Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 29 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

US Battery Manufacturing Charges into the Future

Regulations and incentives are driving a surge in US battery manufacturing, a boom that is set to reshape the auto industry alongside state economies and utilities.

On March 20, the Environmental Protection Agency released updated rules, giving US automakers more lead time in lowering vehicle CO2 emissions. The requirements set more modest reduction goals for 2027, 2028 and 2029 before accelerating sharply, eventually reaching a 50% cut in emissions by 2032 from 2026 levels. Manufacturers may choose different technological routes to reduce emissions. Whether automakers opt to build fully electric vehicles, hybrid EVs or plug-in hybrids, they will all need more batteries.

With the Inflation Reduction Act of 2022, manufacturers can gain a 10-year tax credit for battery cell production, at $35/kWh, and another $10/kWh for battery modules. The law further encourages domestic production by providing a 10% bonus incentive on top of a 30% investment tax credit for US-made batteries.

“It's hard to actually keep up with how much money is pouring into the development of batteries and the corresponding electric vehicle supply chain,” said Nick Nigro, founder of Atlas Public Policy. “We are in the very early stages of a once-in-a-century transition.”

The White House has touted $161 billion in announced EV and battery private investments since early 2021, and analysts expect US EV demand to grow 174% between 2024 and 2028, eventually reaching 4.5 million cars produced annually.

Beyond boosting EVs, battery storage can capture excess energy generated by wind and solar during the day and provide power back into the grid at night. S&P Global Commodity Insights expects 40.6 GW of combined capacity additions in 2024 from wind, solar and stored power, with batteries making up 8.6 GW. Twenty-nine US states have battery storage capacity systems under development, with seven states surpassing a key 500 MW milestone, according to the American Clean Power Association.

David Erne, deputy director of the California Energy Commission's Energy Assessments Division, said California has twice the battery storage of any other US state. The Golden State is projected to reach 10 GW of capacity this spring. Driving these energy storage additions is California Senate Bill 350, which requires the state’s electric sector to reduce greenhouse gas emissions to 8 million metric tons by 2045, from 47 million metric tons in 2006, while maintaining reliability.

The race to build more batteries is driving increasing demand for many crucial metals used in production, including lithium, nickel and cobalt. Total exploration allocation for these three metals was up 42% to a high of $1.64 billion in 2023. Batteries also use copper, aluminum and graphite. S&P Global Commodity Insights analysts forecast that high-quality aluminum sources, such as recycled beverage cans, will not be enough to crush increasing aluminum demand in North America. Meanwhile, China produced 77% of the world’s graphite in 2023 and refined more than 90% of global supplies, while the US imported 84,000 metric tons of this key metal used in lithium-ion batteries.

To meet demand, the US is again turning to incentives. On Jan. 18, the US Energy Department announced $131 million in research funding for EV batteries and charging systems. The DOE earmarked $60 million for the Southfield, Mich.-based United States Advanced Battery Consortium to develop storage using "earth-abundant" materials readily available from domestic sources. And in February, spurred by Chinese supply restrictions imposed by the actions of US and Chinese regulators, manufacturers in Alabama, Tennessee and Louisiana signed agreements to secure graphite from suppliers in South Korea, Australia and Canada.

As the US battery boom charges ahead, it will power the future of transportation, energize regional economies and help drive environmental change.

Today is Monday, April 29, 2024, and here is today’s essential intelligence.

- Written by Ken Fredman.

Credit Trends: Q2 2024 Global Refinancing Update: Window Of Opportunity May Be Closing

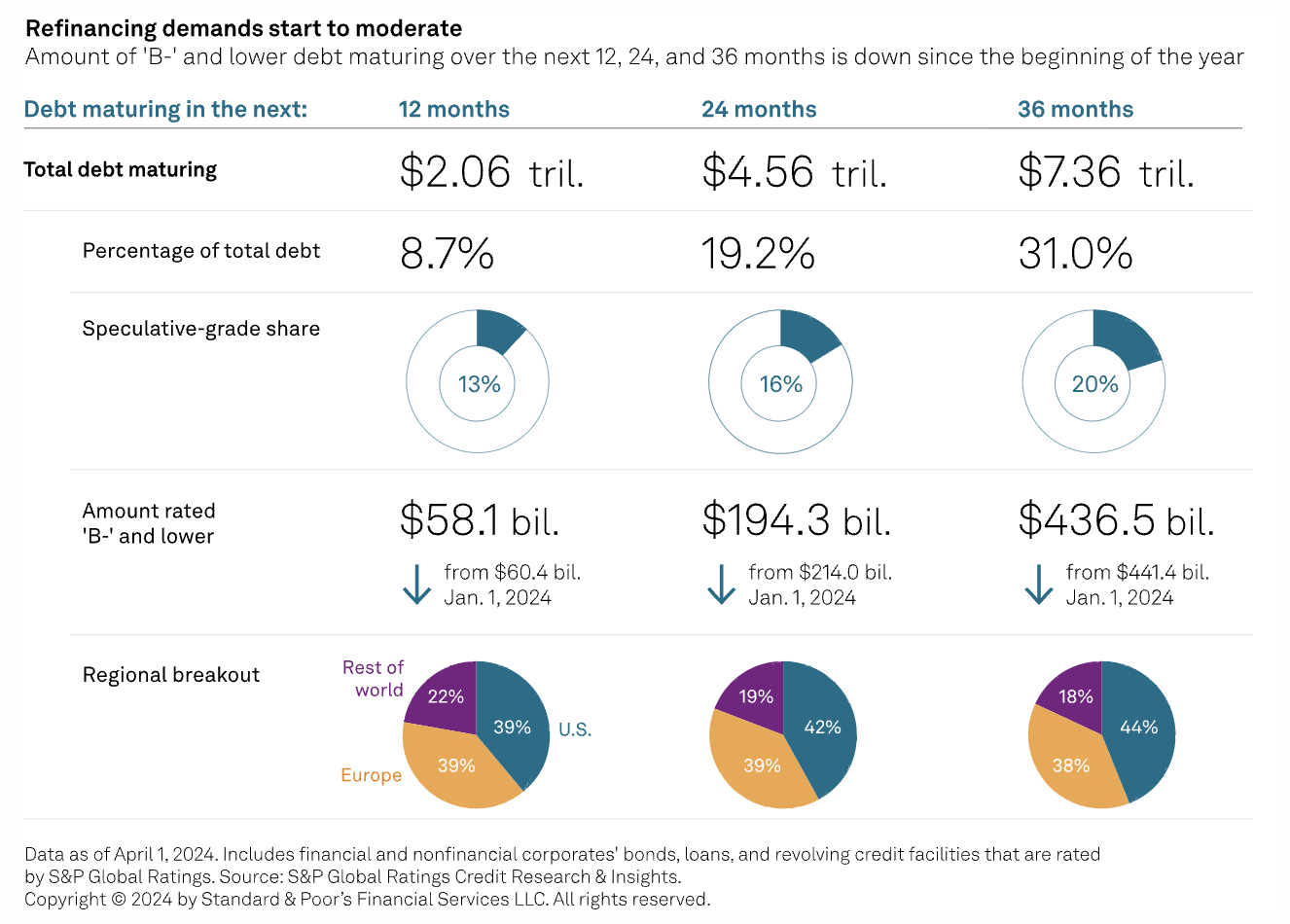

Improving financing conditions in the first quarter of 2024 presented a window of opportunity that many companies took to refinance upcoming debt. Although main central banks kept policy interest rates unchanged in the first quarter, investors' expectations for slowing inflation and upcoming interest rate cuts brought an exuberance to primary markets.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

Your Three Minutes In Banking: Higher Minimum Reserve Requirements Will Dent Swiss Banks’ Profits

Higher minimum reserve requirements could cut Swiss banks' return on equity by about 30 basis points according to S&P Global Ratings estimates. However, given that their current level of central bank reserves far exceeds minimum requirements, S&P Global Ratings doesn’t think Swiss banks will struggle to meet the higher reserves overall. Together with the relatively limited impact on profits, it sees the impact on Swiss bank ratings as neutral.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

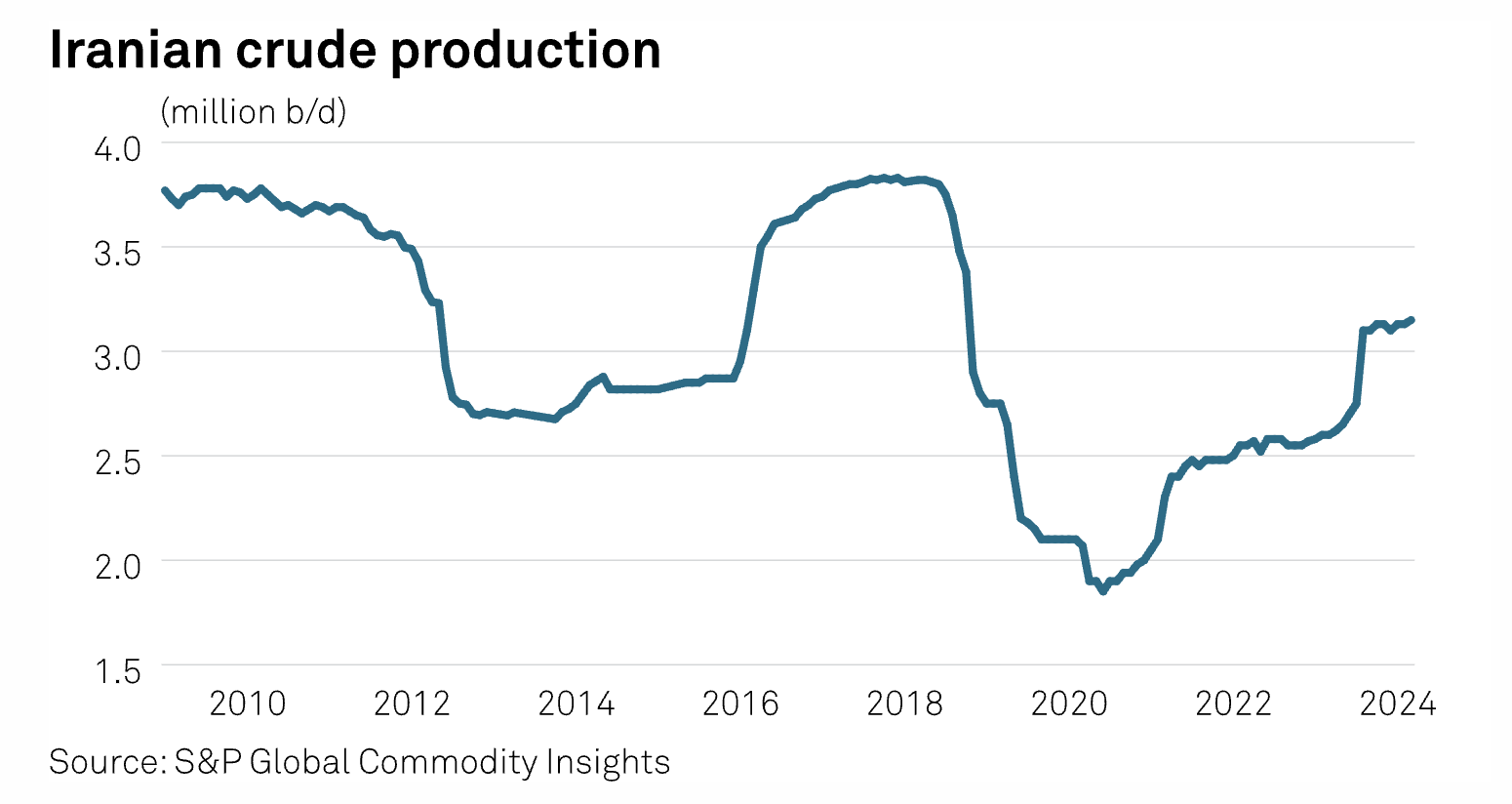

Newly Passed US Law On Iran Sanctions May Have Limited Impact In Near Term: Experts

The Biden administration may leverage new Iran sanctions measures included in the recently passed US security package to pressure Chinese buyers to reduce exposure to Iranian oil, but the legislation is unlikely to have a big impact on oil trade in the near term, experts say. "Since the Biden administration has not enforced existing US sanctions on Iran, expanding sanctions isn't likely to matter," Brenda Shaffer, an energy expert at the US Naval Postgraduate School, told S&P Global Commodity Insights April 24.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

US EPA Defends Carbon Capture Tech Underpinning New Power Plant Rule

The fight over new CO2 limits for power plants is coalescing around a debate over carbon capture, with the US Environmental Protection Agency defending the technology's readiness despite industry groups' arguments to the contrary. The EPA finalized a rule on April 24 that sets a carbon emissions standard for coal- and new gas-fired generation, effectively mandating carbon capture technology for many power plants. The standards prompted criticism from trade groups questioning the feasibility of capturing and storing power plants' CO2 emissions, echoing similar feedback after the EPA's initial proposal in May 2023.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

South Korea Pays Less For US Crude Than Saudi Arabian Barrels For 2nd Straight Month

South Korea reduced imports of Saudi Arabian crude and boosted shipments of US cargoes for the second straight month in March because of more attractive feedstock trading economics for American barrels, as Persian Gulf-Asia tanker insurance costs rose in the wake of geopolitical tensions in the Middle East, industry sources said over April 24-26.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: MediaTalk | Season 2 Ep. 10: Broadband by the Numbers: Adds, Losses and Closing the Digital Divide

In this episode, MediaTalk host Mike Reynolds sits down with S&P Global Market Intelligence Kagan analyst John Fletcher, who specializes in multichannel and broadband. John shares his thoughts on which broadband providers — cable, telco, satellite or fixed wireless — still have room for growth in an age where broadband has very much become a utility. They also discuss how US providers plan to further close the digital divide, especially as federal dollars begin flowing into the system.

—Listen and subscribe to the podcast from S&P Global Market Intelligence