Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 5 Jun, 2020

By S&P Global

Weeks after all 50 U.S. states began lifting coronavirus-containment measures, restarting at least some economic activity, protests against systemic racism continued for a 10th tumultuous day—yet financial markets are bullish, suggesting that investors don’t expect damages to be severe.

“The [market’s] disconnect from basic human suffering is shocking,” Robert Jenkins, head of global research at the financial services firm Lipper, told CNBC on June 3. “It gets more and more insane by the day.”

Investors’ optimistic reaction to the turmoil unfolding nationwide is “consistent with the very sharp disconnect between markets and the economy,” Mohamed El-Erian, Allianz’s chief economic adviser, told the Financial Times on June 1.

PCS, a division of the risk-management firm Verisk, declared the violent protests to be a catastrophe event, according to S&P Global Market Intelligence, the first time it has applied that designation to riots in multiple states.

Still, industry analysts don’t anticipate the insurance losses from the ongoing demonstrations to be significant. While the damage has been “horrific,” Keefe, Bruyette, & Woods analyst Meyer Shields told S&P Global Market Intelligence that the actual percentage of affected property is likely much lower than what has been portrayed in media coverage of the protests. "From an insurance industry perspective, my guess is it's a relatively small insured loss. In the low billions of dollars, perhaps, but that's not enough to make a difference in this industry,” he said.

S&P Global Market Intelligence reported that the most expensive riots in U.S. history were the Los Angeles riots in 1992, which cost $775 million, or $1.4 billion in 2020 dollars, and the 1965 Watts riots, estimated at $357 million in 2020 dollars. Insurers paid $12.4 million in claims relating to the unrest in Baltimore in 2015 after Freddie Gray, a black man, died in police custody.

“We are living in an age of global mass protests that are historically unprecedented in frequency, scope, and size” that “eclipse historical examples of eras of mass protest, such as the late-1960s, late-1980s, and early-1990s,” the Center for Strategic and International Studies said in a March report, forecasting then that protests would continue and increase. “Factors that could increase the rate of protest include slowing global economic growth, worsening effects of climate change, and foreign meddling in internal politics via disinformation and other tactics.”

The current protests in the wake of the death of George Floyd, a 46-year-old black man who died at the hands of Minneapolis police, are throwing into greater relief the country’s persistent social and income inequalities.

As if the Spanish Flu of a century ago, the Great Depression of the 1930s, and the riots following the assassination of Martin Luther King, Jr. in 1968 are happening simultaneously, today’s civil unrest comes as the coronavirus crisis has thrust the U.S. economy into a sharp and sudden recession. The COVID-19 crisis has deepened the existing systemic health and socioeconomic disparities that communities of color suffer—particularly black Americans. As such, the George Floyd protests can be seen as collective advocacy toward not only criminal justice reform, but also economic and social justice reform.

According to the latest Financial Times-Peterson Foundation poll, on June 4, almost all black U.S. voters—98%—reported that an additional government-stimulus payment, replicating the one-time $1,200 payment delivered to most Americans through the $2 trillion Coronavirus Aid, Relief, and Economic Security Act, would have a significant benefit for them and their families. Nearly three-quarters of black respondents have suffered blows to their financial stability and one-fourth have been laid-off or furloughed since the start of the pandemic, compared to 58% and 19% of white U.S. voters, respectively. The survey, covering opinions of 1,000 likely voters, was conducted the Democratic polling company Global Strategy Group and Republican firm North Star Opinion Research, from May 20 to 26, the day after Mr. Floyd’s death.

The Congressional Budget Office projected on June 1 in a letter to Congress that the U.S. economy would suffer mammoth losses of $7.9 trillion in output over the next decade due to the pandemic. Long recoveries from economic crises hurt everyone, but especially black Americans, who are vulnerable even in periods of prosperity. In 2007—before the Great Recession—black households earned average incomes of $55,265, 63% less than white, non-Hispanic families, according to U.S. Census data. A decade later, median incomes for black American families had grown approximately 6%, while white households’ had recovered by 8%.

Prior to the pandemic, in 2018, black households’ median income was $41,361, according to Census data, while non-Hispanic white families boasted a median income of $70,642.

Black Americans are more likely to be affected by what labor economists refer to as the “last-hired, first-fired” dynamic, under which more black individuals enter the workforce as the economy grows but are forced out of employment when the economy worsens, and are also more likely to work low-wage jobs.

“The fallout from the pandemic is unevenly affecting lower-wage workers who have less access to paid time off, health care, or job security. This has prompted a reconsideration of the value of workers including the salaries and benefits they are being offered,” S&P Global Ratings reported. “Workers in lower-paid sectors are much less likely to have access to employment benefits such as employer-sponsored health insurance, remote-working accommodations, and paid time off.”

Workers in the U.S. filed 1.9 million new unemployment claims last week, according to the Department of Labor. An additional 623,000 individuals filed under the temporary Pandemic Unemployment Assistance program for those who can’t claim traditional unemployment benefits. In April, when the coronavirus hammered employment in the U.S., job losses for white Americans amounted to 15.5%, while black job losses totaled 17.8%, according to Economic Policy Institute research.

"With the states slowly opening their doors post-COVID-19, the May... report will likely signal the bottom for the jobs market," Beth Ann Bovino, S&P Global Ratings’ U.S. Chief Economist, said in an interview with S&P Global Market Intelligence. "Unfortunately, healing the jobs market will take time. We don't see the unemployment rate reaching its pre-crisis rate until sometime in 2023."

Today is Friday, June 5, 2020, and here is today’s essential intelligence.

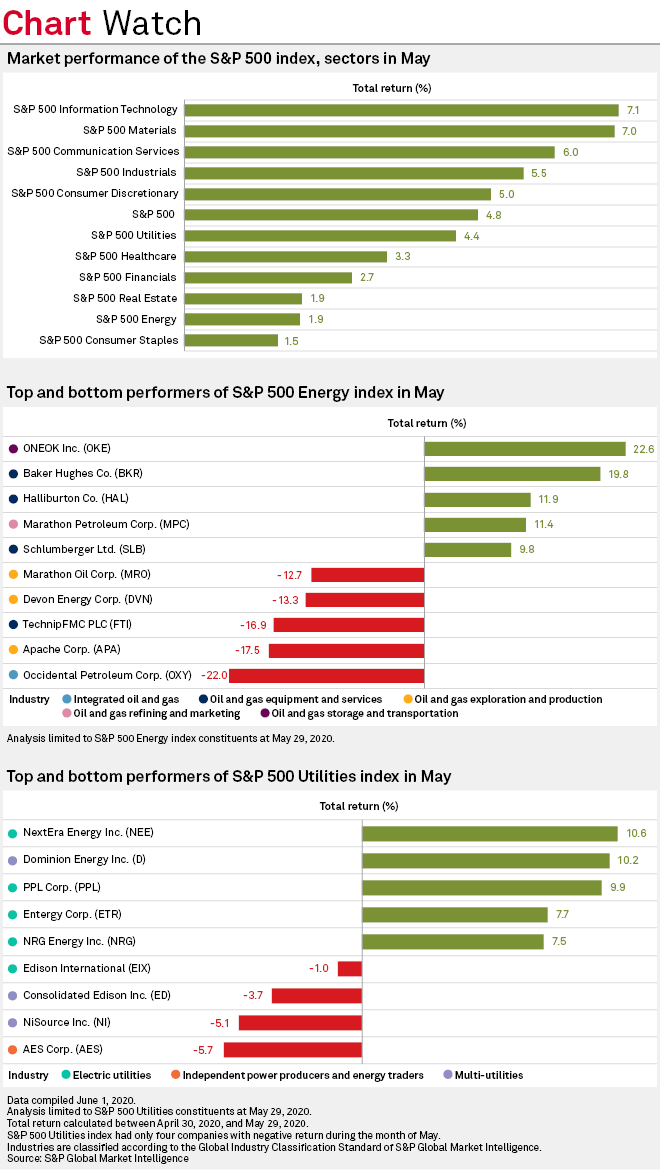

S&P 500 utilities, energy indexes underperform broader markets in May

S&P 500 indexes in May extended gains from April, with the broader S&P 500 index performing better than the S&P 500 Utilities and S&P 500 Energy indexes during the month. The S&P 500 index saw a total return of 4.8%, according to S&P Global Market Intelligence data. Over the same period, the S&P 500 Utilities index posted a total return of 4.4%, and the S&P 500 Energy index recorded a total return of 1.9%.

—Read the full article from S&P Global Market Intelligence

No significant insurance losses expected from George Floyd demonstrations

Insured losses from the ongoing demonstrations over the death of an African American man in police custody are not expected to be significant, two industry analysts have said. The civil disturbances that started in Minneapolis on May 26 have led to destruction and looting in most major U.S. cities. The protests were sparked by the May 25 death of George Floyd. He died after a Minneapolis police officer pinned him to the ground with a knee on his neck for nearly nine minutes during an arrest.

—Read the full article from S&P Global Market Intelligence

People Power: COVID-19 Will Redefine Workforce Dynamics In The Post-Pandemic Era

Unprecedented employment challenges stemming from the coronavirus pandemic are rippling across the broader economy and affecting how employees operate and interact with their employers. The fallout from the pandemic is unevenly affecting lower-wage workers who have less access to paid time off, health care, or job security. This has prompted a reconsideration of the value of workers including the salaries and benefits they are being offered. It has also presented a rare opportunity for employees to leverage the pandemic as a platform to demand change in the workplace, including improved health and safety measures. Workplace culture is more fluid now than ever, and corporations will likely need to make significant financial and time investments in their employees to remain competitive in the post-pandemic labor market. Ultimately, we believe changing workforce dynamics will have profound future implications on the workplace structure, health and safety benefits offered to employees, and technological innovation.

—Read the full report from S&P Global Ratings

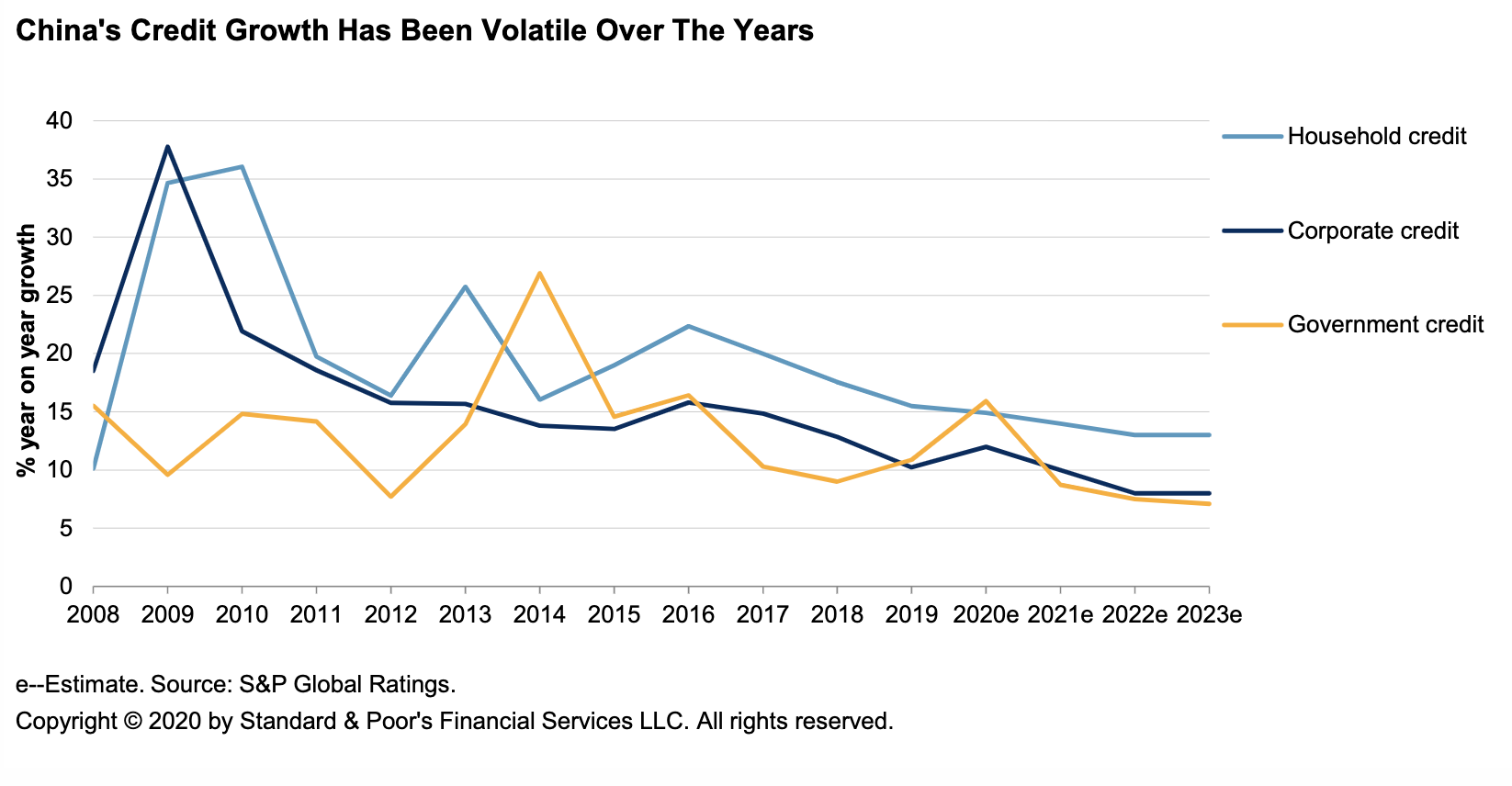

China Debt After COVID-19: Flattening The Other Curve

The arc of China's debt curve bends toward policy. The COVID-19 outbreak should slow the country's economic growth to just 1.2% this year, prompting a rapid expansion in credit. This will escalate China's debt-to-GDP ratio, which we estimate will rise 24 percentage points to 273% in 2020. So far, so normal. GDP slowdowns typically lead to credit expansions in China. But S&P Global Ratings believes this crisis may be different in how aggressively China may restore debt discipline.

—Read the full report from S&P Global Ratings

US leveraged loan downgrade ratio hits staggering 43:1 as pandemic stalls market

The impact of the COVID-19 pandemic — yet to fully play out in terms of corporate earnings — is reflected in the record speed of downgrades by rating agencies. The three-month rolling downgrade count of loan facilities in the S&P/LSTA Leveraged Loan Index outpaced the rate of upgrades by a ratio of 43 to 1 in May.

—Read the full article from S&P Global Market Intelligence

Default risk looms large for AMC as a few European theaters resume operation

AMC Entertainment Holdings Inc. is raising red flags about its future, even as it begins opening theaters in Europe. After postponing its first-quarter earnings release in April, the theater operator on June 3 provided preliminary first-quarter earnings estimates, disclosed a going-concern warning and announced a distressed debt exchange that represents a default from a credit ratings perspective. Following the June 3 filing, S&P Global Ratings downgraded AMC's issuer credit rating to CC, and it issued a negative outlook. The agency expects the company will take an SD rating following the completion of the debt exchange.

—Read the full article from S&P Global Market Intelligence

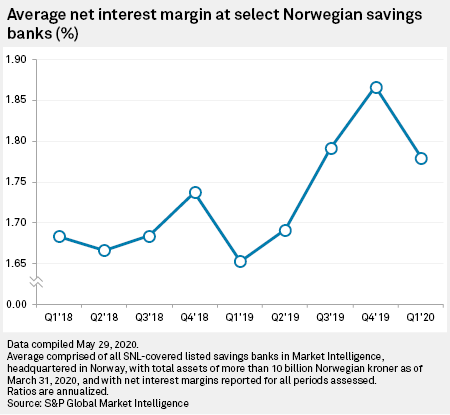

Norway's savings banks face big hit from new zero-rate environment

A zero-rate environment in Norway will put the country's savings banks' net interest margins and profitability under pressure. On top of rising loan losses, it could have a "dramatic impact" on the Norwegian banking sector, according to Nordic Credit Rating, which found that some banks risk falling foul of capital requirements. The Norwegian savings bank business model is typically based on taking customer deposits and providing retail mortgage loans. There are more than 100 savings banks in Norway and they play an important role in the banking sector, claiming some 45% share of the retail lending market, with large Nordic commercial banks such as DNB ASA, Danske Bank A/S, Nordea Bank Abp and Svenska Handelsbanken AB (publ) accounting for most of the remaining market.

—Read the full article from S&P Global Market Intelligence

Scope Of Policy Responses To COVID-19 Varies Among Latin America's Central Banks

As the COVID-19 outbreak spreads throughout Latin America, expectations of a widespread economic recession in the region have been materializing. In this sense, the regional banking regulators have responded with measures to support financial systems, allowing credit to continue flowing to households and corporations. The financial relief programs are similar to those in other parts of the world, such as credit facilities for financial institutions; loan moratoriums; looser loan classification and provisioning, and capital requirements; and government and special trust guarantees on loans to small- to medium-size enterprises. However, the effectiveness, timeliness, and scope of these measures has varied from country to country. Chile, Peru, and Brazil implemented the more comprehensive set of measures while Mexico has been slower. Colombia and Argentina's responses have fallen in the middle.

—Read the full report from S&P Global Ratings

How U.S. Bank Dividend Cuts Could Affect Ratings

COVID-19 pressures led to significant declines in earnings and waning regulatory capital ratios for most banks in the first quarter. With this as the backdrop, new focus has emerged on whether U.S. banks should—and could—keep paying their common equity dividends. While a cut in those payouts wouldn't in and of itself trigger a rating action, the reason behind it could add to rating pressures in certain cases.

—Read the full report from S&P Global Ratings

PayPal, Adyen, Square to thrive post-pandemic as online payment habits stick

A global boom in e-commerce has been one of the few positive business stories to emerge from the coronavirus pandemic. Listed payment gateways Adyen NV, PayPal Holdings Inc. and Square Inc. are in the perfect position to capitalize on it. The share prices of all three have soared during the pandemic, and this strong run is likely to continue even after lockdowns ease, according to industry insiders. The coronavirus has catalyzed a major shift in consumer behavior, with in-store sales falling and online transactions taking center stage. For many consumers, especially those who have tried e-commerce for the first time, the change in their buying habits could be permanent, they said.

—Read the full article from S&P Global Market Intelligence

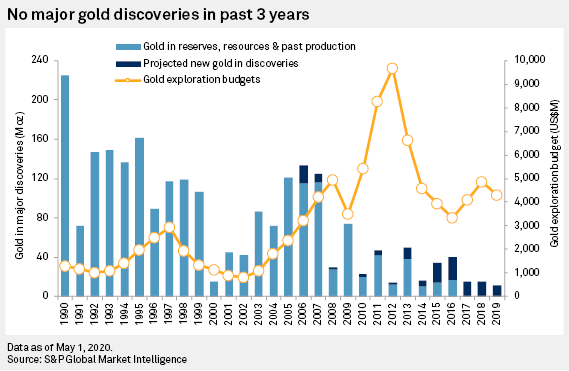

A Decade of Underperformance for Gold Discoveries

S&P Global Market Intelligence’s annual analysis of major gold discoveries has identified 278 deposits discovered over the 1990-2019 period containing 2,194.5 million ounces of gold in reserves, resources and past production. There are no major gold discoveries on our list in the past three years, and only 25 in the past decade. The lack is driven by exploration focusing on older discoveries and later-stage assets. While there are still plenty of gold assets to be developed, the lack of new major deposits being discovered means that the project pipeline is increasingly short of large, high-quality assets needed to replace aging major gold mines.

—Read the full report from S&P Global Market Intelligence

Gold takes a breather, market predicts higher prices

The gold price is taking a breather, with eyes on what it will take to propel the metal higher as investors move money into riskier asset classes, sources said June 4. Gold had been on a stellar run higher throughout 2020, bolstered by the coronavirus pandemic and associated panic as allocations moved into safe-havens. However, since countries have started to ease lockdown measures, and some form of new normality has emerged, traders have been parking their money elsewhere.

—Read the full article from S&P Global Platts

Trump seeks to use 'economic emergency' order to speed pipeline approvals

The Trump administration aims to speed federal approval of energy pipelines, mines, highways and other infrastructure by asserting that a national "economic emergency" warrants that agencies waive long-standing environmental rules, the Washington Post reported June 4. Trump plans to sign the order later June 4, according to the White House schedule, but the administration has not released any text.

—Read the full article from S&P Global Platts

Trump orders US government to streamline permitting, citing 'economic crisis'

President Donald Trump issued a sweeping executive order June 4 instructing agencies to do everything they can to streamline federal permitting of infrastructure projects in light of the economic havoc wrought by the coronavirus pandemic. The order said federal agencies should "take all reasonable measures" to speed infrastructure investments and other activities that would "strengthen the economy and return Americans to work," while providing "appropriate" health and environmental safeguards required by law. The order asserted the need for streamlined permitting, which was already a priority for Trump, is "all the more acute" due to "the ongoing economic crisis" prompted by the pandemic.

—Read the full article from S&P Global Market Intelligence

Pandemic forces dozens of changes in how Texas power sector operates: panelists

Top generation, transmission and retail electricity executives said June 4 that their policies responding to the novel coronavirus pandemic are likely to persist for months, even as an industrial trade group's executive raised the possibility of significant power demand growth. During a Gulf Coast Power Association virtual seminar entitled, "Real World Impacts of COVID-19 on the Electric Power Industry," Curt Morgan, Vistra Energy president and CEO, said, "We have counted over 100 activities now that we were not doing three months ago."

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language