Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 10 Aug, 2020

By Takeo Kumagai and Philip Vahn

Middle Eastern sour crude supply is expected to increase this month after OPEC+ members on July 15 agreed to pare back their production cut commitment. But Asian consumers, who under normal circumstances would have welcomed the move, have barely taken notice.

It remains to be seen where all this excess oil will eventually end up as Asian buyers grapple with crippling demand and have to tweak refining strategies to minimize losses.

S&P Global Platts Analytics in a recent note said that it sees Dated Brent struggling to remain above $40/barrel over the next couple of months as supply is on the rise, but demand growth faces a slowdown on a worsening COVID-19 scenario.

The 23-country OPEC+ coalition enacted a 9.7 million b/d production cut accord in May in response to the coronavirus crisis, but rolled the deal back to 7.7 million b/d in August through to the end of the year. The coalition is betting on a pick-up in global fuel consumption and better preparedness by governments to prevent another spike in COVID-19 cases.

But in Asia, ample petroleum products supply amid deteriorating oil demand means that it could take at least several months to see a pickup in Asian refiners’ appetite for incremental crude oil supply, more so as some refiners are opting to import motor fuels instead of raising refinery runs.

“Asian refiners are seeing much worse margins compared to their peers in Europe or the US. Factors behind this include weakened demand in the region as a result of COVID-19, a closed European gasoil arbitrage, diminished gasoline imports by Indonesia, plus strong exports from China and India,” Alex Yap, senior analyst with Platts Analytics said.

“Even with a tentative demand recovery, we expect pressure on margins to keep Asian refinery runs down by over 1 million b/d year on year through the third quarter 2020,” Yap said.

Low runs, more product imports

The lack of any significant recovery in demand for jet fuel, the product worst hit by the pandemic, has made it difficult for refiners to boost run rates.

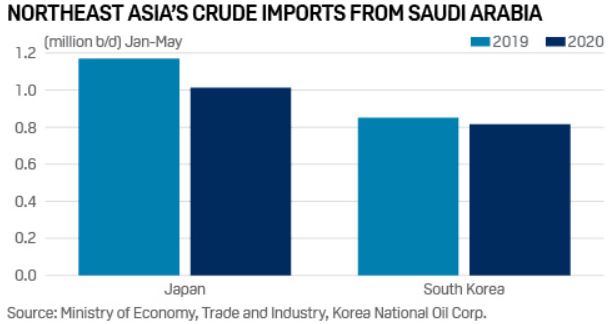

Northeast Asian refiners in particular are determined not to abruptly boost crude imports and refinery run rates in coming months as fuel demand recovery remains fragile across Asia amid a resurgence in COVID-19 cases in some countries in the region.

South Korean refiners, who are typically active exporters of refined products, are focusing on maintaining a supply-demand balance and remain cautious about not over-committing to crude procurements, industry sources have said.

South Korea’s refined oil products demand in June dipped 0.3% from a year earlier to 2.4 million b/d, with a sharp decline in jet fuel consumption offsetting a recovery in auto fuel demand during the month, according to data from Korea National Oil Corp.

Reflecting the cautious sentiment, refiner SK Energy plans to run its refineries at 80%-85% rates in the third quarter, higher than the record-low 74% in the second quarter but well below the first-quarter run rate of 92%.

Similarly, Japanese refiners are keeping a close eye on crude procurements in the coming months, amid rising concerns over the growing number of new COVID-19 cases, according to company sources.

Japanese refiners have been opting to import oil products such as gasoline, demand for which has seen some recovery, while maintaining their refinery run rates relatively low at about 60% of installed capacity of 3.52 million b/d, leaving their crude requirements at a minimum.

“Production yield for jet fuel and kerosene distillates are usually around 20% [of total production],” Petroleum Association of Japan President Tsutomu Sugimori said on July 17. Sugimori, who is also chairman of ENEOS Holdings, the parent of the largest Japanese refiner ENEOS, said that ENEOS has cut its distillate yields by half and said other refiners were doing the same. Japanese refiners are also opting to import refined products instead of raising run rates.

ENEOS, which is not typically an active importer of refined products, has stepped up its imports of gasoline and gasoil in recent months instead of raising run rates because of recovery in the domestic motor fuels demand.

China, India may disappoint OPEC+

China and India have always been the most dependable and by far the biggest outlet for OPEC+ producers but Asia’s biggest oil consumers may also disappoint the suppliers in the second half of 2020.

India, one of the fasting growing oil markets in Asia in recent years, is expected to end 2020 with its oil demand slipping into the red, a trend not seen for nearly two decades. According to Platts Analytics, India’s oil demand is expected to be down 115,000 b/d, year on year in H2, and whole-year demand will be down by 405,000 b/d, year on year.

“India’s refinery runs in the second half of the year are expected to be 260,000 b/d lower, year on year, as refiners hold back from raising throughput,” said Lim Jit Yang, advisor for oil markets at Platts Analytics.

Total capacity utilization across all refineries in India had risen to 85% in June, from 77% in May, as retail fuel demand had started showing signs of revival with the easing of the lockdowns. But the trend is getting reversed again.

Meanwhile, backed up by ample onshore storage space and facilities, China has been aggressively buying crude oil in order to take full advantage of low oil prices.

China’s crude oil imports surged 34.4% year on year to hit a record high of 12.99 million b/d in June, official customs data showed. The volume was set to remain high in July.

However, plagued by high crude stockpiles and weak domestic refining margins, China’s crude shopping spree is about to come to a halt from August. China’s crude stockpiles reached a record high level in July as refiners struggle to digest the mass of crude oil cargoes purchased during the second quarter, while domestic fuel consumption slowed amid widespread flooding across 23 provinces during the month. As a result, the high inventory has dampened China’s crude oil demand for delivery in the third quarter as it might take a while to destock.

China’s crude inventory hit a fresh high of 889.35 million barrels in the week beginning July 20, comparing to 874.84 million barrels in a month ago and 766.21 million barrels in the same week a year ago, according to data intelligence firm Kpler.

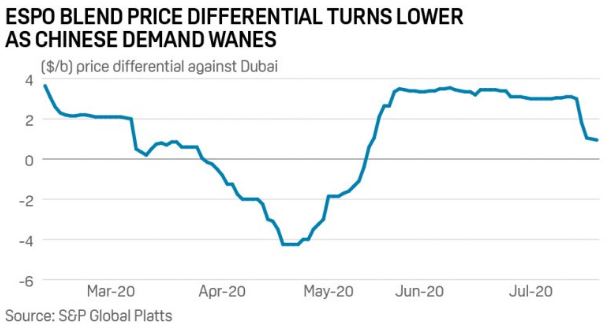

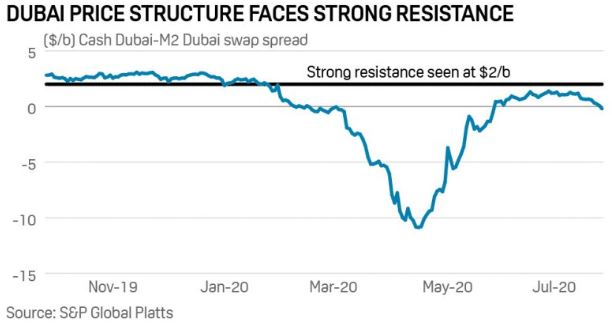

Signs of waning Chinese crude oil demand and requirements for Q3 have directly hit price differentials for various OPEC+ export crude grades, as well as the Platts benchmark Dubai price structure.

Chinese refiners’ top crude picks, Oman and ESPO Blend grades, have taken a hit recently, with price differentials for the Middle Eastern and Russian grades falling to multi-week lows. The spread between front-month Platts cash Dubai and same-month Dubai swap may also struggle to push above the $2/b premium threshold in Q3 as Chinese refiners put the brakes on crude procurement activities, trading desk managers in Beijing, Hong Kong, Seoul and Singapore said.

Chinese refiners, especially those along the Yangtze River, are poised to slash their crude throughput levels and oil product outputs as the widespread flooding in about 23 provinces would continue to dent consumer and industrial oil consumption for the next several trading cycles at the very least.

Content Type

Theme

Location

Language