Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global — 29 Apr, 2020

By S&P Global

While each region is experiencing distinct difficulties due to the coronavirus crisis, the pandemic’s effect on climate risk has been felt across the entirety of the global economy. Its destruction of demand is set to cause a dramatic decrease in global carbon dioxide emissions and could catapult the world almost a decade ahead of schedule on a 2 degrees Celsius emissions path to limit global warming by 2100, according to S&P Global Platts Analytics.

“CO2 emissions from energy sector fossil-fuel combustion are expected to drop by 5.5% [this year]. While this 5.5% decline pales in comparison to the double-digit plunges during the Great Depression (around 25%) ... and [at] the end of World War II (around 20%), the overall reduction in CO2 emissions from coronavirus in absolute terms is projected to be by far the largest in human history,” S&P Global Platts Analytics stated. “The projected drop in 2020 emissions far surpasses what is required on average over 2020-2050 to comply with 2 degrees Celsius warming targets. In fact, 2020 emissions are on track to fall to levels equivalent to 2027 emissions on our 2 degrees scenario,” which calls for a 2.6% per year fall in energy sector CO2 emissions on average in the next 30 years.

For years, investors have dedicated increasing attention to environmental, social, and governance (ESG) issues, including climate change, gender diversity, and prioritizing stakeholders (including employees and customers) over stockholders. The COVID-19 crisis hasn’t diminished their interests; rather, the pandemic will likely prompt ratings agencies and index providers to continue buying up smaller firms that provide ESG ratings and research, according to S&P Global Market Intelligence.

However, this unprecedented change to the state of the climate doesn’t mean that all efforts to decrease emissions, advance the energy transition, and invest in a more sustainable world are sailing smoothly.

Lower levels of economic activity caused by the pandemic are likely to lower greenhouse-gas emissions by approximately 14% in the EU this year but that could bounce back to even higher levels afterward, according to S&P Global Ratings. CO2 emissions declined 8% during the 2008-2009 financial crisis but by 2010 had risen to levels even higher than before. Nonetheless, the European Commission is still determined to realize its 2030 emission-reductions target, despite resistance from sectors suffering from the virus’ implications. German Chancellor Angela Merkel yesterday endorsed their proposal to raise the CO2 reduction target to 50%-55%, from 40%.

Worldwide supply-chain problems in the renewables sector will likely delay some wind and solar projects for the utility sector.

S&P Global Platts Analytics expects China's renewable-power demand to normalize by the third quarter, but sees uncertainty for the U.S., where weaker demand from utilities and corporate buyers could hurt the renewably energy industry.

By contrast, oil markets face increased uncertainty as behavioral changes during this crisis threaten the future of the industry. Global storage for oil is almost full as lockdowns continue to obliterate demand. S&P Global Platts reported that crude oil producers, refiners, and other traders in the U.S. market may explore alternatives for pricing barrels following the historic collapse and extreme volatility in the May NYMEX light sweet crude futures contract last week, when in the last three days of trading of the May contract the settled price swung from $18.27 a barrel on April 17 to negative $37.63/b on April 20 before rebounding to $10.01/b. On April 21, dated Brent and ICE Brent futures hit 21-year-lows. Such oil price volatility could lead to credit quality issues for U.S. banks with significant energy exposure, according to S&P Global Market Intelligence.

Vietnam has reported no new cases of coronavirus for the fifth consecutive day and is beginning to lift its containment measures, but driving is expected to return slowly, keeping pressure on refiners in the country. Venezuela is considering privatizing an extensive portion of its oil industry, according to an internal proposal document seen by S&P Global Platts.

Beyond the energy industry, banking sectors in regions around the world are suffering a particular stress under the coronavirus’ strain.

Colombian banks are holding back on lending to micro-businesses and small and medium-sized enterprises, despite the country’s 16 trillion-peso (approximately $4 billion) government guarantee program that backs up 90% of new loans to the sector, according to S&P Global Market Intelligence.

In the U.S., the Small Business Administration reopened its Paycheck Protection Program on Monday after a contentious start. The first round of funding evaporated in 13 days, with large businesses that received billions of dollars being asked to return the loans. S&P Global Market Intelligence reported that the second round of funding was also hectic—as chaotic technological problems arose, large banks obtained a larger and more disproportionate amount of funds, and the program left community banks behind. PPP funds ran out in less than 36 hours. S&P Global Ratings expects that most U.S. small businesses' revenues will suffer severely in the near-term from the COVID-19 pandemic.

U.S. GDP contracted by an annualized rate of 4.8% from January to March—the worst first-quarter performance the country has seen since the 2008 financial crisis and a harbinger that worse is to come.

The Federal Reserve said today it would do whatever is needed “using its full range of tools to support the U.S. economy in this challenging time,” keeping interest rates close to zero.

“People are putting their lives and livelihoods on hold at significant economic and personal cost. All of us are affected, but the burdens are falling most heavily on those least able to carry them. It is worth remembering that the measures we are taking to contain the virus represent an investment in our individual and collective health. As a society, we should do everything we can to provide relief to those who are suffering for the public good,” Fed Chairman Jerome Powell said at a press conference today. “We were hearing from low- and moderate-income and minority communities that this was the best labor market they’d seen in their lifetime. All the data supported that as well, and it is heartbreaking, frankly, to see that all threatened now. All the more need for our urgent response and also that of Congress, which has been urgent and large.”

Australia appears as a bright spot for the banking sector. S&P Global Ratings expects that issuer credit ratings on nearly all Australian banks will likely remain unchanged in the event the economic risk score is revised, meaning that these banks are projected to withstand increasing economic risks and credit losses spurred by the crisis.

Today is Wednesday, April 29, 2020, and here’s an overview of today’s essential intelligence.

Market Meltdown: Why the Brent crude price matters

Both Dated Brent and ICE Brent futures remain under pressure after hitting 21-year-lows on April 21 as the coronavirus pandemic obliterates oil demand, overwhelming global storage capacity. The North Sea benchmarks have become the latest global oil measure in focus after the NYMEX WTI contract – anchored around landlocked Cushing, US -- dipped into negative territory for the first time ever. They are used to price more than half of the world's crude, and are closely watched as a barometer for the oil market.

—Read the full article from S&P Global Platts

Historic WTI contract collapse pushes some buyers, sellers to explore fixed pricing

Crude oil producers, refiners, and other traders in the US market may explore alternatives for pricing barrels following the historic collapse and extreme volatility in the May NYMEX light sweet crude futures contract last week, according to sources. In the last three days of trading of the May contract, the settled price swung from $18.27/b on April 17 to minus $37.63/b on April 20, before rebounding to $10.01/b. The collapse of May NYMEX light sweet crude contract, which delivers to Cushing, Oklahoma, was attributed to trading dynamics prior to the NYMEX light sweet crude contract expiration on Tuesday and a squeeze on available storage in the US, on top of extremely limited refinery demand due to the coronavirus pandemic. “Most of the market is just gob smacked,” one source said in the days following the price collapse. “This has messed up a lot, broke the system for sure.”

—Read the full article from S&P Global Platts

Coronavirus to cut CO2 emissions by most in human history: Platts Analytics

The demand destruction caused by the coronavirus pandemic is set to cause global carbon dioxide emissions to fall by the most in human history, S&P Global Platts Analytics said in a report Wednesday. The massive drop in emissions also puts the world seven years ahead of schedule on an emissions path consistent with holding global warming to two degrees Celsius above pre-industrial levels by 2100, it said. The expected drop in CO2 emissions in 2020 is so significant that it puts the world on track to where it would have been in 2027 in terms of a two degrees Celsius global warming emissions trajectory. The stalling of demand opens a window for clean energy technologies such as renewables, cleaner transportation and energy storage to catch up with overall demand growth, according to Platts Analytics.

—Read the full article from S&P Global Platts

Challenges grow for renewables sector in China, US amid pandemic: Platts Analytics

With more than half the world's population under severe lockdowns due to the coronavirus pandemic, S&P Global Platts Analytics expects China's power demand to normalize by the third quarter, while there is more uncertainty in the US where stay-at-home orders remain in place in most states. There is some evidence of manufacturing recovery in China, but concerns remain regarding grid-parity solar PV projects going forward, according to a Platts Analytics webinar held Tuesday. In the US, the pandemic has come at a delicate time for the solar power industry as the federal Investment Tax Credit is stepping down and policy support for the industry post-pandemic remains unclear, Platts Analytics said. To date, clean energy industry support has not been included in any of the stimulus measures taken in the US. Recent power purchase agreements for solar have ranged between $16/MWh and $35/MWh, according to Platts Analytics.

—Read the full article from S&P Global Platts

Dollar bond deals in Asia fall sharply due to virus; spreads may not narrow soon

Significantly fewer U.S. dollar bonds have been issued in Asia since March, as investors demand higher yields or shun emerging markets amid a global economic slowdown caused by the coronavirus outbreak. While issuance started recovering in April, credit spreads for new corporate dollar bonds in the region are likely to remain high for now, which could continue sidelining high-yield issuers, analysts say. In March, only 49 dollar bond deals were struck in Asia excluding Australia and New Zealand, according to data from Morningstar Direct. Although the count rose to 90 in the first half of April, it was still much lower than 404 in January and 277 in February. Dollar bonds have been one of the major funding sources for Asian companies and governments, as they take advantage of relatively lower interest rates offshore to boost their capital or refinance their overseas debt.

—Read the full article from S&P Global Market Intelligence

Pandemic exposes lower-rated Asian property companies to higher default risk

Default risk is rising for Asia-Pacific property companies rated below investment grade, due to reduced funding options and higher refinancing costs as the coronavirus outbreak further weakens their credit metrics, analysts say. However, for most other developers in the region, their default risk remains relatively low. Analysts say many of them have reasonably sufficient reserves of cash and undrawn bank loans to meet their debt obligations. They have also retained income from previous good years as earnings buffer during downturn, as well as a broad base of recurring revenue from investment properties. From Jan. 1 to April 20, S&P Global Ratings lowered or reviewed the long-term credit ratings or outlook of 21 property developers in Asia. Of the companies analyzed, 11 received a rating below the BBB- investment-grade level. During the same period, Moody's downgraded or reviewed the ratings or outlook of 30 developers, 17 of which are rated below Baa3, or the so-called high-yield issuers.

—Read the full article from S&P Global Market Intelligence

Vietnam's gasoline, gasoil oversupply woes to persist even as government eases movement controls

Vietnam's successful control of the spread of the coronavirus within the country has spurred its government to gradually ease domestic travel restrictions, but the country's refiners are not out of the woods yet, with the pick up in driving activity expected to be slow, while inventories and run rates remain high. On Wednesday, Vietnam, for the fifth consecutive day, reported no new coronavirus cases, one of the first Southeast Asian countries to have reigned in COVID-19, according to media reports. Social distancing measures have been gradually eased in some provinces with essential businesses allowed to resume operations from April 16 onwards, while the ban on nonessential services and gatherings of more than 20 people remained in place until April 22. The lockdown at major business centers such as Hanoi, Ho Chi Minh and Da Nang have also eased from April 22 onwards. But even with economic activity gradually returning, Vietnamese refiners will remain under pressure as the biggest challenge is the pace at which demand will return, industry sources said.

—Read the full article from S&P Global Platts

Nearly All Australian Bank Ratings Can Withstand Rising Economic Risks, Credit Losses

S&P Global Ratings today said that the economic risk trend for banks operating in Australia has turned negative, reflecting a one-in-three possibility that the economic downturn due to the COVID-19 outbreak and containment measures could be significantly more severe or prolonged than the base case. In such a scenario, S&P Global Ratings expects to assess the economic risk score within the Banking Industry Country Risk Assessment for Australia to have worsened by one category. Nevertheless, S&P Global Ratings expects that the issuer credit ratings on nearly all Australian banks, including the four major banks, will likely remain unchanged in the event the economic risk score is revised.

A contracting economy, rising unemployment, and weak consumer and business sentiment will impact the asset quality of banks in Australia, in S&P Global Ratings' view. However, S&P Global Ratings considers that the substantial fiscal and policy support from the Australian authorities and a strong economic rebound during fiscal 2021 (year ending June 2021) should help to limit the rise in credit losses. In line with S&P Global Ratings' broader economic forecast, economic risks for Australian banks would revert broadly to pre COVID-19 outbreak levels by fiscal 2022 following the peak of the economic downturn.

—Read the full report from S&P Global Ratings

Only the brave drawn by attractive emerging-market valuations amid uncertainty

Today, plotting a safe path through the sector involves weighing a raft of hard-to-know variables, including the passage of the coronavirus pandemic through countries with varying amounts of reliable data; a broad range of policy responses, both health and economic; the pace of reopening of developed economies; the extent of damage to commodity markets; investor tolerance of higher government debt levels; and the actions of multilateral lenders such as the International Monetary Fund. Investors also cannot rely on the playbook from the financial crisis. In 2009, many commodity-dependent economies were hauled out of the mire by the Chinese government as a 4 trillion yuan spending package hoovered up metals, oil and food from around the world. These days, China is more watchful about its spending habits and has taken a measured approach to supporting its economy with fiscal stimulus.

For now, many investors are taking their money elsewhere. The emerging market complex experienced its largest outflow on record in the first quarter of 2020. The Institute of International Finance high-frequency tracker revealed portfolio equity outflows of $72 billion and debt outflows of $25 billion, with investors initially exiting Asia in droves and then selling off elsewhere as the coronavirus outbreak spread.

—Read the full article from S&P Global Market Intelligence

Developing Markets: Credit Memo | April 2020

Using S&P Global Market Intelligence’s CreditModel™ (CM) and Probability of Default Market Signal (PDMS), from the suite of Credit Analytics statistical models, S&P Global Market Intelligence assessed the creditworthiness of 6,158 financial and non-financial corporates based in Central Asia, European Emerging Markets, Middle East and North Africa, Sub-Saharan Africa, and the Indian sub-continent. The credit landscape of the sample study is largely skewed towards the lower-end of the scoring spectrum. In the context of emerging markets, weaker credit scores takes an even more paramount importance as a result of unprecedented capital outflow, rollover risk and higher cost of funds. This view is validated by the market’s view, according to our PDMS model, with increasing probability of default (PD) as we go down that scoring spectrum (from ‘a’ to ‘ccc’). The emergence and spread of Covid-19 globally naturally triggered a negative pressure on asset values worldwide and on the markets sampled in this study, which however was further exacerbated by the drop in oil prices. A significant number of countries in the sample study rely heavily on revenues generated from oil exports to finance their budgets, especially infrastructure investments. Economic growth in such oil-exporting countries is therefore highly sensitive to the oil price landscape leading to capital outflow and hence stress on equity prices, and ultimately the market derived likelihood of default.

—Read the full report from S&P Global Market Intelligence

Listen: Europe's steel industry battles with supply and demand during COVID-19

Europe is slowly coming out of lockdown and steel mills in Southern Europe can gradually ramp up production again. The steel market is however still far away from a healthy supply and demand balance - with prices dipping and production cuts remaining in place across most of Europe's steelmakers. Laura Varriale talks to Annalisa Villa, Viral Shah and Amanda Flint about how the steel industry is reacting to dropping demand and what that means for steel and scrap prices during these unprecedented times.

—Listen to this episode of the Commodities Focus podcast, from S&P Global Platts

Volkswagen expects Q2'20 loss, backs government actions to stimulate demand

German automaker Volkswagen AG expects to report a loss for the second quarter of 2020 due to the shutdown of most of its global retail network in April before a recovery takes hold in the second half of the year, executives said April 29. While the group has observed an encouraging recovery in China, particularly in the more profitable premium segment and among its range of electric vehicles, plants in Europe are just beginning a partial restart. "Operating profit in the second quarter will be negative," CFO Frank Witter said on a conference call after the company reported an 87% dive in first-quarter EPS. "I believe that financially, the second quarter will probably be the worst based on our current assessments. And we still expect to deliver positive earnings for the year as a whole."

—Read the full article from S&P Global Market Intelligence

The EU's Drive For Carbon Neutrality By 2050 Is Undeterred By COVID-19

The EU's long-term goal to tackle climate change remains unchanged. But the COVID-19 pandemic will likely delay specific laws needed to reach carbon neutrality as governments and firms mobilize their finances to deal with the economic fallout. Some sectors, such as automotive and aviation, are pushing back on stricter environmental standards and commitments amid the COVID-19 measures. There is also a risk that the drop in global energy demand may end up delaying investment in the transition to a low-carbon economy. Changing consumer habits and preferences in a COVID-19 recovery could push companies and governments to do more in terms of greening the economy.

—Read the full report from S&P Global Ratings

Germany's Merkel endorses EC proposal for deeper 2030 CO2 cut of 50%-55%

German Chancellor Angela Merkel has endorsed the European Commission's proposal to raise the EU's 2030 CO2 reduction target from 40% to 50%-55%. "We know it is going to be a long road [to make Europe the first climate neutral continent by 2050] and that is why I welcome the interim target proposal for the European Union to reduce emissions by 50%-55% by 2030 over 1990 levels," the Chancellor said in a speech Tuesday at the Petersberg Climate Dialog. It was important, as economic stimulus programs were set up post-coronavirus, to "keep a close eye on climate protection and to make it clear that we are not saving on climate protection, but investing in climate protection," Merkel said. She characterized debates on climate financing as "difficult," while indicating Germany was prepared to significantly increase its share. Climate-friendly financing would need to be provided by states, development banks and the private sector, she said.

—Read the full article from S&P Global Platts

Pandemic credit losses won't reach 2008 crisis levels, Deutsche Bank CEO says

Despite increased risks related to the COVID-19 pandemic, Deutsche Bank AG does not expect to see 2020 credit losses reach the level they did during the global financial crisis, CEO Christian Sewing said April 29. The German banks booked loan loss provisions of €506 million for the first quarter, equivalent to 44 basis points of loans, up from 31 basis points a year ago, and expected full-year provisions of 35 basis points to 45 basis points. "We expect the majority of these provisions to be taken in the first half of 2020 with a normalization later in the year. This reflects our expectations of the macroeconomic impact from COVID-19 including the effect of the government support programs," Sewing told analysts at an earnings presentation. With a small profit of €66 million and flat year-over-year revenues of €6.35 billion, the report was received well on the market even though Deutsche Bank scrapped most of its 2020 financial targets. Its share price surged more than 11%, breaching the €7 mark at close.

—Read the full article from S&P Global Market Intelligence

How COVID-19 Risks Prompted European Bank Rating Actions

Despite European governments' measures to contain the sanitary effect of the COVID-19 pandemic on their population, they face an unprecedented challenge to their economies. The economic outlook has steadily worsened in recent weeks, mainly because of stricter public health measures across Europe and in many countries around the world to combat the coronavirus. S&P Global Ratings now expects GDP in the eurozone and U.K. to shrink by 7.3% and 6.5% this year before rebounding by 5.6% and 6% in 2021. Most European financial and nonfinancial institutions enter the current maelstrom with considerably lower levels of debt.

S&P Global Ratings continues to expect the wide-ranging fiscal and related monetary measures to substantially mitigate this extraordinarily sharp, cyclical shock to European economies, and so also to support national banking systems. However, even under S&P Global Ratings’ base case of an economic recovery starting in third-quarter 2020, bank earnings, asset quality, and in some cases, capitalization, is expected to weaken meaningfully through end-2020 and into 2021. The COVID-19 crisis is an unwelcome complication for banks that were already wrestling with two paramount questions: how to harmonize balance sheet strength with solid investor returns, and how to refine business and operating models in the face of the looming risks and opportunities of the digital era.

—Read the full report from S&P Global Ratings

COVID-19 Credit Update: Latin American Structured Finance Begins To Feel The Pandemic’s Effects

In Latin America, the COVID-19-related shutdown is in full swing, and economic activity has decreased accordingly. S&P Global Ratings' has identified an additional risk factor for Latin American securitizations since their last report: an increased concentration in transactions supported by trade receivables. Several entities have proposed amendments to rated transactions' terms and conditions, which S&P Global Ratings is reviewing carefully.

—Read the full report from S&P Global Ratings

Colombian banks holding back on SME lending despite state guarantees

More than a month into a lockdown that has paralyzed the economy of Colombia, its banks are holding back on lending to micro-businesses and small and medium-sized enterprises despite a 16 trillion-peso guarantee program from the government that will back up 90% of new loans to the sector. The disbursement of loans to micro-companies and SMEs dropped 18% in the first three weeks of April from the year-ago period and contracted 39% compared to the first three weeks of March, the latest data available from the financial regulator shows. Although average interest rates for these loans have been edging downward, some large banks, including Bancolombia SA and Banco de Bogotá SA, are notching them up.

Colombia's sustained GDP growth over the last two decades boosted banks' loan disbursements to the segment, which accounted for 53% of banks' total commercial portfolios in 2019, not counting business overdrafts and credit cards. A decade ago, loans to micro-companies and SMEs represented 43% of total commercial portfolios, according to the Superintendencia Financiera financial regulator. But since the onset of the coronavirus pandemic, banks have been readjusting their lending strategy as they brace themselves for weaker operating conditions, especially in the SME and consumer sectors, which banks had been eyeing in the first months of the year.

—Read the full article from S&P Global Market Intelligence

The Difference a Month Makes: Keeping the Pulse of the Mexican Insurance Market

In February 2020, S&P Dow Jones Indices (S&P DJI) and the Association of Mexican Insurance Companies (AMIS) conducted the second annual survey of insurance investment officers in Mexico about the state of the local insurance industry. While this survey was meant to help take the pulse of the Mexican insurance market, what S&P DJI did not predict was that shortly after the survey concluded, the Mexican economy would feel the combined shocks of COVID-19 and lower global oil prices. S&P DJI recently published the results of this survey to highlight the perspectives of the insurance investment officers at a point in time, with the recognition that this survey assumes relatively “normal” market conditions, and importantly, these are now no longer “normal” market conditions.

—Read the full article from S&P Dow Jones Indices

Pension Fund Industry in Mexico: Analyzing the S&P/BMV Mexico Target Risk Index Series across Different Economic Crises

It is unnecessary to give an update on today’s economic situation since most already have a wealth of information over the repercussions of the COVID-19 pandemic. This article instead focuses on another major concern: how have pension funds performed, and furthermore, are there similarities in how they have performed during other crises? After the S&P/BMV IPC dropped 16.38% from its highest monthly return posted in the past 10 years, the S&P/BMV Sovereign MBONOS Bond Index fell 0.72% and the S&P/BMV Sovereign UDIBONOS Bond Index followed with a loss of 3.10%. In this environment, we would expect that pension funds would have their worst month, or even their worst quarter.

—Read the full article from S&P Dow Jones Indices

Venezuela report proposes extensive privatization of oil industry

A Venezuelan commission set up to study the restructuring of state PDVSA had recommended lifting state control over all its operations and is calling for private national and international capital to open up the country's oil business, according to an internal document seen Tuesday by S&P Global Platts. The 64-page proposal, which recognizes that Venezuela is no longer a strategic player in the oil market, aims to bring oil production to 2 million b/d from the current 618,000 b/d "in the shortest possible time." In a 180-degree turnaround, Venezuela, in addition to massive privatization in oil and gas production, refineries and the domestic market, would allow the private sector to directly market hydrocarbons and derivatives without state control.

"Eliminating the nationalization of all processes is a drastic change in the orientation of the economic model advocated by the government of Nicolas Maduro, says Dolores Dobarro, an attorney and Venezuelan university professor specializing in oil law. "Even the possibility of opening up completely to private capital is more aggressive that the proposals of the political opposition that is fighting to remove [President Nicholas] Maduro from power." The proposal was dated March, but released Monday in parallel with the appointment of commission head Tareck El Aissami as oil minister, replacing Manuel Quevedo, in office since November 2017. El Aissami was vice president-economy when he was named to head he commission. Monday's Venezuelan official gazette also reported on the appointment of Asdrubal Chavez as president of PDVSA and the restructuring of the oil ministry. Chavez had been president of PDVSA's US refining and marketing arm Citgo and vice president of refining at PDVSA.

—Read the full article from S&P Global Platts

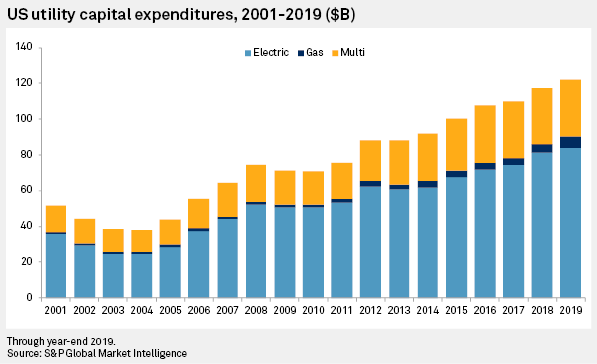

COVID-19 Related Obstacles Could Give Pause To Utility Capital Expenditure Plans

While expectations remain high that considerable levels of capital expenditures will continue to support utility profit expansion in coming years, the ongoing COVID-19 pandemic will likely give management teams pause regarding the timing and scale of capital expenditure programs given ongoing economic uncertainty and an anticipated recession. Also, supply chain manufacturing problems worldwide in the booming renewables sector will likely delay some wind and solar projects for the utility sector. During the December 2007-June 2009 recession, numerous utilities made downward revisions to capital spending budgets, with credit market and economic uncertainty as well as slower demand forecasts tied to the weakened economy factoring heavily in utility infrastructure and spending outlooks. We note that capex continues to be a moving target that could change as the financial and economic landscape evolves and companies evaluate both short- and long-term forecasts in coming weeks and months.

—Read the full article from S&P Global Market Intelligence

The Recession Could Erode U.S. Not-For-Profit Utilities' Financial Flexibility

In the past, U.S. public utilities' rate-setting autonomy has been a key financial and rating strength. However, during the economy's shutdown, utilities' ability to raise rates to offset lower sales could be limited. S&P Global Ratings believe certain utilities—and ratings—could be vulnerable to the fallout from the recession.

—Read the full report from S&P Global Ratings

Community bankers frustrated by 'disaster' 2nd round launch of SBA program

Congress set aside $30 billion of funds for community banking clients in need of an emergency small-business loan. The money lasted less than 36 hours. Community bankers reported another rough start to the Paycheck Protection Program, which provides forgivable loans to small businesses affected by the COVID-19 pandemic. The chaotic launch to the second round of funding and the quick exhaustion of funds reserved for community banks is raising questions of whether all small businesses in need can access the program. The first round of $349 billion in funding lasted less than two weeks and was marred by public relations issues as large, publicly traded companies secured funds and small businesses filed lawsuits against big banks. The second round of funding, which totaled $310 billion, opened for applications on April 27, and several community bankers reported severe technological issues that prevented application processing.

—Read the full article from S&P Global Market Intelligence

Small Business ABS Credit Quality Hinges On Pandemic Duration And Stimulus Efficacy

S&P Global Ratings expects that most U.S. small businesses' revenues will suffer a severe near-term negative impact from the COVID-19 pandemic and the related social distancing measures, as well as the overall adverse effect on the economy and reduced household spending. Accordingly, S&P Global Ratings expects collateral delinquencies to rise in our rated small business asset-backed securities (ABS) universe due to payment deferrals and lower prepayments. In turn, this could increase liquidity risk and obligor defaults, which could also affect longer-term credit risk. Looking ahead, S&P Global Ratings believes the ultimate result on collateral and ratings will depend on the severity and duration of the coronavirus crisis, as well as the speed and scale of government stimulus intended to benefit this sector.

—Read the full report from S&P Global Ratings

Midsize US bank earnings down 40% as reserve builds take precedence

All eyes have been on credit quality in first-quarter earnings for U.S. banks, which have responded with heavy reserve builds that drove earnings down 40% on both linked-quarter and year-over-year bases. Forty-one banks with assets between $10 billion and $100 billion have reported first-quarter results since the start of earnings season through April 24. Provisioning has turned earnings growth negative almost entirely, with just one of the 41 banks reporting linked-quarter earnings growth driven by an acquisition. For the group, the median linked-quarter EPS change was a decline of 42.0%. Results were nearly identical on a year-over-year basis with a median drop of 43.2% in EPS. There have been some bright spots, though. Investors were enthused by Bank OZK's earnings report, which showed a past-due rate of just 18 basis points. The bank's stock jumped 11.8% the day of its earnings release, compared to a 2.1% gain in the KBW Nasdaq Bank Index.

—Read the full article from S&P Global Market Intelligence

NAFTA replacement set for troubled birth as supply chains reel from COVID-19

For years, the Trump administration looked to replace the North American Free Trade Agreement, battling lawmakers from both parties and the nation's northern and southern neighbors for a signature trade policy piece to boost U.S. manufacturing and farmers. Now that the United States-Mexico-Canada Agreement is set to take effect July 1, the coronavirus pandemic threatens to upend the pact's implementation and wipe out its promised benefits.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language