Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Aug, 2020

By S&P Global

Earlier this week, New Zealand celebrated a milestone 100 days without local infection of COVID-19. But on August 12, Auckland, the country’s biggest city, will resume lockdowns after four new cases emerged. Residents will be expected to work from home unless they are essential workers. Bars, cafes, and restaurants, as well as schools will be closed for the rest of the week.

The re-emergence of local infections in New Zealand speaks to the difficulty of controlling the spread of coronavirus. New Zealand, under the leadership of Prime Minister Jacinda Ardern, has earned plaudits from the World Health Organization and others for its response to the pandemic. A recent article in The New England Journal of Medicine from a group of academics at the University of Otago entitled “Successful Elimination of Covid-19 Transmission in New Zealand” published on August 7, laid out the factors that have made the country a case study for virus response and control.

“There are several lessons from New Zealand’s pandemic response,” the article’s authors wrote. “Rapid, science-based risk assessment linked to early, decisive government action was critical. Implementing interventions at various levels (border-control measures, community-transmission control measures, and case-based control measures) was effective.”

New Zealand’s total case count (1,573) and deaths (22) reflect favorably when you compare them to a U.S. state with a similar population. New Zealand has approximately 4.8 million people, and Alabama has a population of about 4.9 million. However, Alabama’s total reported case count stands at more than 103,000, with COVID-related deaths of 1,797. Alabama’s measures to control the pandemic have been notably less strict than other similar states.

On June 30, Alabama governor Kay Ivey issued a proclamation, which read, in part: "Widescale business closures and stay-at-home orders carry significant costs. They impede business investment and expansion. They reduce tax revenues that fund vital public services. And most importantly, they prevent working people from supporting their families."

New Zealand’s economy had rebounded faster than expected following nationwide lockdowns in March and April. However, government officials had long warned that a return of the virus was inevitable.

“This is something we have prepared for,” Ms. Ardern said in a statement to New Zealand residents on August 11. “Now, that moment has arrived. So my request is not to be dispirited or disheartened. I’m asking that everyone joins us on that journey again.”

Today is Wednesday, August 12, 2020, and here is today’s essential intelligence.

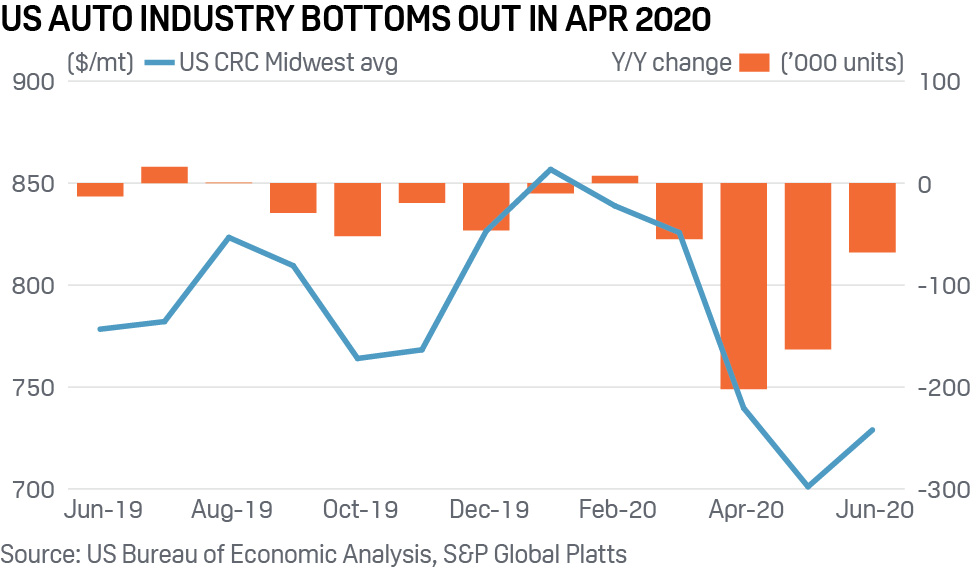

Around the tracks: World’s auto markets sink in H1

As the coronavirus crisis plays out, Clement Choo assesses the recovery in the world’s key auto production hubs, with China the exception to an otherwise weak environment. Carmakers across the globe saw initial signs of improvement in the second quarter, but the auto industry remains concerned about the prospects for a long-term recovery as COVID-19 cases have continued to flare up.

—Read the full article from S&P Global Platts

Carmakers' Q2 losses slimmer than feared but cost-cutting pressures intensify

Carmakers' losses were less severe in the second quarter than analysts had feared, but the impact of the coronavirus pandemic has weakened smaller manufacturers' ability to keep up with their larger rivals' defensive pursuit of scale and efficiency. Tesla Inc. confounded expectations by reporting a non-GAAP $451 million profit, an achievement that keeps it on track for possible entry into the S&P 500 index, while Toyota Motor Corp. and French automaker Peugeot SA also avoided losses. Ford's loss was less than half the $5 billion the company itself had warned of.

—Read the full article from S&P Global Market Intelligence

Auto Sector Amid COVID-19

As the coronavirus pandemic has obliterated demand for autos, analysts estimate that almost all global automakers are preparing to report significant losses for a calamitous second quarter—switching industry watchers' focus from profit to cash flow management and survival.

—Read more on the auto sector in a Special Report

COVID-19, economic issues complicating assessment of Beirut blast claims

The coronavirus pandemic, economic difficulties and social unrest are complicating the work to assess the insured losses from the Aug. 4 explosion in the Lebanese capital of Beirut, loss adjusters say. The blast at the city's port, which has killed more than 200 people according to the BBC, caused widespread property damage. Andrew Bart, global president of loss adjuster Crawford & Co.'s global technical services division, which handles large and complex claims, said in an interview that his company was seeing "significant structural damage up to two kilometers away and possibly further." He added that in the area immediately adjacent to the blast site "the destruction is almost total."

—Read the full article from S&P Global Market Intelligence

China Securitization Performance Watch 2Q 2020: The Worst May Have Passed

A better-than-expected economic revival may have moderated any possible damage to China securitization transactions from the COVID-19 outbreak. But an about turn is unlikely. Issuance volume fell in the second quarter (2Q) of the year, and defaults increased--albeit marginally. S&P Global Ratings expects issuance volume to continue to decline over the next few quarters. Asset performance will remain under pressure, but to a lesser degree than in the previous quarters. The outbreak is bringing about changes in how the market operates. The effects of some of these changes will play out over the next few quarters.

—Read the full report from S&P Global Ratings

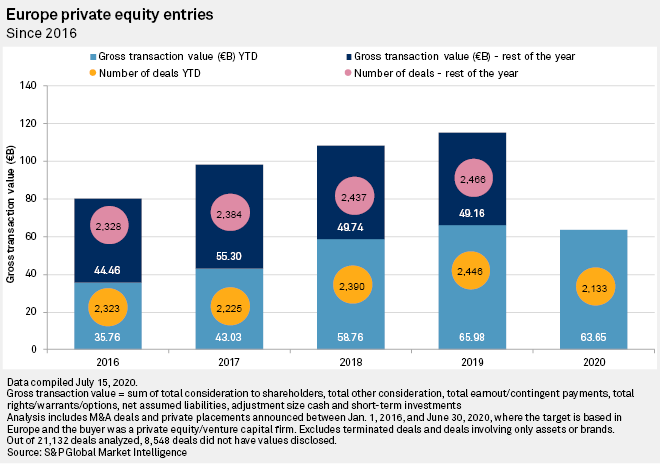

European PE deal-making drops to 5-year low in H1'20

European private equity and venture capital entry volume dropped to a five-year low in the first half of 2020 as managers turned away from deal-making to focus on their existing portfolios in the wake of the coronavirus outbreak. The number of deals announced dropped 13% compared with the first half of 2019 to 2,133, according to S&P Global Market Intelligence data. But while announced gross transaction value dipped by 9% to €63.65 billion over the period, it remained higher than valuations for the first half of 2016 through to 2018 due to a handful of large deals.

—Read the full article from S&P Global Market Intelligence

How Mexican banks plan to hone efficiency ratios

Mexico's three largest banks will look to streamline non-interest operating expenses in the coming quarters as the impact of the pandemic on their bottom lines has drawn the focus of their attention to their efficiency ratios. Banco Santander México SA, Grupo Financiero Banorte SAB de CV and Grupo Financiero BBVA Bancomer SA de CV scaled back their non-interest expenses in the second quarter and boosted their digital investment, in an attempt to offset a spike in provisions, tighter interest margins and lower revenues. The three largest financial institutions by total assets saw their provisions shoot up by an average of 55.4% during the first half of 2020, and their net income decline by an average of 18.5%.

—Read the full article from S&P Global Market Intelligence

Europe's dividend ban hurts bank investors. These shares are most impacted

When the European Central Bank asked banks not to pay dividends until 2021, it recognized the move would not go down well with investors."We know that investors have not been particularly pleased with our decision, but we think this is a necessary action to be taken at this stage of heightened uncertainty," Andrea Enria, chair of the ECB's supervisory board, told reporters July 28 following the announcement.

—Read the full article from S&P Global Market Intelligence

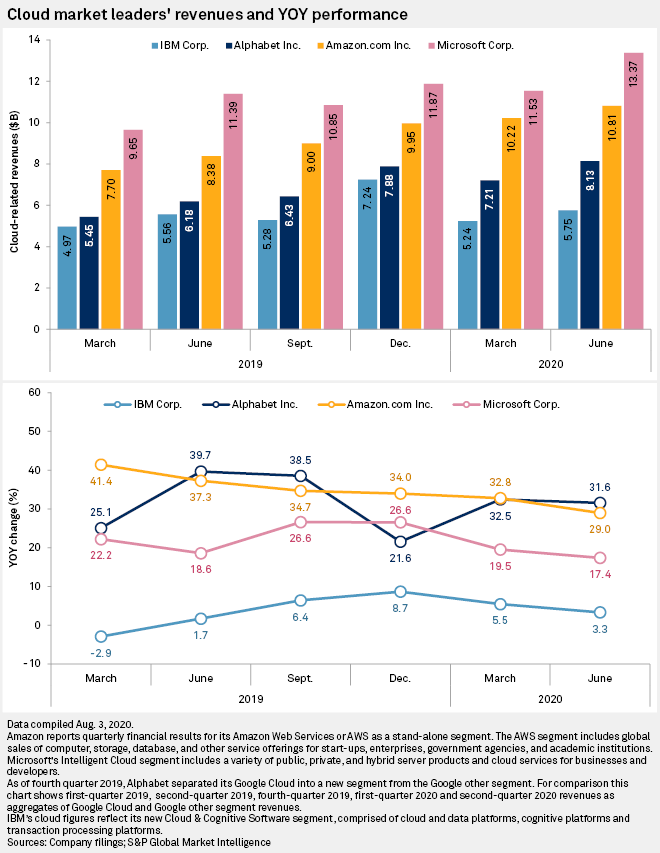

Cloud-revenue growth slows as companies cut spending due to COVID-19

Although cloud-computing platforms continued to thrive in the first full quarter amid COVID-19, overall growth in the sector declined due to the pandemic's impact on certain industries and businesses. Every major cloud provider reported year-over-year growth in their respective cloud revenues during the June quarter. However, cloud executives said many companies started pulling back their more complex enterprise migration and transformational cloud projects in favor of prioritizing the most crucial IT tasks in response to the economic fallout of the pandemic. This resulted in a quarter-over-quarter decline in growth for all platforms.

—Read the full article from S&P Global Market Intelligence

Beyond The Buzz: The Geopolitics Of Water

In the second episode of Beyond the Buzz, we delve into the topic of water – often referred to as “blue gold.” With water disputes on the rise, the World Economic Forum ranks water scarcity as more impactful than even infectious diseases in its 2020 Global Risks Report. S&P Global Ratings’ resident water risk expert, Beth Burks, joins Corinne Bendersky and Mike Ferguson in the episode to explore the myriad risks related to water and how they may be exacerbated by climate change going forward. The trio also unpack the corporate perspective on water risk, how businesses and governments are addressing this growing threat, and the key indicators to monitor to mitigate long-term risk exposure.

—Listen and subscribe to Beyond the Buzz, a podcast from S&P Global Ratings

Interview: SABIC sees COVID-19 change plastic usage, need to maintain sustainability efforts

Major petrochemicals producer, SABIC, expects the lifestyle changes brought about by the COVID-19 pandemic to shape the different usage of plastics going forward, according to the company's vice president and regional head for South Asia and ANZ, Janardhanan Ramanujalu. "We have seen a rise in demand for new and enhanced applications to help safeguard against COVID-19 on the frontlines," Ramanujalu said in an email interview with S&P Global Platts. This included "production of ventilators and respiratory masks; polypropylene (PP) products used in making medical disposable gowns, masks, shields and coveralls to safeguard community health as well as other intensive care equipment, such as infusion pumps, monitors and diagnostic devices."

—Read the full article from S&P Global Platts

Market Movers Americas, Aug 10-14: PVC demand bounces back from six-week decline

In this week's Market Movers, presented by Jacquelyn Melinkek: PVC demand bounces back from a six-week decline, Midland WTI could see boost from stepped-up exports, Slow flight recovery hampers US jet exports, Expectations for higher corn yields pressure futures.

—Watch the full video from S&P Global Platts

Crude higher on US fiscal stimulus hopes; slowdown in COVID-19 cases

Crude oil futures were higher in mid-morning trade in Asia on Aug. 11 as the prospects of an imminent US fiscal stimulus package that may lift consumption buoyed market sentiment, while the number of COVID-19 case count in the US and worldwide trended lower. At 10:38 am Singapore time (0238 GMT), the ICE Brent October crude futures was up 19 cents/b (0.42%) from the Aug. 10 settle at $45.18/b, while NYMEX September light sweet crude contract was up by 27 cents/b (0.64%) at $42.21/b.

—Read the full article from S&P Global Platts

Miners continue to increase market cap in July

The market value of mining companies grew by a median of 22.3% month over month in July, extending gains for the fourth month in a row. The industry's 25 largest players — consisting of 13 precious metals-focused companies, six base metals companies, five diversified commodities companies and a single bulk commodities company — all had higher market cap than in the previous month. Industry indexes similarly remained on the uptick month over month. The SNL Metals & Mining Index climbed 12.1% between June 30 and July 31, while the SNL Precious Metals Index rose 17.9% over the same period. The SNL Base Metals Index grew 14.0% and the SNL Diversified Mining Index gained 9.3% month over month.

—Read the full article from S&P Global Market Intelligence

Consol Energy Q2 coal production, sales tumble due to coronavirus pandemic

Consol Energy reported coal production volumes of 2.4 million st for the second quarter, down from 7.2 million st in the year-ago quarter, due to the coronavirus pandemic, the company said Aug. 10. The Canonsburg, Pennsylvania-based company said in its quarterly earnings statement the lower production at its three mines that make up the Pennsylvania Mining Complex -- Bailey, Enlow Fork and Harvey – were due to an "unprecedented reduction in customer demand and an increase in force majeure requests from our customers," as well as idlings of two mines. The Enlow Fork mine was idled in April and remained idled throughout the quarter, while the Bailey mine was idled earlier in the quarter, but "ran only on an as-needed basis while the Harvey mine produced to the reduced demand levels," according to the company statement.

—Read the full article from S&P Global Platts

Canadian aluminum tariffs likely déjà vu moment for some

Settling in with a favorite film can be comforting in times like these. There’s something reassuring about seeing the same familiar scenes play out on screen. I still laugh at Rodney Dangerfield’s obnoxious tycoon, Al Czervik, in “Caddyshack” or the scene in “Office Space” where disgruntled co-workers take out their frustrations on an unreliable fax machine. Those are classic comedies, though. A repeat viewing of a mob drama like “Goodfellas” can generate the same anxious feelings and emotions I had the first time I saw it. Even though I know what’s coming, there’s an impending sense of doom that just can’t be shaken.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language