Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

When Good News Becomes Bad News

Last Friday, the U.S. Bureau of Labor Statistics released its jobs report for July. By all accounts, it beat expectations. Average hourly earnings rose 0.5%, and 528,000 new jobs were added. This reduced the headline unemployment rate to 3.5%, which is at pre-pandemic levels. In reaction to the news, the S&P 500 index fell 0.2%.

At first blush, Friday’s market swoon looks strange. After all, if more people are making more money, doesn’t that indicate a growing economy, and isn’t that good for corporate earnings and share prices? Yes, but there are caveats. First, it is entirely possible the U.S. economy is already in recession. According to S&P Global Ratings, real U.S. gross domestic product contracted 0.9% in the second quarter after a fall of 1.6% in the first quarter. Two quarters of negative growth are generally considered a sign that a recession has already begun. However, consumer spending rose 1.0% in the second quarter. S&P Global Ratings U.S. Chief Economist Beth Ann Bovino puts the chances of a U.S. recession in the next 12 months at 45%, which is, in her memorable phrase, “a toss-up.”

In an interview with the Daily Update, Chris Varvares, co-head of the U.S. Economics team at S&P Global Market Intelligence, provided additional context to Friday’s numbers. “Further tightening in the labor market stoked concerns that inflation could move higher or be more persistent. In turn, that suggested that the Federal Reserve might have to raise interest rates more aggressively in its efforts to return inflation to its 2% target,” Varvares said.

“Such increases in interest rates are often bad for stock prices, especially when the Fed’s stated goal is to cool demand. Stock prices represent the value today of expected future dividends or capital gains. Higher rates mean future income is valued less today; so, rates up, stock valuations down.”

In 2022, many central banks, including the Fed, have pivoted from monetary stimulus to monetary tightening in response to high inflation. The problem with raising interest rates is that cooling off an overheated economy can result in a “hard landing,” or a rapid shift from growth to stagnation. If inflation remains high and unemployment starts creeping up, the economy could fall into stagflation. While there is some evidence global inflation has peaked, the Fed may decide the lower unemployment numbers allow it greater latitude to combat inflation through further rate hikes.

Not all economic indicators are looking so positive. An S&P Global Ratings analysis of nine economic indicators in June showed a majority of five in negative territory and two in neutral. Despite rising payrolls and relatively healthy savings, consumer sentiment was sharply negative for May and June. On the positive side, the S&P 500 seems to have bounced out of bear territory in July.

This will not be the first or the last time the markets have a seemingly paradoxical response to good or bad news. Reducing inflation is a delicate balancing act in which bad news may be good and good news may be bad.

Today is Thursday, August 11, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

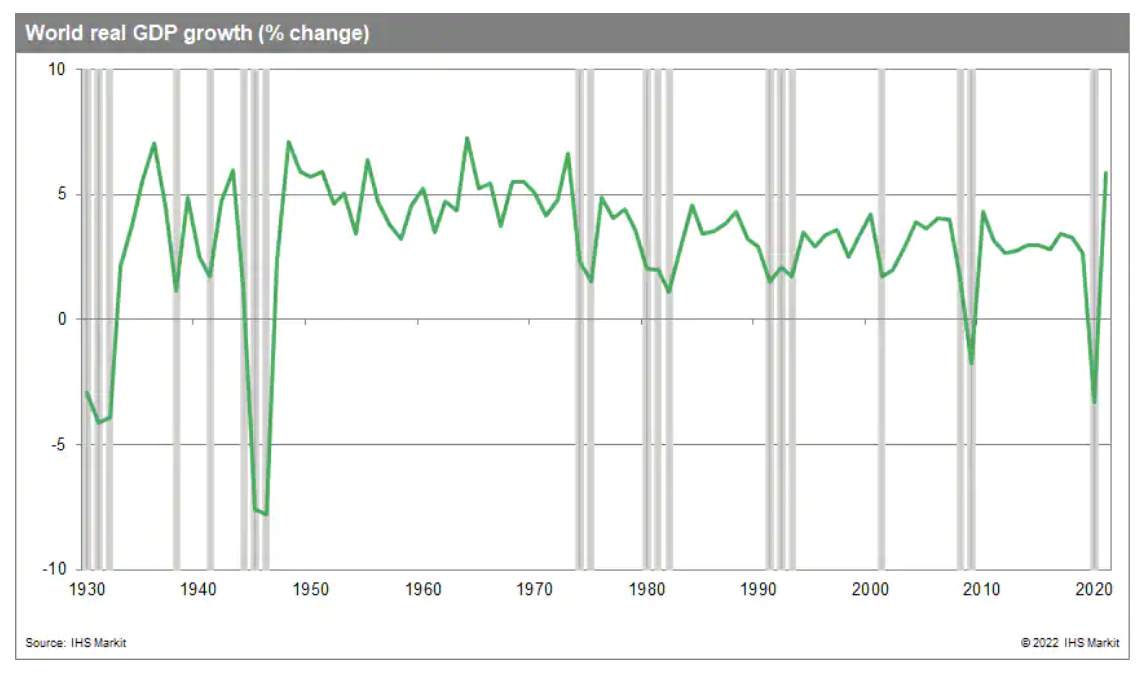

Global Recession Watch: Inflation At A Fever Pitch

The global business climate is deteriorating in mid-2022, putting forecasters on recession watch. With inflation at a fever pitch, central banks are quickly raising interest rates, aiming to slow the growth of aggregate demand and achieve a better alignment with supply. It's a difficult balancing act, and risks are high amid Russia's brutal war with Ukraine, soaring energy prices, ongoing supply chain disruptions, endemic COVID-19, and financial market turbulence.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Listen: Take Notes: The Health Of U.S. Consumers

In this week’s episode of Take Notes, hosts Tom Schopflocher and Jim Manzi discuss their recently published chartbook: U.S. Structured Finance Snapshot: The Health Of U.S. Consumers. Topics include U.S. macroeconomic conditions, consumer ABS, housing/RMBS, and non-agency multifamily CMBS, and how the trends in asset classes reflect the health of U.S. consumers.

—Listen and subscribe to Take Notes, a podcast from S&P Global Ratings

Access more insights on capital markets >

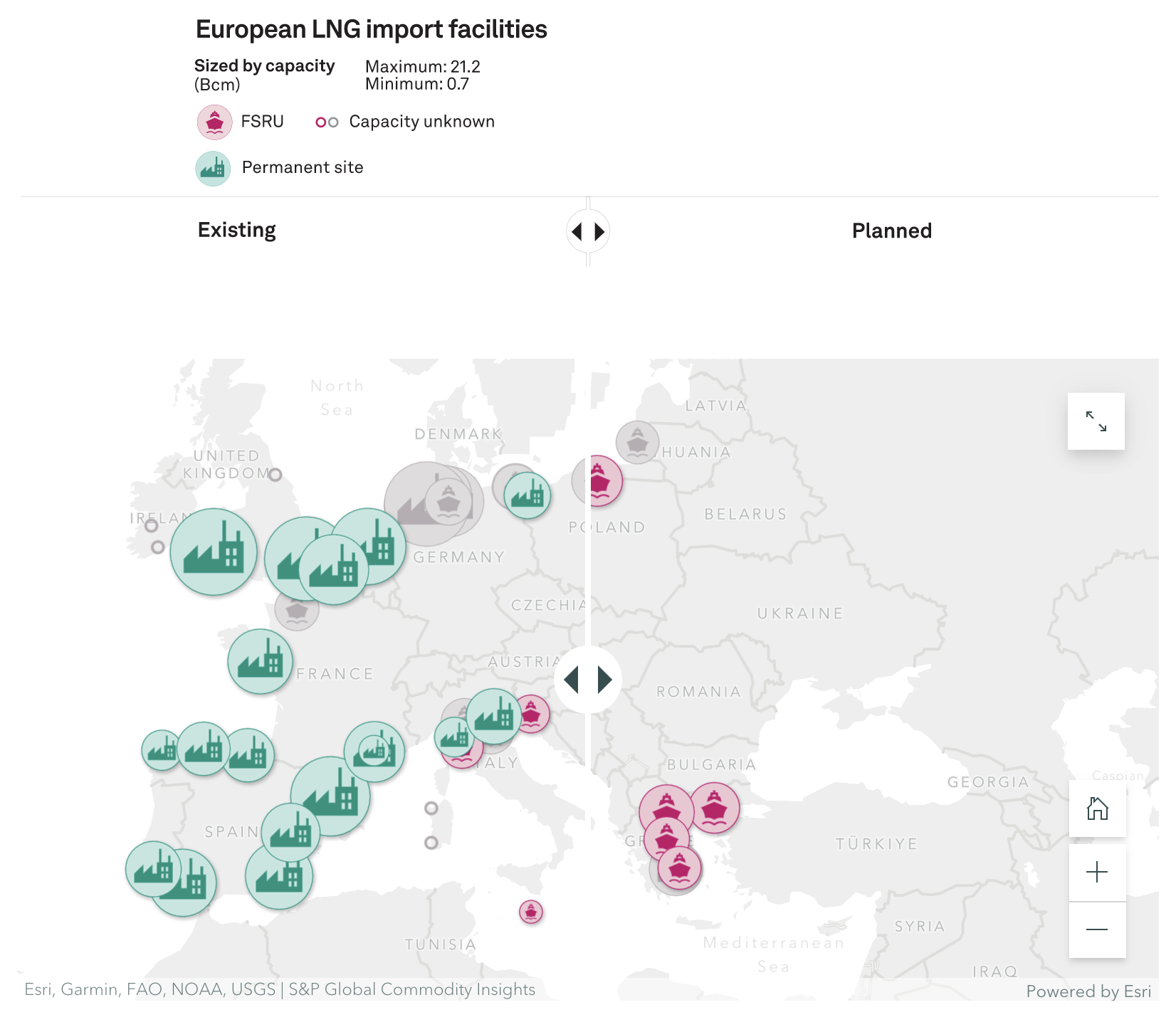

Feature: Europe's Dash For New LNG Import Infrastructure Picks Up Pace

The scramble by countries across Europe to install new LNG import facilities in record time continues to pick up pace, with FSRUs now secured for deployment in a number of EU member states. The sharp fall in Russian pipeline imports—and the prospect of flows from Russia being cut further or halted completely—has led to plans to realize numerous projects, both old and new, as quickly as possible.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

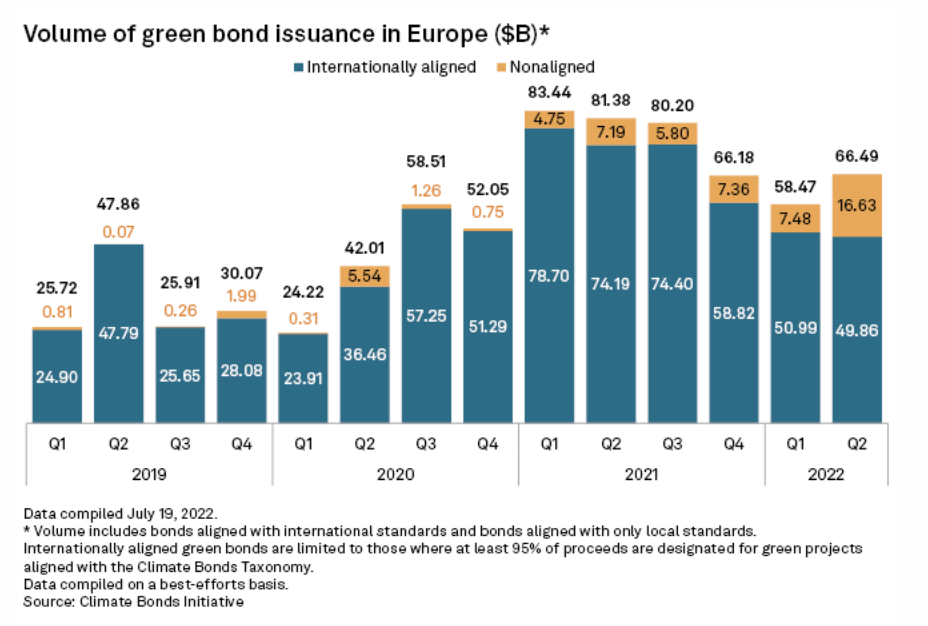

Germany, France Drive Green Bond Issuance In Europe To $66.49B In Q2

Green bond issuance in Europe recovered in the second quarter, driven by strong activity in Germany and France that looks set to continue. The region sold $66.49 billion of environmentally focused debt in the three months to June-end, an increase from $58.47 billion in the first quarter. On a yearly basis, second-quarter issuances were down more than 18% from $81.38 billion, according to data from the Climate Bonds Initiative, during a period marked by market volatility, rising interest rates, and Russia's ongoing war in Ukraine.

—Read the article from S&P Global Market Intelligence

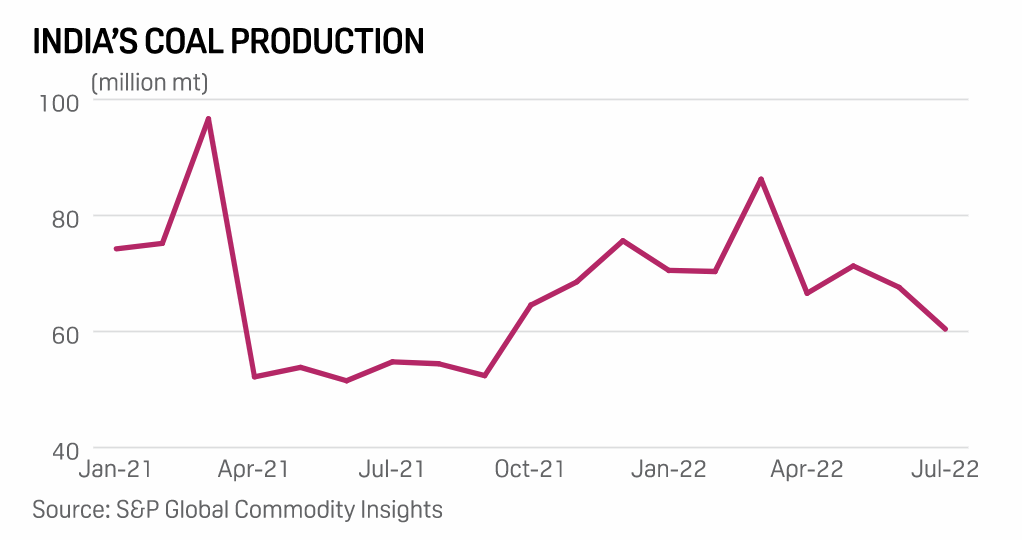

India Fancies Renewables Actively But Doesn't Want To Let Go Of Coal

Amid long-standing global push to embrace renewables as a primary source of power generation, India does not want to be left far behind, but at the same time lowering dependence on coal is emerging to be a constant struggle, given how affordable and abundant it is. With a slew of lucrative measures like 100% FDI under the automatic route for renewable energy and setting up of project development cell for facilitating investments, the government aims to attract domestic and international investors, which has indeed shown results with some private players showing interest.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 77: Language In Tech

Too often, the language in technology is taken for granted and yet it is the fundamental means through which we communicate ideas. Director of Company Information Services Emily Jasper and copy editor Patrice Calise join host Eric Hanselman to look at ways we can be more intentional in language use and more mindful of the communities that consume it. Organizations need to take a wider view and check the lens through which they’re viewing their audience. Clarity and understanding can follow.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Access more insights on technology and media >