Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Manufacturing Is Down From Pandemic-Era Highs

The problem with unprecedented events is that they are quickly treated as precedents. During the pandemic- era restrictions of 2020–2021, a sudden shift of consumption to manufactured goods from services was described at the time as an unprecedented change. Locked-down consumers invested in consumer electronics, home improvement projects, and new hobbies, avoiding contact with frontline service sector workers. Lockdowns also disrupted supply chains, leading to shortages. Retailers reacted to these shortages by increasing their inventories, further boosting global manufacturing. Eventually, lockdowns and other restrictions were phased out worldwide and consumption patterns broadly shifted back to services from manufactured goods. Retailers concentrated on selling off their inflated inventories and reduced orders from manufacturers.

There is nothing unexpected about the fact that manufacturing has fallen from the unusual highs of 2021. The J.P.Morgan Global Manufacturing Purchasing Managers' Index™, compiled by S&P Global, declined for an 11th straight month in July, meaning that the global production of, and new orders for, manufactured goods are down. The decline in manufacturing was most acute in the eurozone, but mainland China, Taiwan, South Korea, Malaysia, the UK, Brazil and Japan also experienced reductions in manufacturing. For many emerging market economies that are dependent on exports of manufactured goods and raw materials, lower demand has put a crimp on GDP growth.

Higher inflation and rising wages have put manufacturers in a bind. While raw material costs have retreated from inflation-driven highs and are now below their long- run averages, wage growth is over six times the long-run average. With a drop in raw material and energy costs, as well as demand for manufactured goods, factory owners would normally reduce prices to stimulate demand. But prices have remained unusually sticky for manufactured goods given the increase in wages.

Chris Williamson, chief business economist at S&P Global Market Intelligence, attributes much of the manufacturing slowdown to the residual effects of the pandemic and supply chain disruptions. Backlogs of orders rose during the pandemic due to supply shortages, but many manufacturers that were able to clear their backlogs became dependent on new orders to drive production. Inventory sell-off is also an ongoing process. Stocks of finished goods have fallen in seven of the last eight months, as retailers are no longer anticipating shortages from suppliers.

Looking at manufacturing and service sector activity over the last year paints a picture of depressed manufacturing and surging services,. but their performance seems fairly consistent compared with the period immediately before the pandemic. The unprecedented economic conditions of the pandemic may provide a poor precedent for evaluating performance today.

Today is Thursday, August 3, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

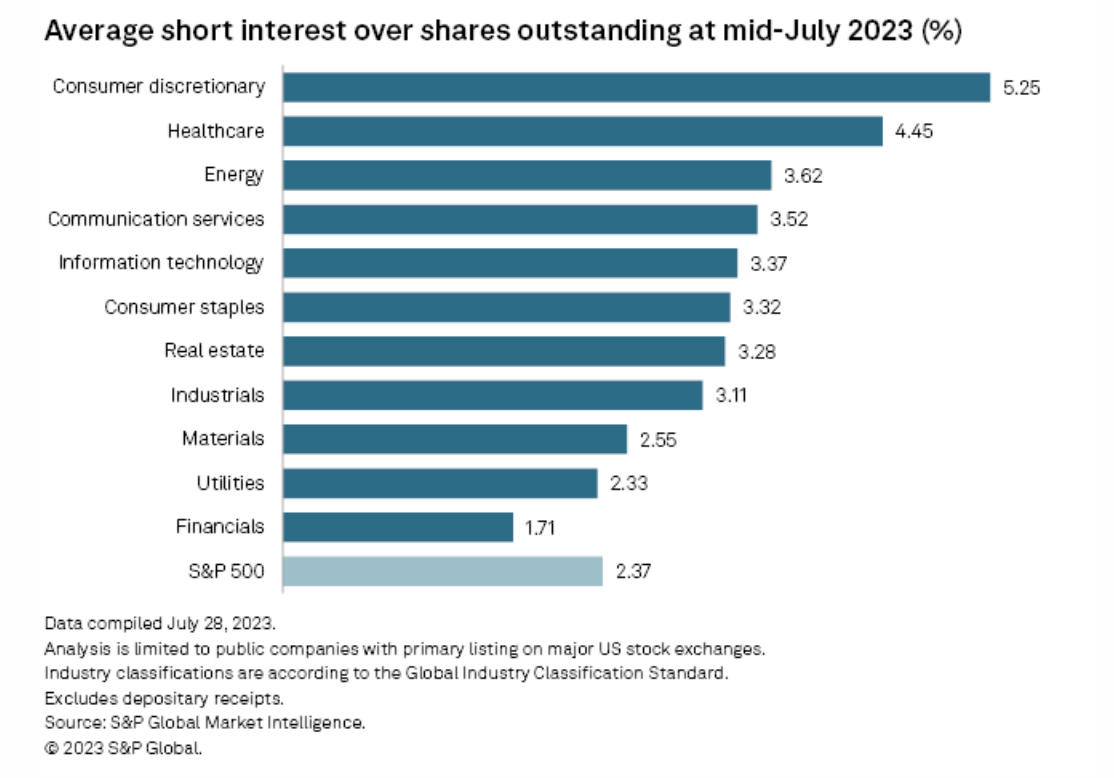

Short Sellers Bet Big Against US Consumer Discretionary Stocks

Short sellers are largely holding tight to their bets against consumer discretionary stocks, wagering that persistently high inflation and interest rates will significantly hinder consumer demand. Throughout all major US stock exchanges, short interest in the consumer discretionary sector was 5.25%, the most-shorted sector by 80 basis points, followed by healthcare at 4.45%, according to the latest S&P Global Market Intelligence data. Consumer discretionary has been the most shorted US stock sector for 18 months.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Hot Temperatures And A Hot Start To The Second Half Of 2023 For Commodities

The S&P GSCI, the broad commodities benchmark, started the second half of the year in a blistering heat wave and rose 11% on the back of petroleum commodities, which all increased by more than 14% in July. The remaining four sectors within the S&P GSCI also rose during the month, as fears of a recession abated with inflation falling and the Fed possibly getting close to ending their rate hiking cycle. Strong inflows into commodity ETFs and the covering of short positions across individual commodities helped to create a potential bottom in a few key commodities futures markets.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

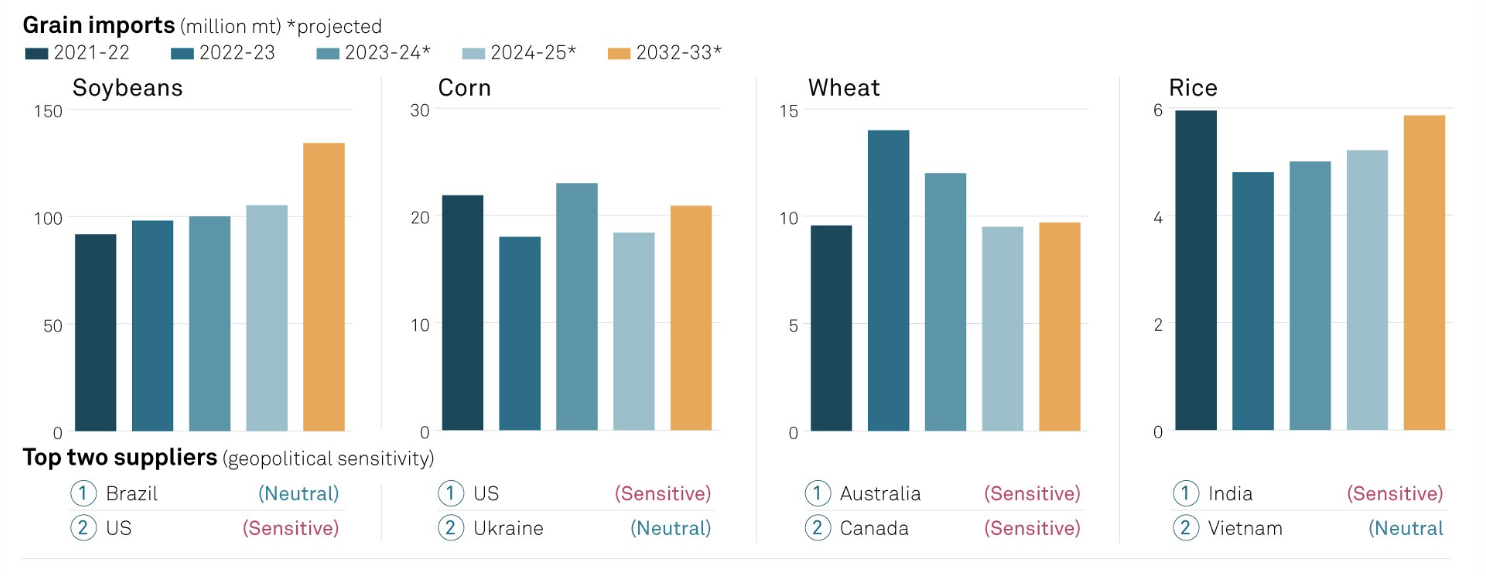

China's Food Security Push Is Fraught With Formidable Challenges

China has put food security as its top strategic agenda in recent years. Beijing wants to be self-sufficient in agricultural production and shield itself from volatility in global food supply chain. But the country's heavy dependence on imports is likely to put the spotlight on the colossal challenges it faces in attaining food self-sufficiency. China is currently the world's largest food importer and projections show it will remain the top purchaser in 10 years’ time. This casts serious doubt on Beijing’s food security drive.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

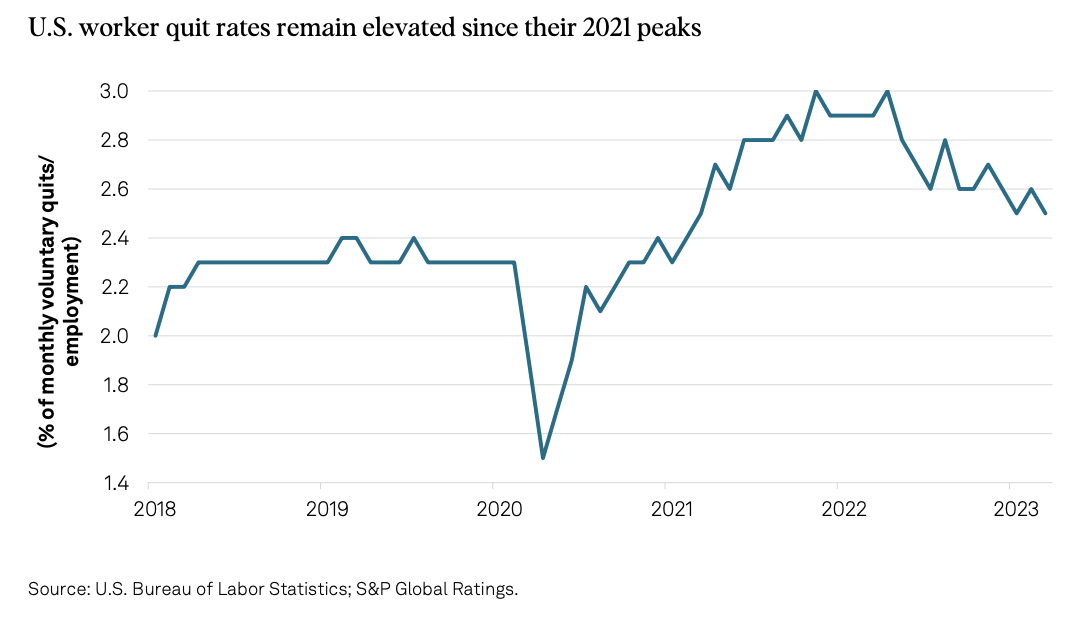

Sustainability Insights: Research: How Changing Workforce Dynamics May Affect US Companies

Changing relationships between workers and employers in the US and a sharp increase in voluntary employee turnover have resulted in a tight labor market. In some sectors it has been particularly difficult to attract and retain workers with specialized skills. Demographic shifts in the workplace accelerated during the first years of the pandemic, with younger people now making up a far more substantial portion of the US workforce. Reimagining the workforce culture and employee experience remains a challenge for management teams in some sectors, mainly due to technological disruption and staff attitudes toward hybrid work.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

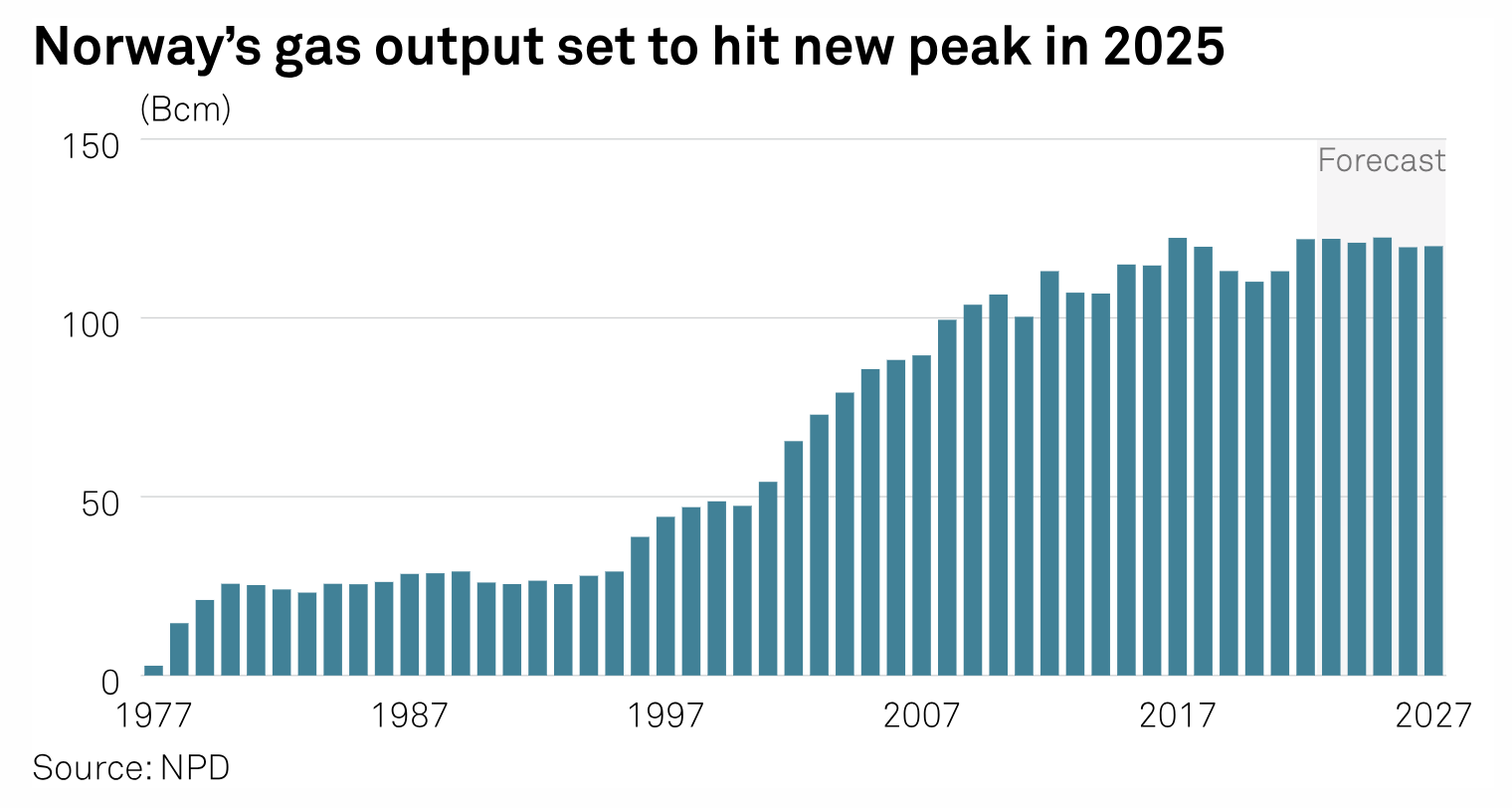

Norway's Dvalin Producing Gas From Two Wells In Eastern Part Of Field: Operator

The Dvalin gas field offshore Norway is currently producing from two wells in the eastern part of the field, while testing continues on the wells in the western part, operator Wintershall Dea said Aug. 1. Dvalin — which has been beset by technical issues over the past few years — resumed production on July 29, according to transparency notes from grid operator Gassco. In emailed comments, Wintershall Dea said production from the two eastern wells started over the weekend after a "thorough" technical evaluation of the safety barriers in the entire field was carried out.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Telcos' Opportunities Expand With New Technologies In 5G Era

Maturing telecommunications infrastructure in developed markets stands to expand the role of telco operators to service enablers as well as providers. At the recent MVNOs World Congress 2023, S&P Global highlighted key opportunities for telcos to leverage 5G and embedded SIM (eSIM) technologies to power the growing universe of the internet of things (IoT). The S&P Global presentation, which included data and insights from Kagan and 451 Research, focused on three key trends for the industry: opportunities for mobile network operators (MNOs) as specialized companies, industry attitudes toward enterprise IoT deployments and the role of eSIM in enterprise deployments.

—Read the article from S&P Global Market Intelligence