Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 09, 2022

The Russian invasion of Ukraine and the subsequent imposition of sanctions by a range of governments have served to reset the global geopolitical compass, with an immediate impact on oil and gas markets and investments. While the war is continuing and full implications will take years to emerge, some early outcomes for above-ground risk are already crystalising.

Market shifts and price dynamics create immediate costs and benefits

Given Russia's global significance as an energy producer and Europe as its main market, a full-scale recalibration of oil and gas demand and supply in that region is a key non-military component of the global response. So far measures imposed on Russia fall short of impeding general oil and gas trade and shipping, while its oil and gas companies can still invest overseas, despite restrictions on finance. Western companies with announced plans to exit or halt investments in Russia account for only a small percentage of the country's oil and gas output and will therefore have a limited impact on Russian production in the near term.

In this context, the Asia Pacific region, led by China, is emerging as an important if less than complete offset to anticipated cuts in demand for Russian production. All regions will be affected by increases in prices and likely slower growth in economic activity and demand while rival producer states will see opportunities for increases in production and exports as Europe re-balances its energy sourcing.

Near-term, high oil and gas prices represent a boon for net exporters, including Russia. Major beneficiaries include Angola, Iraq, and Kuwait, in which net oil exports as a percent of GDP will rise to well over 50%, assuming that Brent averages USD106/barrel in 2022. Conversely, rising costs for net importers will exacerbate existing inflationary trends that may foment civil instability, electoral shifts, and threats of regime change, as is already happening in parts of South Asia.

Current and aspiring producers benefit from the search for new opportunities

Elevated prices and new sources of demand will create opportunities for producer states where resource availability, project economics, investor support, and infrastructure availability coalesce with government backing.

Gas projects with access to existing infrastructure are in a particularly strong position to compete, lending new opportunities to African and East Mediterranean suppliers in particular. In some cases, this may persuade producer states to revive oil and gas licensing and rethink transition strategies. Changes to fiscal terms are likely to be slower to materialise, given the sluggish evolution of government policy, the uncertain impact of the energy transition, and producer government perceptions that changes in prices and supply dynamics will be sufficient to attract investment.

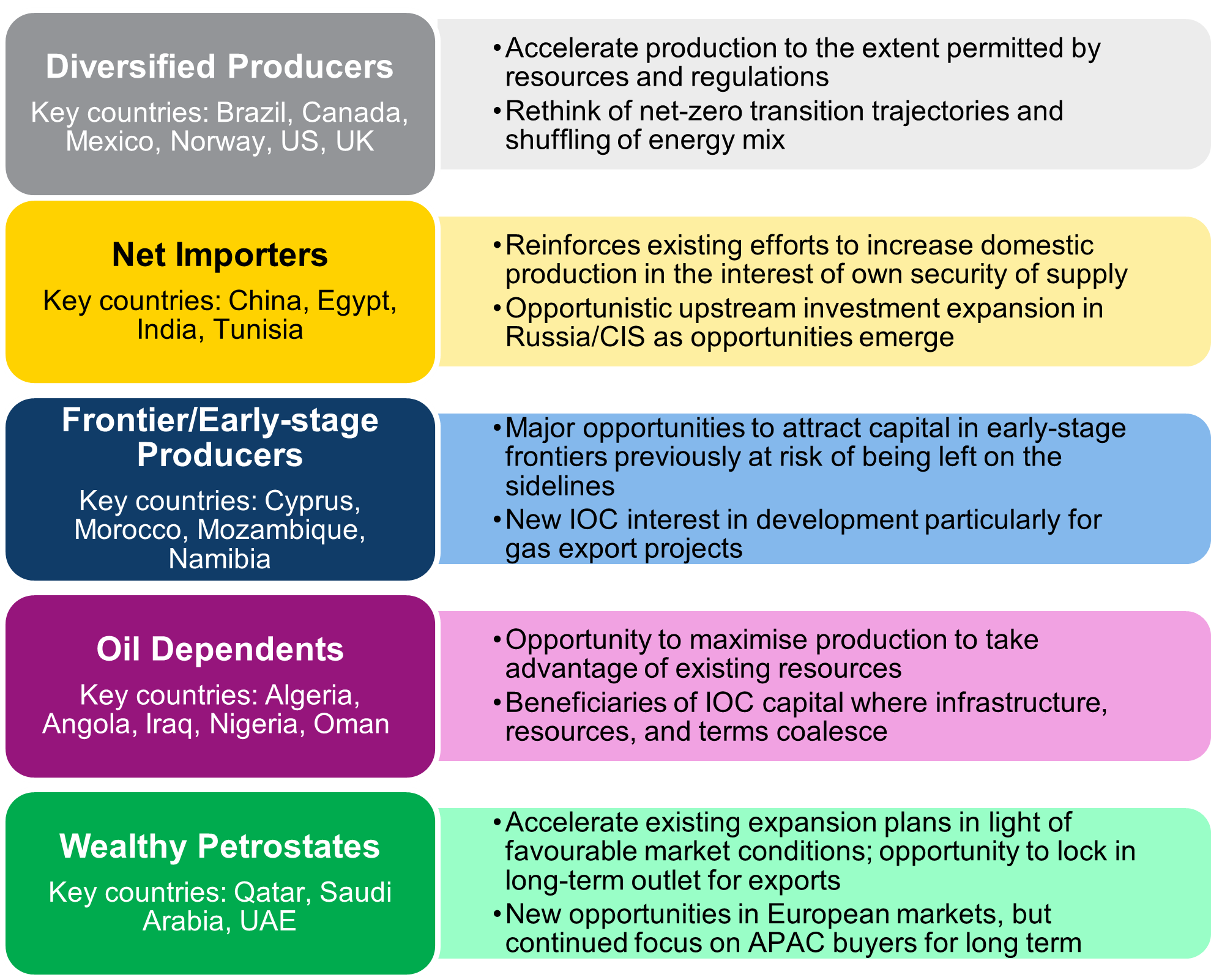

With higher prices, new market opportunities, and greater realism regarding the role of fossil fuels in energy transition, how host governments respond to the challenges of the current environment will vary depending on the scale and maturity of their resources, their economic wherewithal, and their structural dependence on hydrocarbons. While country specifics are critical, differences between producer peer groups are worth noting:

• Diversified producers like Brazil, Canada, Mexico, Norway, the US, and the UK are likely to have to balance priorities, with energy security perhaps shifting attitudes to domestic hydrocarbon production even if longer-term energy transition objectives remain in place.

• Net importers like China, Egypt, India, and Tunisia are likely to double down on existing strategies to sustain and grow production.

• Frontier / early-stage producers like Cyprus, Morocco, Mozambique, and Namibia, with no existing export infrastructure, may now find opportunities to accelerate monetisation.

• Oil dependents, in most cases current or former major producers like Algeria, Angola, Iraq, Nigeria, and Oman, may find themselves with a potentially longer window of opportunity to monetise their remaining reserves, leverage infrastructure, and invest in diversification where there is the capacity to plan and execute plans.

• Wealthy petrostates like Qatar, Saudi Arabia, and the UAE are likely to maintain and/or accelerate existing strategies to sustain and grow output in an effort to monetise remaining resources in advance of a global energy transition.

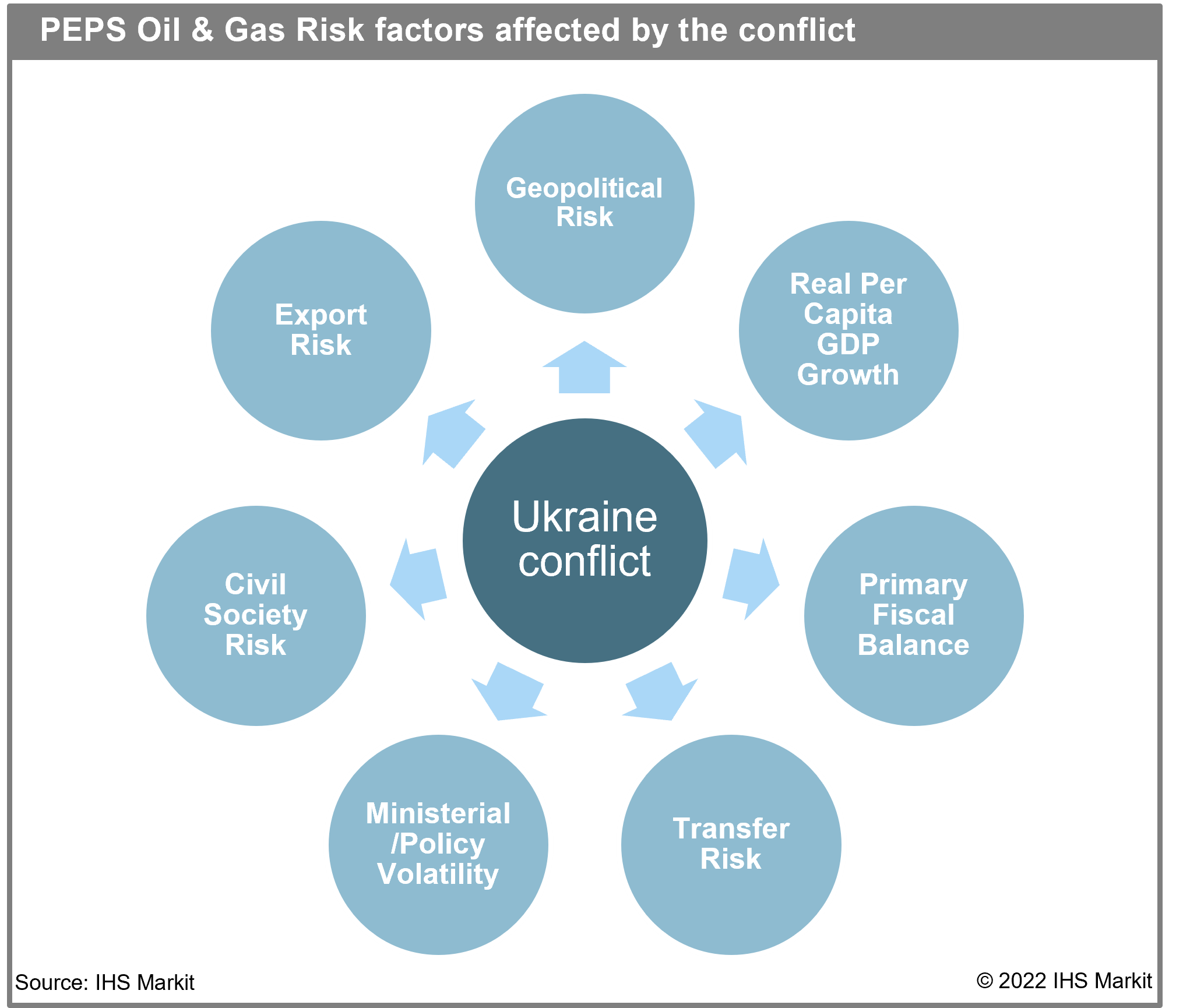

Specific responses will vary by country, shaped in large part by above-ground factors. Above-ground risks with particular relevance in the current situation include:

• Geopolitical Risk, notably in Russia's immediate neighbourhood.

• Real Per Capita GDP Growth, as production and exports of oil and gas fluctuate and higher prices for crude and natural gas begin to affect consumer spending.

• Primary Fiscal Balance and Transfer Risk, reflecting some of the same factors that affect overall economic activity but with sanctions adding a new dimension to the possibilities for capital and foreign-exchange controls.

• Ministerial/Policy Volatility, as some governments re-prioritise energy security, albeit constrained in cases by the level of Civil Society Risk, as inflationary pressures increase.

• Other affected factors include Export Risk, given recent and forthcoming changes to export policies and infrastructure.

Energy transition efforts tempered by renewed energy security concerns

The Ukraine invasion will also have implications for energy transition, primarily in Europe, where a renewed focus on energy security highlights the need to secure additional fossil fuel supplies in short order. As indicated above, near-term measures will likely include stepped up investment in LNG regasification as well as investment to increase the production of biomethane and renewable hydrogen and to front-load wind and solar. Beyond this, there are indications that some countries are recognising that nuclear will need to play a greater role.

In the United States, the administration is likely to double down on efforts to accelerate the energy transition. While the drive to supply additional gas to Europe may ease some near-term restrictions, e.g., around new pipelines and even leasing, the climate will remain the priority.

In the rest of the world, the elevation of security concerns will prove positive for producing countries seeking to secure upstream investment to counter energy poverty and may ease financing. Overall, however, efforts to reduce hydrocarbon consumption, combined with elevated prices and supply chain issues, will likely curb the extent of demand growth, compounding transition uncertainties in the longer term.

***

To read the report, Oil & Gas Risk Quarterly: Reverberations of the Ukraine Crisis - above-ground risk implications for the global upstream, sign up for complimentary access to the Upstream Oil & Gas Hub.

Posted 09 May 2022 by Cat Hunter, Director, E&P Terms and Above-Ground Risk, North Africa and Levant, S&P Global Energy and

David Gates, Senior Consultant, S&P Global and

Mariam Al-Shamma, Director, Energy Research & Consulting, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.