Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 7 Apr, 2020

By Ved Malla

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

In the past five years, capital markets in India have witnessed bull and bear phases. The bulls accounted for most of the five-year period; however, Q1 2020 completely changed this landscape. Due to the COVID-19 outbreak, capital markets have taken a beating both globally and locally in India.

Exhibit 1 and 2 showcase the five-year returns for India’s leading size indices.

From Exhibits 1 and 2, we can see that the returns were promising for large-, mid-, and small-cap segments through December 2019; however, the scenario completely changed in Q1 2020. The returns of the large-cap segment were better than the small- and mid-cap segments across the five-year period. The S&P BSE SENSEX, which comprises the 30 largest and most liquid BSE-listed companies in India, outperformed all size indices.

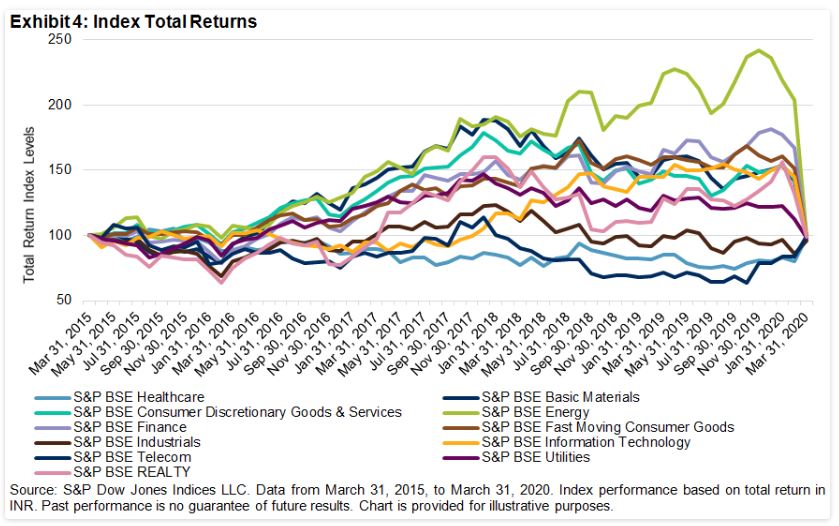

Exhibits 3 and 4 showcase returns for the 11 leading sector indices in India in the past five years.

From Exhibits 3 and 4, we can see that the S&P BSE Energy and S&P BSE Fast Moving Consumer Goods posted promising returns, while the S&P BSE Healthcare, S&P BSE Telecom, and S&P BSE Industrials posted negative returns for the five-year period. All the sectors had negative returns in the Q1 2020.

To summarize, we can say that the bulls had their way during most of the five-year period across all sizes and most sectors through December 2019; however, due to the COVID-19 outbreak, things went south at Dalal street as markets tumbled across all sizes and all sectors during Q1 2020, especially during March.