Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Four I’s of Indian Mobility

In honor of our new “Look Forward” report on India, this week’s Daily Updates will cover different aspects of the Indian economy.

India has a population of approximately 1.4 billion people. While only 15%-20% of the population drive personal vehicles, that means the number of Indian drivers is roughly equivalent to the number of US drivers. If India’s economy expands as predicted, at a rate of 6.7% per year from fiscal 2024 to fiscal 2031, then the mobility needs of the population will expand. To accommodate this, India must build on what Puneet Gupta, a director at S&P Global Mobility, calls “The Four I’s of Mobility” – namely, infrastructure, innovation and technology, investment, and inclusive growth.

India’s current mobility infrastructure is not fit for purpose. The traffic gridlock in Indian cities, where there are more than 100 registered vehicles per kilometer of road, is legendary. Traffic causes pollution as idling cars burn petrol. Right now, 40 of the world’s 100 most-polluted cities are in India. Federal and state governments in India have undertaken massive development projects in road infrastructure, but more work is clearly required.

“A city like Delhi has over 25% of its land area under road infrastructure, 90% of which caters to the 15%-20% of the commuting population that travels in personal vehicles,” said Sunita Narain,

director general at the Centre for Science and Environment, in an interview with S&P Global. “The bulk of people in cities still walk, cycle or take the bus, or now the metro — this is where the huge opportunity is. We need to envision and reengineer our cities so that people can use public transport that is massively augmented and available to all.”

The next “I” of mobility in India is innovation. Indian carmakers are focused on developing a battery-electric vehicle (BEV) affordable for Indian consumers. BEVs also require new infrastructure investment to accommodate for charging and for their additional weight. Autonomous vehicles that can be shared are also a major innovation opportunity for India.

Investment will be required from both manufacturers and suppliers to meet the growing consumer demand in India. Approximately $15 billion is expected to be invested in manufacturing in India for the mobility sector through 2030. The automotive industry generates almost 7% of Indian GDP and provides a livelihood to more than 40 million households. As consumers with new wealth in their pockets demand more mobility options, the automotive sector in India can be expected to grow substantially. Investment must begin now to address the scale of the opportunity.

The final ingredient defining the future of mobility in India is inclusive growth. Other countries have allowed their mobility sectors to pursue competitive growth, in which technology for electric vehicles, for example, has been allowed to develop along parallel, but not compatible, pathways. India does not have the luxury of indulging in a redundant mobility ecosystem. Carmakers, parts suppliers, fuel-filling companies, energy providers and the government must all collaborate on common platforms to provide affordable and efficient mobility solutions. But inclusive growth must also include meeting the mobility needs of the population not driving personal vehicles.

“We literally do not have the space for the remaining 80% of people to drive personal vehicles, which will then contribute to emissions,” Narain said. “Like the issue of climate justice in our world, this needs policies deliberately designed to cater to the growing needs of people, and, in this case, it means building mobility systems of the future that are suitable for all.”

Today is Thursday, August 10, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

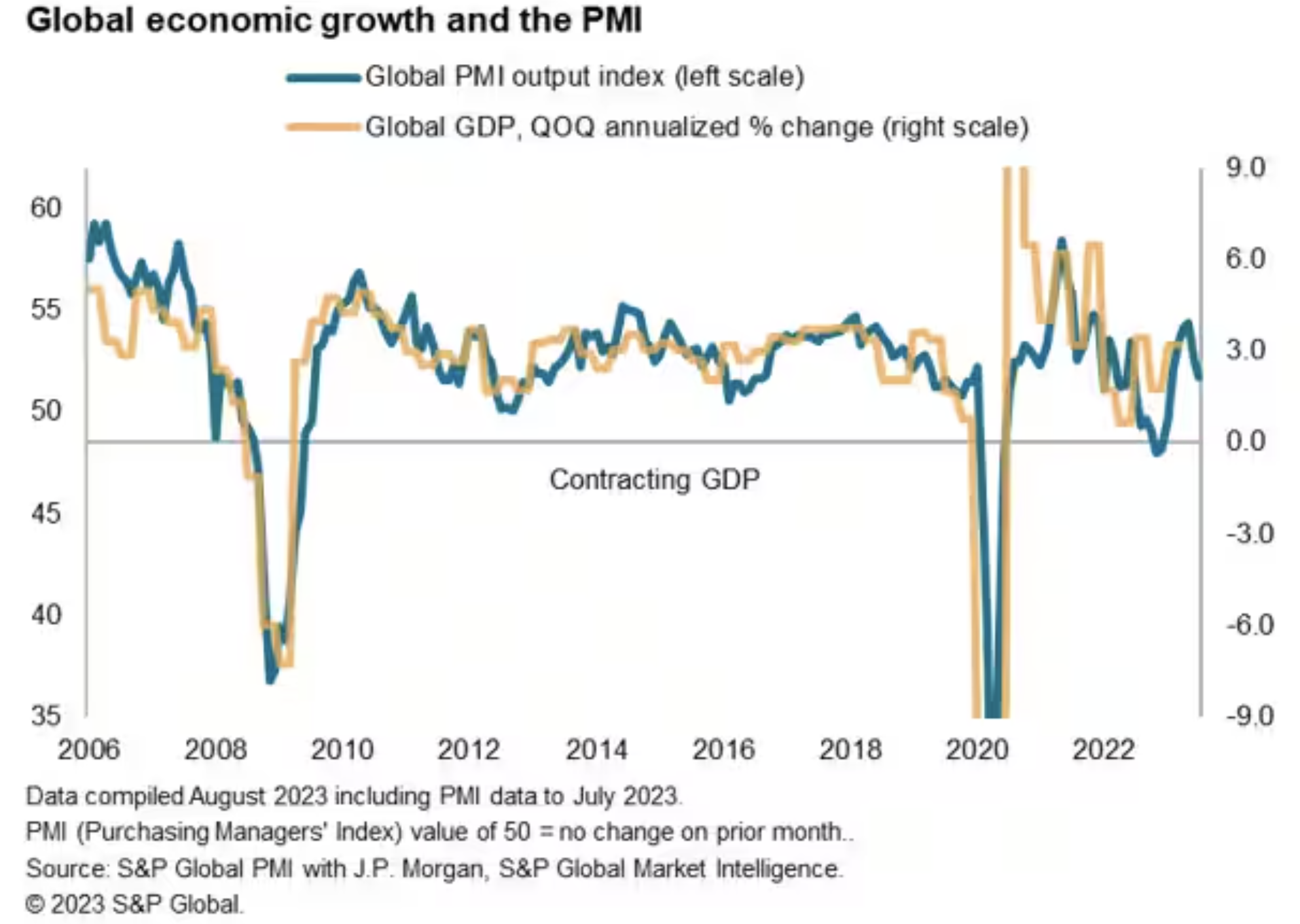

Global Upturn Loses Further Momentum at Start of Third Quarter, Hiring Spree Cools

The global economy continued to lose growth momentum in July, according to the S&P Global PMI surveys, based on data provided by over 27,000 companies. A further cooling of a recent revival of service sector growth, which had been buoyed by a post-pandemic tailwind of increased spending, waned for a second month in a row, accompanied by a deepening manufacturing downturn.

—Read the full report from S&P Global Market Intelligence

Access more insights on the global economy >

Credit Unions Add Loans, Shed Deposits in Q2

Despite credit quality data showing gradual deterioration, US credit unions are shifting more of their asset mix into loans.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

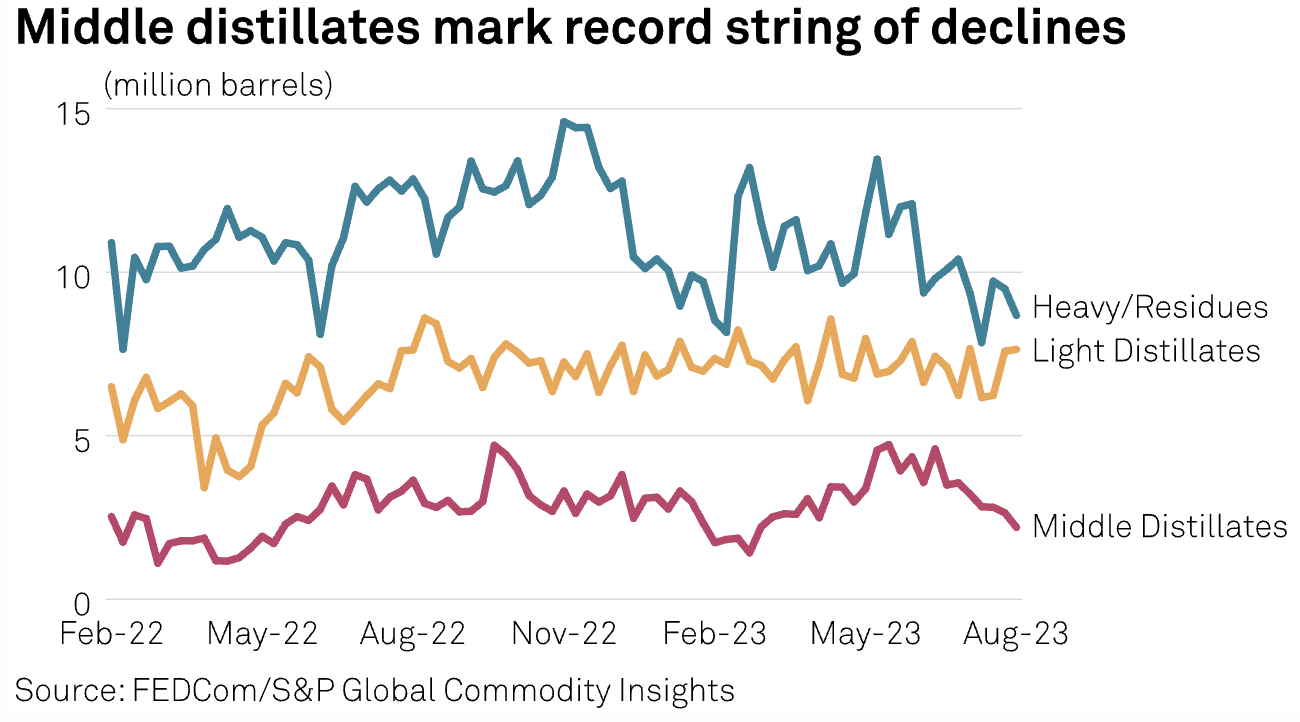

Oil Product Stockpiles Fall to Three-Week Low

Stockpiles of oil products at the UAE's Port of Fujairah dropped to a three-week low Aug. 7 after middle distillates such as jet fuel and diesel fell 17% from a week earlier to 2.199 million barrels, the lowest since Feb. 27, according to Aug. 9 data from the Fujairah Oil Industry Zone.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

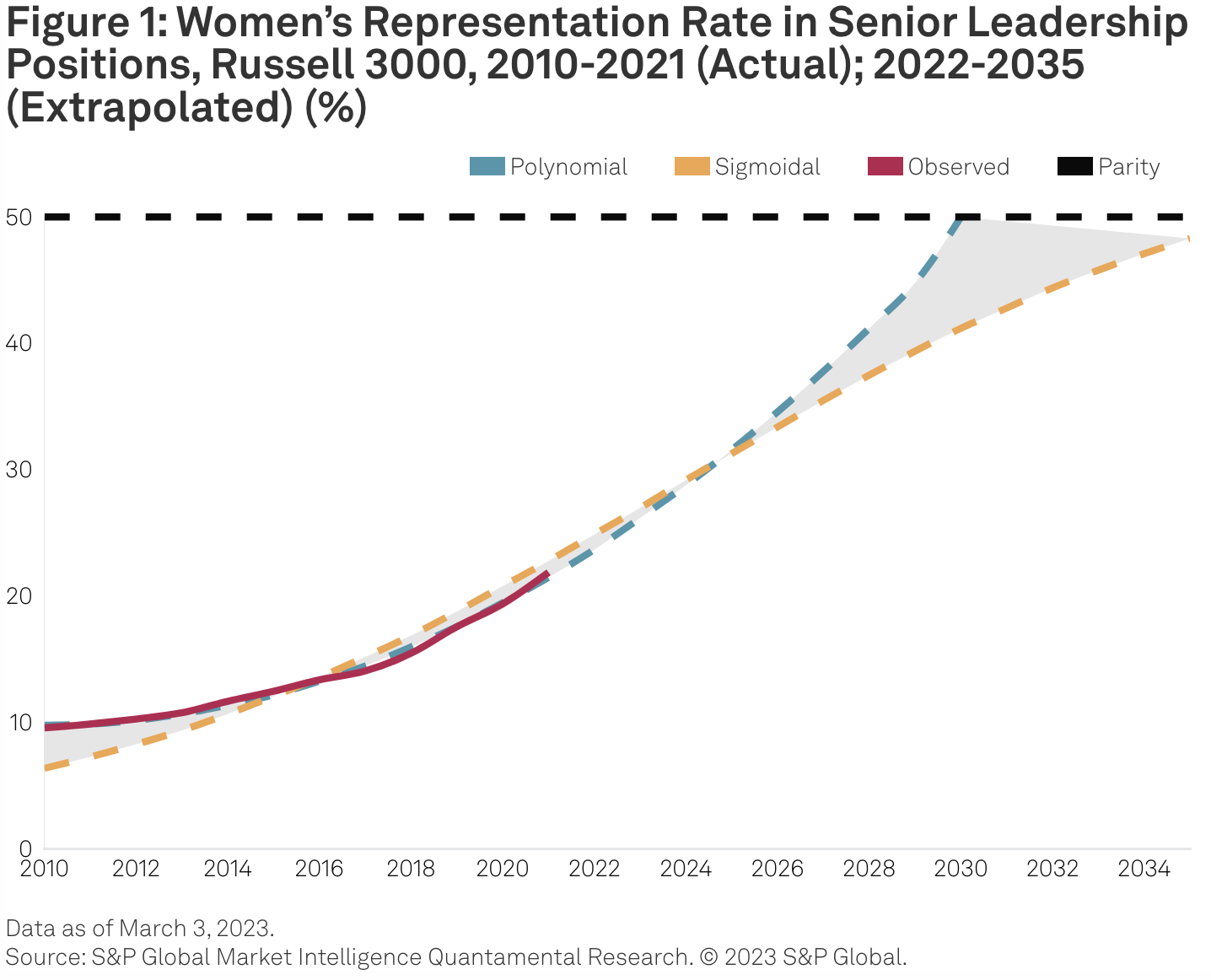

Breaking Boundaries: Women Poised for Milestone Achievement in Parity Amid Otherwise Bleak Outlook

While diversity in leadership has received increasing attention, most data show slow, incremental improvements at best. Yet in an otherwise bleak landscape, a bright spot has emerged: An analysis of 86,000 executives from 7,300 U.S. firms over 12 years found that women could reach parity in senior leadership positions between 2030 and 2037, among companies in the Russell 3000.

—Read the full cross-divisional report from S&P Global Market Intelligence & S&P Global Sustainable1

Access more insights on sustainability >

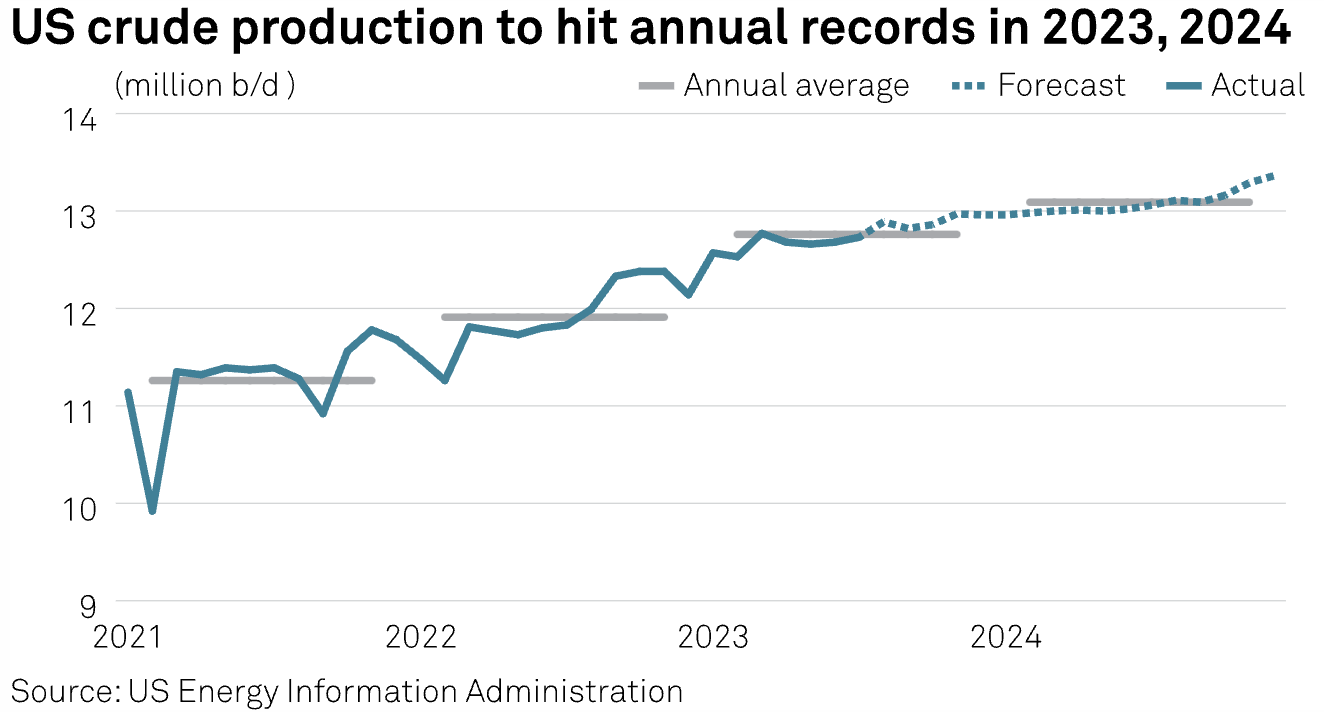

Global Crude Production Growth Seen in 2023, 2024 as US, Others Offset OPEC Cuts: EIA

Expected higher oil prices spurred by Saudi Arabia's extended voluntary production cuts are creating incentives for non-OPEC producers to ramp up their output, allowing for growth in global oil production to continue in 2023 and 2024, the US Energy Information Administration said Aug. 8.

—Read the full article S&P Global Commodity Insights

Access more insights on energy and commodities >

Generative AI Steps Into Starring Role in Actor, Writer Strikes

Technology overall is playing an outsized role in the impasse between studio executives and their creative workforce. As generative AI becomes more commonplace, both the Writers Guild of America and the Screen Actors Guild – American Federation of Television and Radio Artists want assurances that their members will retain control over their literary materials or likenesses — including any digital replications.

—Read the full article from S&P Global Market Intelligence