Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Mar, 2020

By S&P Global

World Health Organization Director-General Tedros Adhanom Ghebreyesus said today that many countries have “squandered the first window of opportunity” to fight the coronavirus pandemic and that the time to act was “more than a month ago or two months ago.” As the humanitarian impact continues to rise—with confirmed cases approaching half a million—determining what the global economy will look like, and how it will operate, at the conclusion of this crisis is difficult to predict.

In the immediate term, current forecasts foresee proximate detrimental risks to sovereigns’ and companies’ creditworthiness and stability. Private equity firms are turning away from mergers and acquisitions to focus on their portfolio companies, delaying and even abandoning deals close to the finish line. With airline fleets grounded, airports deserted, and travelers ordered to stay home, the global aviation industry could require billions of dollars of government cash to secure its future. The aircraft-leasing sector should fare better than airlines in the downturn but may still face pressure on revenues and cash flow.

Coronavirus is having a particular impact on Europe, where Italy is suffering from the world’s greatest death toll due to COVID-19, more people have died in Spain than in China, and England’s Prince Charles tested positive for the virus.

In an effort to ease lending during the COVID-19 outbreak, bank authorities across Europe have either cut or frozen countercyclical buffers. The buffers are meant to protect banks from procyclicality, which may disrupt the credit supply and amplify the impact of an economic downswing on the financial system. Supervisors may deem it necessary for banks to use all "rainy-day" reserves they had set aside for times of crisis.

European utilities are likely to lower their planned investments 10%-15% this year as they try to preserve cash and adapt to supply chain disruptions. Dividends in the sector could also be scaled back and earnings could be cut significantly. Europe's largest utilities plan to spend billions on building new wind and solar plants, expanding their power and gas networks, and branching out into new business areas such as energy storage and electric vehicles. The U.S. coal industry is concerned that the federal government has not explicitly included coal-fired power plants to be critical infrastructure as the country combats the COVID-19 pandemic.

Hotels and lodging companies are suffering sharp falls in revenue due to the escalation of the pandemic. S&P Global Ratings believes that asset-light hotel operators' lower fixed costs place them in a better position than asset-heavy operators to withstand pressures. Our base case assumes a European revenue per available decline of 20%-30% this year, with a full recovery only in 2022-2023.

Like most other sectors, the European CLO market is vulnerable to the effects of the pandemic, but in the short-term S&P Global Ratings doesn’t expect rated European CLO transactions to experience significant downgrades. Key transaction indicators such as the level of 'CCC' category rated assets, the proportion of defaulted assets, and overcollateralization cushions suggest transactions are protected from a degree of deterioration in portfolio credit quality.

Oil markets are trapped in the same uncertainty as other global markets. Crude futures extended gains in midmorning trade in Asia today following an overnight rally in U.S. equities in anticipation of Washington’s economic-stimulus package. However, the Trump Administration's plan to add to petroleum reserves appears to be on hold after Congressional leaders removed funding for it from the coronavirus aid package. The $3 billion requested by the administration to buy U.S. oil could still be added to future coronavirus stimulus legislation. The Federal Reserve Bank of Dallas released a quarterly energy survey today that painted a grim portrait of the U.S. oil and natural gas sector’s struggles. Next week, Saudi Arabia is set to unleash a surge of crude oil that refiners increasingly say they neither want nor need. The kingdom has yet to prove it can follow through on its plans to pump an unprecedented 12 million b/d of crude — almost 1 million b/d higher than previous levels.

India’s lockdown, implemented yesterday to protect its 1.3 billion people, could hurt energy consumption and logistics at the world's third-largest oil importer and fourth biggest LNG consumer.

As countries scramble to tackle the spread of the coronavirus, action against climate change has taken a back seat. Investors seem confident that in the long-term, the clean-energy sector is poised for growth—but companies that generate predictable revenues from contracted renewable energy assets have seen their status as safe havens disappear in recent weeks.

Additionally, recycled polyethylene terephthalate plants in the United Kingdom remain at high production capacity as orders for food and beverage packaging remain robust. As the pandemic has prompted consumers to stock up on supermarket essentials, like packaged food and bottled water, converters are calling on suppliers of R-PET clear flakes and food-grade pellets for additional volumes. However, as infection rates continue to rise and European nations restrict movement in an attempt to limit the geographic spread of the virus, petrochemical supply chain concerns are rising.

Today is Wednesday, March 25, 2020, and here is essential insight on COVID-19 and the markets.

Private equity firms drop M&A to focus on portfolio companies amid coronavirus

The private equity industry has turned its attention away from dealmaking activity to focus on its portfolio companies for the time being, amid the immense uncertainty driven by the coronavirus outbreak. Processes that were near to closing are being completed, but those that were not as far along are, on the whole, being delayed or canceled, according to market participants.

Private equity firms are keeping a particular eye on their portfolio companies operating in sectors that have been hit by uncertainty and social distancing measures, such as travel; food, beverage and restaurants; and entertainment and theaters. But the broader business market is also being advised of knock-on effects to businesses within the supply chain as companies review their spending and costs.

—Read the full report from S&P Global Market Intelligence

Coronaviral Correlations

Roughly a month ago, Craig Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices, used a dispersion-correlation map to describe how index dynamics can illuminate market movements. In particular, he reported that since high dispersion seems to be a necessary condition for a bear market, and S&P 500 dispersion levels at the end of February were far below those prevailing in past declines and conditions at that time did not look like bear markets had historically looked. Since our analysis uses a 21 trading day lookback, he providentially noted that “in 21 more days we’ll have a completely new set of observations.”

21 days have now passed, and we have a completely new set of observations. Market dynamics have evolved with extraordinary speed, as any sentient observer knows. There has been a decline in the S&P 500 since its February 19th high, plotted against comparable data from the 2007-09 financial crisis. The index declined 32% from its peak through the close of trading on March 20, 2020. The comparable loss of value during the financial crisis required a full year.

—Read the full article from S&P Dow Jones Indices

U.S. Corporate Debt Market under Pressure

Since mid-February, the market has turned sharply down in response to the coronavirus pandemic. The S&P 500® has fallen about 32% from its peak this year. Equity volatility shot up, as VIX® went from historical lows to the 70-80 range, which was last seen in November 2008. The 10-year U.S. Treasury Bond yield reached 0.32% intraday before it bounced back above 1%, as the market expected more debt issuance with drastic fiscal measures to combat the economic slowdown. How has U.S. corporate debt weathered this market storm so far?

S&P Dow Jones Indices shows the average credit spread of the U.S. corporate bond market in the context of post-2008 global financial crisis (GFC). The recent move has put spreads at the widest since the GFC, and still much tighter than the peak level during the 2008 GFC when the investment grade spread reached over 500 bps and high yield over 2000 bps.

How did corporate bonds with different credit quality perform during this market stress? S&P Dow Jones Indices charts the spread difference between spreads of investment grade versus ‘BBB’ and ‘BB’ versus ‘B’. The widening of spreads between rating buckets has been consistent with the direction of spread widening, and the fact that the spread between ‘BB’ and ‘B’ has reached a new post-GFC high is very concerning. In fact, the weighted average price of leveraged loans dropped to 77.06 on March 19, 2020, a new low since the rally after 2009. Market participants may now wonder about the funding and default risk ahead.

—Read the full article from S&P Dow Jones Indices

Nike shares rise as digital sales offset store closures in China

Shares of Nike Inc. jumped in after-hours trading as the company's digital sales offset the fiscal third-quarter 2020 revenue drop in China amid the COVID-19 outbreak. The company's retail volume in China plummeted after Nike closed more than 5,000 stores in the region and reduced hours at others, but Nike CEO John Donahoe said online sales made up for the losses. As cities across China shut down to prevent further spread of the virus, Donahoe said Nike used its digital app ecosystem and expert trainer network to encourage consumers across China to stay active while at home.

—Read the full article from S&P Global Market Intelligence

Rating Actions Taken On Various European Hotel And Travel Companies As COVID-19 Pandemic Escalates

The hotel and lodging sector is facing an unprecedented freefall in passenger numbers due to the rapid escalation of the COVID-19 pandemic. In addition, S&P Global Ratings' economists are now pointing to a global recession in 2020 which could translate to a financial and liquidity crisis for some companies within the sector. Hotels and lodging companies are undergoing acute falls in revenue per available room (RevPar). We believe that asset-light hotel operators' lower fixed costs place them in a better position than asset-heavy operators to withstand these pressures.

We are therefore revising the outlooks on asset-light operators InterContinental Hotels Group PLC and Accor S.A. to negative from stable and affirming the ratings. At the same time, we are downgrading Thame and London Ltd. (Travelodge) and placing the ratings on Casper MidCo SAS (B&B Hotels) on CreditWatch negative. We are placing the ratings on Amadeus IT Group S.A. on CreditWatch negative and last week we downgraded the tour operator TUI to 'B-' and placed it on CreditWatch negative because of liquidity concerns.

Our base case assumes a European RevPar decline of 20%-30% for 2020, with a full recovery only in 2022-2023. We continue to monitor the fast-evolving situation and update our expectations and assessments for European hotel and travel operators.

—Read the full research report from S&P Global Ratings

European CLOs: Assessing The Credit Effects Of COVID-19

At the beginning of 2020, the European collateralized loan obligation (CLO) market was facing several challenges, including credit deterioration, difficult arbitrage conditions, and asset scarcity. CLO investor concerns were typically over corporate credit deterioration and leverage ratios, expected recoveries, and loose documentation. At the macro level, trade wars, Brexit, and extended low rates were among the top risks. In spite of these concerns, CLO issuance started strongly, with several new transactions and senior note spreads dipping to a 20 month low. However, the sudden economic stop caused by the spread of COVID-19 and related containment measures will lead to a global recession, in S&P Global Ratings' view.

We expect a surge in the European speculative-grade corporate default rate to the high single digits over the next 12 months, although the severity will vary significantly by sector and individual credit characteristics. As a result, there could also be an impact on CLOs, which are securities backed by a portfolio of corporate debt, typically senior secured loans made to speculative-grade companies, whose average credit rating is in the 'B' ('B+', 'B', and 'B-') category.

—Read the full article from S&P Global Ratings

Global Covered Bonds: Assessing The Credit Effects Of COVID-19

It's unlikely that a deterioration in short-term liquidity caused solely by mortgage forbearance initiatives would lead to the downgrade of covered bond programs, given their dual-recourse nature. Any potential changes to sovereign or issuer credit ratings as a result of the COVID-19 pandemic would be more likely to trigger changes in our covered bond ratings. However, most covered bond programs that S&P Global Ratings rates have a stable outlook and can withstand some degree of issuer or sovereign downgrades without affecting the program rating.

—Read the full article from S&P Global Ratings

Not-For-Profit Acute Care Sector Outlook Revised To Negative Reflecting Possible Prolonged COVID-19 Impact

S&P Global Ratings is revising its sector outlook on the not-for-profit acute health care sector to negative from stable due to the rapidly evolving COVID-19 pandemic that has created additional and significant uncertainty in the industry and may lead to a higher than typical rate of negative outlook revisions or rating changes in 2020 if the crisis is prolonged. For all health care organizations, we believe the pandemic will result in sizeable increases in operating costs, particularly for labor and supplies, reduced volume and revenues related to elective and non-essential health care needs, reliance on working capital lines of credit, and material declines in unrestricted reserves and non-operating revenue as the investment markets weaken. These added constraints are coming at a time when organizations were already under some revenue and expense pressure related to industry dynamics and balance sheet strength had been a stabilizing factor.

—Read the full article from S&P Global Ratings

European bank authorities release rainy-day funds to aid lending amid COVID-19

In an effort to ease lending during the COVID-19 outbreak, bank supervisors across Europe have either cut or frozen countercyclical buffers alongside a slew of other measures aimed at releasing more bank capital. The buffers are meant to protect banks from procyclicality, which may disrupt the credit supply and amplify the impact of an economic downswing on the financial system. The blow the outbreak has dealt to the real economy so far is severe enough that supervisors deem it necessary that banks use all the "rainy-day" reserves they had set aside for times of crisis.

—Read the full article from S&P Global Market Intelligence

Federal Reserve Becomes Buyer of Last Resort

In a previous blog, S&P Dow Jones Indices discussed the U.S. Federal Reserve’s initial responses to the current market volatility and resultant dislocations. In short, dropping rates to 0% and adding over USD 1 trillion to the funding markets did little to abate the severity of the situation. In an effort to prevent a liquidity crisis from turning into a solvency crisis, the Federal Open Market Committee (FOMC), in combination with the Department of Treasury, has rolled out the following measures.

Quantitative Easing (QE) is back and bigger than ever: The FOMC will purchase at least USD 500 billion of Treasury securities and at least USD 200 billion of mortgage-backed securities. There’s no telling exactly what this amount could climb to, given that the objective is to purchase “amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy.”

—Read the full article from S&P Dow Jones Indices

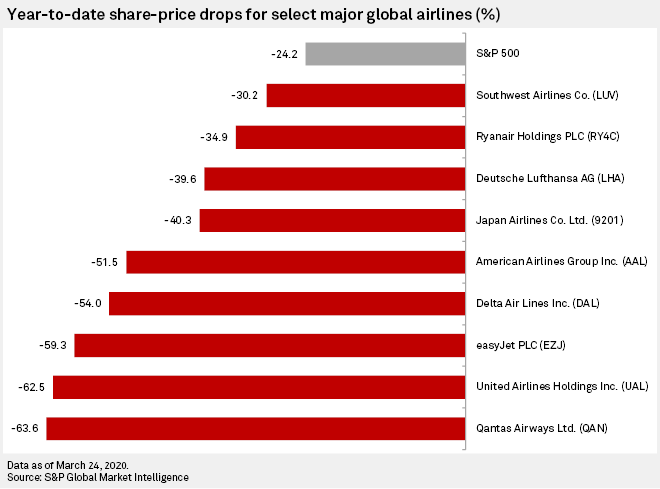

CHART OF THE DAY

Airlines seek state aid as industry grapples with coronavirus crisis

Air traffic had approximately halved in Western Europe by March 19, according to the International Air Transport Association, or IATA. CEO Alexandre de Juniac said March 24 that demand for air travel could fall 38% year over year in 2020 if lockdowns persist for three months, equating to $252 billion in lost revenue.

As airlines around the world were withdrawing earnings guidance, putting staff on leave and announcing layoffs, Deutsche Lufthansa AG's CEO Carsten Spohr on March 19 told analysts that the aviation industry would emerge "smaller" in the aftermath of the crisis. Executives at American Airlines Group Inc. and Delta Air Lines Inc. said they were already considering early retirement of older, less-efficient aircraft.

—Read the full article from S&P Global Market Intelligence

Aircraft Lessors, Hit By Coronavirus Fallout, Should Fare Better Than Their Airline Customers

Aircraft leasing companies are facing mounting requests from their airline customers for deferral of lease rentals, and will very likely have to repossess planes from airlines that enter bankruptcy or shut down. Still, their revenues and cash flows aren't as directly affected from the travel slump created by the coronavirus pandemic as those of the airlines, and S&P Global Ratings sees their credit situation as somewhat less negative. We've been focused on reviewing airlines, hard hit by the coronavirus and government measures to combat it, but we will soon turn our attention to the aircraft leasing companies. Based on the current situation, which is clearly subject to change, we anticipate revising rating outlooks to negative from stable for most or all aircraft leasing companies, and are likely to downgrade some or place their ratings on CreditWatch. We hope to complete our reviews on the aircraft leasing companies in the coming weeks.

—Read the full article from S&P Global Ratings

European utilities could cut 2020 capex by up to 15% due to coronavirus – S&P

European utilities are likely to lower their planned investments between 10% and 15% this year as they try to preserve cash and cope with supply chain disruptions and other delays related to the spreading coronavirus, S&P Global Ratings said. Dividends in the sector could also be scaled back if the pandemic drags on and threatens to significantly cut into earnings.

"We see significant risks that [capital expenditure] will decline materially from utilities' previous plans as they focus on their priority projects," analysts from Ratings said in a report March 24. "Utilities currently have some degree of flexibility on their investment program and dividends, which can therefore be cut to accommodate lower earnings and cash preservation."

Europe's largest utilities plan to spend billions on building new wind and solar plants, expanding their power and gas networks, and branching out into new business areas such as energy storage and electric vehicles. Italy's Enel SpA, one of the largest in the sector, expects to invest about €10 billion every year. The prediction by Ratings echoes previous comments by Moody's and Fitch Ratings, whose analysts also think that companies could scale back their growth plans amid lower power prices and the suspension of consumer bills, which could squeeze short-term cash flow.

—Read the full article from S&P Global Market Intelligence

Research Update: Ecuador Ratings Lowered To 'CCC-/C' And Placed On CreditWatch Negative On Risks To Debt Service

Ecuador's already large budgetary financing needs have been exacerbated by the recent plunge in oil prices and the negative global economic impact of the COVID-19 pandemic. On March 23, 2020, the Ecuadorian government announced that it would delay the upcoming March 27 interest payment on its 2022, 2025, and 2030 bonds. The government is seeking additional sources of funding to make the payment within the 30-day grace period ending April 27.

As a result, we are lowering our long- and short-term sovereign credit ratings on Ecuador to 'CCC-/C' from 'B-/B', reflecting that a default, distressed exchange, or redemption appears inevitable within six months, absent unanticipated significantly favorable changes in business, financial, and economic conditions. We are also placing the sovereign credit ratings on CreditWatch with negative implications, reflecting the risk of a further downgrade to selective default ('SD') if Ecuador fails to secure funds to cover the interest payment within the grace period.

—Read the research update from S&P Global Ratings

Coronavirus recession may cut into industrial gas use more than financial crisis

Gas utilities and marketers are on the cusp of a brief but potentially painful drop in industrial gas demand following a plunge in U.S. manufacturing activity and forecasts of continued constraints on factory floors. Recent economic data suggest the COVID-19 pandemic has already pushed the U.S. into recession. While consumer-facing industries such as restaurants and hotels have been most impacted, the nation's industrial operators are not immune.

That is a major concern for gas demand because the industrial sector is the second-largest gas consumer after the electric power industry. Industrial customers accounted for nearly 30% of U.S. volumes delivered to consumers in 2019, according to the U.S. Energy Information Administration.

—Read the full article from S&P Global Market Intelligence

Mine closures pick up speed in Canada as coronavirus restrictions mount

Mine closures in Canada accelerated in recent days as mining companies responded to a patchwork of provincial emergency measures and growing risks to workers and local communities amid the coronavirus pandemic.

"The decisions are really different depending on where you are," Mining Association of Canada President Pierre Gratton said in an interview. One key factor companies are taking into account in closing mines is their proximity to vulnerable communities, in particular remote First Nations where access to medical services and transportation may be limited, according to Gratton.

—Read the full article from S&P Global Market Intelligence

Smaller midstream firms may face financial ruin amid oil, gas tumult

As some U.S. midstream companies heed calls for slashing spending and investor payouts to weather collapsing oil prices, those tools — and more drastic actions like corporate simplification and consolidation — may not be enough to keep the pipeline industry bankruptcy-free, energy industry lawyers and analysts said.

"There will be pain and insolvencies," Simpson Thacher & Bartlett LLP attorney Robert Rabalais said in an interview. "It's going to be a death spiral ... if you're over-levered and your assets are specific to a producer or basin."

—Read the full article from S&P Global Market Intelligence

US oil, gas sector sees historic declines, but executives expect a price rebound: Dallas Fed

The Federal Reserve Bank of Dallas released a quarterly energy survey Wednesday that painted a grim portrait of a US oil and natural gas sector struggling with the demand impact of the coronavirus pandemic and the price war between Russia and Saudi Arabia.

"My outlook on the domestic oil and gas industry has never been bleaker," one executive at an exploration-and-production firm wrote to the survey. "We are now expecting an almost total stop in business in the coming weeks and months," an executive at an oilfield services company told the Dallas Fed. "It is not a pretty picture."

—Read the full article from S&P Global Platts

PODCAST OF THE DAY

Listen: US distillate prices in free fall amid coronavirus outbreak

Cash prices for US diesel and jet fuel markets have been under heavy pressure since the coronavirus outbreak hit the US. Jet fuel has seen the worst impact, with prices falling to multiyear lows. Diesel prices have mostly avoided any large drops, but it's unclear how long that will last. Ellie Valencia, senior pricing specialist for US jet fuel; and Margaret Rogers, senior pricing specialist, US diesel; discuss the markets with Josh Brown, manager, US distillates and Latin products.

—Share the Commodities Focus podcast from S&P Global Platts

Interview: Oil industry, North Sea producers face 'ugly times' before recovery: MOL upstream chief

The upstream oil and gas industry faces "ugly times," with the North Sea likely to come under pressure due to the coronavirus-induced price collapse, but consolidation and recovery eventually emerging, according to Berislav Gaso, upstream executive vice president at Hungary's MOL.

Speaking from Budapest on the recent industry meltdown, which has seen oil prices halve in the course of a month to under $30/b, together with a rout in company share prices, Gaso voiced confidence in MOL's future.

—Read the full article from S&P Global Platts

Crude futures extend uptick in Asia trade on hopes of fresh US stimulus

Crude futures extended gains in mid-morning trade in Asia Wednesday following an overnight rally in US equities on anticipation of new stimulus measures from the US government. At 10:25 am Singapore time (0225 GMT), ICE Brent May crude futures were up 87 cents/b (3.20%) from Tuesday's settle at $28.02/b, while the NYMEX May light sweet crude contract was 88 cents/b (3.67%) higher at $24.89/b. US Senators and the White House continued to negotiate late Tuesday on an estimated $2 trillion stimulus package in response to the coronavirus pandemic, according to media reports.

—Read the full article from S&P Global Platts

Deal in Congress axes funding to fill SPR with US crudes

The Trump administration's plan to fill the US Strategic Petroleum Reserve with 77 million barrels of medium and heavy crudes appears to be on hold after Congressional leaders removed funding for it from a contentious coronavirus aid package. The $3 billion requested by the Trump administration to buy US-origin crudes could still be added to future coronavirus stimulus legislation. A spokesman for Senator Chuck Schumer, Democrat-New York, confirmed early Wednesday that the final deal reached overnight removed the SPR funding.

—Read the full article from S&P Global Platts

Analysis: Light crudes get cheaper vs heavy as COVID-19 hits gasoline, jet demand

Declining refining margins for transport fuels such as gasoline and jet fuel have impacted demand for lighter crude grades in Asia, with the value of premium grades such as Abu Dhabi's Murban crude flattening against medium, heavy-sour barrels in March.

Spot price differentials for light sour crudes such as Murban have taken a beating in the spot market in March on thin demand as refiners face widespread demand destruction for lighter fuels. On the other hand refining margins for residual products such as high sulfur fuel oil have soared, supporting demand for heavier sour grades such as Oman and Basrah Light.

—Read the full article from S&P Global Platts

India lockdown: Asia spot LNG prices under pressure amid lockdown, Adani force majeure

Spot LNG prices in Asia were under pressure following India's announcement to impose a 21-day lockdown and a force majeure declaration by the country's Adani Ports and Logistics at its Mundra and Tuna ports Tuesday.

Prime Minister Narendra Modi directed 1.3 billion Indian citizens to stay in their homes for three weeks from Wednesday to contain the spread of coronavirus, which is expected to impact energy consumption and logistics at the world's third largest oil importer and fourth biggest LNG consumer

—Read the full article from S&P Global Platts

India lockdown: Domestic oil demand hit, cheaper crude offers opportunity to store

The collapse in oil prices has created opportunities for India to ship in incremental crude cargoes, but dwindling domestic demand because of a countrywide lockdown means that oil buyers will be treading cautiously as they try to gauge the demand outlook ahead, analysts told S&P Global Platts.

—Read the full article from S&P Global Platts

India lockdown: Indian gasoline exports to put North Asian suppliers in jeopardy

India's decision on Tuesday to lock down over a billion of its people could pose a grave threat to South Korean and Chinese gasoline exporters as a potential downfall in South Asia's motor fuel demand would lead to excess Indian supplies flooding the Asian market.

—Read the full article from S&P Global Platts

India lockdown: Indian gasoline exports to put North Asian suppliers in jeopardy

India's decision on Tuesday to lock down over a billion of its people could pose a grave threat to South Korean and Chinese gasoline exporters as a potential downfall in South Asia's motor fuel demand would lead to excess Indian supplies flooding the Asian market.

—Read the full article from S&P Global Platts

UK consumer stockpiling lifts R-PET demand

UK recycled polyethylene terephthalate plants remain at high production capacity as order books for the food and beverage packaging markets remain robust. As consumers stock up on supermarket essentials, including packaged food and bottled water, converters are calling on suppliers of R-PET clear flakes and food-grade pellets for additional volumes.

"We've had more calls on material over the weekend than all of February," one supplier said. A recycler said bottled water was "flying off the shelves. We're not seeing any downturn in demand." A consumer said they were increasing stock levels from the usual three days of supply to seven days, but were nearing warehouse capacity.

It is also clear that UK converters are searching for more local supply, fearing disruption to logistics for material coming in from the continent. Despite these concerns, some UK converters were continuing to seek material for April delivery from Northwest Europe, saying a lack of UK supply meant they had little choice. Even within the UK, truck driver availability is a concern. One buyer was requiring truck drivers to sign declarations and wear personal protective equipment when entering production sites, according to a seller.

—Read the full article from S&P Global Platts

FACTBOX: Coronavirus affecting EMEA petrochemicals markets

As infection rates continue to rise and European nations restrict movement in an attempt to limit the spread of the coronavirus pandemic, the European petrochemical industry is facing unprecedented challenges and uncertainty. With borders across Europe closing, supply chain concerns are rising.

"The market is caught between a rock and a hard place, demand destruction as a result of the coronavirus pandemic and the OPEC price war which could see crude oil prices below $20/b in the coming months. Supply chain and logistics constraints could result in producers having to cut rates regardless of margins. We are in unchartered territory but the risk for the next three to six months are still to the downside," Senior Manager Petrochemical Analytics at S&P Global Platts Rob Stier said.

—Read the full article from S&P Global Platts

Normally safe bets, renewable-energy companies face growing market turmoil

Long term, investors seem confident that the clean-energy sector is poised for growth: Prices for renewable energy are falling, and governments and corporations are stepping up efforts to cut emissions of carbon dioxide. A basket of renewable energy stocks tracked by S&P Global Market Intelligence gained 49% in 2019, outperforming the S&P 500 by 20 percentage points. But those tailwinds are not shielding the industry from the pandemic's immediate financial and economic fallout. The ALPS Clean Energy ETF is down 26% in March compared to a 17% decline in the S&P 500. Even companies that generate predictable revenues from contracted renewable energy assets have seen their status as safe havens disappear in recent weeks.

—Read the full article from S&P Global Market Intelligence

As climate focus wavers, advocates eye COVID-19 stimulus to boost green growth

As countries scramble to tackle the spread of the coronavirus, action against climate change has taken a back seat. Parts of the European Green Deal, the EU's landmark package of climate legislation, have been pushed back and environmental campaigners fear this year's climate summit convened by the United Nations could be postponed. Meanwhile, national legislation to boost renewable energy or phase out coal power is also on hold in some countries.

But while those delays are unwelcome and even risk robbing momentum from the global fight against climate change, environmental activists and analysts say the massive economic stimulus required to respond to the pandemic also offers a once-in-a-lifetime opportunity to speed up the shift to a greener economy.

—Read the full article from S&P Global Market Intelligence

US coal sector nudges feds to deem supply chain critical as COVID-19 spreads

The U.S. coal industry is concerned that the federal government has not explicitly included the supply chain backing coal-fired power plants to be critical infrastructure as the country combats the COVID-19 pandemic. The U.S. Department of Homeland Security's Cybersecurity and Infrastructure Security Agency, or CISA, designated the electricity industry broadly as critical infrastructure in a March 19 memo. However, it did not explicitly mention the supply chain feeding coal-fired power plants, coal advocacy group America's Power, formerly known as the American Coalition for Clean Coal Electricity, wrote in a March 20 letter to CISA Director Christopher Krebs that was provided to S&P Global Market Intelligence.

Under the "energy" category in an initial list of essential critical infrastructure workers, CISA lists workers in the electricity industry, petroleum workers, and workers in the natural gas and propane gas sectors.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language