Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global — 26 Mar, 2020

By S&P Global

More than 525,000 cases of coronavirus have been confirmed worldwide, according to the latest Johns Hopkins University data. Italy has suffered the most deaths, followed by Spain, where the majority of deaths have been reported in nursing homes. Critics are eyeing what they see as Britain’s slow response to addressing this crisis. Mexico and Brazil are dismissing concerns about coronavirus. Nonetheless, while China has celebrated its success in its efforts to control the spread of coronavirus within its own country, some reports suggest that hospitals may be refusing to test symptomatic patients for COVID-19.

The crisis is causing turmoil in the U.S., where confirmed cases exceed 82,000—more than any other country. Approximately half of these cases are in New York State, where almost 40,000 cases have been reported. New York Mayor Bill DeBlasio suggested today that half the city’s population is likely to be infected.

U.S. stocks surged today after Congress’s historic $2 trillion federal rescue bill to support the economy, despite the record 3.3 million Americans that filed for unemployment insurance last week—up from the 282,000 the previous week. For context, 665,000 claims were filed in the depths of the recession in March 2009.

The Federal Reserve announced unprecedented measures to shore up the country’s economy on Monday. Today, Chairman Jerome Powell tried to reassure Americans about the economic effects of the pandemic. The Fed is “working hard to support you now, and our policies will be very important when the recovery does come, to make that recovery as strong as possible,” Powell said. “I think the sooner we get the spread of the virus under control, people will regain confidence—when they become confident that is the case, then they will very willingly open their businesses up, go back to work, the consumer will be spending. So I think the first order of business will be to get the spread of the virus under control, then resume economic activity.”

Leaders around the world are taking similar actions to support economies. G20 leaders committed to do “whatever it takes” to control the damage caused by the crisis, and E.U. leaders discussed appropriate monetary measures the bloc can take to provide emergency aid.

The outbreak could permanently change the ranking of global financial centers as businesses experiment with teleworking and governments adopt a "wartime economy" approach to finance, according to think tank Z/Yen Group. Some emerging markets may be especially vulnerable in a coronavirus-caused recession. Foreign investors are yanking funds from developing economies and driving up credit default risk spreads, creating an uncertain future.

The situation remains troubled for oil markets. Saudi Arabia and Russia appear no closer to a rapprochement in their oil price war, despite today’s G20 videoconference summit. Petroleum prices fell again today, remaining in the $20s/b, as the coronavirus pandemic continued to reduce travel and demand for transportation fuels. Saudi Aramco is moving a substantial amount of its crude to storage caverns in Rotterdam in the Netherlands and Sidi Kerir in Egypt, in line with pledges by the world's largest exporter to supply more barrels to the market in April, sources said.

Today is Thursday, March 26, 2020, and here is essential insight on COVID-19 and the markets.

COVID-19: The 451 Research Take

The rapid spread of COVID-19 may in part be a function of the global, connected economy, but it's also clear that modern technology is already playing a key role in helping organizations cope with this extraordinary and unique situation. From the obvious role that tech is playing in enabling home-based working, keeping at-home children schooled (and entertained) and helping families in isolation keep in touch with their loved ones, we also believe technology will be deployed in increasingly creative and innovative ways – perhaps acting as a catalyst for further adoption and more substantial growth. We already expect to see a surge in the use of contactless payments and mobile wallets to help enable social distancing, for example.

Against all of this, we must balance the increased risk that accompanies the situation – from having staff access sensitive and critical systems remotely to managing a broader attack surface, and ensuring that critical infrastructure can be physically maintained. And it all must happen against a background of ongoing uncertainty as to the extent and duration of the pandemic. The 451 Research team will continue to work to deliver the insight to help leaders navigate this balance as the situation evolves.

—Read the full report from 451 Research, part of S&P Global Market Intelligence

Senate passes $2 trillion emergency economic aid bill as pandemic rages

The U.S. Senate voted March 25 overwhelmingly in favor of a roughly $2 trillion package to provide economic aid to American citizens and businesses affected by the coronavirus pandemic. Senators voted 96-0 to pass the $1.8 trillion CARES Act, which would provide much sought-after cash relief to workers who make up to $75,000 per year: $1,200 for individuals and $2,400 for married couples, with an additional $500 for each child, as well as four months of enhanced unemployment insurance.

The bill also aims to provide hundreds of billions of dollars to U.S. businesses decimated by widespread layoffs and closures, including $500 billion in loans or investments to corporations as well as $350 billion to small businesses.

—Read the full article from S&P Global Market Intelligence

In a coronavirus recession, some emerging markets look especially vulnerable

As the novel coronavirus pandemic has spurred an en masse flight to safety and battered economic growth expectations, foreign investors are yanking funds from emerging markets and driving up credit default risk spreads, creating an increasingly uncertain future for some developing countries.

Across global emerging markets, credit default swap spreads, a key measure of credit risk, have jumped markedly in recent weeks — tripling or quadrupling in some cases — as fears of a global recession have grown. In Indonesia and Malaysia, for instance, CDS spreads have spiked by more than 400% over the past month. African countries like Angola and Nigeria and Latin American countries including Brazil and Colombia have seen even sharper increases.

—Read the full article from S&P Global Market Intelligence

COVID-19 to hit global financial centers; London, Tokyo more exposed – Z/Yen

The COVID-19 outbreak could permanently change the ranking of global financial centers as businesses experiment with teleworking and governments adopt a "wartime economy" approach to finance, Z/Yen Group said. The think tank, in cooperation with the China Development Institute, compiles a ranking of the leading global financial centers, which is released twice a year, in March and September. The latest index, its 27th installment, released March 26, shows Hong Kong dropping from third place to sixth and being replaced by Tokyo. New York and London retained first and second, while Shanghai and Singapore were fourth and fifth.

All five leading global financial centers posted double-digit drops in their ranking since the September 2019 installment of the index. The change in the latest index, GFCI27, has been "tremendous" and bigger than ever seen before, Michael Mainelli, executive chairman of Z/Yen Group said at the presentation of the results.

—Read the full article from S&P Global Market Intelligence

Rapid Reset

Over the past decade, we witnessed the longest economic expansion in history. During that time, risk appetite spiked, elevated largely by deflated interest rates around the globe in the wake of the Global Financial Crisis, as accommodative monetary policy lifted many investors up the risk curve. As in previous crisis periods, elevated risk asset valuations could not hold; today, those levels face the sobering reality of a global pandemic, which has driven global equities into a bear market and threatens to cause a global recession. This drop was different than others before it, however, as it took only a month for stock prices to fall from all-time highs to a deep trough, making it the fastest decline into bear market territory for many major equity benchmarks in history. Investors are now struggling through a rapid reset, looking for the bottom while curtailing their risk appetite.

Though some market pundits repeatedly predicted the collapse of the stock market over the past decade only to be proven wrong time and again with each new market high, during the 2010s, we witnessed one of the least-volatile eras in modern financial markets. There was one asset class that remained volatile during the past 10 years, however. Commodity market volatility has nearly always been more elevated than that of equities markets, and for good reason: commodities are not anticipatory assets, and spot prices largely reflect the current physical supply and demand dynamics of each underlying commodity. S&P Dow Jones Indices highlights that difference in volatility; of particular note is the volatility over the longer term, where the S&P GSCI and S&P GSCI Gold were clearly more volatile than equities or fixed income.

—Read the full article from S&P Dow Jones Indices

CLO Spotlight: To 'B-' Or Not To 'B-'? A CLO Scenario Analysis In Three Acts (UPDATE)

As of today, exposure to loans from 'B-' rated obligors has reached a record level, constituting nearly 19% of U.S. broadly syndicated loan (BSL) CLO transaction collateral pools. This reflects the trends playing out in the overall U.S. corporate loan market. The increase in loans from 'B-' rated obligors has drawn the market's attention, as ratings on these companies can be volatile. Even in relatively benign credit environments, about 10% of 'B-' rated issuers, on average, experience downgrades. During periods of economic stress, credit deterioration among 'B-' issuers can be particularly severe: In the last credit downturn, more than 40% were downgraded over the course of a given year, some of which defaulted.

In an effort to shed some light on the potential impact of downgrades and defaults within the cohort of 'B-' rated obligors on rated U.S. BSL CLOs, we created three scenarios of increasing severity, based on broad hypothetical outcomes. These scenarios are not meant to be predictive or part of any outlook statement, nor are they meant to reflect any of the stresses outlined in our rating definitions; they are specifically geared to address the questions and concerns voiced to us from CLO market participants.

—Read the full article from S&P Global Ratings

European Corporate Securitizations: Assessing The Credit Effects Of COVID-19

In the U.K., a mandatory closure of all public houses (pubs), restaurants, cafes, and other non-essential businesses came into effect on March 22, 2020, with three-week-long restrictions put in place starting the evening of March 23. We have identified three European corporate securitization transactions that, in our view, will be directly affected. The ability of the borrowers to withstand the pending liquidity stress will come down to their current level of headroom over their financial covenants and readily available sources of liquidity. As we develop better clarity on the expected size and duration of reductions in transactions' securitized net cash flows, we will evaluate whether adjustments to our base-case and downside projections are appropriate.

—Read the full article from S&P Global Ratings

COVID-19: Implications For European Real Estate Investment, As Tenants Begin To Suspend Rent Payments

Measures to contain COVID-19 are eroding the credit quality of real estate investment companies in Europe as tenants start to skip rental payments. Social-distancing measures and authorizations to skip rental payments for corporates in difficulty will likely weigh on landlords' revenue in 2020, depending on the duration of the outbreak. The retail and hotels property segments should suffer the most in the short term, while the effects on other real estate segments will likely take more time. Deteriorating financing conditions could affect real estate companies, which heavily rely on capital markets.

—Read the full article from S&P Global Ratings

S&P: For-profit hospitals may weather procedure cancellations amid COVID-19

Most for-profit hospitals should have enough liquidity to overcome the next three to six months of volume declines as the coronavirus pandemic continues to stress health systems and take a toll on the U.S. economy, according to S&P Global Ratings analysts.

David Peknay, director of corporate healthcare ratings for Ratings, said during a March 26 webcast that for-profit hospitals could face as much as a 20% drop in admissions primarily from the canceling of elective procedures due to the accelerating U.S. outbreak. "We will see unprecedented volume decline in a very short time frame," Peknay said. "It's already happening." However, most hospital companies should be able to recover from the setback in the short-term, according to Peknay.

"As of now, we think that most of the hospital companies that we rate do have the liquidity to overcome the temporary dislocation that they now face in three-month and six-month periods," Peknay said, adding that the situation is subject to unknown factors.

—Read the full article from S&P Global Market Intelligence

CHART OF THE DAY

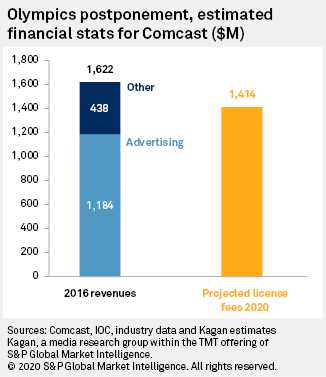

Another Outcome Of COVID-19: Olympics Postponed

As live professional sports hit a standstill around the world, a new casualty of postponement is the 2020 Summer Olympic Games, formerly scheduled to begin in July. Comcast Corp.'s NBC had licensed U.S. rights to the games for an estimated $1.4 billion. However, the impact will be spread across their broadcast and cable networks, along with TV stations, since most outlets were slated to air some of the games.

Total revenue from the 2016 Rio games was $1.6 billion, which included nearly $1.2 billion in advertising. In early March, NBC revealed that it had received more than $1.25 billion in commitments against the games, selling 90% of inventory for national ads. That figure is about 6% above the total delivery for the 2016 games.

—Read the full article from S&P Global Market Intelligence

APAC box office revenues drop 85% YOY as COVID-19 closes theaters

Asia-Pacific box office revenues fell 85% year over year in the first two months of 2020, according to data from S&P Global Market Intelligence and OPUSData, as the coronavirus caused theater closures and a sharp drop in the number of releases.

China was the worst hit, seeing an estimated 96.2% decline year over year in January and February. Cinemas in the country closed at the end of January to prevent the spread of the coronavirus. Just over 500, or 4.5% of the total, reopened in late-March, although audience numbers reportedly remain below pre-virus levels. Blockbuster releases planned for the long Lunar New Year weekend were postponed, with just 24 films being screened for the first time in January and February, according to the data. The number of releases across APAC fell 49.2% year over year in February to a 13-month low.

—Read the full article from S&P Global Market Intelligence

Italy, UK box offices saw solid start to 2020 before COVID-19 hit

Box offices in the United Kingdom and Italy enjoyed a solid start to 2020 before the coronavirus outbreak closed film theaters across Europe, according to data compiled by S&P Global Market Intelligence and OPUSData. The U.K. was the highest-grossing country in the region in January and February with US$201.9 million, down 0.1% year over year. The number of film releases rose 17.8% year over year in the first two months of 2020, to 126. Film theaters closed in mid-March as businesses took measures to stop the spread of the coronavirus. Italy recorded US$128.8 million in the box office revenue in January and February, down 5.1% from the prior-year period. Releases fell 39.1% year over year. Cinemas closed early-March and film production halted until at least April 3. France was the second-highest-grossing European box office in January and February with US$139.6 million, down 53.6% on the prior-year period.

Europe box office revenues declined 21.9% in the first two months of the year, as every tracked market except Turkey saw year-over-year declines. The number of film releases in Europe dropped 22.4% year over year in February to a 13-month low.

—Read the full article from S&P Global Market Intelligence

OTT Winners, Losers In The Age Of COVID-19

Over-the-top video services might seem to be obvious winners as people around the world go into mandatory or self-imposed quarantines, but the outlook remains uncertain for most operators. The popular subscription video-on-demand model is based on fixed-rate pricing regardless of consumption, so popular SVOD services such as Netflix Inc., Amazon.com Inc. Prime Video, and HBO Now do not directly benefit from a short-term spike in consumption. Hybrid services such as ViacomCBS Inc.'s CBS All Access and Hulu LLC that offer an ad-supported tier might be more likely to see a bump in advertising revenues. Many major sports leagues around the world are pressing the pause button and big advertisers potentially shift digital ad spend that might otherwise have gone towards live sports on linear TV.

Complicating matters, though, is that ViacomCBS and The Walt Disney Co. — the respective parents of CBS All Access and Hulu — derive a relatively small percentage of their revenues from their OTT offerings, with any gains from digital advertising minimized when compared to losses felt across their other operations. Most major SVOD services are operated by larger parents such as Amazon, Apple Inc., AT&T Inc. and big media companies with much larger revenue streams outside of their video offerings that could face far more downside there from the impact of the novel coronavirus.

—Read the full article from S&P Global Market Intelligence

G20 summit concludes, with no resolution on Saudi-Russia oil price war

Saudi Arabia and Russia appear no closer to a detente in their oil price war, despite Thursday's videoconference summit of G20 leaders to discuss the coronavirus' impact on the world economy. A post-meeting statement by the organization did not mention oil nor energy, despite US pressure on Saudi Arabia this week to ease off its plans to flood the market with crude, with prices already reeling from the coronavirus outbreak. The virtual meeting was hosted by Saudi King Salman bin Abdulaziz, who holds the G20's chairmanship this year.

"We commit to do whatever it takes and to use all available policy tools to minimize the economic and social damage from the pandemic, restore global growth, maintain market stability, and strengthen resilience," the G20 said.

—Read the full article from S&P Global Platts

US pressures Saudi Arabia to give up oil price war with Russia

The US is urging Saudi Arabia to back off its oil price war with Russia, with Secretary of State Mike Pompeo calling Crown Prince Mohammed bin Salman on Tuesday. The official Saudi Press Agency said the two "reviewed exerted efforts to maintain stability in the global energy markets."

The US State Department's readout of the call said that Pompeo "stressed that as a leader of the G20 and an important energy leader, Saudi Arabia has a real opportunity to rise to the occasion and reassure global energy and financial markets when the world faces serious economic uncertainty."

The call came ahead of a G20 leaders videoconference that Saudi King Salman bin Abdulaziz, who holds the international body's chairmanship this year, is hosting Wednesday to discuss the response to the coronavirus outbreak, which has already caused a major contraction in oil demand.

—Read the full article from S&P Global Platts

Russian oil, gas output to continue smoothly despite new coronavirus measures

Russian oil and gas producers said Thursday that measures introduced so far to combat the spread of the coronavirus in Russia will not affect oil and gas production and supply. Russia ramped up measures to combat the virus on Wednesday, with Russian President Vladimir Putin announcing that next week would be a paid non-working week throughout the country. Oil and gas producers said that this does not apply to those workers ensuring smooth operations at oil and gas production projects and supply chains.

—Read the full article from S&P Global Platts

Factbox: Crude remains in the $20s/b as coronavirus spread reduces demand

Petroleum prices fell Thursday, remaining in the $20s/b, as the coronavirus spread continued to reduce travel and demand for transportation fuels. The market remains glutted with crude as Saudi Arabia and Russia have yet to back off their plans to expand market share regardless of the drop in demand. The two countries appear no closer to a detente in their oil price war, despite US pressure on Saudi Arabia this week, and a videoconference summit of G20 leaders to discuss the coronavirus' impact on the world economy.

Global coronavirus cases continue to grow. According to Johns Hopkins University, there were 491,623 confirmed cases Thursday, up 240,119 cases in a week. Cases in China have flattened out at roughly 82,000, with the growth coming from the rest of the world. Gasoline and jet fuel crack spreads have been especially hard hit, with some turning negative as governments increasingly close businesses and schools, while airlines slash flights.

—Read the full article from S&P Global Platts

US oil, gas rig count drops by 47 to 766 on week amid extreme activity cutbacks

The US oil and natural gas rig count dropped by 47 to 766 on the week, according to rig data provider Enverus, as exploration and production operators continued to steeply reduce capital budgets and activity for 2020 owing to both low oil demand and plunging crude prices due to the coronavirus pandemic.

The drop was the largest single-week hit since the final week of December 2015, when the rig count fell 77 to 691 while oil prices were in the mid-$30s/b and falling. Crude prices are even lower now. Around 2:40 pm ET Thursday, front-month WTI crude was trading below $23/b.

—Read the full article from S&P Global Platts

Saudi Aramco boosts European crude inventories in bid to gain market share

Saudi oil giant Saudi Aramco is moving a substantial amount of its crude to storage caverns in Rotterdam in the Netherlands and Sidi Kerir in Egypt, in line with pledges by the world's largest exporter to supply more barrels to the market in April, shipping and trading sources said Thursday. With refinery demand severely weakened by the coronavirus pandemic, sources said Aramco was making use of its storage hubs near the world's key refineries.

This week five tankers carrying a total of 7 million barrels of crude have been placed on subjects on a Sidi Kerir to Rotterdam voyage by Saudi state-owned shipping company Bahri, according to sources. All these tankers are poised to load in the first week of April, with three Suexmazes and two VLCCs being used. It is very rare for Saudi Aramco to send so much crude to Rotterdam, sources said.

—Read the full article from S&P Global Platts

US extends Iraq's waiver to import Iran electricity and gas, possibly for last time

The US on Thursday again extended a waiver allowing Iraq to import Iranian electricity and natural gas despite US sanctions, Morgan Ortagus, a State Department spokeswoman, said in a statement.

"Under a US-issued sanctions waiver, Iraq is permitted to engage in financial transactions related to the import of electricity from Iran," Ortagus said. "The purpose of this waiver, which the United States is renewing today, is to meet the immediate energy needs of the Iraqi people."

The extension is for 30 days, the shortest extension yet for Iraq, and will be the last extension issued, AFP reported Thursday. State Department officials did not respond to requests for additional information Thursday.

—Read the full article from S&P Global Platts

PODCAST OF THE DAY

Listen: Efforts to combat coronavirus lead to changes for US power markets

The coronavirus pandemic has impacted all aspects of daily life and US power markets are not immune. With the majority of people staying at home, per recommendations to stop the spread of the disease, grid operators are keeping a close eye on changes in power demand and how to respond.

—Share the Commodities Focus podcast from S&P Global Platts

Future dims for Middle East refiners amid worsening Q2 outlook

Refiners in the Middle East are expected to face mounting pressures in the second-quarter of the year, with product cash differentials likely to extend their downward trend as the region suffers a double whammy of faltering consumer fuel demand and oversupply, following the end of an extensive refinery turnaround season.

The bearishness comes as the coronavirus, or COVID-19, has continued to spread rampantly across the region, an issue that has rocked the global economy, equity and commodity markets. Saudi Arabia, the hardest hit of the Gulf Cooperation Council, or GCC states with 900 cases as of early Thursday, has locked down three cities and tightened curfews, joining fellow GCC member Kuwait, which announced a two-week public holiday from March 12, after suspending all international flights, except cargo carriers. UAE's national carrier Ethihad Airways also announced earlier this week a temporary 14-day suspension of all passenger flights top, from and via Abu Dhabi with effect from Thursday, March 26. Emirate Airlines mirrored the move and also announced a temporary two-weeks suspension of all passenger flights which took effect from Wednesday, March 25. With people staying home and businesses shut, this has translated to feeble demand for refined oil products, with gasoline and gasoil the hardest hit in line with a sharp slowdown in driving activity.

According to latest S&P Global Platts Analytics estimates, oil product demand in the Middle East is forecast to fall 0.6% year on year to average 9.7 million b/d in the first half of this year, with full year 2020 total oil product demand also likely drop by 0.2% year on year.

—Read the full article from S&P Global Platts

Pennsylvania's orders to stem coronavirus outbreak pause several gas pipeline projects

Pennsylvania's social-distancing orders prompted a temporary halt to construction of several natural gas pipeline projects in the state, but some developers were working to secure waivers to allow more work to continue. The state, with its large shale deposits, also is home to a number of ongoing midstream projects meant to move gas to market. After Pennsylvania Governor Tom Wolf late last week ordered all non-life-sustaining businesses to close, Energy Transfer was halting new construction on the Mariner East 2 project, but has since gained permission for limited activity, such as maintaining the right-of-way and work sites, and securing, stabilizing, and moving equipment.

—Read the full article from S&P Global Platts

Road to 5G largely on track despite COVID-19 concerns

The coronavirus should not significantly hinder U.S. operators' next-generation 5G deployment strategies this year and could even spur quicker adoption of future use cases for the mobile technology, analysts said. As the novel coronavirus requires more people to stay at home, top U.S. wireless carriers — T-Mobile US Inc., Verizon Communications Inc., AT&T Inc. and Sprint Corp. — have been busy accommodating the surge in network traffic by requesting additional bandwidth from the government to meet customer demands for more data. While the companies' response efforts could temporarily halt their 5G rollout plans, analysts expect the impact to be short-lived. They also note the way the virus is changing the business landscape could speed up adoption of future 5G applications that were largely considered a few years off, including augmented and virtual reality, telemedicine and industrial automation.

Three of the top four U.S. wireless carriers have either launched or vowed to launch nationwide 5G service this year. When fully implemented, 5G promises to offer download speeds several times faster than current LTE wireless networks and significantly lower latency times, or the amount of time between data leaving a source and arriving at its desired destination.

—Read the full article from S&P Global Market Intelligence

US utilities divided on plans to sequester essential employees

While all Americans have been advised by healthcare professionals to practice "social distancing" or to work from home if possible in order to "flatten the curve" of active coronavirus cases, the question looms as to when and where more-stringent pandemic containment measures may be enacted. The problem? Many utility workers could be hard-pressed to perform their critical roles if they become subject to a shelter-in-place order.

"Those who have the ability to work from home are trying to set this up, but there are obviously a lot of our members who aren't able to do this," said Utility Workers Union of America President Jim Slevin in an emailed statement. According to the union, essential power plant, utility or grid operator employees currently are not legally required to continue working during an emergency. Perhaps because of that lack of a requirement, U.S. electric utilities as a whole do not have one across-the-board policy guiding their staffing decisions during the COVID-19 pandemic, and their individual responses to S&P Global Market Intelligence inquiries regarding any plans they may have to sequester essential workers varied.

—Read the full article from S&P Global Market Intelligence

US battery storage boom hits COVID-19 roadblock as project delays mount

After entering 2020 buoyed by aggressive growth forecasts, U.S. energy storage developers now face widespread project delays as a result of disruptions caused by the global coronavirus pandemic. Pacific Gas and Electric Co.'s 182.5-MW Tesla Moss Landing Battery Energy Storage Project (Elkhorn), for instance, a marquee project planned near the shores of California's Monterey Bay, was on track to start construction in late March. That will not happen now as Pacific Gas and Electric, or PG&E, has postponed groundbreaking "until after the stay-at-home order is lifted," according to Paul Doherty, a spokesperson for the utility.

Gov. Gavin Newsom issued the statewide order March 19 without naming a specific end date. In the meantime, the PG&E Corp. subsidiary is prioritizing "critical and essential safety and maintenance work" on its electric and natural gas system, Doherty said. The utility still hopes to have the system, which uses lithium-ion batteries from Tesla Inc., "energized by the end of 2020 and fully operational in the first quarter of 2021," Doherty said. But that depends on when Newsom deems it safe for Californians to resume their normal daily lives. Such postponements and risks are mounting fast, jeopardizing the momentum of an emerging industry in a critical year in which some market observers had expected annual U.S. battery storage additions to exceed 1,000 MW for the first time.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language