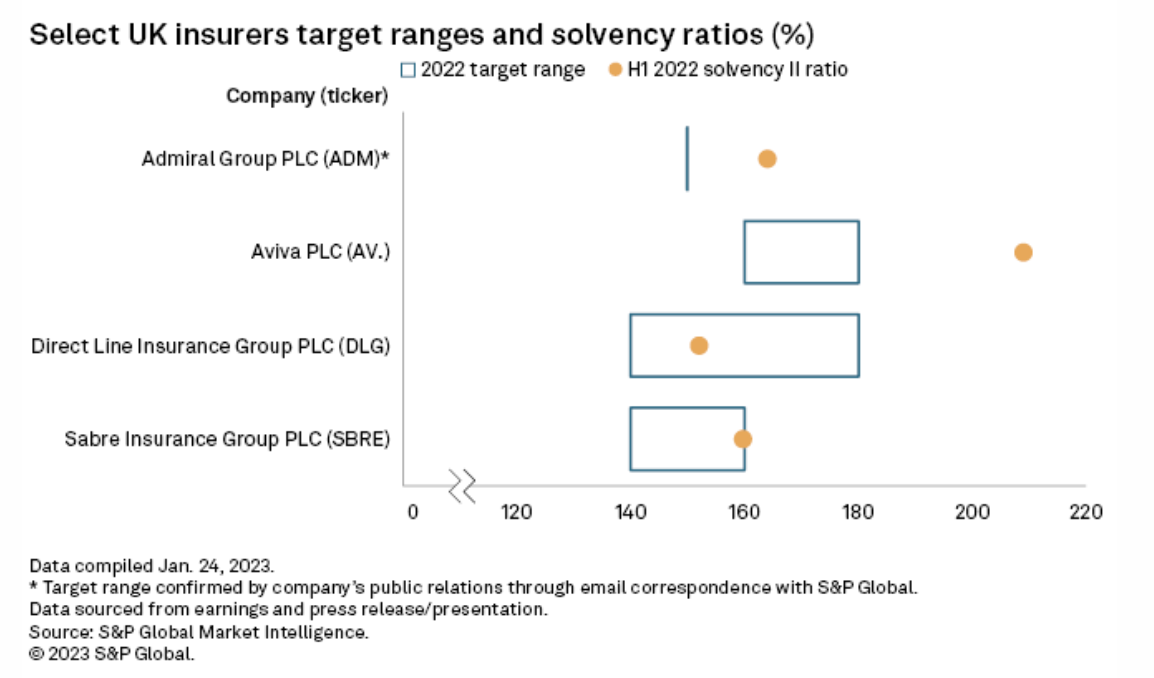

Direct Line Woes Signal Tough 2023 For U.K. Personal Lines Insurers

Direct Line Insurance Group PLC's shock cancellation of its final 2022 dividend has set the tone for a difficult 2023 for U.K. nonlife insurers, particularly in personal lines. Final dividends are unlikely to be at risk at other listed U.K. nonlife insurers, but the trends underpinning Direct Line's decision — particularly claims inflation — will be a drag on profits industrywide this year after an already bruising 2022. The outlook for U.K. nonlife insurance in 2023 is just as bad as it was for 2022 or possibly even worse, according to Ekaterina Ishchenko, a director at Fitch Ratings covering Europe, the Middle East and Africa.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

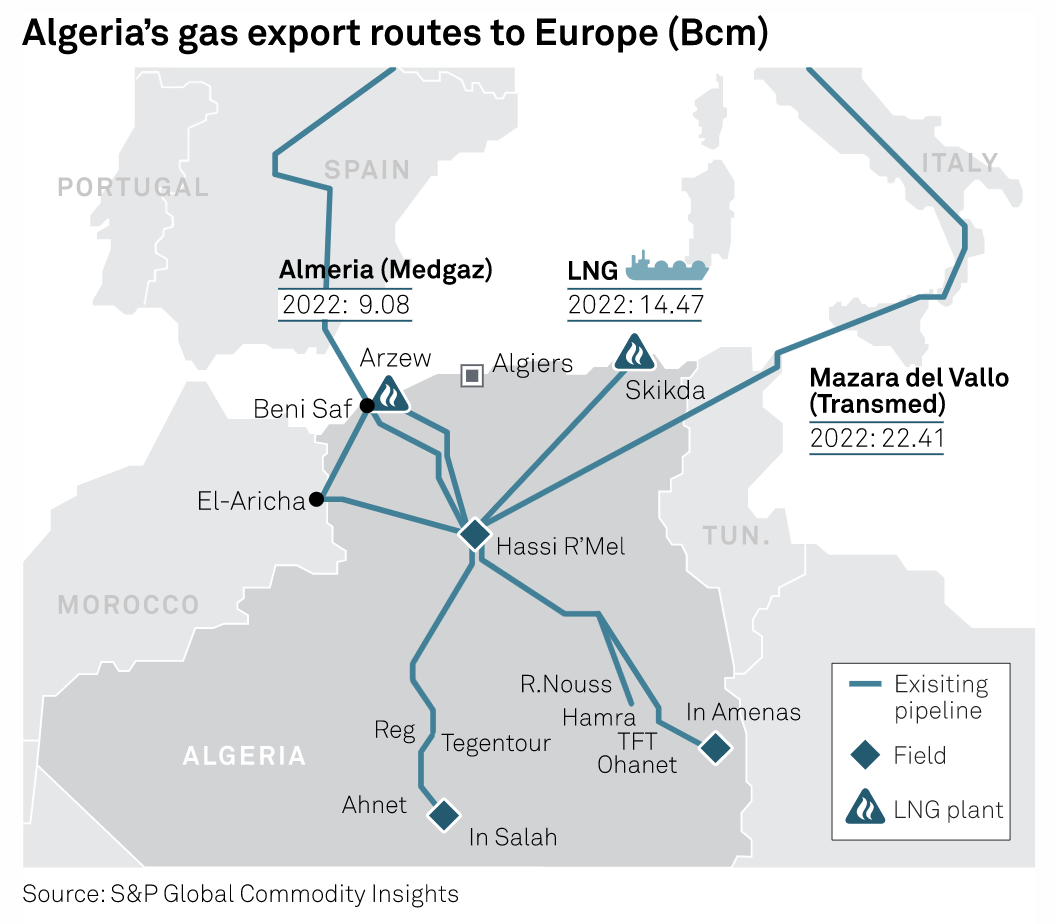

Algerian Gas Flows To Europe Shrink, But Italy Gains As Trade Ties Strengthen

Algerian gas flows to Europe fell by around 6 Bcm in 2022, totaling 44 Bcm last year, according to data from S&P Global Commodity Insights, as lower LNG exports to the Continent and reduced transit to Spain were only partially offset by burgeoning energy ties with Italy. However, with lower Russian gas supplies to Europe last year, Algeria — Africa's largest gas exporter — saw its share of EU gas imports increase, accounting for around 12% of the EU's gas imports in 2022, S&P Global data showed, up from some 10% in 2021.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

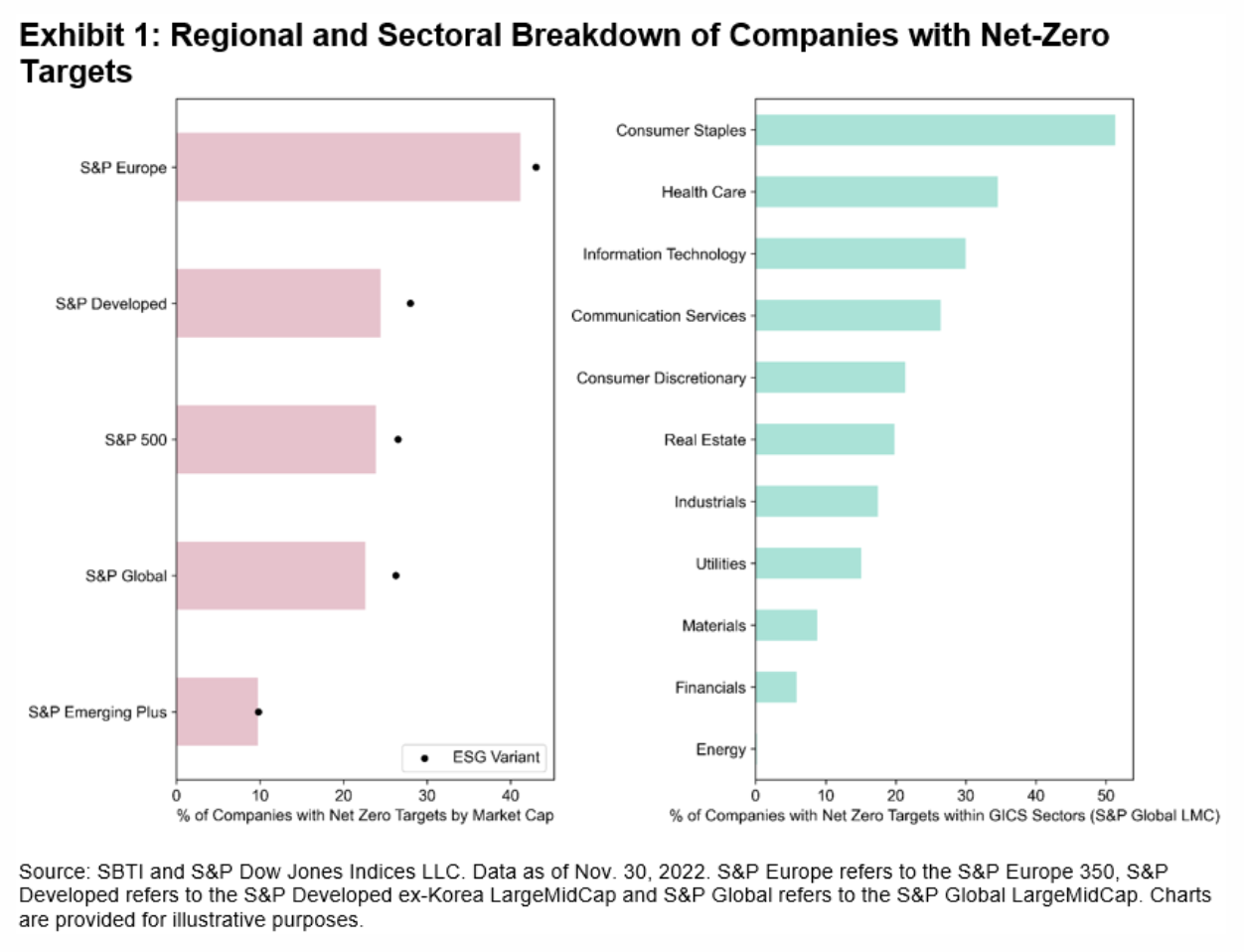

Net-Zero Targets And Temperature Alignment: Two Sides Of The Same Coin?

For many people, a new year represents a chance to set new objectives and to tick (or scrap) the previous year’s list of resolutions. Whether this objective-setting exercise works is debatable. A similar phenomenon might be observed within companies. Scientific consensus maintains that net-zero emissions should be reached by 2050 if the world is to keep warming levels below 1.5°C, aligned with the goals of the Paris Agreement. As such, an increasing number of companies, countries and investment actors have been setting climate-related targets, which comprise one of the four pillars of the recommendations put forward by the Task Force on Climate-related Financial Disclosures.

—Read the article from S&P Dow Jones Indices

Access more insights on sustainability >

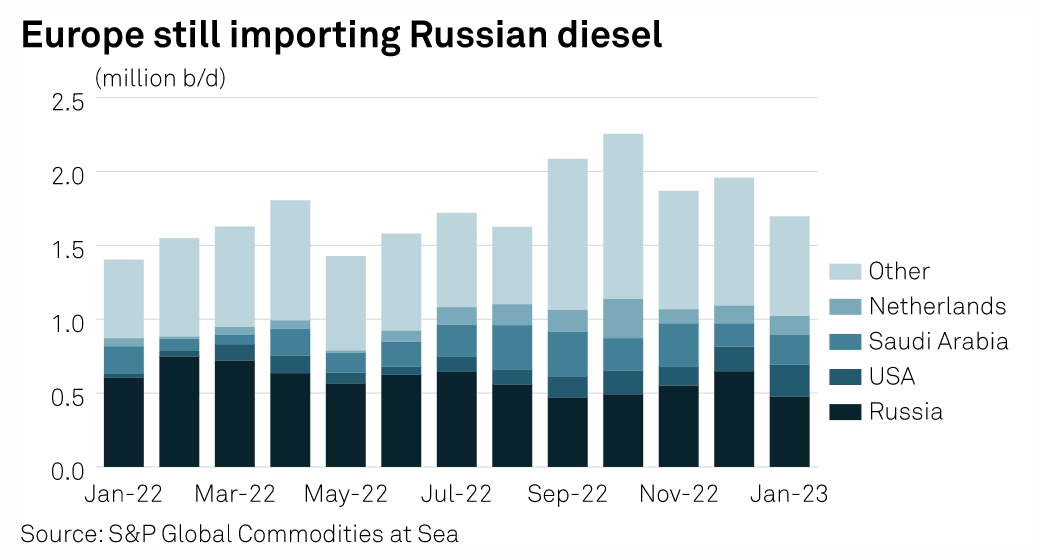

Middle East Refiners Capitalizing On Europe's Thirst For Non-Russian Diesel

The Middle East, flush with new refining capacity, has stepped up its fuel exports to Europe, just as the EU's embargo on Russian oil products is set to go into effect Feb. 5. Diesel shipments from the Middle East to Europe have seen volumes hit a weekly peak of just below 500,000 b/d in January, according to data from S&P Global Commodity Insights, helping the continent ease a supply crunch expected ahead of the ban on Russian imports and the G7's planned price cap.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

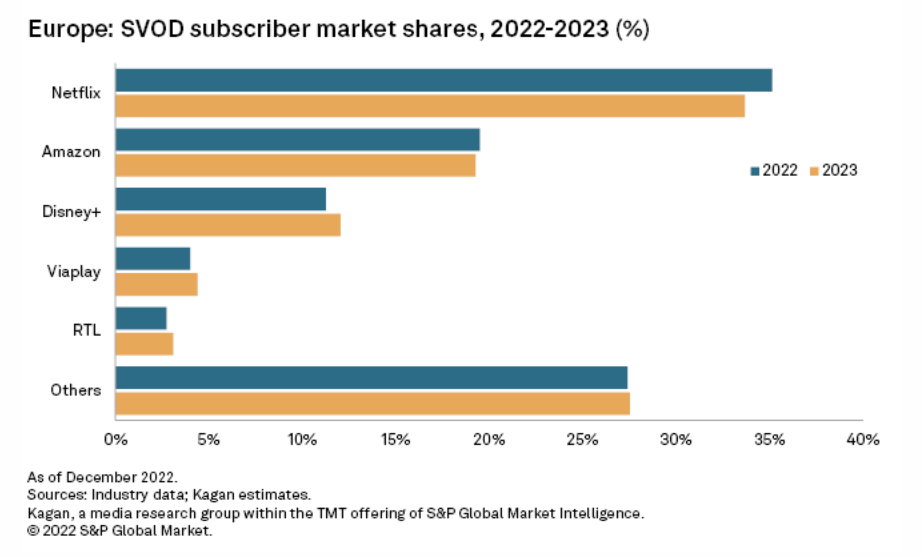

Europe: 5 Key OTT Trends To Watch In 2023

A projected annual rise of 12% in paid subscriptions for 2022 is becoming less meaningful among media industry experts as progress toward profitability takes center stage. Both local and international media groups that operate in the streaming space are looking for ways to improve their finances, diversify their revenue sources and keep customers satisfied in a fragmented and saturated media landscape.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek