Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 31 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Japanese Monetary Policy at an Inflection Point

In 1993, a movie starring a Sean Connery and Wesley Snipes hit American multiplexes. The movie, "Rising Sun,” reflected American fears of Japanese economic dominance. But by the time of its release, the film was already a time capsule of a different era. An asset price bubble fueled by large amounts of lending by Japanese banks popped in 1991. The Japanese economic miracle that had raised the country from post-war ruin to an economic and manufacturing powerhouse was at an end. What followed has been described as the lost 30 years, during which Japanese GDP grew at a slow rate due to high unemployment and deflation. The Bank of Japan attempted to restart the economy using ultralow interest rates and quantitative easing, but the country maintained a paradoxical position of being both an economic powerhouse and a growth laggard. In the previous two years, something seems to have shifted for the Japanese economy. Rising inflation and new leadership in the Bank of Japan have led to a reevaluation of existing policies.

According to S&P Global Ratings, higher inflation and global interest rates are starting to put pressure on the Bank of Japan to move away from existing monetary policy that has kept interest rates at close to 0% since 2008. Kazuo Ueda, the new governor of the Bank of Japan since April, is not expected to raise interest rates very quickly or very steeply. But with Japanese core inflation, excluding energy and food prices, rising at 4.3% in May, there is a growing perception that something must be done to return to the central bank’s target inflation of 2%. Japan has been largely spared from the higher interest rate cycle of the past year in other developed economies.

However, there is a case for caution. The recent rise in inflation in Japan has been largely driven by higher input costs rather than wage growth in an overheated economy. Although there is debate amongst economists on this point, inflation resulting from higher input costs is believed to be the least responsive to monetary tightening. But the more challenging issue for Ueda is Japan’s large amount of government debt. Japan's gross government debt stood at 261% of GDP at the end of 2022. Comparatively, the US’ gross government debt as a percentage of GDP stood at 122% in 2022. A large amount of Japanese government debt is currently held by the Bank of Japan due to a longstanding yield curve control policy, under which the bank committed to buying government bonds to maintain a low yield for 10-year government bonds. If the Bank of Japan was to increase interest rates by 1 percentage point, the cost of debt service would go up by ¥3.6 trillion, equal to about 0.6% of GDP. The fiscal impact of that increase would be considerable.

In April, the International Monetary Fund's “World Economic Outlook” estimated that the nominal neutral interest rate in Japan would be about 1%-1.5% in a few years. While this is far lower than current interest rates in most developed economies, it is a significant increase from the current Japanese interest rate of -0.6%. The Bank of Japan has already begun tweaking its yield curve control policies, which are projected to lead to a positive impact on the net interest margins of Japanese megabanks.

“The initial steps toward normalization of monetary policy in Japan will be small, and the country's interest rates are likely to remain well below those in the US and Europe,” said Louis Kuijs, Asia-Pacific chief economist at S&P Global Ratings. “But for the first time in a long while, the [Bank of Japan] may depart from its ultra-accommodative monetary policy.”

Today is Thursday, August 31, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

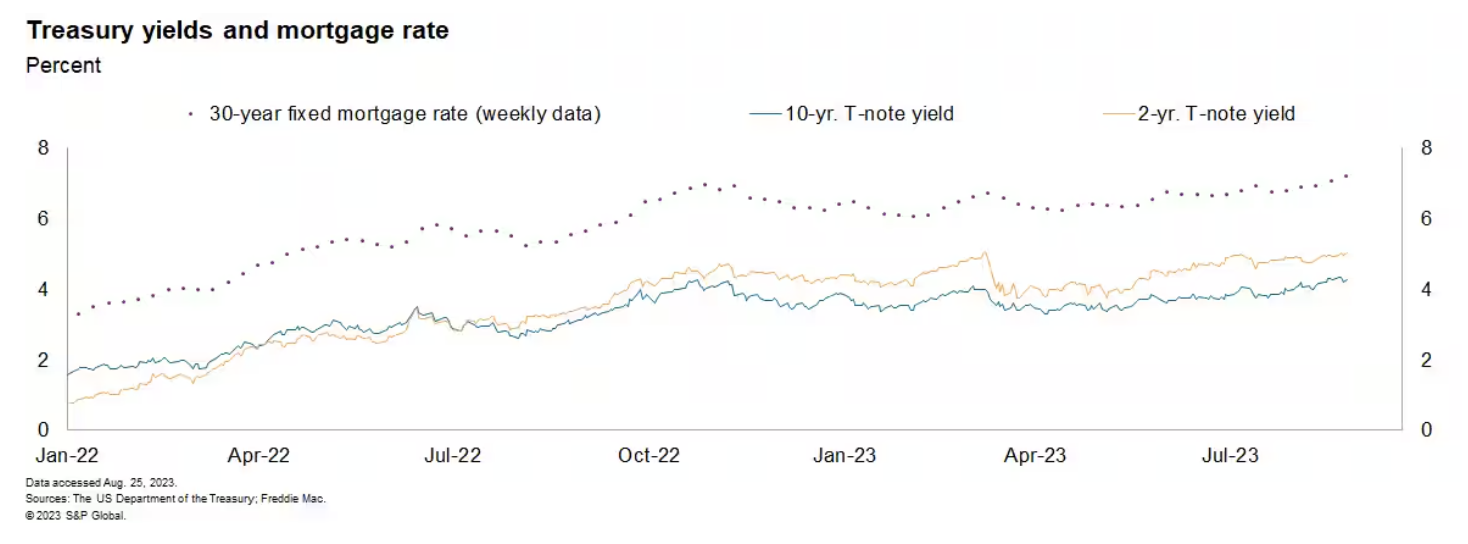

US Weekly Economic Commentary: ‘Until The Job Is Done’

Federal Reserve Chair Jay Powell, in strong and direct language, reiterated the Fed's commitment to bring inflation down to its 2% target in his remarks to the annual monetary policy conference hosted by the Kansas City Fed at Jackson Hole, Wyoming. He concluded his speech with this quote: "We will keep at it until the job is done." These comments came in a week that brought further evidence that growth is not cooling rapidly enough and, in Powell's words, "has come in above expectations and above its longer-run trend, and recent readings on consumer spending have been especially robust."

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

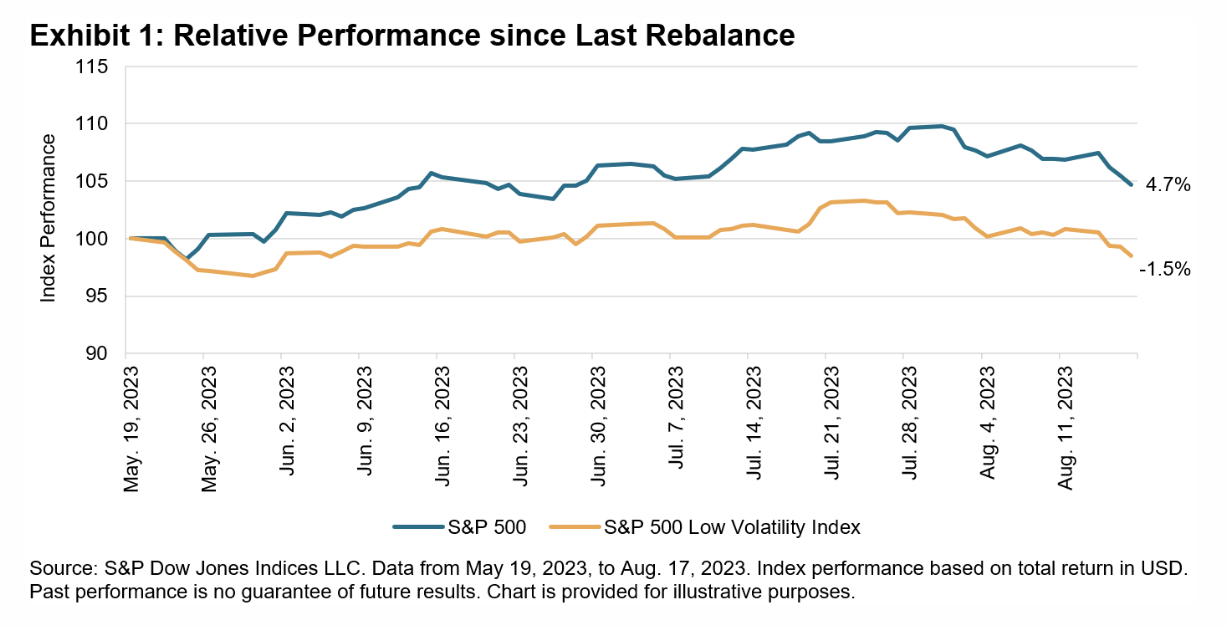

S&P 500 Low Volatility Index August 2023 Rebalance

The S&P 500 performed well from the last rebalance for the S&P 500 Low Volatility Index on May 19, 2023, through the most recent rebalance on Aug. 18, 2023. The S&P 500 was up 4.7% during this period versus a decline of 1.5% for the S&P 500 Low Volatility Index. This divergence tends to happen especially during periods of strong performance and low volatility for the S&P 500. Interestingly, the annualized daily standard deviation over this period for the S&P 500 was a relatively low 10.7%.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

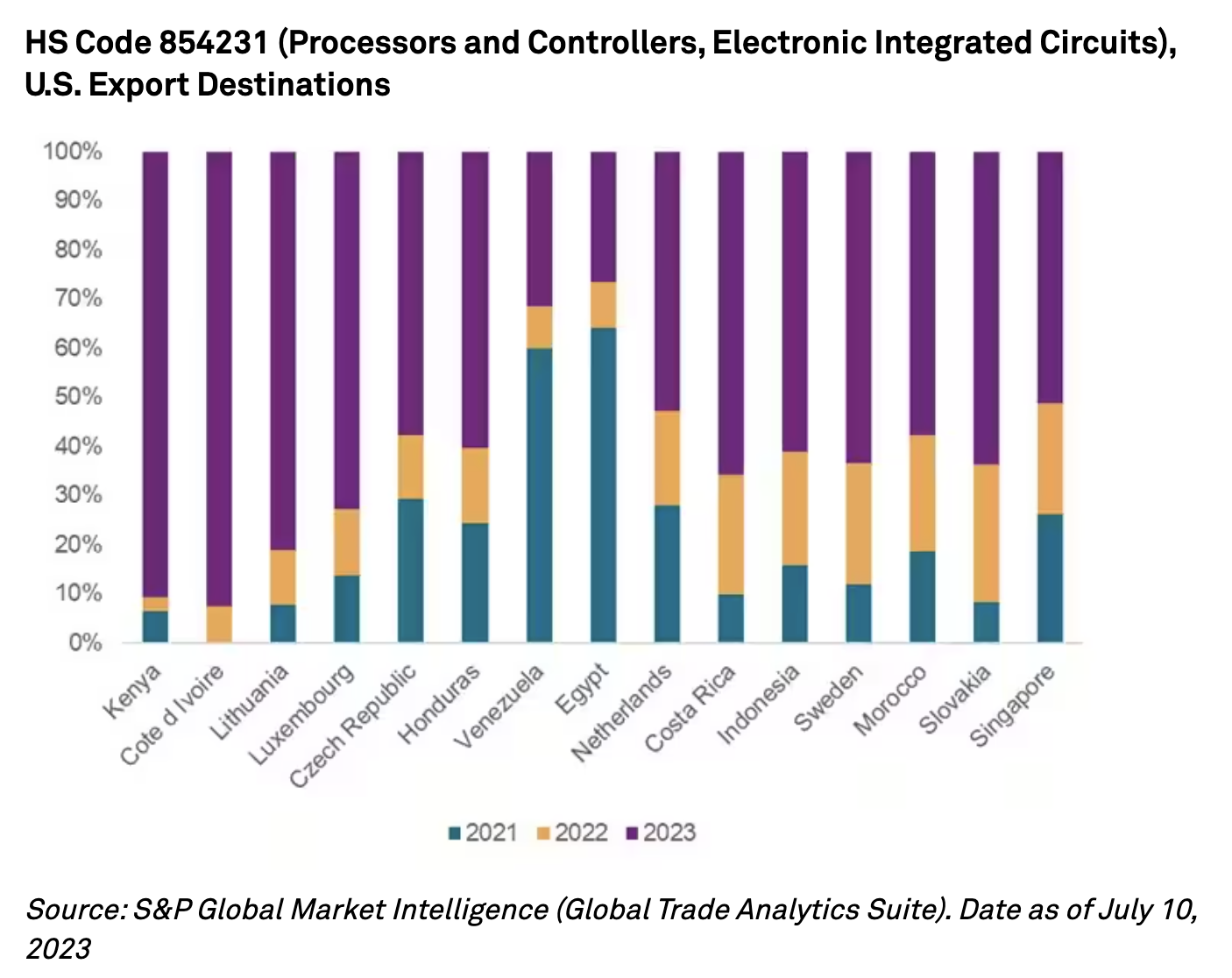

US FinCEN & BIS High Priority Items List — Trade Patterns For Russian Battlefield Electronics

The US Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) and the US Department of Commerce's Bureau of Industry and Security (BIS) issued a joint alert regarding the proliferation of certain 'high priority goods' being exported and transshipped to Russia in order to support its war effort in Ukraine. The alert, issued in May 2023, identifies 9 Harmonized System (HS) Codes which should be used by financial institutions and others for enhanced customer due diligence purposes.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: Exploring India's Energy Transition And Climate Adaptation Landscape

Earlier this year, India became the world’s most-populous nation. This episode of the ESG Insider podcast explores the challenges and opportunities the country faces in transitioning to a low-carbon economy and adapting to climate change. To understand the energy transition outlook for India, hear from Dr. Atul Arya, senior vice president and chief energy strategist at S&P Global Commodity Insights.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

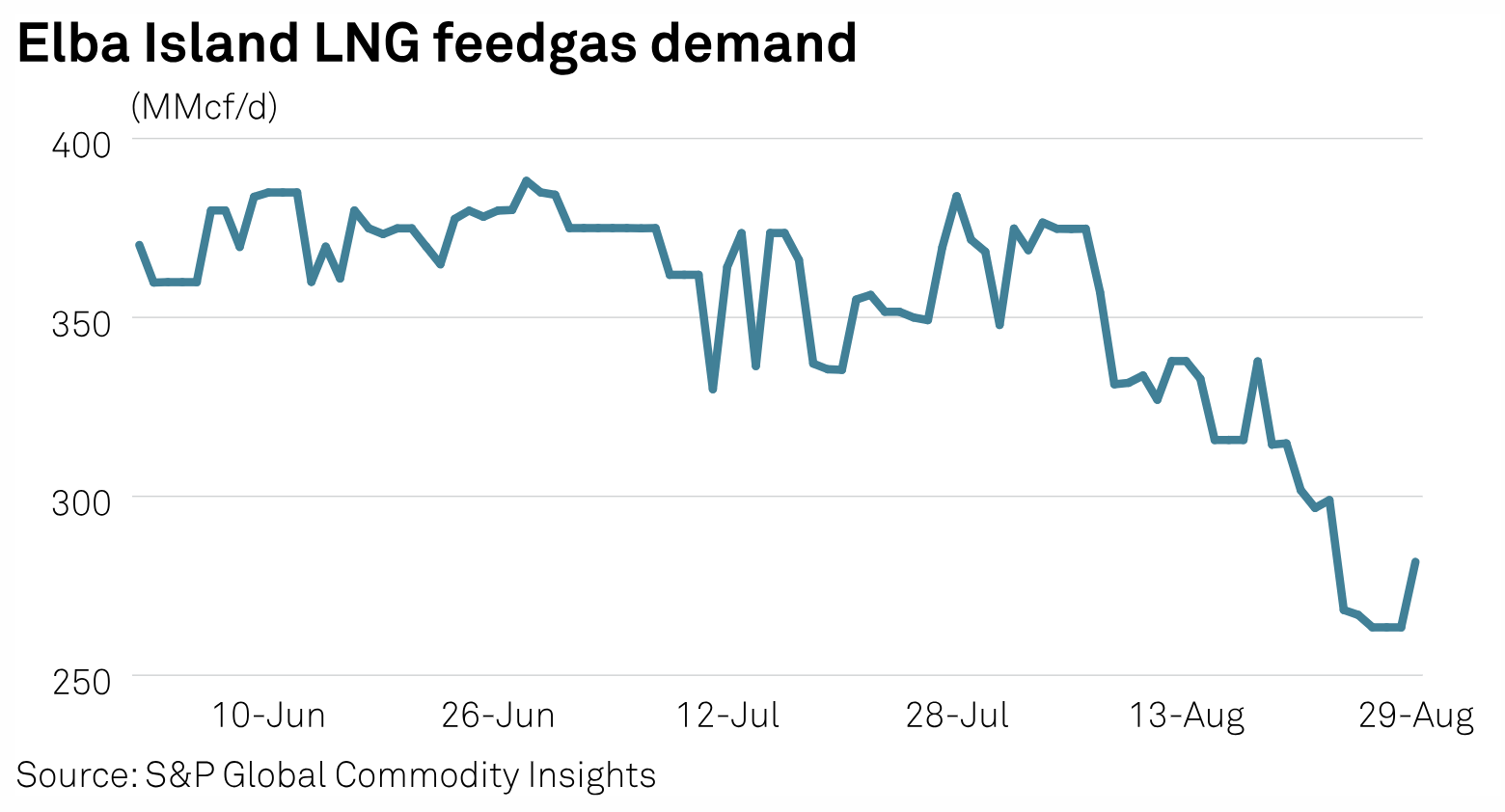

Hurricane Idalia To Hit Florida Gulf Coast, Likely Cutting Energy Demand, Prices

Hurricane Idalia is forecast to hit the Florida Gulf Coast early Aug. 30 as a major hurricane and emerge into the Atlantic along the coast of the Carolinas Aug. 31, probably cutting power to hundreds of thousands, weakening power and natural gas demand and prices. And while Idalia appears to be staying clear of most Gulf of Mexico offshore oil and gas platforms, producers have begun taking precautions, as they did in September 2022 ahead of Hurricane Ian, which also made landfall on Florida's western coast.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Global Cyber Insurance: Reinsurance Remains Key To Growth

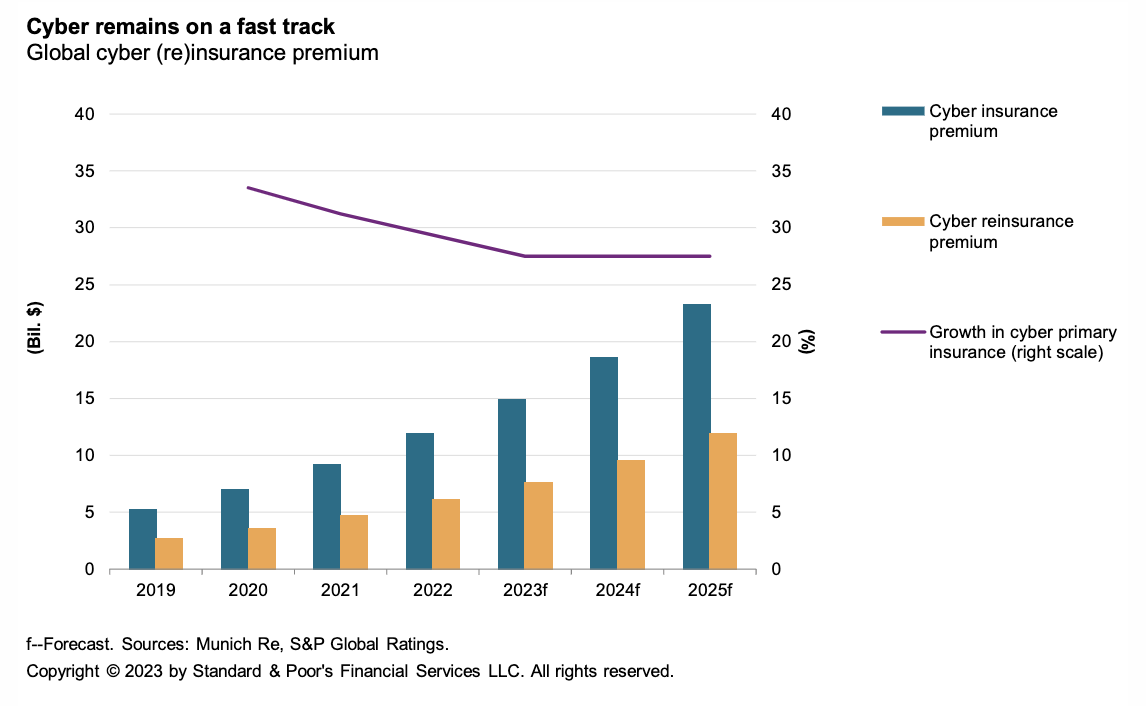

Cyber insurance is still the fastest-growing subsector of the global insurance market. Global cyber insurance premiums reached about $12 billion in 2022, and in S&P Global Ratings' view, are likely to increase by an average 25%-30% per year to about $23 billion by 2025. Cyber insurance relies to a great extent on reinsurance protection, and S&P Global Ratings believes reinsurers remain critical to the sustainable growth of the market.

—Read the report from S&P Global Ratings

Content Type

Language