Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Aug, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Record high metals prices will likely have varying implications for the mining industry and decarbonization efforts.

The price of gold, copper, iron ore, nickel, and other metals have hit all-time highs at some point in the year-plus since the pandemic-prompted lows of last year. Supply cuts and rebounding demand have largely driven the metals price recovery, which is pushing profits for the mining sector higher, according to S&P Global Ratings. Most recently, S&P Global Market Intelligence data showed that the global economic recovery has boosted investor optimism and supported the recovery in base metals prices in July, but that the recent surge of COVID cases has begun to weigh on prices this month. Likewise, decarbonization efforts around the globe are likely to bolster prices of metals used in electric vehicle batteries.

Gold reached a historic high of more than $2,000 per ounce last year, but has drifted to approximately $1,700 in early August. The U.S. Federal Reserve’s dovish monetary policy stance supported gold prices this summer and prompted a revision of the consensus price forecast to 0.8% higher for 2021, and capped projected gains at 0.3% for 2022 and 2023, according to S&P Global Market Intelligence.

“In 2020, with the economic lockdown, the recession, and the pandemic, you saw investors buying more than twice as much physical gold and probably twice as much silver too. So you had investors coming in. In 2020, and continuing into earlier this year, you saw a lot of investors who were new to gold and silver flocking to the market,” Jeffrey Christian, managing partner at the commodities research firm CPM Group and a gold market expert, told S&P Global Market Intelligence. “There were a lot of economic fears that caused investors to come into the gold market and the silver market. That drove gold prices to a record high last year.”

“We've also seen disenchanted investors,” Mr. Christian added. “They haven't seen hyperinflation. The global financial structure hasn't crumbled. The dollar hasn't collapsed. The stock market hasn't collapsed. Gold didn't go to $10,000 per ounce. Silver didn't go to $100 per ounce. And so you've got a lot of disenchanted investors who bought gold as the price rose.”

Strong metals prices are supporting mining and discovery. As the size of exploration budgets typically align with metals prices within a one-year lag, high metals prices are likely to expand exploration budgets by 25%-35% this year, according to S&P Global Market Intelligence’s forecast. In the immediate term, strong gold prices have fostered a boom in smaller discoveries. Additional 5%-15% increases are expected next year as metal prices are expected remain at relative historical highs albeit below 2021 average prices, but budgets may recede slightly following this boost between 2023 and 2025 as global growth is expected to stabilize at moderate levels.

The race to net-zero has pumped up the pressure on the battery minerals and metals sector to meet demand for electric-vehicle production and entice new investors. The prices of lithium and cobalt, both used in electric vehicle batteries, have held firm and rallied this quarter. Market sources told S&P Global Platts that lithium prices are expected to remain elevated during the second half of this year as new electric vehicle sales in China continue to rally.

Today is Thursday, August 19, 2021, and here is today’s essential intelligence.

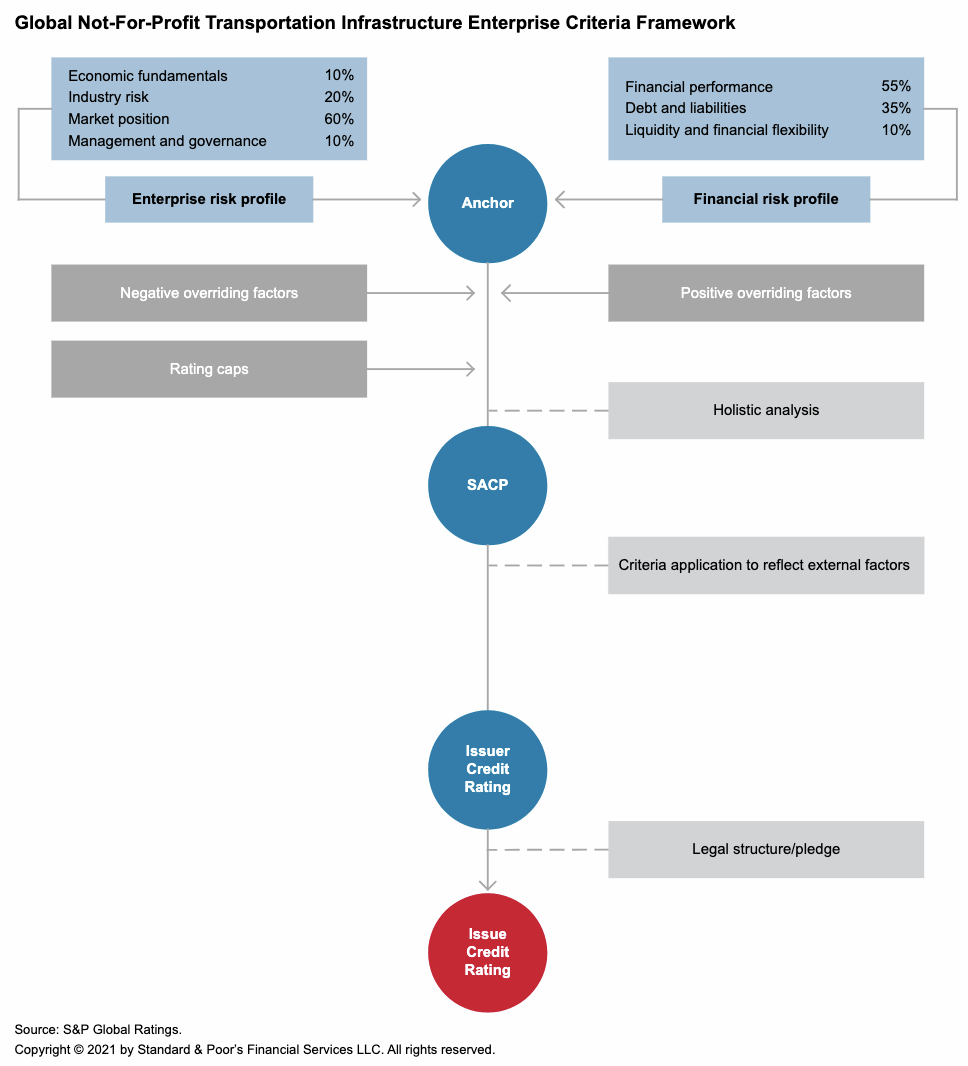

Credit FAQ: Global Not-For-Profit Transportation Criteria Implementation Results Show How Operational Risk And Tax Support Influence Ratings

The implementation of S&P Global Ratings' updated not-for-profit transportation infrastructure enterprise (TIE) criteria resulted in 22 rating actions (15 upgrades and seven downgrades) where the TIE criteria were the primary criteria applied; and four priority-lien rating upgrades where the updated TIE criteria were used to determine the obligor's creditworthiness for 32 priority-lien ratings of 21 different mass transit obligors that issued sales tax-backed obligations.

—Read the full report from S&P Global Ratings

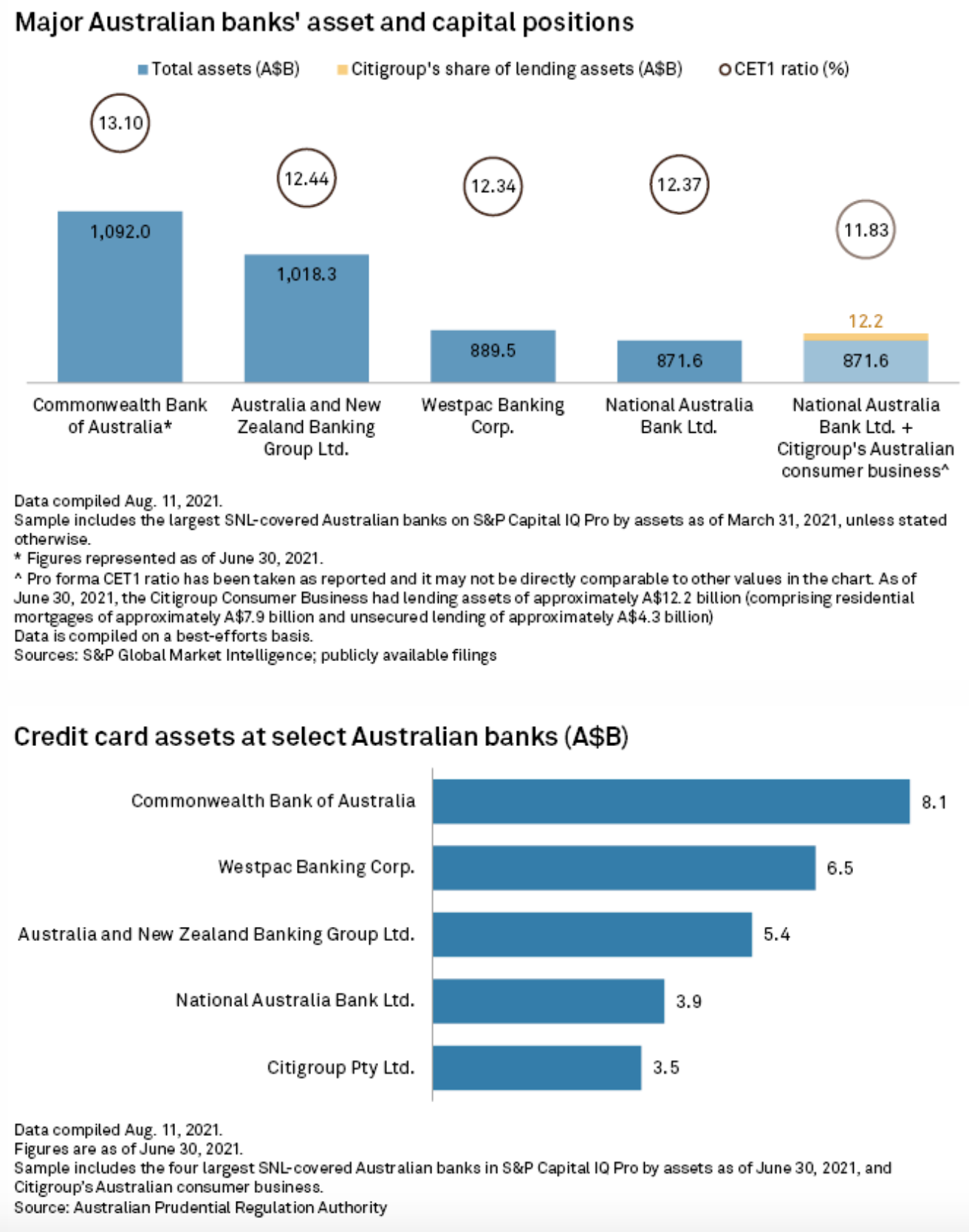

National Australia Bank Bets On Credit Card Revival With Citi Assets Acquisition

The A$1.2 billion deal to acquire Citi's Australian consumer business underscores NAB's bet that credit card usage will return to growth after the pandemic recedes. If the acquisition succeeds, the size of NAB's credit card portfolio, based on current outstanding balances, will rise closer to market leader Commonwealth Bank of Australia. It currently ranks fourth, behind Australia and New Zealand Banking Group Ltd. and Westpac Banking Corp., according to Australian Prudential Regulation Authority data.

—Read the full article from S&P Global Market Intelligence

Lower-For-Longer Rates Threaten Dutch Bank ING's ROE Ambitions – Analysts

The impact of a persistently low-interest-rate environment will continue to weigh on ING Groep NV in the coming years and hinder its ability to reach its return-on-equity target in the coming years, analysts said.

—Read the full article from S&P Global Market Intelligence

Analysts Skeptical Of Commerzbank's Bold 2024 Profit Goals

Commerzbank AG's latest restructuring plan features its most ambitious profitability goals in nearly 10 years, yet analysts are not convinced the targets are achievable. Like many other banks in Europe, Germany's second-largest listed lender is embarking on a major overhaul of its branch network and workforce, which analysts fear could limit the potential for revenue growth. Meanwhile, low interest rates are putting pressure on net interest income and margins, and more one-off charges could hamper the cost-cutting drive, further reasons for the mismatch between consensus forecasts and the bank's own targets.

—Read the full article from S&P Global Market Intelligence

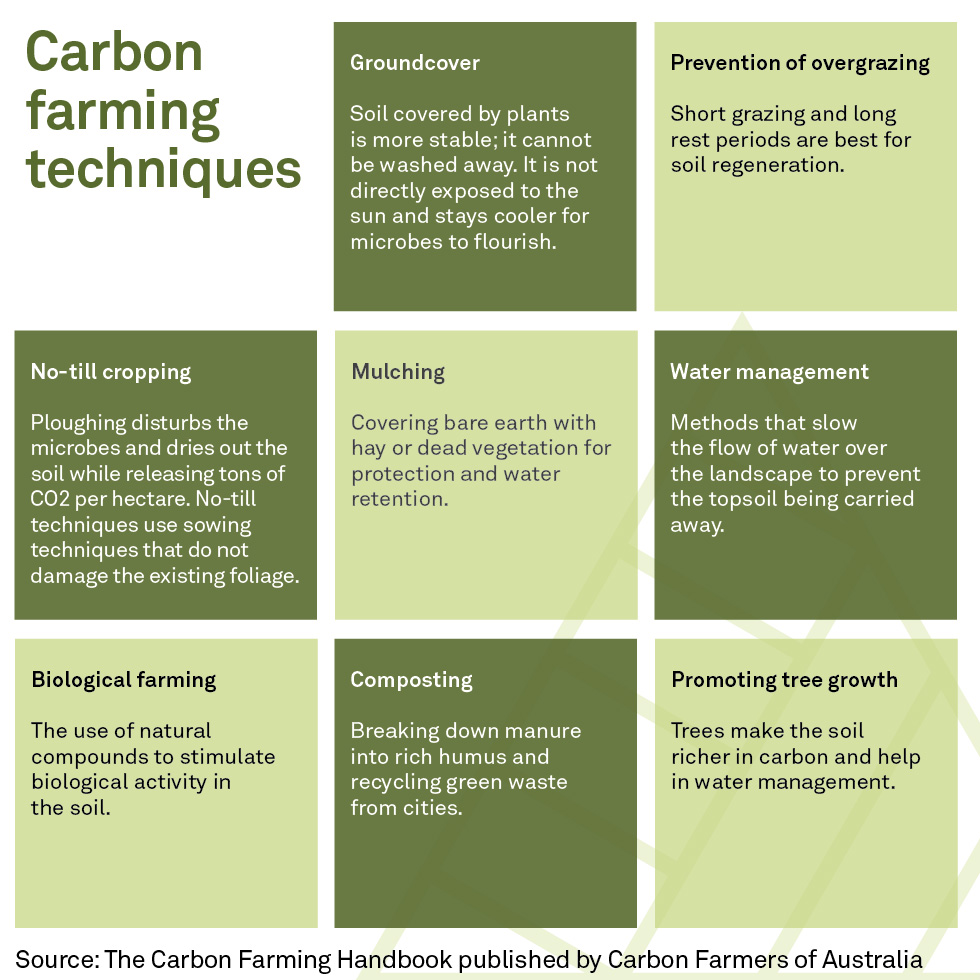

Soil Carbon Credits: The Realities On The Ground

In 2005, when Louisa and Michael Kiely began talking to farmers about soil carbon in New South Wales in Australia, they were met with incredulity. More than 20 years later, Carbon Farmers of Australia—the advisory they founded—has licensed projects spanning 750,000 hectares with a 3,700 sq km project in South Australia.

—Read the full article from S&P Global Platts

EU Wind, Solar Peak At 123 GW Helping To Ease Record Spot Power Prices

Wind and solar power generation across EU markets peaked at 123 GW Aug. 17 amid a spell in wind that helped ease record spot power prices, grid operator data aggregated by WindEurope show. The brief surge in wind reduced demand for gas and coal generation with average generation costs for such plant now exceeding Eur100/MWh ($118/MWh), S&P Global Platts data show.

—Read the full article from S&P Global Platts

India's Oil, Coal Addiction Hurdle For Speeding Up Emission Goals

The sharp growth in energy demand anticipated over the next decade will make it imperative for India to ensure that oil and coal supplies grow accordingly, as renewable energy on its own may not be able to cater to the entire incremental demand, creating challenges in lowering emissions at the desired pace.

—Read the full article from S&P Global Platts

US BLM Considers Mining Claim Ban For 10M Acres Of Bird Habitat

Millions of acres across public lands in the U.S. West could be rendered off-limits for mining claims by the federal government in order to protect a chicken-like bird known as the greater sage-grouse. The U.S. Bureau of Land Management, or BLM, said Aug. 17 that it would consider whether to impose a mineral withdrawal covering about 10 million acres in Idaho, Montana, Nevada, Oregon, Utah and Wyoming to support the sage-grouse, an imperiled bird species whose range spreads across 173 million acres of the U.S. West. The bird, best known for a mating ritual that involves inflating sacs on its chest, is known to live on areas sought after for mining and fossil fuel development.

—Read the full article from S&P Global Market Intelligence

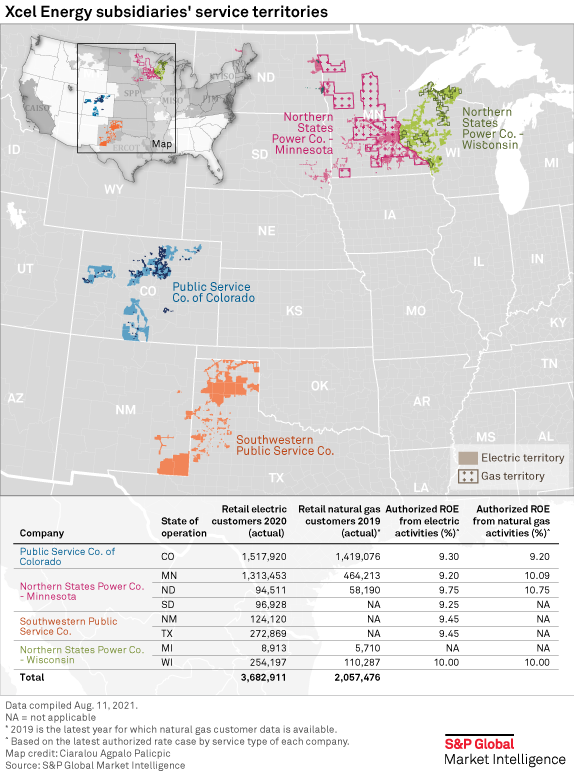

As Xcel Energy CEO Departs, Utility Will Keep Fueling Growth With Clean Energy

Benjamin Fowke spent the past 10 years guiding Xcel Energy Inc. from a "middle of the road" Midwestern utility, as judged by investors, to an industry leader and trendsetter in the clean energy transition. When Fowke retires Aug. 18, the outgoing CEO will leave the Minneapolis-headquartered company with a market cap of about $37 billion and a $23.5 billion base capital forecast for 2021 through 2025. Fowke will still serve as executive chairman of the company's board of directors during a transition period. Xcel Energy serves about 3.7 million electric customers and more than 2 million natural gas customers through four utility subsidiaries operating in eight states.

—Read the full article from S&P Global Market Intelligence

China's Beifang Asphalt Fuel Cuts Crude Throughput Amid Supervision

China-based private refinery Beifang Asphalt Fuel has cut its crude throughput as teams of external officials were appointed by the local government to supervise its operation, a source closed to the company and analysts said on Aug. 19. The refinery, based in Panjin city in China's northeastern Liaoning province, was found to be in arrears of tax payments during an investigation by the local tax authority in May, according to sources with knowledge of the matter.

—Read the full article from S&P Global Platts

India's Petronet LNG Prefers Long-Term LNG Deals Over Spot Exposure

India's biggest LNG importer Petronet LNG is open to extending the existing long-term contract with Qatar's RasGas beyond 2028 to secure uninterrupted supplies to user industries such as power, fertilizers, and city gas distribution in Asia's third-largest economy, company officials said Aug. 18. They also said Petronet LNG favors a long-term contract for LNG supplies over spot deals.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language