Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 13 May, 2020

By Paul Hickin and George Griffiths

Highlights

If OPEC looks out to sea it will find a kindred spirit. Both the oil industry and global trade have been ransacked by a collapse in global demand, with oil producers and the shipping sector employing strategies to restore balance.

While an alliance of ocean carriers has been keeping freight rates stable, there is a difficult journey ahead before they are seen as flag bearers for market management.

Carriers moved fast and decisively to reduce overcapacity and prevent a dramatic drop in freight rates. The sector has voided more than 400 sailings this year – or 10% of nominal TEU capacity from active service – as lower volumes offset the drop in coronavirus-hit demand. And there are plenty more blank sailings to come.

“Surely this comes at a cost – but that you cannot see from the face of freight rates,” says Peter Sand, chief analyst at BIMCO, the world’s largest international shipping association.

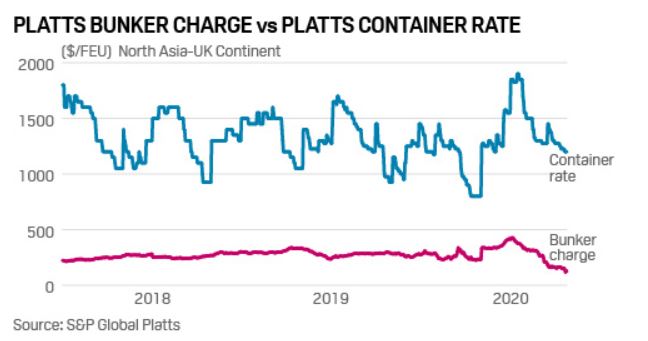

Platts Container Rate 5 – North Asia-to-West Coast North America – has remained rather stable on the year, rising $50 from January 6 to $1,650/FEU on May 6. This came despite the expected fall into February and March as is typically seen at Lunar New Year, but the recovery and stabilization reflects the strong performance from carriers in pulling excess supply from the market.

Go deeper: Read S&P Global Platts’ special report – Shipping: out of the frying pan, into the fire?

The success originates from consolidation as some good comes out of the Hanjin bankruptcy in 2017. The 10 largest liner shipping companies have a market share of 82%. On the deepsea east-west trades, three alliances control the vast majority of capacity. The largest of those is 2M, formed by the two world leaders in the sector, the Danish Maersk Line and the Italian-Mediterranean Mediterranean Shipping Co.

Lars Jensen, CEO of Sea-Intelligence Consulting, says the “oligopoly provides the carriers the foundation for effective capacity management,” and points out that the carriers aren’t interested in a price war. “They are all, until now, seemingly more interested in avoiding losses than growing market share,” he adds.

Even with glimmers of optimism that lockdowns around the coronavirus are starting to ease, the outlook for global trade and economic growth remain bleak. S&P Global Ratings predicts global GDP will contract 2.4% this year, with a significant decline in demand for container transport “for at least the next several months.”

A look at the most recent economic indicators shows the PMI for Global New Export Orders came in at 27.3 in April, down from 42.0 in March, signalling a turnaround is some way away.

“We are going to lack cargoes to ship at an unprecedented scale during the coming weeks, and months,” Sand says.

Even China’s manufacturing sector remains moribund despite being further ahead in its recovery from the pandemic.

The view from market players is similarly stark as a recession looms.

“If people aren’t allowed out, or to go shopping for anything other than food, why would anyone need to import quantities of other products?” a freight forwarder said.

Some retail companies have been cancelling their orders up to three years out. This begs the question as to whether the strategy of blank sailings can continue to be effective.

“We are all right at the moment, but if someone suddenly drops their prices to try and secure more cargo, we will be in a really sticky situation,” a carrier source said. “It will create a bidding war and that will just wipe out all the hard work we’ve seen this year to date.”

Another source warned “surely these new prices can’t stick around for a long time right now. It seems artificially high on removal of supply, rather than demand… all it takes is one vessel too many not to be canceled and we’ll slip straight down.”

But these ocean alliances will know the cost of failure. They have already focused on cost savings and used economies of scale to mitigate lower margins, and have benefited from the power of cooperation much like their OPEC counterparts, even if the mechanisms of their market management are very different.

Maybe container shipping should heed the warning of the wobble in OPEC’s alliance in March, when a production-cut agreement fell apart and led to oil prices plunging 40%. While OPEC could treat the event as its Hanjin moment. Sometimes when you can’t win, not losing is the biggest success of all.