Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Dec, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The walls separating work and family life have crumbled this year. The COVID-19 pandemic has thrust parental and family leave policies in the spotlight, and in many ways has helped companies accelerate their adoption of such benefits and more flexible work policies across the U.S. private sector. However, as many corporations have responded to the growing needs of their employees by expanding the benefits they offer—including much-needed flexibility in the workday—the moves have favored parents over family caregivers.

Failing to narrow that gap could potentially push women out of the workforce.

S&P Global, in partnership with AARP, examined Corporate America’s family-leave policies, since the U.S. private sector has largely taken the lead in such policies, by analyzing the relationship between family-friendly benefits, turnover, and company performance.

Firms were generally more supportive to parents of young children than family caregivers of adults, according to an S&P Global/AARP survey of 53 U.S. companies in the S&P 1200, which includes the 1,200 largest companies in the world, conducted from July 23-Oct. 1.

Sixty-six percent of companies said they were very supportive of parents with children aged five or younger, while just 32% of companies said they were very supportive of family caregivers. Similarly, 60% of respondents said benefits for parents are a high priority or one of the top priorities at their company—compared to only 30% for family caregivers of adults.

In the face of school and daycare closures, and with many children moving to virtual learning environments, the time required for childcare duties since the pandemic began has increased for 58% of parents, according to the survey, according to an S&P Global/AARP survey of nearly 1,600 employees at large U.S. companies conducted in late-summer. Many parents and family caregivers have reported that their at-home commitments have grown since the pandemic began, leading to increased stress levels and some feeling that they were being penalized at work for their increasing responsibilities.

The lack of formal policies and the lack of awareness of family caregiving could help explain the differences between the heightened support for parents of young children compared with family caregivers of adults. The research found that 80% of firms do not have a formal, written policy pertaining to family caregivers of adults. In addition, employers may lack awareness of the issue of family caregiving, implying that more education is needed.

Still, companies recognize that meeting employees’ needs supports their bottom lines, according to the research. S&P Global and AARP found that companies reporting the lowest voluntary turnover rates tended to offer more benefits to family caregivers and parents. Additionally, companies in the survey with more generous family-friendly policies produced stronger returns.

Today is Thursday, December 17, 2020, and here is today’s essential intelligence.

Gray Swans: Blinded By Pandemic, Investors May Be Ignoring These Risks in 2021

When a pandemic takes over the world, it is hard to focus on much else. But analysts and hedge fund chiefs foresee a number of potential market shocks — so-called gray swans — in 2021 that investors may miss.

—Read the full article from S&P Global Market Intelligence

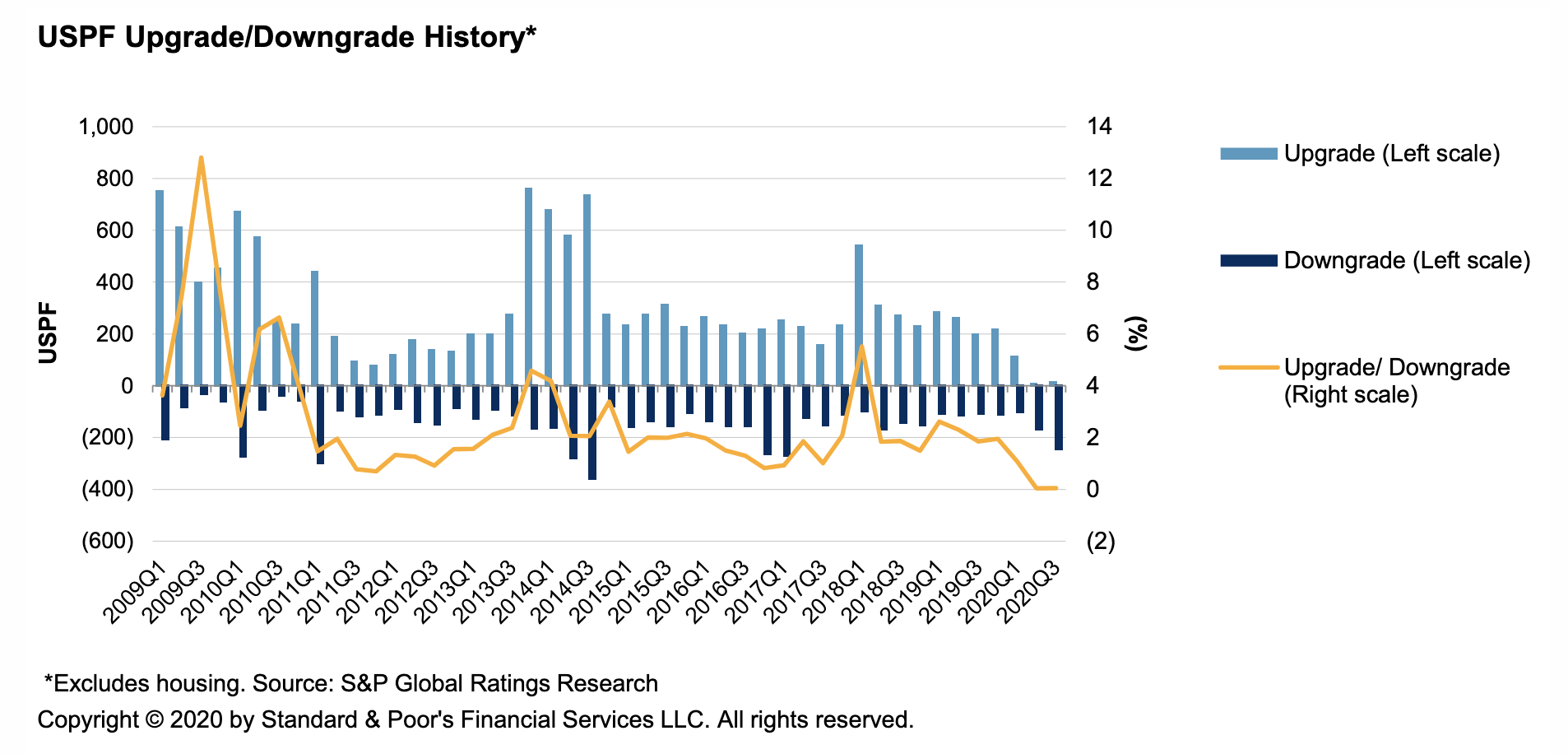

Credit Trends: U.S. Public Finance Downgrades Picked Up in the Third Quarter

U.S. public finance rated by S&P Global Ratings had 318 downgrades in the third quarter of 2020 (245 in nonhousing sectors and 73 in housing), up from 208 in the second quarter (168 nonhousing and 40 housing).

—Read the full report from S&P Global Ratings

The U.K. Treasury's Review of Solvency II Ahead of Brexit: Still Awaiting Game For Insurers

As the U.K.'s transition period for exiting the EU comes to an end, the government has launched a review of Solvency II, a harmonized European Economic Area-wide insurance regulatory framework that came into force in 2016.

—Read the full report from S&P Global Ratings

The Credit Implications if The U.K. And EU Fail to Reach a Free Trade Deal By Year-End

The recent decision to continue negotiations to reach a trade accord between the U.K. and EU means that S&P Global Ratings is maintaining its base-case assumption that a limited free trade agreement will be agreed to prior to year-end.

—Read the full report from S&P Global Ratings

U.K. Utilities Confront Regulatory Challenges, Brexit, and COVID-19 Fallout in 2021

U.K. utilities are facing a unique set of challenges. Decarbonizing operations and staying buoyant amid the COVID-19 pandemic are worldwide concerns, but U.K. utilities also have regulatory obstacles to overcome and the effects of Brexit to consider.

—Read the full report from S&P Global Ratings

UK Student Accommodation Sector Could See Distress in 2021

Some smaller, independent student accommodation providers in the U.K. could go bust in 2021 as a consequence of the COVID-19 pandemic, offering opportunities to some larger players, according to industry experts.

—Read the full article from S&P Global Market Intelligence

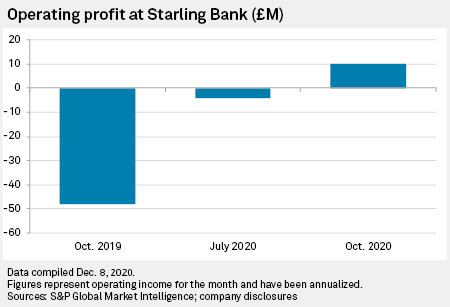

Starling and TSB: Potential Bidders Eyeing UK Digital and High Street Banks

British lenders Starling Bank Ltd. and TSB Banking Group PLC have each been touted as potential takeover targets, even as the former aims for a stock market listing and the latter's losses have widened during the coronavirus pandemic.

—Read the full article from S&P Global Market Intelligence

Intesa, Nordea, ING, BNP Paribas Most Affected by ECB Dividend Limits – Analysts

The European Central Bank has lifted its blanket recommendation against distributions, including dividends and share buybacks, but under strict conditions that will have the biggest impact on eurozone banks with high capital returns, analysts said.

—Read the full article from S&P Global Market Intelligence

Bank Regulator Races to Enact Lending Rule That Would Deal a Blow to ESG

An Alaskan wildlife refuge is at the center of an escalating, highly politicized sustainability debate that has pulled in big banks, federal regulators, Congress, climate activists, the oil-and-gas industry and the local Native community.

—Read the full article from S&P Global Market Intelligence

Go Big or Go Home: EVS Put Squeeze on Europe's Once-Cherished Minicars

European automakers are slowly withdrawing the urban minicars to which they owe a great deal of their present-day fortunes as the costly transition to electric and digitalized vehicles prompts manufacturers to axe their least profitable products.

—Read the full article from S&P Global Market Intelligence

Renewables Developers Vying For More Than 40 GW in Europe's 2021 Auction Bonanza

Renewable energy developers are set to compete for dozens of gigawatts worth of government contracts to build new renewable energy plants in Europe during 2021, teeing up a bumper year for the industry at a time of increasing focus on reaching EU climate targets.

—Read the full article from S&P Global Market Intelligence

US Solar Installations Booming, Could Overtake Onshore Wind Longer Term

US solar power capacity additions accounted for 43% of all incremental power generation capacity through Q3 2020 and appear set to record 19 GW of new solar capacity installations in 2020, a new record, according to a solar trade group report released Dec 15.

—Read the full article from S&P Global Platts

San Jose, Calif., Adopts Citywide Building Gas Ban

San Jose, Calif., will ban natural gas use in most new construction, becoming the largest U.S. municipality to adopt a citywide building electrification requirement to combat climate change.

—Read the full article from S&P Global Market Intelligence

Spain to Remove Renewable Subsidies From Consumer Bills

Spain's government has proposed a new law that will gradually separate the funding of renewable energy from consumers' bills and move it to the balance sheets of suppliers and oil and gas companies, it announced Dec. 15.

—Read the full article from S&P Global Platts

Study Finds U.S. Can Reach Net-Zero Emissions By Spending 3% More on Energy

The U.S. can completely decarbonize its economy by midcentury without spending significantly more on energy, according to a new report released Dec. 15 by a team of researchers at Princeton University.

—Read the full article from S&P Global Platts

S&P Global Platts to Publish First Voluntary Carbon Credit Price Assessments

S&P Global Platts is to publish the world's first daily "CORSIA-eligible" carbon credit price assessments form Jan. 4, 2021, Price Group Senior Director Jonty Rushforth said Dec. 16.

—Read the full article from S&P Global Platts

Listen: The Future of Cobalt in Electric Vehicles - With Robin Tisserand, SCB Group

Cobalt is a pivotal metal for the batteries that underpin electric vehicles. Recent long-term supply commitments signed by battery makers suggest that cobalt is set to remain a crucial component for many years, as such understanding the market and pricing of this metal is critical.

—Listen and subscribe to Platts Future Energy, a podcast from S&P Global Platts

Watch: Market Movers Asia, Dec 14-18: All Eyes on Oil Prices After Crude Touches 9-Month Highs

The highlights in Asia this week on S&P Global Platts Market Movers Asia with Shikha Singh: all eyes are on benchmark crude oil prices this week, after front-month ICE Brent futures rose to almost $50/b last week for the first time since early March, while Asian refiners as they look to conclude term contract negotiations for 2021 crude supply with major Middle Eastern producers.

—Watch and share this Market Movers video from S&P Global Platts

Fuel For Thought: An Overenthusiastic Market May Be Detrimental to Oil’s Recovery

Oil market optimism risks derailing its own recovery, with the recent rise in crude prices above $50/b possibly harming demand and incentivizing additional supply.

—Read the full article from S&P Global Platts

Murphy Oil Takes Long View Of U.S. Gulf Amid Industry Downturn

US-based Murphy Oil, which revitalized and grew its US Gulf of Mexico presence in recent years, sees the region as one of the world's best despite this year's oil demand and price downturn, the company's top executive said Dec. 15.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language