Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jun 15, 2023

Distribution is a critical link in the Indian power sector value chain, and the performance of Distribution Companies (DISCOMs) remains a matter of concern, particularly with state-owned DISCOMs. Challenges such as high Aggregate Technical and Commercial (AT&C) losses, non-cost reflective tariffs, outdated infrastructure, and inefficient system-level planning persist, posing significant obstacles. These issues have a cascading effect, impacting all players in the power sector and jeopardizing and their financial viability.

As of March 2021, the accumulated losses of distribution companies have soared to a staggering 5.2 trillion Indian rupees (~$70 billion). Although there has been a slowdown in the growth rate of losses in recent years, the situation remains alarming. These mounting losses highlight the urgent need for effective measures to address the financial woes plaguing DISCOMs.

State-owned DISCOMs have been the recipients of various schemes by Indian government (Center and state) aimed at refinancing debt and providing capital support for network improvement investments (e.g. Financial restructuring plan in 2012, UDAY[1] in 2016, RDSS[2] in 2022). However, the impact of these schemes has been limited. Despite the initiatives, state-owned DISCOMs continue to struggle with financial sustainability and operational inefficiencies, perpetuating the challenges faced by the distribution sector. The inefficiencies within power distribution have far-reaching implications for all stakeholders in the value chain. Delayed payments and anti-market practices create ripple effects that disrupt the operations and financial viability of power generators, OA buyers, transmission companies, and other players in the sector.

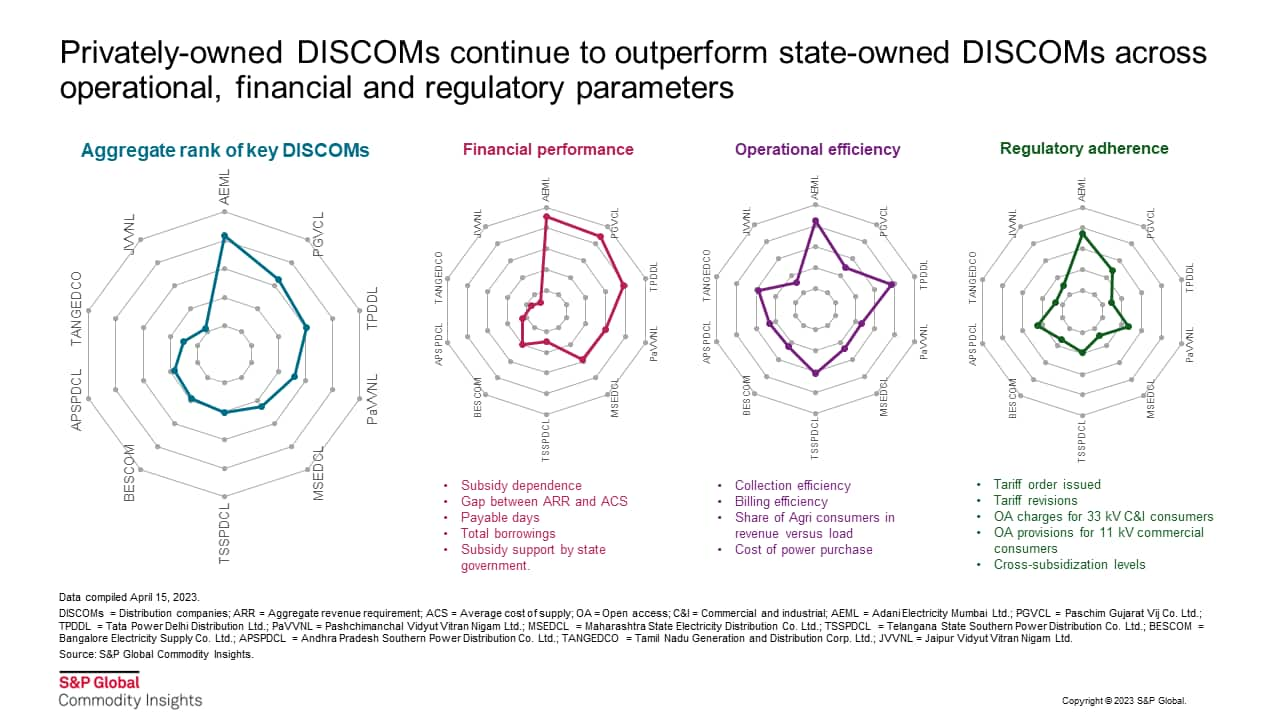

In contrast, private DISCOMs have shown relatively better performance. They have managed to maintain their average cost of supply and improve their average billing rates, contributing to their financial stability. However, even private DISCOMs are not immune to the pressures due to political interference, as evidenced by the situation with Delhi DISCOMs (BRPL[3]. BYPL[4] and TPDDL[5]).

Recognizing the complexity of challenges faced by investors, we have taken a proactive approach by developing a comprehensive ranking system to evaluate DISCOMs based on their operational efficiency, financial performance, and regulatory adherence. By comparing DISCOMs across these key parameters, we aim to provide investors with valuable insights to inform their investment decisions and identify potential risks.

Learn more about our Asia Pacific integrated energy research.

Ashish Singla, associate director with the Gas, Power, and Climate Solutions team at S&P Global Energy, covers power and renewables research for South Asian markets.

Posted on 15 June 2023

_______________________

[1] Ujwal DISCOM Assurance Yojana

[2] Revamped Distribution Sector Scheme

[3] BSES Rajdhani Power Ltd.

[4] BSES Yamuna Power Ltd.

[5] Tata Power Delhi Distribution Ltd.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.