Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

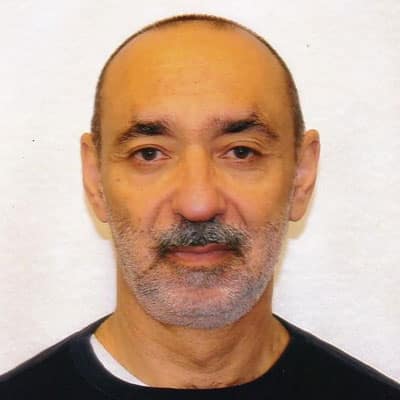

By Daniel Yergin, Ph.D., Carlos Pascual, Michael Stoppard, Eric Eyberg, Leandro Caputo, Mohsen Bonakdarpour, Ed Kelly, Madeline Jowdy, Aube Montero, and Horacio Cuenca

The US liquefied natural gas (LNG) Industry has emerged within the past decade to become an important and growing sector of the US economy, with LNG exports not only contributing more than $400 billion to US GDP but also supporting hundreds of thousands of high-quality American jobs since 2016. However, the industry is facing significant hurdles, from the January 2024 US Department of Energy ‘pause’ to mounting permitting challenges and the shifting regulatory and political landscape.

The impact on the industry already is being felt and extends beyond the ‘pause’ itself. With the US LNG sector’s export capacity projected to double over the next 5 years, driving an average of half a million jobs per year and representing an incremental $1.3 trillion dollar boost to the economy through 2040, much is at stake in the current policy debate.

This industry’s impact reaches far beyond gas-producing states, with the LNG value chain and its related economic impact extending throughout much of the US. Beyond US shores, US LNG supplies responded when Europe faced an energy crisis during the Ukraine-Russia war. Indeed, US LNG adds a new dimension to the influence and geopolitical position of the US in the world.

Around the world, US LNG flows provide reliable, affordable and in many cases cleaner alternatives to other fossil fuels. LNG has become fundamental to the global energy transition, complementing rapid growth in renewables, displacing oil and coal consumption and promoting decarbonization in developing countries.

The objective of this study is to provide a clear understanding of an industry that has, in less than a decade, gone from zero to become one of America’s major export industries, with wide-ranging benefits for the US economy, for the position of the US in the world and for global efforts to reduce carbon emissions.

However, an array of regulatory and legal risks is jeopardizing more than $250 billion in incremental GDP and over 100,000 jobs annually through 2040. Furthermore, if US export growth potential were not to materialize, 85% of the resulting gap would be filled by fossil fuels from outside the US, according to S&P Global’s analysis.

In this Phase 1 report, S&P Global’s unique energy, economics, and data analytics capabilities provide an objective and independent view of the impact of US LNG on the national economy.

A Phase 2 companion study, to be released in March 2025, will complement Phase 1 with the most rigorous emissions analysis on the topic to date and regional economic and supply chain impact.

This Phase 1 report is structured in three main sections:

Impact & Influence: US LNG Exports to Date, focuses on the economic impact of the US LNG industry through 2024 and its global influence. We establish the role of US exports as the leading supplier in a competitive global market. Overall, the report quantifies the total impact of this activity on the country’s job market, GDP, tax revenues, business revenues and associated expenditures.

Looking Forward: Base Case US LNG Exports Impact leverages S&P Global’s ‘Inflections’ Base Case to assess the long-term outlook for the LNG industry through 2040, and its projected economic and social impact within the US.

The ‘Pause’ & Beyond: Risk of a US LNG ‘Extended Halt’ Scenario presents the results of an added scenario quantifying the US and global impacts of excluding all new pre-Final Investment Decision (pre-FID) and US halted projects without FERC authorizations (28.2 & 16.2 million tons per annum (MMtpa), respectively) from S&P’s Base Case. The effects of this ‘halt’ and the projected global response will be a critical input for the companion Phase 2 report, particularly for the emissions impact analysis.

Key Findings

The US LNG industry is critical to serving the world’s energy needs and has rapidly become an integral contributor to the US economy.

$408 billion in GDP contribution since 2016, supporting an average of 273,000 direct, indirect and induced US jobs

As of 2023, larger revenues than US corn and soybean exports, roughly double US movie and TV related exports and half of US semiconductor exports

#1 global supplier meeting the world’s energy needs including replacing almost half of lost Russian gas into Europe

US LNG industry growth is expected to double its US economic footprint to 2040.

$1.3 trillion in GDP contribution supporting an average of 495,000 direct, indirect and induced US jobs

$2.5 trillion in revenues for US businesses, over $900 billion in expenditures, $165 billion in tax revenue, and $250 income per year per household

Annual US LNG exports equal energy needs to heat more than 80% European Union households for a year

LNG exports and feedgas double and drive incremental crude and NGLs volume, supporting domestic manufacturing amongst other demand

Regulatory and legal uncertainty, beyond potential lifting of the LNG ‘pause’, is putting growth at risk

Over $250 billion in lost GDP growth and an average of >100,000 direct, indirect and induced US jobs at risk

40% of US LNG growth is at risk in the US LNG ‘Extended Halt’ Scenario, which assumes no new pre-final investment decision US LNG capacity or halted US LNG capacity is developed

85% of the resulting global energy gap would be replaced by fossil fuels from non-US sources, led by alternative LNG and coal

Unlocking the halted US LNG would negligibly impact household natural gas costs (<1%)

LNG is a global energy business composed of 20 exporting countries serving more than 50 importing markets. The US has rapidly become the largest player, now accounting for 22% of total LNG supply. S&P Global estimates the industry has contributed $408 billion to US GDP and supported an average of 273,000 US jobs since 2016. Despite US export growth, domestic prices have trended downward due to the United States' endowment of an enormous low-cost natural gas resource base.

Expected to be a major importer of LNG as late as 2010, the US began building and reactivating dormant import facilities in the early 2000s. The shale gas boom that began in the late 2000s changed this dynamic as it became apparent that imports would no longer be required. US companies considered the concept of exporting LNG from the very same facilities. In fact, five of the current exporting facilities were built originally as import receiving terminals in anticipation of a supply shortage. The first cargo was exported from the US Gulf Coast in early 2016 and a major new export industry was born. Not only was import capacity repurposed to export LNG, expansions and new projects were added to reach 13 billion cubic feet per day (bcf/d) in 2024.

Figure 1. Global LNG Imports, Exports and Shipping Routes

Source: S&P Global Commodity Insights / Credit: CI Content Design

© 2024 S&P Global

The US LNG sector’s dramatic development was enabled by breakthroughs in drilling and production technology that have helped the US nearly double its gas production over the past 15 years (from 57.4 to 102.2 bcf/d) from 2010 while keeping wholesale prices at the Henry Hub in 2024, nearly half the 2010 level.

Having grown to 13 bcf/d in less than 10 years, US LNG exports are now one of the fastest growing US export industries. Their value has grown from minimal levels to exceed exports those of many more well-known US products and services, including soybeans, corn, and even movies and television entertainment.

It is important to note that the US gas market is some 50% larger than the global LNG market. As a result, even though the US is the world's largest LNG exporter, those exports represent only approximately 12% of domestic US natural gas production and are currently smaller than most domestic end use sectors, including industrial, power generation and residential/commercial uses.

Figure 2. Illustrative Size of US LNG Exports in 2023

Source: USDA Foreign Agricultural Service, U.S. Department of Commerce, S&P Global Commodity Insights

© 2024 S&P Global

The importance of US LNG goes beyond simply its size: it has transformed global trading patterns and norms. US LNG has unique characteristics: 1) it is usually sold at the point of export ('free on board' or FOB), not the point of import ('delivered ex-ship' or DES) making possible much greater flexibility of trade movements, and, 2) US LNG is usually sold based upon North American gas prices unlike most other long-term contracted LNG which is sold on a price linked to oil prices. This has allowed US LNG to inject considerable liquidity into global markets.

In addition to the scale of the commercial benefits, the development of the US LNG export industry has enhanced and reinforced US trading relationships with key nations throughout the world, from Japan, Korea, Mainland China, and India to Brazil and much of Latin America. US LNG proved critical to meeting Europe’s energy needs after Russia cut gas exports to Europe following its invasion of Ukraine.

The US currently holds more than 35 years of economic natural gas supply (~1,300 Tcf) at current consumption levels (including exports), available at a cost at or below $4.00/MMBtu. These tremendous natural gas resources have supported US domestic natural gas production growth of over 40 bcf/d since 2010, dwarfing LNG export growth by a 3 to 1 ratio, while driving a sustained reduction in US prices. These significant reserves were unlocked by the combined effect of two technologies: hydraulic fracturing and horizontal drilling (collectively referred to as the “Shale Revolution”).

Thus, in this context and despite the 13 bcf/d growth in LNG feedgas requirements since 2016, US domestic wholesale gas prices have continued their downward trend, interrupted only temporarily by the combination of rapid post-COVID growth and Russia’s invasion of Ukraine in 2022.

Figure 3. US Lower 48 Gas Production Growth vs LNG Export Feedgas; Henry Hub Gas Prices

Source: S&P Global Commodity Insights

© 2024 S&P Global

The US LNG industry to date has contributed $408 billion to US GDP and supported an annual average of 273,000 jobs. These results were fueled by private expenditures totaling $289 billion across the extended LNG value chain over the past decade. In addition, the industry’s economic impact stretches beyond core gas producing regions, as LNG’ s full associated value chain extends across multiple states and industry sectors, including steel, equipment manufacturing, and construction among others.

The $289 billion of private expenditures stimulates the three levels of standard activity across the United States’ national economy.

The first level, known as direct activity, aggregates all expenditure allocated directly to US businesses across the LNG value chain. For example, from 2016 through 2024 over 75% of the private expenditure focused on capital expenditures that expanded the upstream, pipeline and liquefaction infrastructure required to support the rapidly growing LNG export sector. Over half of these capital expenditures flowed to the construction and manufacturing sectors, directly supporting numerous skilled high-paying jobs.

The second level, known as indirect activity, is typified as the capital allocated by the primary recipients of direct expenditure to continue to deploy it across their multi-tiered extended supply chains.

Finally, employees of the direct and indirect businesses spend their wages and income across the US economy, triggering the third level, known as induced activity.

LNG's economic impact was quantified across five economic indicators using S&P Global's proprietary integrated economic modelling framework:

Sales activity: the value of direct and follow-on sales transactions that are catalysed by private expenditures across the LNG export value chain

Contribution to GDP: the “value added” component of sales activity contributes to US GDP

Jobs: to support a given level of sales activity, businesses must hire and retain employees

Labor income: the compensation paid to workers

Federal and state taxes: Tax contributions by businesses and employees associated to industry

The following table (Detailed table included in Appendix) shows the aggregate contribution of the US LNG Export sector to each of these economic indicators on a cumulative and annualized basis.

The impact of US LNG exports goes beyond economic benefits. US LNG provides a new dimension of influence for the United States, supporting its geopolitical interests and influence globally. Across the world, US LNG flows provide reliable and affordable energy and, in many cases cleaner alternatives to other fossil fuels. LNG has become fundamental to the global energy transition, complementing rapid growth in renewables, displacing oil and coal demand and promoting decarbonization in developing countries.

During Europe's energy crisis that coincided with Russia's invasion of Ukraine, US LNG supplies responded almost immediately, offsetting nearly half of the loss of imported Russian piped gas. US LNG was uniquely able to respond because its underlying contracts enable companies to divert supplies to wherever they are needed most, in this case, key European markets.

Asia is the second largest market for US LNG, comprising between 30% and 50% of total US LNG exports (the amount varies as flows shift) up to 2024. US allies Japan and Korea are major buyers and count on US LNG as a reliable supplier. Mainland China is also a major market, helping to offset the US trade deficit. Of the remaining Asian exports, approximately 20% flowed to emerging economies such as India, Bangladesh, Pakistan and Vietnam.

The balance of about 10% of US LNG exports is shipped to trading partners in the Americas, reinforcing closer regional ties particularly with Mexico and Brazil.

Establishing LNG as a global and stable commodity also supports the use of natural gas as a viable alternative to coal and traditional wood and waste biomass, in most cases higher-emitting fuels. As a result, US exports facilitate more rapid decarbonization worldwide. In the US, the transition from coal to natural gas made possible the most significant reduction in US CO2 emissions from 2005 to 2020.

Figure 4. Other Benefits of US LNG Exports

Source: S&P Global Commodity Insights

© 2024 S&P Global

In the S&P Global Base Case, US LNG exports more than double to 28 bcf/d by 2030. This growth is expected to drive a contribution of $1.3 trillion to GDP, $2.5 trillion in revenues for US businesses, over $900 billion in expenditures and $165 billion in tax revenues to 2040 and support an average of nearly 500,000 US jobs, while costing US energy consumers very little.

S&P Global develops its ‘Inflections’ Base Case (“Base Case”) outlook for the energy sector using the most rigorous bottom-up analytical approach. The Base Case is structured at an asset and market level, technology by technology, and is supported by the world’s largest expert team of more than 1,400 energy and economic research analysts and consultants that continuously evaluates market fundamentals and assets in response to changing conditions.

Key assumptions of the Base Case (derived through the in-depth analysis used to produce 'Inflections') include global GDP growth expected to average 2.6% through the forecast period to 2040, with a resulting primary energy demand similar to the International Energy Agency’s STEPS case.

S&P Global's Base Case outlook also includes rapid solar and wind growth of 8.6% per year, 10 times expected gas demand growth in the same period. Gas nonetheless is expected to maintain a relevant role in the global energy mix as an important component of the energy transition. Coal demand declines 2.9% annually as gas and renewables replace coal in power generation, while oil demand slowly declines post-2030, as electrification proceeds in the transport sector (and LNG in heavy duty trucking, particularly in Mainland China).

Figure 5. Base Case Global Primary Energy Demand by Fuel

Source: International Energy Agency (IEA) Stated Policies Scenario (STEPS), S&P Global Commodity Insights

© 2024 S&P Global

Today, the US, Qatar and Australia are the leading LNG exporting countries. S&P Global’s Base Case projects a need for more than 100 MMtpa of new global LNG supply capacity (excluding capacity already under construction) to meet growing long-term demand and replace production declines at existing facilities in North Africa and Asia. The United States will continue to drive LNG supply growth to 2030, along with imminent additions of new Canadian and Mexican volumes.

The US and Qatar are expected to dominate the supply response to incremental demand over the next 5 years. The US is projected to account for ~75% of LNG supply final investment decisions (FIDs) for 2025 and 2026 in the Base Case and would more than double its market share (and thus increase economic impact and influence) by 2030, growing from 90 MMt (13 bcf/d) in 2024 to 185 MMt (28 bcf/d) by 2030. Declines in other regions by 2030 will offset the emergence of new suppliers in Africa.

Figure 6. Global LNG Demand and Supply

Source: S&P Global Commodity Insights

© 2024 S&P Global

US LNG exports will satisfy steady LNG demand growth globally. In the key regions of Europe, Asia and Latin America, LNG imports are necessitated by limited regional gas supplies and non-economic factors including geographic and geopolitical constraints to international pipeline development. The benefits from US LNG of security and stability of supply may outweigh cheaper and more proximate gas supply options as in Europe post Russia-Ukraine war and other places in the world. LNG is also critical to meeting energy transition needs. Demand for LNG outpaces overall natural gas demand growth throughout the Base Case period.

In the near-term European LNG demand will continue to grow, peaking in the late 2020s at 165 MMtpa, as LNG is needed to replace declining local production from the UK and, later, Norway. Additionally, LNG will be required to support the closure of coal plants in some central European countries like Poland to support decarbonization goals. This compares to less than 100 MMtpa prior to 2022 as natural gas continues to play a role in both heating and power generation, alongside residual industrial demand. In the medium-term in the 2030s, as renewables continue to pick up, LNG will resume its structural decline.

Asia is the key driver of long-term demand growth, as LNG is one of key sources of energy required to meet growing energy requirements across all sectors. Asia accounts for roughly 70% of global LNG demand in 2024, though that share will stagnate as other importers in the Mideast, Africa and Latin America continue to expand their share. Mainland China LNG demand rises to 2030, but long-term, South and Southeast Asia dominate growth. Of the top Asian importing markets, Japan, South Korea and Taiwan are entirely dependent on LNG for gas supplies, which means they will compete strongly for LNG in periods of demand spikes. They are also willing to sign long-term contracts based on a basket of indexes to ensure security of supply and minimize spot-price exposure. As a result, Japan and South Korea, in particular, have considerable volumes of US LNG under contract and stakes in US LNG exporting facilities that tends to flow to the contracted country market.

Increased natural gas production in the US associated with LNG exports also unlocks additional oil and natural gas liquids (NGLs) production. S&P estimates that the increase in gas production will support an increase in crude oil production averaging 380,000 barrels per day (~3% of the expected total). The increase in NGLs production, the majority of which is a direct consequence of gas production, is projected to reach ~1.1 million barrels per day, or 15% of the expected total. These NGLs will support the economy with low-cost feedstock for critical US industries including petrochemicals and fertilizers in competitive global markets.

This study's forward-looking economic impact analysis will highlight the direct investment, economic contributions and jobs supported by the LNG industry, together with the follow-on impacts of the ongoing investments stimulated across supporting supply chains and the broader US economy. Capturing the "multiplier effects" of direct investment is a critical element of this comprehensive assessment of the LNG industry’s far-reaching contributions to the US economy.

The more than doubling of US LNG exports over the next 5 years will have significant and tangible economic impacts. As LNG exports move from expansion to stabilization, the focus of private expenditure and the subsequent economic impacts shift from 70% upfront capital expenditures and 30% operating expenditures in 2025 to an equilibrium split longer term. The rising proportion of spending on operations will in turn affect the nature of the contribution to the US national economy.

Because operating expenditure reflects the ongoing spending needed to run the infrastructure, jobs related to operations tend to be more durable. Thus, the increasing share of operational spending brings more long-term stability to the economic impact of LNG exports. As a consequence, by 2040 every million dollars of expenditure will lead to $1.4 million of contribution to US GDP and support 9 jobs across the broader national economy, with the cumulative impact on US GDP approaching $1.3 trillion. The cumulative and annual average impacts over the forecast period are summarized below:

The impact of an 'extended halt' in new US LNG development due to legal and regulatory risks is striking. In this scenario, more than $250 billion in lost contribution to GDP and an average of >100,000 US jobs are at risk. Gas price savings in an 'extended halt' are minimal for domestic consumers, with less than 1% gas cost impact per household. Furthermore, 85% of the energy gap from lost US LNG is expected to be filled by fossil fuels from non-US sources.

The impact is already being felt and reflects the competitive nature of global markets, as contracts for binding US LNG supply have notably declined and financing timelines extended in 2024.

S&P Global has assumed that projects accounting for ~44 MMtpa (~5.6 bcf/d of feedgas demand), or ~40% of the growth in US LNG exports expected in the Base Case would not come to fruition in the US LNG 'Extended Halt' Scenario in two main categories:

New pre-Final Investment Decision projects (~28.2 MMtpa) in our Base Case

Halted projects that do not have FERC Authorizations (~16.2 MMtpa)

Figure 7. US Project Incremental Build-Up Post-2024, by Status

Source: S&P Global Commodity Insights

© 2024 S&P Global

The Extended Halt scenario is, in effect, a removal of 20% of the Base Case expenditures as projects are canceled. Thus, by 2040, every dollar of foregone private expenditure will translate to $1.40 of foregone US GDP and will put more than 100,000 jobs at risk across the broader US economy. Referring to the following table, the Extended Halt scenario will lead to a cumulative loss to US GDP exceeding $250 billion while the annual average jobs at risk will surpass 100,000 jobs.

S&P Global analyzed the impact of reducing demand for gas in the US commensurate with the reduction in LNG exports – i.e., the 5.6 bcf/d reduction in LNG feedgas required relative to the Base Case at the Henry Hub, the major wholesale pricing benchmark for natural gas in the US.

The Base Case Henry Hub price forecast expects a temporary rebound in prices in 2025 and 2026, as depressed drilling levels have stalled US production within the 102-103 bcf/d range, while demand growth is continuing. Current swollen storage inventories are expected to be worked down in 2025 and 2026 under normal weather with prices rebounding by late 2025 to induce a drilling response. Normal lags between drilling and production growth will delay a sustained increase in production until late 2026. Prices rebound to $5-$6 per million British thermal units (MMBtu) in real terms through 2027 until production recovers, and prices drop back to $3-$4/MMBtu in 2028, when the impact of the Extended Halt takes hold. Long term, prices drift upward and stabilize.

In the US LNG 'Extended Halt' Scenario, due to the large and low-cost natural gas resource base, the aggregate cost reduction in the 'Extended Halt' per MMBtu is negligible, approximately $0.15/MMBtu at the Henry Hub. The 'Extended Halt' reduces average residential gas prices by 0.7% to 2040. The per household annual gas cost savings amounts to approximately $11 per year to 2040.

Figure 8. Henry Hub Real 2024 Price (‘Halt’ vs Base Case)

Note: We used EIA for average household consumption per residential consumer.

Source: Energy Information Administration (EIA), S&P Global Commodity Insights

© 2024 S&P Global

US residential natural gas prices are already among the lowest in the world driven by competitive wholesale gas prices relative to other developed countries in Europe and Asia. The US gas market has myriad sources of supply and the largest pipeline network worldwide, also with connectivity to significant supply in Canada, delivering to 73 million residential customers.

Figure 9. Residential Natural Gas Prices by Country – 2023 Average, Top 15 OECD Members by Population

Source: IEA, S&P Global Commodity Insights

© 2024 S&P Global

In the US LNG Extended Halt Scenario, global markets are impacted by reduced US LNG exports of approximately 40 MMtpa on average from 2028 - 2040, or 5 bcf/d. In response to this gap, 1) non-US LNG producers will increase supply, and 2) other energy sources will emerge.

Of this amount, the response from non-US LNG projects is projected to be 14 MMtpa (1.8 bcf/d), or 35% of the energy gap. This response results from both accelerated timelines for projects in Qatar, Canada, and Mozambique (there are many other projects in the Base Case that we deem less likely to be accelerated), and new LNG projects that might not otherwise occur absent the US halt. New capacity included in the response are proposed projects in Argentina, Indonesia, Oman and Russia.

Most competing suppliers are not able to accelerate timelines simply because US projects are cancelled. Other unrelated factors, including upstream costs, political risks, sanctions, and permitting and infrastructure, challenge projects. It takes typically four to six years to build a new largescale LNG project, with significantly more time needed before construction begins.

Beyond the alternative non-US LNG supply, the remaining gap will be replaced by the most competitive alternatives for each market, whether coal, oil, renewable power or alternative gas supplies. At a global level, our modelling indicates a combination. 65% of the resulting deficit (25 MMtpa) is addressed by energy sources other than LNG, largely from other fossil fuels (50%). Nearly half includes a return to coal in power and industrial operations, and the rest by a mix of oil used as industrial feedstock and regional increases in piped gas. The remaining 15% are renewable additions, mostly solar and wind, with long-term additions from nuclear and hydrogen generation.

A striking conclusion is that when including the global LNG system response, approximately 85% of the reduction in US LNG exports would be offset by fossil fuels sourced from outside the US.

The global price impact of the 'Extended Halt' is more significant than the US price impact owing to the large role US LNG plays in global LNG trade as previously discussed. Thus, the 'Extended Halt' Scenario increases global gas prices by $1−3/MMBtu from 2027–2031, impacting global consumers.

Figure 10. Energy Response in US LNG 'Extended Halt' Scenario vs. Base Case - Yearly Average 2028 - 2040

Note: This is not an exhaustive list of projects included in S&P`s Base Case, which includes projects in Australia, Malaysia, Papua New Guinea and United Arab Emirates.

Source: S&P Global Commodity Insights

© 2024 S&P Global

These results have been analyzed on a regional and subregional level, based on both the known existing contractual agreements of the halted projects and forecast flows for US LNG exports. On a broad regional basis, nearly 90% of the energy gap left by US LNG is concentrated in Asia (65%) and Europe (25%) due to the scale, relevance and import dependency of those markets.

The Asian response accounts for 26 MMtpa equivalent LNG, with close to half (46%) of that stemming from coal and oil switching in industrial and power sectors in markets where affordability concerns reign and there are abundant domestic reserves in place. Renewables additions are expected long-term, particularly in more developed markets such as Japan and South Korea, which can possibly over time turn to alternative sources such as hydrogen (ammonia), nuclear, and offshore wind. Still, no major infrastructure assumptions are necessary to meet the energy gap given the energy response only represents 2% of the total size of the Asian gas market.

The European response (10 MMtpa LNG equivalent) is also quite limited in terms of scale (less than 4% of overall gas demand in the region), but it is somewhat different than Asia in terms of behavior. It involves more accelerated renewables penetration (24% of the gap) given the market’s maturity and policy drivers, and it also turns more to regional or proximate gas supplies to help offset another 25% of the gap. Similarly to Asia, Europe would also rely more on coal and oil in the short-term.

Figure 11. Asia and Europe Energy Response to ‘Extended Halt’ vs. Base Case, Yearly Average, 2028–2040

Source: S&P Global Commodity Insights

© 2024 S&P Global

We have assessed and quantified throughout this Phase 1 report the meteoric rise of the US LNG export industry, rapidly evolving from a single initial cargo in February 2016 to its emergence in just over a decade as the largest global player, with 22% of total market share. S&P Global's Base Case outlook further reinforces this leadership position, projecting US LNG's market share at ~30% within 5 years, with total export capacity more than doubling.

LNG's growing role in serving the world's increasing needs for reliable, affordable and in many cases cleaner energy has been well established. This industry is not only expected to generate $1.3 trillion in US revenues to 2040, but it also provides a new avenue for US influence, buttressing the geopolitical position of the US in the world.

However, an array of regulatory and legal pressures is jeopardizing the US LNG industry's growth prospects, with its domestic and global impacts explored in our US LNG 'Extended Halt' Scenario.

The key takeaways from this Phase 1 report are summarized below:

The US LNG export sector has rapidly emerged within the past decade to become a $34 billion annual industry, twice the dollar value of US movie and television exports, greater than the value of soybean and corn exports, and over half of the value of US semiconductor exports

Growth potential remains strong – reliable and affordable US LNG supply has set the stage for exports to more than double in the next 5 years, contributing $1.3 trillion to GDP and supporting hundreds of thousands of jobs per year to 2040

Halting this potential growth puts at risk more than one hundred thousand jobs per year in the US and over $250 billion in GDP

The benefits of LNG exports come at minimal costs to US consumers given the vast US resource (<1% residential natural gas price increase to 2040), and these are many times exceeded by the economic benefits of further development that flow across the nation's economy

Furthermore, 85% of the energy gap derived from an extended halt would be sourced from fossil fuels outside the US

Placing this growth at risk diminishes US geopolitical influence, and jeopardizes its reputation as a reliable and affordable energy supplier to allies and trading partners

Figure 12. Overall US LNG Impact Study Methodology and Approach

Source: S&P Global Commodity Insights

© 2024 S&P Global

In this Phase 1 report, S&P Global’s unique energy, economics, and data analytics capabilities provide an objective and independent view of the impact of US LNG exports on the national economy.

A Phase 2 companion study, to be released in March 2025, will complement Phase 1 with state and congressional district level economic impact and a rigorous emissions analysis of US LNG exports and replacement energies under a US LNG 'Extended Halt' Scenario defined in the Phase 1 report.

In Phase 1, the S&P Global team analyzed the global and US gas and energy market impact and US upstream and pricing impact to determine the national US economic impact of the US LNG export industry from three distinct perspectives:

Impact to date (2016-2024)

S&P Global's 'Inflections' Base Case (to 2040), further defined in the Phase 1 report

A potential US LNG 'Extended Halt' Scenario (to 2040), further defined in the Phase 1 report

The overall summarized analytical methodology for Phase 1 includes three key elements:

Global and US Gas and Energy Market Impact

Characterize the domestic and international US LNG export market to date, moving forward under the 'Inflections' Base Case, and under a potential US LNG 'Extended Halt' Scenario

Quantify the US LNG midstream value chain (pipeline, storage, liquefaction) in terms of volumes, projects, capital and operating expenditures to date, Base Case, and 'Extended Halt' Scenario, inputs for both the US Upstream & Pricing Impact and Economic Impact analyses

Model and analyze the global response to less available US LNG under the US 'Extended Halt' Scenario, with the gap filled by a combination of non-US global LNG supply and non-LNG energy system response (markets impacted, replacement energies, and pricing)

US Upstream & Pricing Impact

Utilize US LNG value chain and market data and detailed production cost analysis and supply curves to determine production associated with US LNG exports to date and moving forward in Base Case and US LNG 'Extended Halt' Scenario

Analyze gas-driven (non-associated) and oil-driven (associated) plays to determine effects on drilling and completion activity, facilities and gathering and processing requirements to quantify capital and operating expenditures as inputs for the Economic Impact analysis

Model the US LNG Extended Halt Scenario domestic gas price forecast using the aggregation of bespoke play-level economic models to enable the computation of the price response to the variation in demand and subsequent production requirement

National US Economic Impact

Input US capital and operating expenditures of the Phase 1 analysis into S&P Global's Social Accounting Modelling system that captures the interactions of all industrial sectors to present a complete account of how various activities of expenditures or operations flow through the national economy

Estimate the positive direct, indirect, and induced economic impact of US LNG exports to date and forward-looking in the Base Case

Estimate the economic impact at risk in the US LNG 'Extended Halt' Scenario at a national-level

More detailed methodology for each of the three elements of the Phase 1 analysis follow:

Figure 13. Global and US Gas and Energy Market Impact Analysis Methodology and Approach

Source: S&P Global Commodity Insights

© 2024 S&P Global

Figure 14. US Upstream Impact Methodology and Inputs

Source: S&P Global Commodity Insights

© 2024 S&P Global

Oil and Gas play characteristics and performances are derived from geologic knowledge, company filings and inputs, geography, and industry norms. S&P Lower 48 wells and production datasets form the basis for future well locations. Wells are linked to the most logical play, based on the subsurface data available, via human or machine computation.

Wells are assigned tiers represented with a Class from 1 (best) to 5 (worst) of the location contribution calculated by a Factor Contribution Analysis machine learning algorithm of the relevant land section in the context of each play. The tier designation is aligned with the quintile location of each well from the Factor Contribution Analysis model.

Partitions are identified to show a coherent pattern of decline in historical production for each well. Where there are multiple partitions, the process uses the last analyzable partition to create the forecast. Wells type curves forecasts cover 660 months unless production reaches economic limits before the end of this forecast period.

S&P Global natural gas models segregate natural gas production in dry gas and NGLs. Economic models determine the natural gas volumes enabling an NPV >= 0 at a 15% discount rate. Dry gas production at play level feeds the US LNG facilities via the most relevant pipeline systems.

S&P Global models capital expenditures and operating expenditures in the Upstream segment including wellhead, facilities, and gathering and processing.

The aggregation of bespoke play-level economic models enables the computation of the price response to a variation in production target or demand. Matrices of price and production by play are developed and aggregated. Interpolations enable S&P to identify the price supporting the production of targeted volumes.

S&P Global uses well head production multiplied by commodity price to generate gross revenue. Royalties, capital expenditures, operating expenses and taxes are subtracted from revenue to generate net cash flow. The breakeven price is solved as the price enabling a net present value of 0 given selected macro assumptions.

Figure 15. US Economic and Energy Market Modelling Framework & Methodology

Source: S&P Global Market Intelligence

© 2024 S&P Global

Content Type

S&P Global

Vice Chairman

Daniel Yergin is Vice Chairman of S&P Global. He is a highly respected authority on energy, international politics, and economics, and a Pulitzer Prize winner. He chairs S&P’s CERAWeek conference, which CNBC has called “the Super Bowl of world energy”.

Time Magazine said, “If there is one man whose opinion matters more than any other on global energy markets, it’s Daniel Yergin.” The New York Times called him “America’s most influential energy pundit” And The Wall Street Journal described him as “the energy sage”.

He plays a leadership role in the Commodity Insight research at S&P Global and recently led studies on LNG as a major new U.S. export industry and on “Copper in the Age of AI”.

Dr. Yergin’s most recent book The New Map: Energy, Climate and the Clash of Nations is described by NPR as “a master class on how the world works,” and in The Washington Post as “a tour de force of geopolitical understanding.,” It has been translated into 14 languages.

A Pulitzer Prize winner, Dr. Yergin is the author of the bestseller The Quest: Energy, Security, and the Remaking of the Modern World. The Quest, which The New York Times said it is “necessary reading for C.E.O.’s, conservationists, lawmakers, generals, spies, tech geeks (and) thriller writers.” Bill Gates summed up his review of The Quest by saying, “This is a fantastic book.”

Dr. Yergin is known around the world for his book The Prize: The Epic Quest for Oil Money and Power, which was awarded the Pulitzer Prize. It became a number one New York Times best seller and has been translated into 20 languages.

Of Dr. Yergin’s book Commanding Heights: The Battle for the World Economy, which has been translated into 13 languages, The Wall Street Journal said, “No one could ask for a better account of the world’s political and economic destiny since World War II.” Both The Prize and Commanding Heights were made into award- winning television documentaries for PBS and BBC, which Dr. Yergin co-produced, co-wrote, and narrated.

Dr. Yergin is a senior trustee of the Brookings Institution and a member of the Energy Advisory Council of the Dallas Federal Reserve. Dr. Yergin served on the U.S. Secretary of Energy Advisory Board under four U.S. presidents.

Among his honors, both the Prime Minister of India and the United States Association have presented Dr. Yergin with a “Lifetime Achievement” awards and the U.S. Department of Energy awarded him the first “James Schlesinger Medal for Energy Security.” The University of Pennsylvania presented him with the first Carnot Prize for “distinguished contributions to energy policy.” Dr. Yergin was awarded the Gold Medal of the President of the Republic of Italy for combining “an understanding of the dynamics of the market with a broad view of the forces of geopolitics as he seeks to point the way to the positive outcomes for the world community.

Dr. Yergin is a member of the advisory boards for the Columbia University Center on Global Energy policy and the MIT Energy Initiative.

Dr. Yergin holds a BA from Yale University and an M.A. and Ph.D. from Cambridge University, where he was a Marshall Scholar

S&P Global Energy

Senior Vice President, Head of Geopolitics and International Affairs

Carlos Pascual leads the integration of geopolitics, energy, and markets for S&P Global Energy. He works with clients globally on addressing the geopolitical challenges of energy transition, security and competitiveness -- and the implications for energy justice. Mr. Pascual also leads the coordination of S&P Global Energy businesses in Latin America.

Mr. Pascual was previously US Ambassador to both Mexico and Ukraine and was Special Assistant to the US president for Russia, Ukraine, and Eurasia on the National Security Council. As the former US Energy Envoy and Coordinator for International Energy Affairs at the State Department, Mr. Pascual established and directed the Energy Resources Bureau and served as the Senior Advisor to the Secretary of State on energy issues.

Earlier, Mr. Pascual created the position of Coordinator for Reconstruction and Stabilization in the State Department, establishing the first civilian response capacity to conflicts. Mr. Pascual is a distinguished fellow at the Atlantic Council and was a resident fellow at Columbia University’s Center on Global Energy Policy. He holds a Bachelor of Arts degree from Stanford University and a Master of Public Policy degree from the Kennedy School of Government at Harvard University.

S&P Global Energy

Global Gas Strategy Lead and Special Advisor

Michael is Global Gas Strategy Lead and Special Advisor with S&P Global Energy. He is a member of the S&P Global Energy Leadership Team and also sits on the Gas, Power, and Climate Solutions management team. Previously he spent a decade as Chief Strategist Global Gas at S&P Global (now part of S&P Global), and Vice Chairman CERAWeek, the world's premier annual energy conference. Prior to that, he led the global gas team at S&P Global CERA.

Michael is a specialist in the international gas business of 30 years standing. He set up the research and consulting business of liquefied natural gas (LNG) within S&P Global CERA and is now responsible for the development and coordination of S&P Global's global and interregional coverage of pipeline gas markets and LNG. His expertise also includes long-term scenario planning and European energy policy. Michael has advised some of the world's largest LNG projects across continents. He is also a regular speaker at major conferences including ADIPEC, the ATCE, CERAWeek, GasTech, SPIEF, and the World Gas Conference.

Before joining S&P Global, Michael was a research fellow at the Oxford Institute for Energy Studies (OIES) where he set up the gas programme. In addition, Michael has served as a Parliamentary Special Advisor for the House of Commons Trade and Industry Select Committee in the United Kingdom and as a consultant to the World Bank.

He is the author of numerous S&P Global reports, including "Two Visions of the Future of LNG," "European Natural Gas: The New Configuration," "Six Numbers to Change the Energy Future," and "The New Map of Global Gas."

In 2021, Michael co-led "A Sustainable Flame: the Role of Gas in Net Zero," a cross-industry research programme supported by over 30 leading corporates.

Michael holds an honors degree from the University of York.

S&P Global Energy

Global Head, Gas, LNG & Low Carbon Gases Consulting

Eric leads an expert team of 50 consultants with his results-driven approach and big picture thinking and regularly delivers keynote speeches and moderates dialogues and roundtables with the industry’s foremost leaders.

Eric is a force for growth and has led more than 200 global engagements partnering with C-level executives in the gas and power industry and government officials, pioneering innovative solutions across commercial advisory, strategy and policy, transaction support, and low carbon offerings. He has directed >US$75 billion in successful gas and power deals.

Before joining S&P, Eric held consulting and commercial industry roles at Wood Mackenzie, McKinsey & Co., and Calpine Energy Services and has an INSEAD MBA.

S&P Global Energy

Executive Director, Gas & LNG Energy Consulting

S&P Global Market Intelligence

Executive Director, Economic Consulting

Mohsen is Executive Director of consulting in S&P Global Market Intelligence, working on macroeconomic and industry economics since 1986. He brings more than 30 years of experience in macroeconomic, regional, and industry consulting with a strong focus on scenario analysis, economic impact assessments, and applications of market planning. Mohsen has been responsible for development of a detailed regional application (Business Market Insights) and global information and communication technology capability. He has expertise in regional economic impact assessment and is fluent in relevant modeling tools to a wide array of issues and policies.

Mohsen worked as a partner with Cisco's Global Market Intelligence group to build a model to estimate total addressable market for network technologies and services. The model has become on the forefront of strategic marketing initiative for Cisco via their global market view model and database.

Mohsen was the project manager for series of large scale energy related projects including Crude Oil Export Decision - the Fact-based study and analysis played an important role in lifting the ban, Americas New Energy Future - studies had an extraordinary impact at a time of debate over future of shale and was cited in Presidential State of the Union Address, and Restarting the Engine in US Gulf of Mexico - client used the research to have BOEMER accelerate licensing process in the Gulf of Mexico.

Mohsen holds an M.A. in Economics and a B.S. in Economics and Computer Science from Temple University.

S&P Global Energy

Vice President, Power and Gas

Ed has more than 30 years of experience in the natural gas business, including 20 years in research and consulting. He leads major consulting engagements and advises energy firms regarding business strategy in the North American gas and power industries. Prior to joining the company in 2012, Ed was a senior executive in a North American gas and power consultancy, a founder and leading spokesperson for a North American gas research and consulting practice, and an expert in the gas midstream business and market and basis analysis. Prior to that he was director of research, North American Gas for CERA (now part of S&P Global). During a decade there, Ed edited the research product and directed numerous consulting engagements, applying scenarios to client investment and decision making. He has held a variety of strategic planning, market analysis, and storage development positions for two interstate pipeline companies.

Ed holds a Bachelor of Arts from the University of Chicago and an MBA from the University of Texas at Austin, Texas, United States.

S&P Global Energy

Global Head of LNG, CI Consulting

Specializing in market and policy advisory, strategy development, commercial due diligence, investment analyses and LNG market modeling across the LNG value chain - including midstream and liquefaction, shipping and regasification. Madeline uses her 25 years of global expertise and innate curiosity for how the world works to look at every challenge as part of the bigger picture.

Excited by a paradigm shift in energy consumption, Madeline is helping the oil and gas industry transition to a cleaner, greener and smarter way of working.

Madeline completed a master’s program in Middle Eastern Studies at Georgetown University specializing in energy economics.

S&P Global Energy

Executive Director, Upstream, CI Consulting

Based in Houston, Aube manages, advises and participates in upstream consulting engagements where she leverages her analytics and petroleum economics expertise to enable clients to evaluate prospective investments and/or fiscal systems. She has been working with S&P Global (Now a part of S&P Global) upstream groups in the US and the Middle East for 14 years. Before this, Aube spent 5 years with Schlumberger where she held various analytics and audit roles. Aube typically leads due diligences, bid-round support, resources/fiscal benchmarking or market entry strategy engagements. Her practical expertise includes petroleum fiscal systems, exploration benchmarking, basins and plays evaluations, strategy formulation and modelling, advanced geospatial and statistical analytics and cost factors analysis. She has collaborated with research contributions to studies such as 'The Replacement Imperative', 'Fueling North America Future' or 'Shale Gas Reloaded'.

Aube holds a master's degree in finance from the University Rene Descartes (Paris V) and completed a certificate in petroleum projects evaluation and management at Texas A&M Harold Vance School of Engineering, US.

S&P Global Energy

Senior Director, Energy Transition, Energy Consulting

We want to acknowledge and express appreciation to members of the Executive Advisory Committee, including Andrew Ellis, Eleonor Kramarz, Hassan Eltorie, Jonathan Ablett, Kevin Birn, Laurent Ruseckas, Matt Palmer, Raoul Leblanc, Shankari Srinivasan, and Zhi Xin Chong.

We would like to thank the additional Editorial, Design, and Publishing team members including, but not limited to; subject matter experts; technical energy experts; industry experts; and analysts who have contributed to this study: Alvaro Hernandez, Bob Flanagan, Daniel Bermudez, Daniel McLaughlin, Daniela Torres, Eugenia Salazar, Gray Bender, Ilke Karayigitoglu, Imre Kugler, Jose Contreras, James Crompton, Karen Rosales Molina, Karim Jeafarqomi, Maria Jose Cauduro, Marian Attie, Miguel Acosta, Narmadha Navaneethan, Nick Thomson, Njiah McKinney, Noah Feingold, Omar Ramirez, Pedro Neves, Phil Hopkins, Pragati Parasrampuria, Reed Olmstead, Ricardo Pool Mazun, Sara Hakim, Simon Wood, Stephen Adams, Wanying Shi.

Eric Eyberg

Vice President, Gas & Power Commodity Insights Consulting

Eric.Eyberg@spglobal.com

Leandro Caputo

Executive Director, Gas & LNG Commodity Insights Consulting

Leandro.Caputo@spglobal.com

Linda Kinney

Head of Business Development, Commodity Insights Consulting

Linda.Kinney@spglobal.com

Jeff Marn

Executive Director, Public Relations, S&P Global

Jeff.Marn@spglobal.com