Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Feb 17, 2022

By Aaron Brady, Bhushan Bahree, and Jim Burkhard

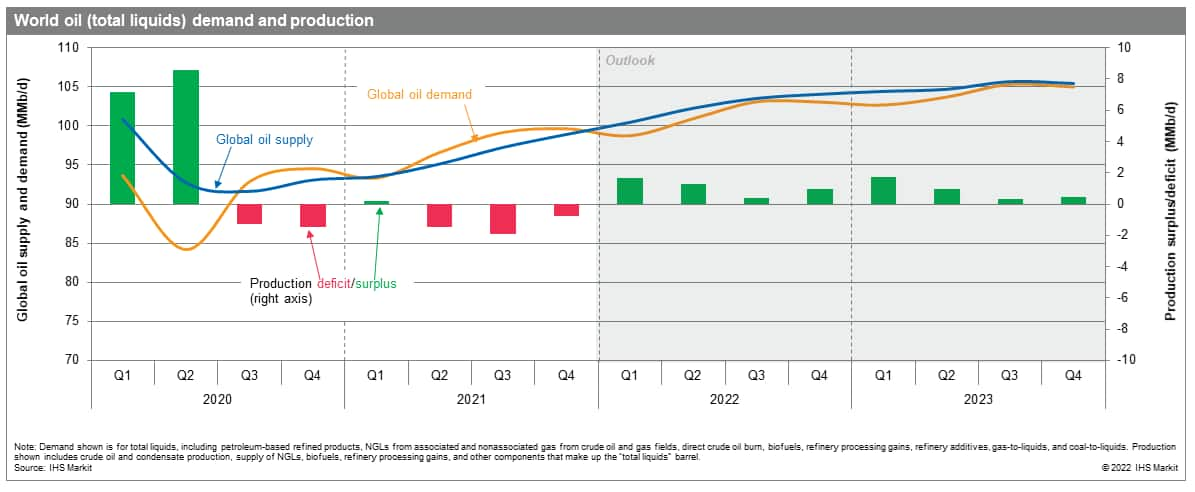

A common refrain among oil market players is how "tight" the market is. And they are right. World oil demand has exceeded supply since mid-2020. OECD oil inventories are drained to their lowest level in seven years—and the lowest ever in Europe and Asia. Spare crude oil production capacity is falling. OPEC+ is unable to meet supply targets owing to eroded production capacity in some member countries. Exceptional backwardation in the ultimate fundamental—price—highlights how strong demand for supply is now. Fervor, anticipation—and, for some, dread—of oil hitting $100/bbl and higher is palpable.

Add into this mix the confrontation over Ukraine and the possibility of a new Iranian nuclear deal. The geopolitical impact on oil prices is rarely so vivid or potentially far-reaching. A key signpost will be if Russian forces posted near Ukraine begin a withdrawal—or not. On 15 February, President Vladimir Putin said Russia is "ready to continue on the negotiating track." Deescalation would diminish some upward oil price pressure. However, it is still possible that relations between Russia and the West could rupture and deepen divisions that will be hard to overcome. In the near term, panic and disruption in markets are possible if severe financial and economic sanctions are placed on Russia—even if oil exports are not explicitly targeted by Western sanctions. The effectiveness of emergency actions to counter high prices, including the release of strategic oil reserves, would be tested. In any case, this confrontation—however it ends—will influence energy policies and investments in both Russia and the West for years to come.

On the Iranian nuclear issue, the current stage of negotiations are potentially decisive. A new deal may be near, which could lead to higher Iranian oil exports. But such an outcome is far from certain and would face opposition in the United States and Iran. But it does hold the prospect that Iran could increase production by around 1 MMb/d over the next year and contribute to an easing of market tightness. We have changed our assumption in our base case by adding more Iranian supply in 2022 instead of 2023. On 9 February, amid the Ukraine crisis, US President Joseph Biden spoke with King Salman bin Abdulaziz Al-Saud of Saudi Arabia and "underscored the US commitment to support Saudi Arabia in the defense of its people and territory."

Setting aside geopolitics, we continue to expect large supply growth outside of the OPEC+ agreement on crude oil. Led by 1.6 MMb/d of liquids growth in the United States, we project a total of 3.5 MMb/d of global liquids supply growth in 2022 outside of the OPEC+ deal. At the same time, we expect world demand growth to be strong, again, and increase 4.3 MMb/d. While OPEC+ supply is, of course, needed, production gains elsewhere could ease prices and boost inventory levels. But if supply falls short of our expectations, spare capacity falls further, and inventories remain low or even decline, then $100+/bbl oil could be with us for some time. Lastly, while it seems the worst of COVID-19 is behind us and the world is moving toward a new normal, the emergence of Omicron less than three months ago is a reminder to be modest in terms of our confidence about predicting the future of COVID-19—as well as the new world order that is emerging turbulently.

Figure 1: World oil (total liquids) demand and production through 2023

Ask our oil market experts a question about the short-term outlook.

Posted 17 February 2022 by Aaron Brady, Vice President, Energy Oil Market Services, S&P Global Energy and

Bhushan Bahree, Executive Director, Oil Markets, Downstream and Chemicals Team, S&P Global Energy and

Jim Burkhard, Vice President & Head of research for oil markets, energy & mobility, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.