Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Dec 07, 2022

By Zayd Wahab

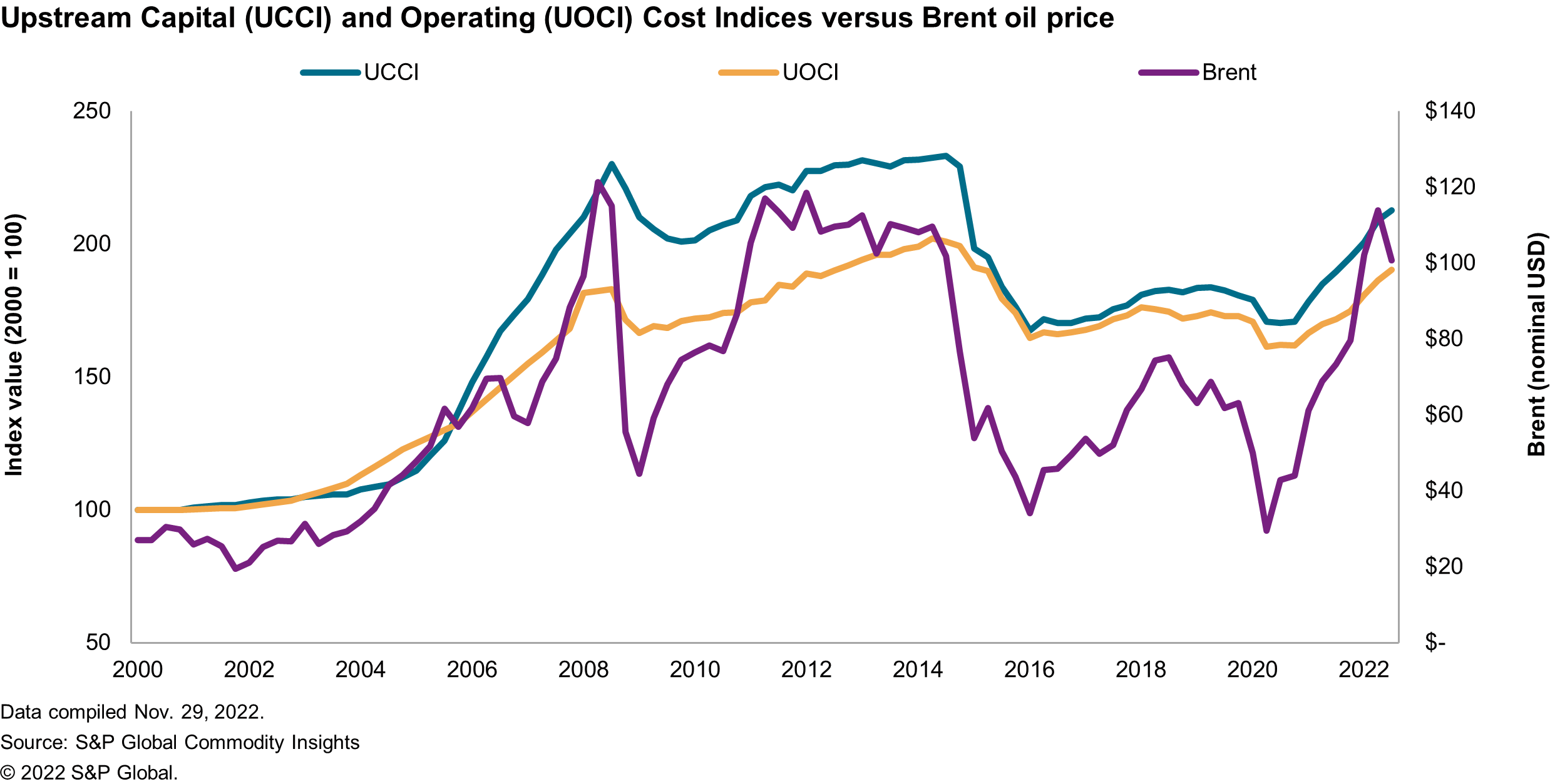

The cost of developing upstream oil and gas assets, as tracked by the IHS Markit Upstream Capital Costs Index (UCCI), increased by 1.8% in the third quarter of 2022. Costs continued to be driven upwards by the ongoing conflict in Ukraine and the increase in upstream project activity globally on account of elevated oil and natural gas prices. While expenses in virtually every market continued to trend higher, there has been some relief from lower raw material prices impacting steel products, as bulks derived from oil and copper.

Most markets monitored by the UCCS increased in third quarter 2022, with the largest increase from the land and offshore rig markets, up by 11% and 12%, respectively (see Table 2). Land rig rates are escalating drastically during 2022. Short-term contracting in 2021 allowed contractors to reprice their entire fleet in 2022. The offshore rig market is in recovery. Day rates are on the rise for all regions and rig classes. This is driven by high oil prices and increased drilling activity. Prices will continue to rise in the short term.

Some markets were in decline in the third quarter in the US dollar index: steel, bulk materials, EPM and construction labor. The global average for steel declined by 2.8%. Raw material prices have eased over the summer. Only construction steel products benefited from this decrease. Pipe prices have remained elevated owing to strong demand from the oil and gas industry. Mills are attempting to hold onto increased margins for pipe.

The global average for bulk material declined by 0.8% over the third quarter. Bulk material prices were very material specific in the third quarter as price movements in raw materials dictated most price movements. Falling oil prices contributed to weakness in materials that are oil dependent, and copper prices fell from historical highs, driving down price growth experienced in copper-dependent materials. Supply chain disruptions and elevated inflation are keeping some material prices from collapsing even with the decline in raw material prices.

Both the EPM and construction labor markets experienced modest declines in US dollar terms over the third quarter, declining 0.5%. Ignoring the effects of foreign exchange, both markets experienced an increase in local currencies. The construction labor index increased by 1.4% in local currency terms as wage growth remained resilient even as cracks begin to show in global economic growth. Oil and gas construction activity continues to be robust, which is driving up demand for labor and contributed to rising wages in third quarter 2022. The EPM market rose by 1.7% in local currency terms. Wages are rising in all regions and as availability of workers is tight.

Despite some market declines in the third quarter, all the markets are trending positive for 2022 (see Figure 3). The markets are forecast to end 2022 higher than 2021 even with some declines in the third and fourth quarters. Project costs will continue to rise as Russia's war in Ukraine keeps oil and gas prices elevated and adds to supply chain disruptions. Raw material prices will remain elevated through most of 2022, which will push up prices for energy sector building materials. This will lead to the UCCI increasing by 11.7% in 2022.

In third quarter 2022, the UOCI grew by 2% quarter on quarter (q/q), driven by rising activity and continuing supply/demand disruption, which fed through into key segments.

Activity, particularly in the US onshore and in offshore markets, is recovering. However, crude prices remain extremely volatile. Weaker oil demand growth with a looming global recession has eased supply concerns. However, limited spare oil production capacity is a concern for the rest of this year and 2023. This divergence in the oil market fundamentals with both increased risk of less oil demand growth and less supply will continue to spur volatility. The additional dimension of rising geopolitical tensions will mean additional downside risk in the near term.

S&P Global expects that cost escalation will continue through the final quarter of the year, with the UOCI ending 2022 up 12%. Some relief will come in 2023; forecasted UOCI escalations will likely be more muted at around 5%.

***

This blog is an extract from two reports. The full reports Third quarter 2022 UCCI and UOCI market review are available for S&P Global Energy Connect platform subscribers only. For more information contact James Blanchard.

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.