Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Dec, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Major cities around the world have suffered high rates of coronavirus infections and deaths since the onset of the crisis, due largely to their dense populations. As the largest metropolis in the U.S., New York City’s challenges may be far from over.

New York City existed as the epicenter of the first wave of the country’s outbreak. Since March, it has reported more than 360,000 COVID-19 cases. Now, New York City’s new infections, deaths, and hospitalizations due to the virus are currently surging into a second wave. Thousands of small businesses have shuttered. Economic output has stalled. S&P Global Ratings revised the outlook on New York City’s credit rating to negative from stable as of Dec. 11, citing budgetary inflexibility and a high level of debt and liabilities for its decision.

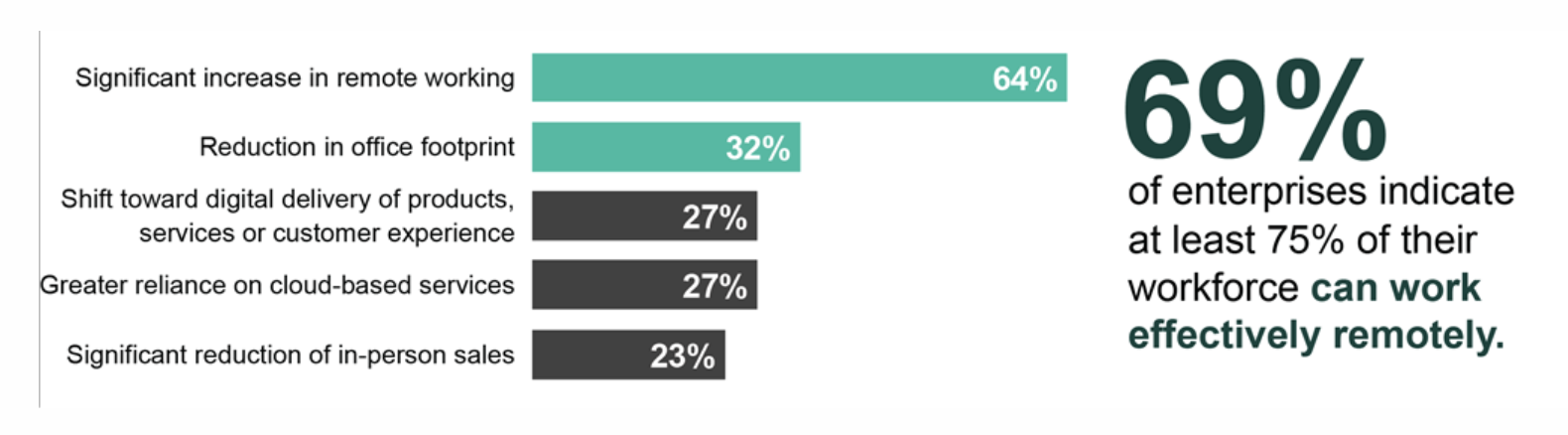

Corporates that previously operated with the belief that having their headquarters in Manhattan was a necessity have discovered during the pandemic that remote workers can maintain the same level of productivity without going into offices. Many companies, particularly in the financial services sector, have begun to explore moving their operations elsewhere—threatening New York City’s position as one of the world’s most powerful business hubs.

“Large urban centers are likely to take longer to recover from the pandemic,” S&P Global Ratings commented in a recent outlook on local and regional U.S. governments. “Services, which thrive on interaction of people, form the backbone of their economies.”

While financial titans have been shifting jobs to lower-cost markets like Dallas over the last decade, the pandemic has accelerated such action across Wall Street.

Recent reports confirmed that Goldman Sachs is exploring moving parts of its Manhattan-based asset management division to Florida. J.P. Morgan is said to be looking for buyers for its 49% stake in one of its office building in Manhattan. Deutsche Bank, which already has large and established offices in Jacksonville, Fla. and Cary, N.C., has indicated its intention to move up to half of the firm’s 4,600 Manhattan-based employees to smaller U.S. hubs over the next five years.

“I’m optimistic that New York remains, to a degree, a hub,” Christiana Riley, the chief executive officer for Deutsche Bank in the Americas and a member of the bank’s management board, told the Financial Times. “You will continue to have significant amounts of institutional capital sitting in and around New York that will make it meaningful for there to be a centralized presence in New York—not to mention the specialized support skills that all of us in the industry rely on, be it legal, be it accounting, be it marketing, you name it.”

However, such investment might not be enough to maintain New York City’s significance for all companies and employees. “That isn’t maybe going to be relevant for all of those people” currently working across different industries in the metropolis, Ms. Riley said.

New York is not the only city experiencing this trend. Globally, big cities that have lengthy commute times are likely to endure long-lasting negative effects from the pandemic-promoted increases in remote working. Additionally, geopolitical developments may drive businesses from metropolises into new areas. Brexit has pushed the investment banking industry to reexamine their commitment to London, which has long served as the hub for financial services in Europe.

“The appeal of living in a megacity compared to a smaller city or a town or a suburb has been dramatically reduced,” HSBC Global Economist James Pomeroy said in a recent interview with S&P Global’s Essential Podcast about peoples’ movement away from cities like New York and London during the coronavirus pandemic. “It could well be that it's the smaller cities that do very well because they're affordable. The jobs will be just as easy to do from there.”

Today is Monday, December 14, 2020, and here is today’s essential intelligence.

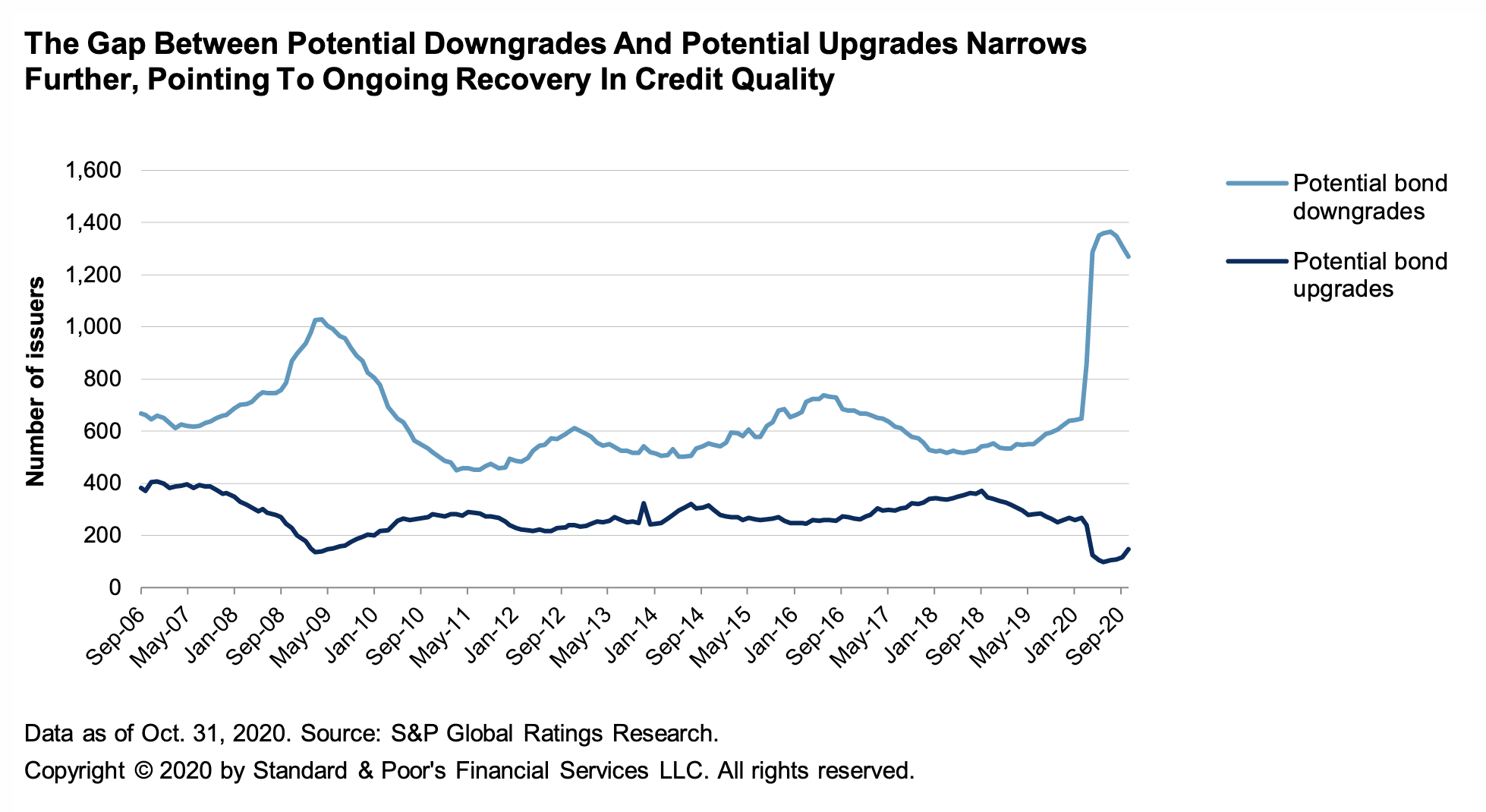

Credit Trends: Downgrade Potential Ebbs While Credit Market Conditions Remain Uncertain

The number of potential bond downgrades decreased to 1,270 in October from 1,308 in September after hitting its all-time high of 1,365 in July.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: Four U.S. Defaults Push the 2020 Corporate Tally to 223

The global corporate default tally has reached 223 so far in 2020, after two U.S.-based companies defaulted since S&P Global Ratings’ last report. These companies are Superior Energy Services Inc. and Community Health Systems Inc.

—Read the full report from S&P Global Ratings

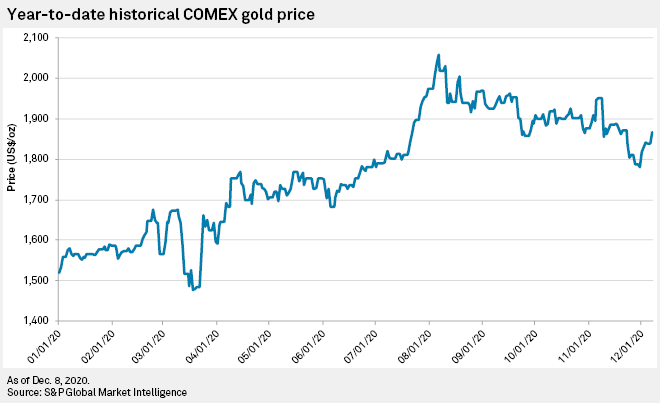

Gold's Big Year Slows Near End, But Market Observers Optimistic For 2021

Gold markets have had an exciting 2020 to date, but positive news regarding COVID-19 vaccines rolling out and the quelling of anxiety around U.S. election outcomes has dampened some of the enthusiasm for the yellow metal, market observers said during a virtual event hosted by State Street Global Advisors and the World Gold Council.

—Read the full article from S&P Global Market Intelligence

As 2021 Approaches, COVID-19 May be Catalyzing the Future of Security

Securing the transformation to remote working has become a top priority for organizations, as revealed in recent 451 Research Voice of the Enterprise (VotE) survey data. But the need for change in security strategy that COVID-19 has revealed goes beyond immediate demands, and speaks to a growing awareness of the longer-term impact of IT transformation.

—Read the full article from S&P Global Market Intelligence

COVID-19/IoT Accelerators Share Critical Characteristics – Including Past Project Success

Enterprises that have accelerated their IoT deployments during the COVID-19 pandemic can be identified by their past project success and confidence that their efforts can deliver strong financial and competitive benefits.

—Read the full article from S&P Global Market Intelligence

5G Survey: Spectrum, Network Evolution and Open Ran Plans

As mobile network operators take aim at their 5G futures, they are presented with multiple pathways to delivering 5G, including frequency spectra, 4G to 5G migration options, and whether to implement software-centric open radio access network, or open RAN, solutions.

—Read the full article from S&P Global Market Intelligence

Global Pay TV Penetration to Peak in 2020 at 60.7%; Revenues Continue Declining

Kagan's survey of global pay-TV trends indicates that multichannel penetration of TV households will peak by the end of 2020, reaching 60.7%.

—Read the full article from S&P Global Market Intelligence

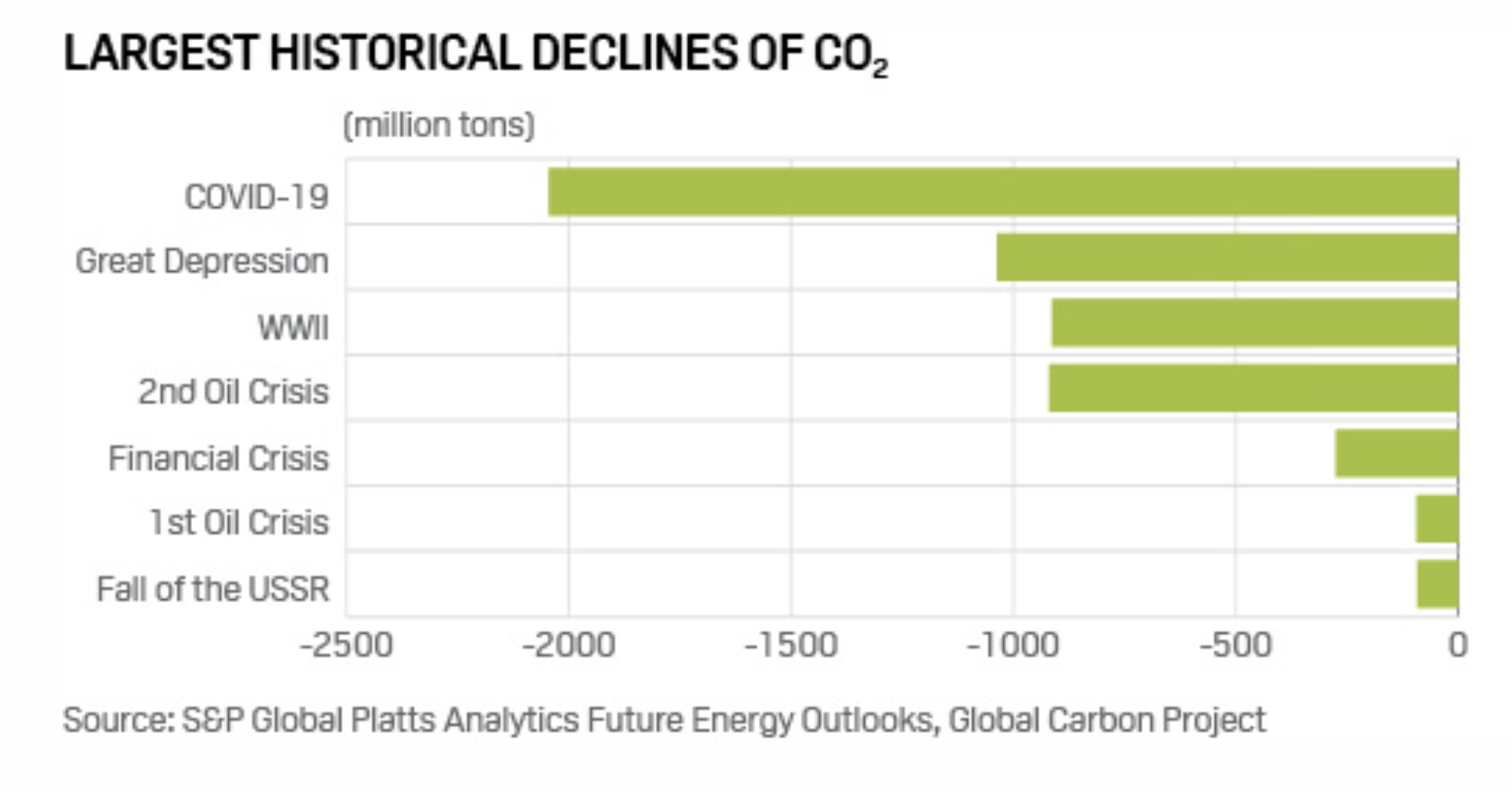

Paradigm Shift: How the Global Pandemic is Shaping Energy Transition

The coronavirus pandemic has accelerated change in the global energy system, from historic declines in GHG emissions, inflections in demand trends and shifting production patterns, to an increased energy transition focus and aspirations towards net-zero emissions, writes S&P Global Platts' global director of analytics, Chris Midgley.

—Read the full article from S&P Global Platts

Biden Could Seek Carbon Taxes With Same Strategy Trump Used For Steel, Aluminum

President-elect Joe Biden could try to unilaterally impose carbon taxes on imported goods or pressure countries into climate action with the threat of carbon penalties for dirtier imports by taking advantage of a decades-old trade law made popular under President Donald Trump, according to certain legal observers and members of Biden's transition team.

—Read the full article from S&P Global Market Intelligence

A Return to the Paris Climate Accord Could Lead to U.S. Substantial Renewables Growth

A return by the US to the Paris Climate Accord expected under the incoming administration of President-elect Joe Biden could give a further boost to renewable and clean energy generation in the country's power markets in order to meet the accord's targets, according to an S&P Global Platts Analytics analyst.

—Read the full article from S&P Global Platts

Global CO2 Emissions Expected to Rise in 2021 Despite Renewable Energy Growth

New wind and solar power capacity build will increase globally in 2021, but economic recovery, gas-to-coal switching and low fossil fuels prices will drive energy sector carbon dioxide emissions 1.4 gigatons (4.4%) higher year on year in 2021, S&P Global Platts Analytics said Dec. 11.

—Read the full article from S&P Global Platts

Listen: Beyond The Buzz: Social Risks Amid COVID-19 and the Booming Social Bond Market

Host Corinne Bendersky speaks with ESG analyst Lori Shapiro about the increasing importance of social risks amid the pandemic, shining a light on what “social risk” actually means and how it’s quantified amid the rapidly growing social bond market, which could exceed $100 billion this year.

—Listen to Beyond the Buzz, a podcast from S&P Global Ratings

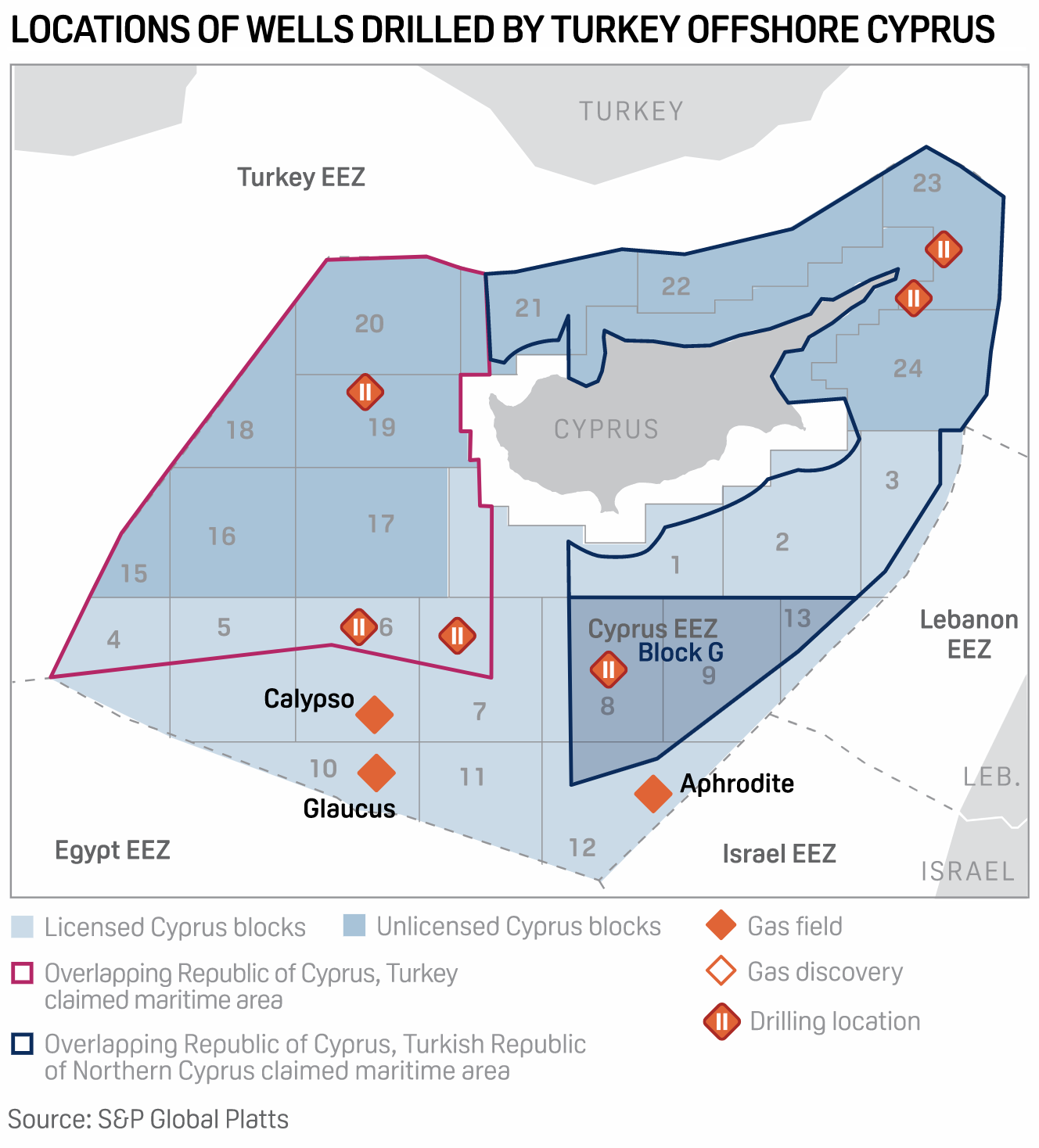

EU Leaders Pave Way For Additional, Limited Sanctions on Turkey Over Gas Drilling

EU leaders have paved the way to place restrictions on more Turkish individuals and companies involved in drilling for gas offshore Cyprus, but stopped short of adopting broader economic sanctions against Ankara.

—Read the full article from S&P Global Platts

CFTC Completes Principles-Based Rule on Electronic Trading; Tarbert Plans Exit

The US Commodity Futures Trading Commission has adopted a final rule designed to address market disruptions associated with automated trading, over objections from a Democratic commissioner who cited April 20 crude oil futures price movements and climate change in suggesting further regulation may be needed.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language